7

Employment, Insurance, and Economic Issues

A history of cancer can have a significant impact on employment opportunities and may also affect being able to obtain and retain health and life insurance (Ferrell and Hassey Dow, 1997; Monaco et al., 1997; President’s Cancer Panel, 2001; Weiner et al., 2002). This chapter outlines the employment and insurance concerns of particular relevance to survivors of childhood cancer.1 The current legal remedies to these socioeconomic problems are described, as are potential educational, legislative, and advocacy responses. Selected federal and state programs are described that are of relevance to childhood cancer survivors, including Medicaid and Medicare, Supplemental Security Income (SSI), Social Security Disability Insurance (SSDI), and the Title V Children with Special Health Care Needs (CSHCN) program.

EMPLOYMENT

The Impact of Cancer on Survivors’ Employment Opportunities

Most cancer survivors who worked before their diagnosis return to work following their treatment (Crothers, 1986). Retaining one’s employ-

ment status has obvious financial benefits and is often also necessary for health insurance coverage, self-esteem, and social support. Survivors of childhood cancer may have late effects that limit their initial entry into the workforce or restrict their employment options. In a recent study of over 10,000 members of the Childhood Cancer Survivor Study cohort, virtually all (95 percent) of the survivors had worked, but the likelihood of employment was lower as compared to their siblings (Pang et al., 2002). Similar findings emerged from an earlier survey of 219 childhood survivors who were treated between 1945 and 1975 and were at least 30 years old at the time of the survey. Childhood survivors, with the exception of survivors of CNS tumors, reported very similar employment histories as a matched control group. Members of the control group, however, reported somewhat higher annual incomes than did the survivors (Hays et al., 1992).

When employed, cancer survivors have often reported problems in the workplace, including dismissal, failure to hire, demotion, denial of promotion, undesirable transfer, denial of benefits, and hostility (Hoffman, 1996). Studies conducted prior to the passage of comprehensive employment discrimination laws suggest that survivors of childhood cancer encountered substantial employment obstacles:

-

43 of 403 (11 percent) Hodgkin’s disease survivors treated at Stanford University experienced difficulties at work that they attributed to their cancer history (Fobair et al., 1986),

-

approximately 11 percent of adult survivors of childhood cancer reported some form of employment-related discrimination according to a study of 227 former pediatric cancer patients (Green et al., 1991),

-

15 of 60 (25 percent) survivors of childhood cancer in another study reported job discrimination (10 persons were refused a job at least once, 3 were denied benefits, 3 experienced illness-related conflict with a supervisor, 4 reported job task problems, and 11 were rejected by the military) (Koocher and O’Malley, 1982),

-

8 of the 40 (20 percent) survivors of childhood/adolescent Hodgkin’s disease reported job problems (Wasserman et al., 1987), and

-

younger cancer survivors who were either employed or active in the labor market were more concerned than older survivors about revealing their cancer history in searching for another job (Koocher and O’Malley, 1982).

Most employers treat cancer survivors fairly and legally. Some employers, however, erect unnecessary and sometimes illegal barriers to survivors’ job opportunities (Hoffman, 1996; Hoffman, 1999; Hoffman, 2002a). Most personnel decisions are driven by economic factors, not by charitable or personal consideration. Employers may be motivated to fire an em-

ployee with cancer (or a history of cancer) because of concerns about increased costs due to insurance expenses and lost productivity or because of concerns about the psychological impact of a survivors’ cancer history on other employees. Some employers may fail to revise their personnel policies to comply with new laws, and even among those with updated policies, employers may not train their personnel managers properly to comply with these laws. The interpretation of laws designed to prohibit discriminatory practices is sometimes unclear and is being resolved in the courts. Some employers and co-workers treat cancer survivors differently from other workers, in part, because they have misconceptions about survivors’ abilities to work during and after cancer treatment (Working Woman/ Amgen, 1996; Yankelovich, 1992).

Cancer Survivors’ Current Employment Rights

Although cancer survivors do not have an unqualified right to obtain and retain employment, they do have the right to some freedom from discrimination and to be treated according to their individual abilities. Three federal laws—the Americans with Disabilities Act, the Family and Medical Leave Act, and the Employee Retirement and Income Security Act—provide cancer survivors with some protection against employment discrimination.

Americans with Disabilities Act

The Americans with Disabilities Act (ADA) of 1990 (42 U.S.C. 12101 et seq.) prohibits some types of job discrimination by employers, employment agencies, and labor unions against people who have or have had cancer. All private employers with 15 or more employees, state and local governments, the legislative branch of the federal government, employment agencies, and labor unions are covered by the ADA.

A “qualified individual with a disability” is protected by the ADA if he or she can perform the “essential functions” of the job. The ADA prohibits employment discrimination against individuals with a “disability,” a “record” of a “disability,” or who are “regarded” as having a “disability.” A “disability” is a major health “impairment” that substantially limits the ability to do everyday activities, such as drive a car or go to work.

Cancer is an “impairment” as defined by the law. In most circumstances, cancer survivors, regardless of whether they are in treatment, in remission, or cured, are protected as persons with a disability because their cancer substantially limited a major life activity. Indeed, many federal courts and the Equal Employment Opportunities Commission (EEOC) consider cancer in most circumstances to be a disability under the ADA

(Hoffman, 2000). Whether a cancer survivor is covered by the ADA is determined, however, on a case-by-case basis. Because the United States Supreme Court has not, to date, squarely addressed whether all cancer survivors are protected by the ADA, cancer survivors’ rights under the law vary depending on the facts of the individual case and the court in which the case is heard. Some courts have concluded that cancer survivors are “persons with a disability” as defined by the statute. Other courts, however, have placed cancer survivors in a “Catch-22” by concluding that a cancer survivor who is sufficiently healthy to work is not a person with a disability as defined by the ADA. In one case a woman with breast cancer was acknowledged to have experienced nausea, fatigue, swelling, inflammation, and pain resulting from her treatment, but the United States Court of Appeals for the Fifth Circuit found that she could nonetheless perform her essential job duties with accommodations (Ellison v. Software Spectrum Inc.). Although the Court of Appeals found that the woman’s cancer affected her ability to work, it concluded that these limitations were not sufficient to render her a “person with a disability” as defined by the ADA. Other courts have followed the reasoning of the Fifth Circuit and rejected lawsuits by cancer survivors. In another case, a long-term survivor of non-Hodgkin’s lymphoma, fired because his employer feared that future health insurance claims would cause his insurance costs to rise, was determined not to be covered under the ADA after his dismissal (Hirsch v. National Mall and Serv., Inc.). The court concluded “that the ADA was not truly meant to apply to this situation” because the claimant was discriminated against due to the costs of his cancer treatment, and not because of the cancer itself” (989 F. Supp. 977, 980).

