Effects of Research Tool Patents and Licensing on Biomedical Innovation1

John P. Walsh

University of Illinois at Chicago and Tokyo University

Ashish Arora

Carnegie Mellon University

Wesley M. Cohen

Duke University

ABSTRACT

Over the last two decades changes in technology and policy have altered the landscape of drug discovery. These changes have led to concerns that the patent system may be creating difficulties for those trying to do research in biomedical fields. Using interviews and archival data, we examine the changes in patenting and licensing in recent years and how these have affected innovation in pharmaceuticals and related biotech industries.

We find that there has in fact been an increase in patents on the inputs to drug discovery (“research tools”). However, we find that drug discovery has not been substantially impeded by these changes. We also find little evidence that university research has been impeded by concerns about patents on research tools. Restrictions on the use of pat

ented genetic diagnostics, where we see some evidence of patents interfering with university research, are an important exception. There is, also, some evidence of delays associated with negotiating access to patented research tools, and there are areas in which patents over targets limit access and where access to foundational discoveries can be restricted. There are also cases in which research is redirected to areas with more intellectual property (IP) freedom. Still, the vast majority of respondents say that there are no cases in which valuable research projects were stopped because of IP problems relating to research inputs.

We do not observe as much breakdown or even restricted access to research tools as one might expect because firms and universities have been able to develop “working solutions” that allow their research to proceed. These working solutions combine taking licenses, inventing around patents, infringement (often informally invoking a research exemption), developing and using public tools, and challenging patents in court. In addition, changes in the institutional environment, particularly new U.S. Patent and Trademark Office (USPTO) guidelines, active intervention by the National Institutes of Health (NIH), and some shift in the courts’ views toward research tool patents, appear to have further reduced the threat of breakdown and access restrictions, although the environment remains uncertain.

We conclude with a discussion of the potential social welfare effects of these changes in the industry and the adoption of these working solutions for dealing with a complex patent landscape. There are social costs associated with these changes, but there are also important benefits. Although we cannot rule out the possibility of new problems in the future, our results highlight some of the mechanisms that exist for overcoming these difficulties.

INTRODUCTION

There is widespread consensus that patents have long benefited biomedical innovation. A forty-year empirical legacy suggests that patents are more effec-

tive, for example, in protecting the commercialization and licensing of innovation in the drug industry than in any other.2 Patents are also widely acknowledged as providing the basis for the surge in biotechnology start-up activity witnessed over the past two decades.3 Heller and Eisenberg (1998) and the National Research Council (1997) have suggested, however, that recent policies and practices associated with the granting, assertion, and licensing of patents on research tools may now be undercutting the stimulative effect of patents on drugs and related biomedical discoveries. In this chapter, we report the results of 70 interviews with personnel at biotechnology and pharmaceutical firms and universities in considering the effects of research tool patents on industrial or academic biomedical research.4 We conceive of research tools broadly to include any tangible or informational input into the process of discovering a drug or any other medical therapy or method of diagnosing disease.5

Heller and Eisenberg (1998) argue that biomedical innovation has become susceptible to what they call a “tragedy of the anticommons,” which can emerge when there are numerous property right claims to separate building blocks for some product or line of research. When these property rights are held by numerous claimants (especially if they are from different kinds of institutions), the negotiations necessary to their combination may fail, quashing the pursuit of otherwise promising lines of research or product development. Heller and Eisenberg suggest that the essential precondition for an anticommons — the need to combine a large number of separately patentable elements to form one product—now applies to drug development because of the patenting of gene fragments or mutations [e.g., expressed sequence tags (ESTs) and single-nucleotide polymorphisms (SNPs)] and a proliferation of patents on research tools that have become essential inputs into the discovery of drugs, other therapies, and diagnostic methods. Heller and Eisenberg (1998) argue that the combining of multiple rights is susceptible to a breakdown in negotiations or, similarly, a stacking of license fees to the point of overwhelming the value of the ultimate product. Shapiro (2000) has raised similar concerns, using the image of the “patent thicket.” He notes that

technologies that depend on the agreement of multiple parties are vulnerable to holdup by any one of them, making commercialization potentially difficult.6

The argument that an anticommons may emerge to undercut innovation emphasizes factors that might frustrate private incentives to realize what should otherwise be mutually beneficial trades. Merges and Nelson (1990) and Scotchmer (1991) have argued, however, that the self-interested use of even just one patent— although lacking the encumbrances of multiple claimants characterizing an “anticommons”—may also impede innovation where a technology is cumulative (i.e., where invention proceeds largely by building on prior invention). An example of such an upstream innovation in biomedicine is the discovery that a particular receptor is important for a disease, which may make that receptor a “target” for a drug development program.7 A key concern regarding the impact of patents in such cumulative technologies is that “unless licensed easily and widely,” patents—especially broad patents—on early, foundational discoveries may limit the use of these discoveries in subsequent discovery and consequently limit the pace of innovation (Merges and Nelson, 1990).8 The revolution in molecular biology and related fields over the past two decades and coincident shifts in the policy environment have now increased the salience of this concern for biomedical research and drug innovation in particular (National Research Council, 1997). Drug discovery is now more guided by prior scientific findings than previously (Gambardella, 1995; Cockburn and Henderson, 2000; Drews, 2000), and those findings are now more likely to be patented after the 1980 passage of the Bayh-Dole Act and related legislation that simplified the patenting of federally supported research outputs that are often upstream to the development of drugs and other biomedical products.