The ADA prohibits discrimination in most job-related activities such as hiring, firing, and benefits. In most cases, a prospective employer may not ask applicants if they have ever had cancer. An employer has the right to know only if an applicant is able to perform the essential functions of the job. A job offer may be contingent upon passing a relevant medical exam, provided that all prospective employees are subject to the same exam. An employer may ask detailed questions about health only after making a job offer.

Cancer survivors who need extra time or help to work are entitled to a “reasonable accommodation.” Common accommodations for survivors include changes in work hours or duties to accommodate medical appointments and treatment side effects. An employer does not have to make changes that would impose an “undue hardship” on the business or other workers. “Undue hardship” refers to any accommodation that would be unduly costly, extensive, substantial or disruptive, or that would fundamentally alter the nature or operation of the business. For example, an

employer may replace a survivor who has to miss six months of work that cannot be performed by a temporary employee.

The ADA does not prohibit an employer from ever firing or refusing to hire a cancer survivor. Because the law requires employers to treat all employees similarly, regardless of disability, an employer may fire a cancer survivor who would have been terminated even if he or she was not a survivor.

Most employment discrimination laws protect only the employee. The ADA offers protection more responsive to survivors’ needs because it prohibits discrimination against family members, too. Employers may not discriminate against workers because of their relationship or association with a “disabled” person. Employers may not assume that an employee’s job performance would be affected by the need to care for a family member who has cancer.

Family and Medical Leave Act

The Family and Medical Leave Act (FMLA) (29 U.S.C. 2601 et seq.) requires employers with at least 50 workers to provide certain benefits for serious medical illness, including cancer, for employees or dependents. The statute provides a number of benefits to cancer survivors:

-

provides 12 weeks of unpaid leave during any 12 month period,

-

requires employers to continue to provide benefits, including health insurance coverage, during the leave period,

-

requires employers to restore employees to the same or equivalent position at the end of the leave period,

-

allows leave to care for a spouse, child, or parent who has a “serious health condition” such as cancer,

-

allows leave because a serious health condition renders the employee “unable to perform the functions of the position,”

-

allows intermittent or reduced work schedule when “medically necessary” (under some circumstances, an employer may transfer the employee to a position with equivalent pay and benefits to accommodate the new work schedule), and

-

allows employees to “stack” or add leave under the FMLA to leave allowable under state medical leave law.

The FMLA reasonably balances the needs of the employer and employee. It

-

requires employees to make reasonable efforts to schedule foreseeable medical care so as to not disrupt unduly the workplace,

-

requires employees to give employers 30 days notice of foreseeable medical leave, or as much notice as is practicable,

-

allows employers to require employees to provide certification of medical needs and allows employers to seek a second opinion, at the employer’s expense, to corroborate medical need, and

-

permits employers to provide leave provisions more generous than those required by the FMLA.

In addition to the ADA and FMLA, another federal law, the Employee Retirement and Income Security Act (ERISA) and an Executive Order provide some legal protection for cancer survivors who encounter problems at work.

The Employee Retirement and Income Security Act (ERISA)

The Employee Retirement and Income Security Act (29 U.S.C. 1001 et seq.) prohibits an employer from discriminating against an employee to prevent him or her from collecting benefits under an employee benefit plan. Employee benefit plans are defined broadly, and include any plan providing “medical, surgical, or hospital care benefits, or benefits in the event of sickness, accident, disability, death, or unemployment.” Employers who offer group benefit packages to their employees are subject to ERISA. ERISA does not, however, apply to the large number of employers who self fund their insurance plans.

Some employers fear that the participation of a cancer survivor in a group medical plan will drain benefit funds or increase the employer’s insurance premiums. An employer may violate ERISA if, upon learning of a worker’s cancer history, it dismisses that worker to exclude him or her from a group health plan. An employer also may violate ERISA by encouraging a person with a cancer history to retire as a “disabled” employee. Most benefit plans define disability narrowly to include only the most debilitating conditions. Individuals with a cancer history often do not fit under such a definition and should not be compelled to so label themselves.

ERISA covers both participants (employees) and beneficiaries (spouses and children). Thus, if the employee is fired because his or her child has cancer, the employee may be entitled to file a claim. ERISA, however, is inapplicable to many victims of employment discrimination, including individuals who are denied a new job because of their medical status, employees who are subjected to differential treatment that does not affect their benefits, and employees whose compensation does not include benefits.

Executive Order

Unlike most private and state employees, federal employees are protected from genetic-based discrimination. An Executive Order issued by President Clinton in 2000 prohibits federal departments and agencies form making employment decisions about civilian federal employees based on protected genetic information (http://www.opm.gov/pressrel/2000/genetic_eo.htm, accessed March 15, 2003). The Order also prohibits federal employers from requiring genetic tests as a condition of being hired or receiving benefits.

State Employment Rights Laws

All states except Alabama and Mississippi have laws that prohibit discrimination against people with disabilities in public and private employment (Hoffman, 1996; Hoffman 2002a; Hoffman, personal communication to Maria hewitt, 2002). Alabama and Mississippi laws, which have not been amended since the 1970s, cover only state employees. Several states, such as New Jersey, cover all employers regardless of the number of employees. The laws in most states, however, cover only employers with a minimum number of employees. A few states, such as California and Vermont, expressly prohibit discrimination against cancer survivors. Many state laws protect individuals with real or perceived disabilities, and therefore, cover most cases of cancer-based discrimination. The rights of cancer survivors who do not have a physical or mental impairment (and would be considered non-“handicapped” in some states) are unclear in those states where courts have not addressed the issue.

Many states have leave laws similar to the federal FMLA in that they guarantee employees in the private sector unpaid leave for pregnancy, childbirth, and the adoption of a child. Some state laws provide employees with medical leave to address a serious illness, such as cancer. Several states provide coverage more extensive than the federal law.

State medical leave laws vary widely as to:

-

how long an employee can take leave,

-

which employees may take leave (most states require an employee to have worked for a minimum period of time),

-

which employers must provide leave (a few states have leave laws that apply to employers of fewer than 50 employees),

-

the definition of “family member” for whose illness an employee may take family medical leave,

-

the type of illness that entitles an employee to medical leave,

-

how much notice an employee must give prior to taking leave,

-

whether an employee continues to receive benefits while on leave and who pays for them, and

-

how the law is enforced (by state agency or through private lawsuit).

HEALTH INSURANCE

The Impact of Cancer on Health Insurance

Employment rights and health insurance rights are closely related because most adult Americans receive health insurance through an employer’s group plan. Loss of health insurance may be secondary to loss of employment and employment discrimination. Many cancer survivors are unable to purchase affordable, effective coverage, especially those who are not covered by group policies. During the past decade, the way in which cancer survivors purchased and used health insurance, as well as the laws governing health insurance, have changed significantly (Hoffman, 1999).

Adult and childhood cancer survivors share many of the same problems in accessing and keeping health insurance. Several studies of survivors of adult cancer have disclosed barriers to insurance, including refusal of new applications, policy cancellations or reductions, higher premiums, waived or excluded pre-existing conditions, and extended waiting periods:

-

Nearly one-half of Hodgkin’s disease and leukemia survivors in one study reported insurance problems due to cancer. These problems include the denial of health insurance, increased insurance rates, problems changing from a group to an individual plan and lost health insurance (Kornblith et al., 1998).

-

Approximately 25 percent of the 940 cancer patients surveyed by the Mayo Clinic Rehabilitation Program reported insurance “discrimination” (Crothers, 1986).

-

Almost 30 percent of all employable cancer survivors in California reported encountering barriers to insurance (Burton and Jones, 1982).

Among survivors of childhood cancer, health insurance problems are compounded, because most survivors have only family-related insurance before the onset of cancer (Hays, 1993). Like survivors of adult cancer, the more years that have passed since treatment, the more likely it is that childhood cancer survivors can obtain health insurance on the same terms as nonsurvivors. Adolescents and young adults may be especially vulnerable to insurance problems. When adolescents turn between 19 and 23 years of age (depending on the state), they may have to leave their parents’

or public insurance coverage and have few options for obtaining their own health insurance (White, 2002).

Several studies have documented insurance-related difficulties of childhood cancer survivors. In one study of 182 young adult survivors of childhood cancer in North Carolina, survivors were more likely than their siblings to be denied health insurance (25 vs 3 percent) and when insured were more likely to have pre-existing condition clauses in their health insurance policy (17 vs 12 percent) (Vann et al., 1995). In another study, adult long-term survivors of childhood cancer were covered by health insurance policies without cancer-related restrictions at similar rates to a control group (81 to 92 percent vs 82 to 95 percent) (Hays et al., 1992). Among survivors, 7 to 14 percent described difficulties experienced by their parents in obtaining affordable health insurance for the entire family during or after the survivor’s illness (as compared with 5 to 10 percent of the controls) (Hays et al., 1992). In another study, 14 percent of male survivors of childhood cancer and 9 percent of female survivors of childhood cancer were rejected for health insurance (as compared with 1 percent and none among the controls) (Teta et al., 1986).

Cancer Survivors’ Health Insurance Rights

Cancer survivors who have health insurance are entitled to all of the rights set forth in their policies. Insurers who fail to pay for treatment in accordance with the terms of the policies may be sued for violating the contract between the survivor and the insurer. Some survivors have successfully sued their insurers for breach of contract for failing to pay for chemotherapy, bone marrow transplants, and other treatment. Some survivors find that their policies have inadequate coverage for needed services. A health insurance policy may, for example, cover one prosthesis a year, but a growing adolescent may require more than one. Some survivors may have coverage for a needed service (e.g., neurocognitive testing), but the specialists needed to deliver it may not be available within a plan’s network of providers (John Fontanesi, Professor, University of California, San Diego, personal communication to Maria Hewitt, November 12, 2002). State and federal laws offer cancer survivors very limited remedies to overcome barriers in securing adequate health insurance coverage.

Among those with insurance, there may be difficulties in getting reimbursement for interventions designed to prevent or ameliorate late effects of childhood cancer because of variations in the scope of benefits offered by plans. In a 1998 review of pediatric care coverage rules (i.e., medical necessity standards) specified in contracts of large commercial insurers, relatively few contracts (4 percent of those reviewed) were found to allow

for services to prevent conditions, impairments, or disabilities (Fox and McManus, 2001).

Federal Health Insurance Laws

Four federal laws provide survivors some opportunities to keep health insurance that they obtain through work.

Americans with Disabilities Act As noted above, the ADA (42 U.S.C. 12101 et seq.) prohibits employers from denying health insurance to cancer survivors if other employees with similar jobs receive insurance. The ADA does not require employers to provide health insurance, but when they choose to provide health insurance, they must do so fairly. An employer who does not provide a cancer survivor with the same health insurance provided to employees with similar jobs must prove that the failure to provide insurance is based on legitimate actuarial data or that the insurance plan would become bankrupt or suffer a drastic increase in premiums, copayments, or deductibles. An employer, such as a small business, who can prove that it is unable to obtain an insurance policy to cover the survivor, may not have to provide the survivor with the same health benefits provided to other employees. Because the ADA protects employees from discrimination based on their “association” with a person with a disability, an employer may not refuse to provide a family health policy solely because one of the employee’s dependents has cancer.

Health Insurance Portability and Accountability Act (HIPAA) HIPPA helps cancer survivors retain their health insurance by:

-

Alleviating “job-lock” by allowing individuals who have been insured for at least 12 months to change to a new job without losing coverage, even if they previously have been diagnosed with cancer. In addition, for previously uninsured individuals, group plans cannot impose pre-existing condition exclusions of more than 12 months for conditions for which medical advice, diagnosis, or treatment was received or recommended within the previous six months.

-

Preventing group health plans from denying coverage based on health status factors such as current and past health, claims experience, medical history, and genetic information. Insurers, however, may uniformly exclude coverage for specific conditions and place lifetime caps on benefits.

-

Increasing insurance portability for people changing from a group policy to an individual one.

-

Requiring insurers of small groups to cover all interested small em-

-

ployers and to accept every eligible individual under the employer’s plan who applies for coverage when first eligible.

-

Requiring health plans to renew coverage for groups and individuals in most cases.

-

Increasing the tax deduction for health insurance expenses available to self-employed individuals.