In this chapter, we consider whether biomedical innovation has suffered be-

cause of either an anticommons or restrictions on the use of upstream discoveries in subsequent research. Notwithstanding the possibility of such impediments to biomedical innovation, there is still ample reason—and recent scholarship (Arora et al., 2003)—to suggest that patenting benefits biomedical innovation, especially via its considerable impact on R&D incentives or via its role in supporting an active market for technology (Arora et al., 2001). Although any ultimate policy judgment requires a consideration of the benefits and costs of patent policy, an examination of the benefit side of this calculus is outside the scope of our current study.

In the second section of this chapter, we provide background to the anticommons and restricted access problems. The third section describes our data and methods. In the fourth section, we provide an overview of the results from our interviews and assess the extent to which we witness either “anticommons” problems or restricted access to intellectual property (IP) on upstream discoveries and research tools. To prefigure the key result, we find little evidence of routine breakdowns in negotiations over rights, although research tool patents are observed to impose a range of social costs and there is some restriction of access. In the fifth section of the chapter, we describe the mechanisms and strategies employed by firms and other institutions that have limited the negative effects of research tool patents on innovation. The final section discusses our findings and our conclusions.

BACKGROUND

Science and Policy

Changes in the science underlying biomedical innovation, and in policies affecting what can be patented and who can patent, have combined to raise concerns over the impact of the patenting and licensing of upstream discoveries and research tools on biomedical research. Over the past twenty years, fundamental changes have revolutionized the science and technology underlying product and process innovation in drugs and the development of medical therapies and diagnostics. Advances in molecular biology have increased our understanding of the genetic bases and molecular pathways of diseases. Automated sequencing techniques and bioinformatics have greatly increased our ability to transform this understanding into patentable discoveries that can be used as targets for drug development. In addition, combinatorial chemistry and high-throughput screening techniques have dramatically increased the number of potential drugs for further development. Reflecting this increase in technological opportunity, the number of drug candidates in phase I clinical trials grew from 386 in 1990 to 1,512 in 2000.9 The consequence of these changes is that progress in biomedical research

is now more cumulative; it depends more heavily than heretofore on prior scientific discoveries and previously developed research tools (Drews, 2000; Henderson et al. 1999).

As the underlying science and technology has advanced, policy changes and court decisions since 1980 have expanded the range of patented subject matter and the nature of patenting institutions. In addition to the 1980 Diamond v. Chakrabarty decision that permitted the patenting of life-forms, and the 1988 Harvard OncoMouse patent that extended this to higher life-forms (and to a research tool), in the 1980s gene fragments, markers and a range of intermediate techniques and other inputs key to drug discovery and commercialization also became patentable. Moreover, Bayh-Dole and related legislation have encouraged universities and national labs, responsible for many such upstream developments and tools, to patent their inventions. Thus coincident changes in the science underpinning biomedicine and the policy environment surrounding IP rights have increased both the generation and patenting of upstream developments in biomedicine.

Conceptual

When is either an “anticommons” problem or restricted access to upstream discovery likely to emerge and why, and what are the welfare implications of their emergence?

Consider the anticommons. The central question here, as posed by both Heller and Eisenberg (1998) and Eisenberg (2001), is, if there is a cooperative surplus to be realized in combining property rights to commercialize some profitable biomedical innovation, why might it not be realized? They argue that biomedical research and innovation may be especially susceptible to breakdowns and delays in negotiations over rights for three reasons. First, the existence of numerous rights holders with claims on the inputs into the discovery process or on elements of a given product increases the likelihood that the licensing and transaction costs of bundling those rights may be greater than the ultimate value of the deal. Second, when there are different kinds of institutions holding those rights, heterogeneity in goals, norms, and managerial practice and experience can increase the difficulty and cost of reaching agreement. Such heterogeneity is manifest in biomedicine given the participation of large pharmaceutical firms, small biotechnology research firms, large chemical firms that have entered the industry (e.g., DuPont and Monsanto), and universities. Third, uncertainty over the value of rights, which is acute for upstream discoveries and research tools, can spawn asymmetric valuations that contribute to bargaining breakdowns and provide opportunities for other biases in judgment. This uncertainty is heightened because the courts have yet to interpret the validity and scope of particular patent claims.