The Consolidated Omnibus Budget Reconciliation Act of 1986 (COBRA) COBRA (PL 99-272) requires employers to offer group medical coverage to employees and their dependents who otherwise would have lost their group coverage due to individual circumstances. Public and private employers with more than 20 employees are required to make continued insurance coverage available to employees who quit, are terminated, or work reduced hours. Coverage must extend to surviving, divorced, or separated spouses, and to dependent children.

By allowing survivors to keep group insurance coverage for a limited time, COBRA provides valuable time to shop for long-term coverage. Although the survivor, and not the former employer, must pay for the continued coverage, the rate may not exceed by more than 2 percent the rate set for the survivor’s former co-workers.

Eligibility for the employee, spouse, and dependent child varies under COBRA. The employee becomes eligible if he or she loses group health coverage because of a reduction in hours or because of termination due to reasons other than gross employee misconduct. The spouse of an employee becomes eligible for any of four reasons:

-

the death of a spouse,

-

termination of a spouse’s employment (for reasons other than gross misconduct) or reduction in a spouse’s hours of employment,

-

divorce or legal separation from a spouse, or

-

a spouse becomes eligible for Medicare.

The dependent child of an employee becomes eligible for any of five reasons:

-

the death of a parent,

-

the termination of a parent’s employment or reduction in a parent’s hours,

-

a parent’s divorce or legal separation,

-

a parent becomes eligible for Medicare, or

-

a dependent ceases to be a “dependent child” under a specific group plan.

The continued coverage under COBRA must be identical to that offered to the families of the employee’s former co-workers. If employment is terminated for any reason other than gross misconduct, the employee and his or her dependents can continue coverage for up to 18 months. A qualified beneficiary who is determined to be disabled for Social Security purposes at the time of the termination of employment or reduction in employment hours can continue COBRA coverage for a total of 29 months. Dependents can continue coverage for up to 36 months if their previous coverage will end because of any of the above reasons.

Continued coverage may be cut short if:

-

the employer no longer provides group health insurance to any of its employees,

-

the continuation coverage premium is not paid,

-

the survivor becomes covered under another group health plan, or

-

the survivor becomes eligible for Medicare.

ERISA As described earlier, ERISA prohibits an employer from discriminating against an employee to prevent him or her from collecting benefits under an employee group benefit plan. Employee benefit plans that are self-insured are regulated only by federal law, not state insurance law. Unlike commercial insurance plans that employers purchase to provide health insurance as a benefit for their employees, self-insured plans are funds set aside by employers to reimburse employees for their allowable medical expenses. Generally, large employer groups or unions find it to their benefit to self-insure, while smaller employer groups choose to finance employee health benefits through commercial insurers. The claims employees file to obtain their reimbursement through these plans are likely to be administered by commercial insurance companies, so most people covered through self-insured plans do not even realize their health insurance is somewhat different from insurance purchased through an insurance company.

State Insurance Laws

Every state regulates policies sold by insurance companies in the state. These laws vary significantly. Some states require insurance policies to cover off-label chemotherapy, minimum hospital stays for cancer surgery, and benefits for certain types of cancer treatment and screening. More than half the states operate high-risk insurance pools to help provide coverage to individuals who have been denied private health insurance in the individual market (Achman and Chollet, 2001). These high-risk pools are often used to comply with provisions in the Health Insurance Portability and Account-

ability Act that provide the right to convert a group health insurance policy to an individual policy. Some states enroll people who are eligible for Medicare in their high-risk pool so that they may obtain supplemental coverage. As of 2002, high-risk insurance pools covered about 153,000 people (DHHS press release, 2002).

According to a recent analysis, state high-risk pools have had a limited impact in making insurance available and affordable for otherwise uninsurable individuals. State risk pools often charge premiums that are high relative to incomes, and typically include sizable deductibles and copayments. Most risk pools limit lifetime benefits (e.g., $1 million in Missouri, Texas, Alabama) (Achman and Chollet, 2001)). Although high-risk pools are designed to meet the needs of people with serious or chronic illnesses, they often limit access by imposing waiting and “look-back” periods for preexisting conditions to reduce adverse selection. Enrollees who were diagnosed for treatment of a condition during a “look-back” period (typically 6 months) before enrolling in the pool are not covered for treatment of that condition during a specified waiting period after coverage (typically 6 months or a year) (Achman and Chollet, 2001). Some states have long waiting lists and others are closed to new applicants altogether (e.g., California, Florida, Illinois) (Achman and Chollet, 2001). In general, applicants for coverage through a high-risk pool must demonstrate evidence of ineligibility for coverage at a reasonable charge. States typically cap premium rates at 125 to 200 percent of standard market rates (Achman and Chollet, 2001).

States finance high-risk pools through surcharges on health insurance premiums, from tobacco taxes, general funds, or some combination of these sources. However, only limited revenues are available through state premium taxes, because the Employee Retirement Income Security Act of 1974 (ERISA) exempts self-insured plans from paying them (Achman and Chollet, 2001). A new federal program to help states create high-risk pools was announced in November 2002 (DHHS press release, 2002). Grants of up to $1 million are available to 27 states and the District of Columbia through the Centers for Medicare and Medicaid Services. In addition, another $80 million was appropriated over two years to offset a portion of losses incurred by states from operating high-risk pools.

Some states, in addition to, or instead of, reliance on high-risk pools, regulate the individual market to require guaranteed issue (i.e., a requirement to sell to all applicants irregardless of their medical history). States may also restrict the extent to which premium rates can vary based on health status and/or age. According to a 2001 report, 13 states required insurers to guarantee issue or hold open-enrollment periods, 16 states limited the extent to which insurers could vary rates overall, and 8 states

prohibited insurers from considering health status in setting rates (Achman and Chollet, 2001). Four states (Arizona, Delaware, Georgia, and North Carolina) had no specific regulation of the individual insurance market designed to improve either access to or affordability of coverage for people with significant health problems (Achman and Chollet, 2001).

Federal Health Insurance and Disability Programs

Childhood cancer survivors may benefit from various federal health insurance and disability programs, most of which are designed to support those from families with low incomes.

Medicaid and S-Chip

Medicaid is a joint federal/state insurance program for low income and certain disabled individuals. As of 2000, an estimated 26 percent of children and young adults under age 21 were Medicaid beneficiaries (www.hcfa.gov/medicaid/msis/2082-9.htm, accessed March 28, 2002). Coverage of uninsured children has been improved through implementation of the State Children’s Health Insurance Program (S-CHIP). By fiscal year (FY) 2001, 4.6 million children had ever been enrolled in S-CHIP, many of them through expansions of Medicaid (Centers for Medicare and Medicaid Services, 2002). Medicaid is the single largest source of health care financing for people with disabilities, and covers nearly 7 million people under age 65 with disabilities. However, Medicaid covers only the low-income severely disabled population, leaving significant coverage gaps for other people with disabilities. Most disabled individuals who are Medicaid beneficiaries become eligible through the Supplemental Security Income (SSI) cash assistance program (see below).

The Medicaid program has evolved in recent years from a largely fee-for-service payment system to capitated arrangements. Estimates are that more than half (54 percent) of children and one in four disabled beneficiaries covered by Medicaid are in managed care plans (www.hcfa.gov/medicaid/msis/2082-9.htm, accessed March 28, 2002; Kaiser Commission on Medicaid and the Uninsured, 2001).

Under Medicaid’s fee-for service arrangements, children with chronic or disabling conditions generally were able to receive specialty care through tertiary care centers and specialty clinics, and from specialty providers (Fox and McManus, 1998). Fully capitated managed care plans may control the use of specialists, especially those outside of their plans’ networks. Recommendations for improving state Medicaid contracts and plan practices for children with special needs include (Fox and McManus, 1998):

-

clarifying the specificity of pediatric benefits,

-

defining appropriate pediatric provider capacity requirements,

-

developing a medical necessity standard specific to children,

-

identifying pediatric quality-of-care measures,

-

setting appropriate pediatric capitation rates, and

-

creating incentives for high-quality pediatric care.

Of special interest to survivors of childhood cancer are services provided under Medicaid’s Early and Periodic Screening, Diagnosis and Treatment (EPSDT). The scope of services provided under EPSDT is dictated by federal statue and includes “diagnostic, screening, preventive, and rehabilitative services, including medical or remedial services recommended for the maximum reduction of physical or mental disability and restoration of an individual to the best possible functional level (in facility, home, or other setting)” (http://www.healthlaw.org/pubs/19990323epsdtfact.html, accessed March 15, 2003). In practice, several barriers to EPSDT have limited the use of services, for example, a shortage of providers participating in the Medicaid program, beneficiaries not being informed of the program and its benefits, and issues related to cost.

State Medicaid programs, while providing a great deal of support, vary by state in terms of coverage and spending, the latter reflecting different provider payment rates, utilization, and other factors.

Supplemental Security Income (SSI)

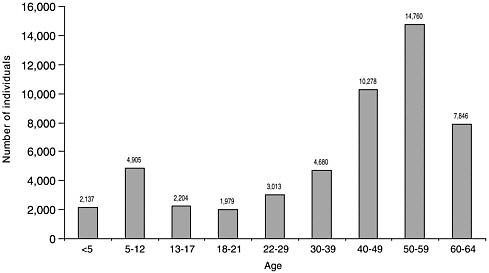

The Supplemental Security Income program was enacted in 1972 to replace state-run benefit programs for adults who were disabled or over age 65. At the same time, coverage was extended so children with disabilities could quality for federal disability benefits. Eligible children must have evidence of marked and severe functional limitations and their condition must have lasted or be expected to last at least 12 months or be expected to result in the child’s death (www.ssa.gov/pubs/10026.html, accessed March 15, 2003). Once eligible, disability is redetermined at least every three years. By December 2001, there were an estimated 52,000 individuals under age 65 receiving SSI benefits because of a diagnosis of cancer, 22 percent of them under age 21 (Figure 7.1) (Social Security Bulletin, 2002).

SSI is an income support program and as of December 2000, the average monthly SSI payment to families with eligible children was $447 (payment depends on income, and some states provide supplemental payments) (Social Security Administration, 2001). Children under age 18 who qualify for SSI because they are disabled and have low family incomes and limited assets are also eligible for coverage under Medicaid in most states. In some states, children who are eligible for SSI because of their impair-

FIGURE 7.1 Number of SSI recipients eligible because of a cancer diagnosis, by age.

SOURCE: Social Security Bulletin, 2002.

ments, but whose families have incomes too high for financial eligibility, can apply for a “Katie Beckett waiver” to allow Medicaid to pay for home and community-based care instead of care in an institution.

Medicare Disability Program

In 1972, Medicare eligibility expanded to include certain disabled individuals under the age of 65. Nonelderly individuals who have received Social Security Disability Insurance (SSDI) payments for 24 months are eligible, but must wait 5 months before receiving disability insurance benefits (they, in effect, must be disabled for 29 months). To be eligible for SSDI, individuals must have limited income and resources and a physical or mental impairment that keeps a person from performing any “substantial” work and is expected to last 12 months or result in death (Social Security Administration, 2002). Individuals diagnosed with end-stage renal disease (ESRD) are also eligible for Medicare regardless of age and financial status. Some adult childhood cancer survivors under age 65 could be eligible for Medicare if they qualified for SSDI or had ESRD. SSDI is an insurance program that provides payments to persons with disabilities based on their having been covered previously under the Social Security program, for example, through their employer. The SSI program is a means-tested income assistance program for disabled, blind, and aged persons who have

limited income and resources regardless of their prior participation in the labor force. The definition of disability and the process of determining disability are the same for both programs (Institute of Medicine, 2002).

By 2000, more than 5 million people under age 65 with disabilities or ESRD were enrolled in Medicare (Department of Health and Human Services, 2000). As of 2000, 142,000 individuals under age 65 were receiving SSDI payments because of cancer (of these, 136,000 were disabled workers and 1,700 were individuals disabled as children) (Social Security Bulletin, 2001). Only individuals receiving SSDI benefits for two years would be eligible for Medicare.