Regarding the restriction of access to upstream discoveries highlighted by Merges and Nelson (1990; 1994), one can ask why that should be a policy concern. From a social welfare perspective, nothing is wrong with restricted access

to IP for the purpose of subsequent discovery so long as the patentholder (or licensee) is as able as other potential downstream users to fully exploit the potential contribution of that tool or input to subsequent innovation and commercialization.10 This, however, is unlikely for several reasons. First, firms and, especially, universities are limited in their capabilities. Second, there is often a good deal of uncertainty about how best to build on a prior discovery, and any one firm will be limited in its views about what that prior discovery might be best used for and how to go about exploiting it. Consequently, a single patentholder or licensee is unlikely to exploit fully the research and commercial potential of a given upstream discovery, and society is better off to the extent that such upstream discoveries are made broadly available.11 For example, if there is a target receptor it is likely that there are a variety of lines of attack, and no single firm is likely capable of mounting or even conceiving of all of them. The notion that prior discoveries should be made broadly available rests, however, on an important assumption—that broad availability will not compromise the incentive to invest the effort required to come up with that discovery to begin with (cf. Scotchmer, 1991).

In this chapter, we are therefore concerned with whether access to upstream discoveries essential to subsequent innovation is restricted. Restriction is, however, a matter of degree. If a discovery is patented at all, then it is to be expected that access will be restricted—reflecting the function of a patent. Indeed, any positive price for a license implies some degree of restriction. Therefore, we are concerned with more extreme forms of restricted access that may come in the form of exclusive licensing of broadly useful research tools, high license fees that may block classes of potential users, or decisions on the part of a patentholder to itself exploit some upstream tool or research finding that it developed.

Historical

The possibility that access to a key pioneering patent may be blocked, or that negotiations over patent rights might break down—even when a successful resolution would be in the collective interests of the parties concerned—is not a matter of conjecture. There is historical precedent. Merges and Nelson (1990) and Merges (1994), for example, consider the case of radio technology where the Marconi Company, De Forest, and De Forest’s main licensee, AT&T, arrived at an impasse over rights that lasted about ten years and was only resolved in 1919

when RCA was formed at the urging of the Navy. In aviation, Merges and Nelson argue that the refusal of the Wright brothers to license their patent significantly retarded progress in the industry. The problems caused by the initial pioneer patent (owned by the Wright brothers) were compounded as improvements and complementary patents, owned by different companies, came into existence. Ultimately, World War I forced the Secretary of the Navy to intervene to work out an automatic cross-licensing arrangement. “By the end of World War I there were so many patents on different aircraft features that a company had to negotiate a large number of licenses to produce a state-of-the-art plane” (Merges and Nelson, 1990, p. 891).

Although breakdowns in negotiations over rights may therefore occur, rights over essential inputs to innovation are routinely transferred and cross-licensed in industries, such as the semiconductor industry, where there are numerous patents associated with a product and multiple claimants (Levin, 1982; Hall and Ziedonis, 2001; Cohen et al., 2000). In Japan, where there are many more patents per product across the entire manufacturing sector than in the United States, licensing and cross-licensing are commonplace (Cohen et al., 2002).

Thus the historical record provides instances of both where the existence of numerous rights holders and the assertion of patents on foundational discoveries have retarded commercialization and subsequent innovation and where no such retardation emerged. The history suggests several questions. Have anticommons failures occurred in biomedicine? Are they pervasive? To what degree do we observe restricted access to foundational discoveries that are essential to the subsequent advance of biomedicine? What factors might affect biomedicine’s susceptibility (or lack thereof) to either anticommons or restrictions on the use of upstream discoveries in subsequent research?

DATA AND METHOD

To address these issues, we conducted 70 interviews with IP attorneys, business managers, and scientists from 10 pharmaceutical firms and 15 biotech firms, as well as university researchers and technology transfer officers from 6 universities, patent lawyers, and government and trade association personnel. Table 1 gives the breakdown of the interview respondents by organization and occupation. These interviews averaged over one and a half hours each. The interviews focused on changes in patenting, licensing activity and the relations between pharmaceuticals, biotechnology firms, and universities, and how patent policy has affected firm behavior.

This purposive sampling was designed to solicit information from respondents representing various aspects of biomedical research and drug development (Whyte, 1984). We used the interviews to probe whether there has been a proliferation and fragmentation of patent rights and whether this has resulted in the failure to realize mutually beneficial trades, as predicted by the theory of anti

TABLE 1 Distribution of Interview Respondents, by Organization and Occupation

commons. We also looked for instances in which restricted access to important upstream discoveries has impeded subsequent research. In addition, we asked our respondents how these conditions may have changed over time, including whether the character of negotiations over IP rights have changed. Finally, we asked about strategies and other factors that may have permitted firms to overcome challenges associated with IP.