Title V Programs

Every state and the District of Columbia has a Title V2 Program for Children with Special Health Care Needs (CSHCN) that is funded, in part, through the federal Title V Maternal and Child Health Block Grant and provides health and support services to children with special needs and their families (http://www.mchb.hrsa.gov/programs/default.htm, assessed March 26, 2003). From the program’s inception through the mid 1970s, most of the state programs funded through Title V were called Crippled Children’s Services (CCS) Programs and focused their efforts on children with orthopedic problems. In the late 1970s Congress funded state CCS programs to provide case management and care coordination services to children under the age of 16 who received benefits from the SSI program (Schulzinger, 1999). As a result of this expansion, more children with chronic illnesses, developmental disabilities, sensory impairments, and other special health needs were being served and the name of the program was changed to State Programs for Children with Special Health Care Needs (CSHCN). In 1989, Congress amended Title V and required that state CSHCN programs “provide and promote family-centered, community-based, coordinated care (including care coordination services . . .) and to facilitate the development of community-based systems of services for such children and their families.” State programs now provide training, finance community support organizations, and promote policies to further coordination and communication. CSHCN programs also provide rehabilitation services to children under age 16 who are receiving SSI, when Medicaid does not pay for those services.

|

2 |

Title V refers to the Title of the Social Security Act, enacted in 1935, to provide funds to states to develop and operate public health care programs for certain children with special health care needs as well as to establish other programs to promote the health of low income mothers and children (http://www.mchb.hrsa.gov/programs/default.htm, accessed March 26, 2003) |

The federal legislation gives states flexibility to use their Title V funds to design and implement direct care programs and services that are responsive to the needs in their state. State programs have different financial and medical criteria and provide different kinds of health care and related services. According to published eligibility criteria for Title V programs, 8 states specifically include cancer as a qualifying condition, and 8 states specifically exclude cancer as a qualifying condition. In the 8 states for which cancer is excluded, some have eligibility criteria that could make services available to cancer survivors with late effects (e.g., cardiac, neurologic, and developmental delay) (Health Resources and Services Administration, 2000). In 1998, 517,000 children were served at a cost of $1.8 billion (an average of $3,557 per child) (Health Resources and Services Administration, 2000) (Table 7.1).

The Maternal and Child Health Bureau and its key partners, including provider and consumer groups, have identified six core desirable outcomes for measurement as part of the Healthy People 2010 initiative (Health Resources and Services Administration, 2001):

-

All children with special health care needs will receive coordinated ongoing comprehensive care within a medical home.

-

All families of children with special health care needs will have adequate private and/or public insurance to pay for the services they need.

-

All children will be screened early and continuously for special health care needs.

-

Families of children with special health care needs will partner in decision making at all levels and will be satisfied with the services they receive.

-

Community-based service systems will be organized so families can use them easily.

-

All youth with special health care needs will receive the services necessary to make transitions to all aspects of adult life, including adult health care, work, and independence.

A national communication strategy, efforts at capacity building, setting standards, and establishing accountability systems are among the activities planned to implement these goals (Health Resources and Services Administration, 2001).

Issues Related to Managed Care

Many children receive care through a managed care plan offered by either a private insurer, Medicaid, or S-CHIP plans. Improved access to primary care and coordination of care are potential benefits of managed

TABLE 7.1 Children with Special Health Care Needs Served in FY 1998 by Each State and the Related Total and Per Child Expenditures Under the Title V Federal-State Block Grants

|

|

Children with Special Health Care Needs Under Title V Federal-State Block Grants |

||

|

State |

Number of Children Served |

Expenditures FY 1998 (million) |

Average Expenditure per Child Served FY 1998 (million) |

|

Alabama |

22,300 |

$16.9 |

$758 |

|

Alaska |

2,458 |

5.1 |

2,075 |

|

Arizona |

15,349 |

6.8 |

443 |

|

Arkansas |

15,159 |

4.7 |

310 |

|

California |

133,007 |

912.8 |

6,862 |

|

Colorado |

8,272 |

6.5 |

786 |

|

Connecticut |

5,284 |

3.3 |

625 |

|

Delaware |

2,732 |

0.5 |

183 |

|

District of Columbia |

892 |

1.9 |

2,130 |

|

Florida |

47,581 |

102.8 |

2,161 |

|

Georgia |

15,105 |

30.7 |

2,032 |

|

Hawaii |

8,567 |

7.6 |

887 |

|

Idaho |

2,276 |

2.1 |

923 |

|

Illinois |

24,626 |

24.5 |

995 |

|

Indiana |

9,314 |

19.3 |

2,072 |

|

Iowa |

5,430 |

4.3 |

792 |

|

Kansas |

10,972 |

3.2 |

292 |

|

Kentucky |

16,060 |

9.1 |

567 |

|

Louisiana |

8,466 |

9.5 |

1,122 |

|

Maine |

2,247 |

3.4 |

1,513 |

|

Maryland |

14,125 |

7.4 |

524 |

|

Massachusetts |

22,988 |

29.3 |

1,275 |

|

Michigan |

27,550 |

34.1 |

1,238 |

|

Minnesota |

7,309 |

7.2 |

985 |

|

Mississippi |

6,249 |

7.9 |

1,264 |

|

Missouri |

5,647 |

7.0 |

1,240 |

care plans. There are, however, potential disadvantages within managed care plans for children with special health care needs who need specialized complex care. A work group convened by the federal Maternal and Child Health Bureau in 2000 reviewed managed care issues of concern to children with special health care needs. Problems in three areas were identified that are of relevance to childhood cancer survivors: capacity and expertise in managed care organizations, access to specialized pediatric services, and reimbursement (McManus et al., 2000) (Box 7.1).

Recommended approaches that can be adopted by managed care plans

|

|

Children with Special Health Care Needs Under Title V Federal-State Block Grants |

||

|

State |

Number of Children Served |

Expenditures FY 1998 (million) |

Average Expenditure per Child Served FY 1998 (million) |

|

Montana |

1,379 |

1.5 |

1,088 |

|

Nebraska |

4,097 |

2.0 |

488 |

|

Nevada |

7,148 |

1.6 |

224 |

|

New Hampshire |

4,238 |

3.1 |

732 |

|

New Jersey |

67,839 |

8.6 |

127 |

|

New Mexico |

12,256 |

4.6 |

375 |

|

New York |

60,763 |

328.4 |

5,404 |

|

North Carolina |

64,787 |

54.7 |

844 |

|

North Dakota |

1,799 |

1.1 |

612 |

|

Ohio |

31,572 |

32.7 |

1,036 |

|

Oklahoma |

16,727 |

3.9 |

233 |

|

Oregon |

7,748 |

3.3 |

426 |

|

Pennsylvania |

33,593 |

11.5 |

342 |

|

Rhode Island |

3,700 |

4.2 |

1,135 |

|

South Carolina |

13,589 |

22.1 |

1,626 |

|

South Dakota |

5,576 |

1.3 |

233 |

|

Tennessee |

4,695 |

6.5 |

1,385 |

|

Texas |

26,848 |

33.0 |

1,229 |

|

Utah |

4,320 |

9.5 |

2,199 |

|

Vermont |

3,624 |

1.5 |

414 |

|

Virginia |

11,160 |

11.8 |

1,057 |

|

Washington |

9,165 |

5.0 |

546 |

|

West Virginia |

5,126 |

12.7 |

2,478 |

|

Wisconsin |

1,896 |

5.5 |

2,901 |

|

Wyoming |

3,137 |

2.3 |

733 |

|

TOTAL |

517,423 |

1840.2 |

3557 |

|

SOURCE: Health Resources and Services Administration, 2000. |

|||

to improve care for children with special health care needs include (Fox and McManus, 1998):

-

ensuring that assigned primary care providers have appropriate training and experience,

-

offering support systems for primary care practices,

-

providing specialty consultation for primary care providers,

-

establishing arrangements for the comanagement of primary and specialty pediatric services,

|

Box 7.1 Managed Care Issues of Concern to Children with Special Health Care Needs Capacity and expertise in managed care organizations

Access to specialized pediatric services

|

-

arranging for comprehensive care coordination,

-

establishing flexible service authorization policies,

-

implementing provider profiling systems that adjust for pediatric case mix,

-

creating financial incentives for serving children with special needs, and

-

encouraging family involvement in plan operations.

LIFE INSURANCE

Obtaining life insurance coverage is difficult for survivors of childhood cancer largely because they have not established their careers and families at the time of their cancer diagnosis. They do not face financial and life planning issues until several years after their cancer treatment. Since life insurance plans are based on an actuarial risk of death (or survival), the

Reimbursement

SOURCE: McManus et al., 2000. |

cancer history is often taken into account because it increases the potential risk of death at an earlier age. Some life insurance companies will not insure cancer survivors, and others will charge very high premiums. Group life insurance (through employment) is a possible solution, since a health history is not usually required for such plans.

SUMMARY AND CONCLUSIONS

Since the early 1990s, significant progress has been made in improving the employment opportunities of cancer survivors. With the recent passage of federal laws such as the Americans with Disabilities Act and the Family and Medical Leave Act, as well as the expansion of many state laws, cancer survivors have gained new legal rights and remedies. Additionally, the rise of cancer survivorship advocacy has helped dispel the myths that fuel survivors’ employment problems.

Providing better information to survivors regarding employment rights can lessen the effects of cancer on employment opportunities. From the time of diagnosis, all working-aged (or near working-age) survivors should receive from their cancer center and/or oncologist information about their legal rights, including information about how to avoid employment problems and how to respond to employment discrimination. Additionally, everyone who provides psychosocial support (such as oncology nurses, social workers, therapists, counselors, and peer support organizations) should be familiar with cancer survivors’ rights. These health care professionals often are survivors’ most important advocates in confronting the psychosocial consequences of cancer. Health care providers can further help their patients avoid job problems by educating employers about their patients’ prognoses, abilities, and limitations.

The legal community should become more aware of how current laws apply to cancer survivors’ employment rights. Legal education programs to teach attorneys, state and federal enforcement agencies, and the judiciary how laws such as the ADA and FMLA apply to cancer-based discrimination could improve representation and formulation of legal judgments. Incidences of employment discrimination will probably decrease if more survivors prevail with their claims.

An expansion of educational and direct services programs offered by cancer survivor advocacy organizations might also reduce and ultimately prevent employment discrimination. These programs could include attorney referral programs, personal advocacy assistance, workplace counseling to teach employers about the abilities and needs of cancer survivors to mitigate discrimination and to encourage the development of reasonable accommodations, and public educational materials and programs. Any service program must be able to meet the needs of minority populations that may have language and/or cultural barriers, in addition to their cancer history.

The goal of any health insurance reform should be to ensure that all Americans, regardless of medical history or employment status, have access to affordable, quality medical care. Broad-based national health insurance reform is unlikely to take place in the near future. Instead, cancer survivors’ best hope for significant insurance reform rests with federal and state legislation that targets specific issues. Because federal legislation generally covers only federal programs, such as Medicare and Medicaid, many insurance reforms must be addressed at the state level. In some cases, states could, for example, expand access to health insurance through increased support of state high-risk insurance pools. Health insurance reforms to improve patient protections must be considered carefully because when reforms increase the costs of insurance products, reforms can have the unintended consequence of higher rates of uninsurance

Medicaid and Medicare are federally supported programs that provide health insurance to at least some cancer survivors, by virtue of either low income and limited assets or disability. Cancer survivors, if disabled and with limited means, may receive cash assistance or income support through the SSI and SSDI programs. Eligibility for these programs may open the door to health insurance coverage through the Medicaid or Medicare programs. Other state-based programs such as the Title V Children with Special Health Needs programs can provide services such as assistance with health care and rehabilitation, care coordination, and case management. State-based demonstration projects supported through HRSA’s Special Projects of Regional and National Significance (SPRANS) and Community Integrated Service Systems (CISS) grants may offer opportunities to learn more about effective health service delivery strategies of relevance to childhood cancer survivors (see description of these grants in Chapter 8).

REFERENCES

Achman L, Chollet D. 2001. Insuring the Uninsurable: An Overview of State High-Risk Health Insurance Pools. Mathematica Policy Research, Inc. Princeton NJ (http://www.mathematica-mpr.com/3rdlevel/uninsurablehot.htm, last accessed March 21, 2003).

Burton L, Jones J. 1982. The Incidence of Insurance Barriers and Employment Discrimination Among Californians With Cancer Health History in 1983. Oakland, CA: California Division of the American Cancer Society.

Centers for Medicare and Medicaid Services. 2002. State Children’s Health Insurance Program: Fiscal Year 2001 Annual Enrollment Report. Washington, DC: U.S. DHHS.

Crothers, H.M. 1986. Employment Problems of Cancer Survivors: Local Program and Local Solutions, Proceedings of the Workshop on Employment Insurance and the Patient With Cancer. Atlanta, GA: American Cancer Society.

Department of Health and Human Services, HCFA. 2000. Medicare 2000:35 Years of Improving Americans’ Health and Security. Washington, DC.

Department of Health and Human Services, CMS. 2002. HHS to Help States Create High-Risk Pools to Increase Access to Health Coverage. Press release, November 26, 2002. (www.hhs.gov/news/press/2002pres/20021126a.html, last accessed January 31, 2003).

Ferrell BR, Hassey Dow K. 1997. Quality of life among long-term cancer survivors. Oncology (Huntingt) 11(4):565-8, 571; discussion 572, 575-6.

Fobair P, Hoppe RT, Bloom J, Cox R, Varghese A, Spiegel D. 1986. Psychosocial problems among survivors of Hodgkin’s disease. J Clin Oncol 4(5):805-14.

Fox HB, McManus MA. 1998. Improving state Medicaid contracts and plan practices for children with special needs. Future Child 8(2):105-18.

Fox HB, McManus MA. 2001. A national study of commercial health insurance and Medicaid definitions of medical necessity: what do they mean for children? Ambul Pediatr 1(1):16-22.

Green DM, Zevon MA, Hall B. 1991. Achievement of life goals by adult survivors of modern treatment for childhood cancer. Cancer 67(1):206-13.

Hays DM. 1993. Adult survivors of childhood cancer. Employment and insurance issues in different age groups. Cancer 71(10 Suppl):3306-9.

Hays DM, Landsverk J, Sallan SE, Hewett KD, Patenaude AF, Schoonover D, Zilber SL, Ruccione K, Siegel SE. 1992. Educational, occupational, and insurance status of childhood cancer survivors in their fourth and fifth decades of life. J Clin Oncol 10(9):1397-406.

Health Resources and Services Administration. 2000. Title V: A Snapshot of Maternal and Child Health, 2000. Rockville, MD: Health Resources and Services Administration.

Health Resources and Services Administration. 2001. Achieving Success for All Children and Youth With Speical Health Care Needs: A 10-Year Action Plan to Accompany Healthy People 2010. Washington, DC: US DHHS.

Hoffman B, eds. 1996. A Cancer Survivors’ Almanac: Charting Your Journey. National Coalition for Cancer Survivorship (U.S.). Minneapolis, MN: Chronimed Publishing.

Hoffman B. 1999. Cancer survivors’ employment and insurance rights: a primer for oncologists. Oncology (Huntingt) 13(6):841-6; discussion 846, 849, 852.

Hoffman B. 2000. Between a Disability and a Hard Place: The Cancer Survivors’ Catch-22 of Proving Disability Status Under the Americans With Disabilities Act. Baltimore, MD: Maryland Law Review.

Hoffman B. 2002a. Policy Recommendations to Address the Employment and Insurance Concerns of Cancer Survivors (IOM commissioned background paper). (www.nas.edu).

Institute of Medicine. 2002. The Dynamics of Disability: Measuring and Monitoring Disability for Social Security Programs. Washington DC: National Academy Press.

Kaiser Commission on Medicaid and the Uninsured. 2001. Medicaid’s Role for the Disabled Population Under Age 65. Washington, DC: The Henry J. Kaiser Family Foundation.

Koocher G, O’Malley J. 1982. The Damocles Syndrome. McGraw Hill: New York.

Kornblith AB, Herndon JE 2nd, Zuckerman E, Cella DF, Cherin E, Wolchok S, Weiss RB, Diehl LF, Henderson E, Cooper MR, Schiffer C, Canellos GP, Mayer RJ, Silver RT, Schilling A, Peterson BA, Greenberg D, Holland JC. 1998. Comparison of psychosocial adaptation of advanced stage Hodgkin’s disease and acute leukemia survivors. Cancer and Leukemia Group B. Ann Oncol 9(3):297-306.

McManus M, Fox H, Newacheck P. 2000. Report From an Expert Working Group: Pediatric Provider Networks for Children With Special Needs in the Current Health Insurance Market. Washington DC: HRSA, U.S. DHHS.

Monaco GP, Fiduccia D, Smith G. 1997. Legal and societal issues facing survivors of childhood cancer. Pediatr Clin North Am 44(4):1043-58.

Pang PW, Friedman DL, Whitton J, Weiss NS, Mertens A, Robison L. 2002. Employment Status of Adult Survivors of Pediatric Cancers: A Report from the Childhood Cancer Survivors Study (CCSS). Poster Presentation. Cancer Survivorship: Resilience Across the Lifespan. National Cancer Institute, Washington, DC. June 2-4.

President’s Cancer Panel NCI. 2001. Voices of a Broken System: Real People, Real Problems. Report of the Chairman, 2000-2001. Bethesda, MD: National Cancer Institute.

Schulzinger R. Institute for Child Health Policy. 1999. State Title V Rehabilitation Services: The Federal Law and How States Implement It. Gainesville, FL.

Social Security Administration. 2001. Children Receiving SSI December 2000. Baltimore, MD: Social Security Administration, Office of Policy, Office of Research, Evaluation, and Statistics, Division of SSI Statistics and Analysis.

Social Security Administration. 2002. A Desktop Guide to SSI Eligibility Requirements. Baltimore, MD: Social Security Administration.

Social Security Bulletin. 2001. Annual Statistical Supplement. Baltimore, MD: Social Security Administration.

Social Security Bulletin. 2002. SSI Annual Statistical Report. Baltimore, MD: Social Security Administration.

Teta MJ, Del Po MC, Kasl SV, Meigs JW, Myers MH, Mulvihill JJ. 1986. Psychosocial consequences of childhood and adolescent cancer survival. J Chronic Dis 39(9):751-9.

Vann JC, Biddle AK, Daeschner CW, Chaffee S, Gold SH. 1995. Health insurance access to young adult survivors of childhood cancer in North Carolina. Med Pediatr Oncol 25(5):389-95.

Wasserman AL, Thompson EI, Wilimas JA, Fairclough DL. 1987. The Psychological Status of Survivors of Childhood/Adolescent Hodgkin’s Disease. American Journal of Diseases of Children 141(6):626-31.

Weiner SL, McCabe MS, Smith GP, Monaco GP, Fiduccia D. 2002. Pediatric Cancer: Advocacy Insurance, Education, and Employment. Pizzo PA, Poplack DG, (eds). Principles and Practice of Pediatric Oncology. Philadelphia: Lippincott Williams and Wilkins. Pp. 1512-1526.

White PH. 2002. Access to health care: health insurance considerations for young adults with special health care needs/disabilities. Pediatrics 110(6 Pt 2):1328-35.

Working Woman/Amgen. 1996. Cancer in the Workplace Survey. Working Woman/Amgen.

Yankelovich CS. 1992. Cerenex Survey on Cancer Patients in the Workplace: Breaking Down Discrimination Barriers. Unpublished.