FINDINGS

Preconditions for an Anticommons

Do conditions that might foster an “anticommons” exist in biomedicine? The essential precondition for an anticommons is the existence of multiple patents covering different components of some product, its method of manufacture, or inputs into the process through which it is discovered.

We have no direct measure of the number of patents covering a new product. There has, however, been a rapid growth in biotechnology patents over the past fifteen years, from 2,000 issued in 1985 to over 13,000 in 2000.12 Such rapid growth is consistent with a sizable number of patents granted for research tools and other patents related to drug development. Our interview respondents also suggest that there are indeed now more patents related to a given drug development project. One biotechnology executive responsible for IP states:

The patent landscape has gotten much more complex in the 11 years I’ve been here. I tell the story that when I started and we were interested in assessing the third party patent situation, back then, it consisted of looking at [4 or 5 named firms]. If none were working on it, that was the extent of due diligence. Now, it

is a routine matter that when I ask for some search for third-party patents, it is not unusual to get an inch or two thick printout filled with patent applications and granted patents…. In addition to dealing with patents over the end product, there are a multitude of patents, potentially, related to intermediate research tools that you may be concerned with as well.”

Almost half of our respondents (representing all three sectors of our sample: big pharmaceutical firms, small biotech firms, and universities) addressed this issue, and all of them agreed that the patent landscape has indeed become more complex.13 How complex is, however, an important issue. Although there are often a large number of patents potentially relevant to a given project, the actual number needed to conduct a drug development project is often substantially smaller. For example, Heller and Eisenberg (1998) use the case of “adrenergic receptor” claims as an illustration of the anticommons problem and find over 100 patents that might require a license to do research in this area. Responding to the Heller and Eisenberg article, Seide and MacLeod (1998) did a search on “adrenergic receptor” and, indeed, found 135 patents using this term. They then did an (admittedly cursory) patent clearance review and found that the vast majority would not in fact be infringed by an assay to screen for ligands against this receptor and that, at most, only a small number of licenses might be required. Another case (from agricultural biotech) was that of putting hemoglobin in maize (Warcoin, 2002). Here, 500 patent applications were initially reviewed, of which 100 were potentially of interest. In the end, 13 relevant patents were identified, including research tools, specific DNA for expression, and the technology for transforming the plant.

We asked about 10 of our industry respondents to tell us how many pieces of IP had to be in-licensed for a typical project. They said that there may be a large number of patents to consider initially—sometimes in the hundreds, and that this number is surely larger than in the past. However, respondents then went on to say that in practice there may be, in a complicated case, about 6-12 that they have to seriously address, but that more typically the number was zero. An IP lawyer at a biotech firm states:

The head of research comes to you and says he intends to develop this product and he wants you to look into the patent situation. You get back an inch or two thick pile of patents. You go through… and make judgments, what patents are relevant? Then, you go through those more in depth…. At the next step, you are

left with 5-10, maybe 20, it depends. Not hundreds. You investigate these…. In the end, there are probably 3-6 that you have to negotiate.

Thus, although most R&D executives report that the number of licenses they must obtain in the course of any given project has increased over the past decade, that number is considered to be manageable.

In addition to a larger number of patents typically bearing on a given project, the numbers and types of institutions involved have also grown. Preceding the recent growth in biotechnology patenting, the number of biotechnology firms grew rapidly in the 1980s (Cockburn et al., 2000). More recently, we observe biotechnology firms acquiring significant patent positions. Hicks et al. (2001), for example, report that the number of U.S. biotechnology firms receiving more than 50 patents in the prior six years grew from zero in 1990 to 13 by 1999.

Universities have also become major players in biotechnology, as sources of both patented biomedical inventions and start-up firms that are often founded on the strength of university-origin patents. Many respondents (14 from industry and 6 from universities) noted that this new role of universities is one of the significant changes over the last two decades in the drug and related industries. Universities have increased their patenting dramatically over the last two decades, and although still small, their share of all patents is significantly higher than before 1980. Furthermore, much of the growth in university patents tends to concentrate in a few utility classes, particularly those related to life sciences. In three of the key biomedical utility classes, universities’ share of total patents increased from about 8 percent in the early 1970s to over 25 percent by the mid-1990s (NSF, 1998). Also, universities’ adjusted gross licensing revenue has grown from 186 million dollars going to 130 universities in 1991 to $862 million going to 190 universities in 1999 (AUTM, 2000), with the preponderance of these sums reflecting activity in the life sciences. An eightfold increase in university technology licensing offices from 1980 to 1995 is further evidence of increasing emphasis on the licensing of university discoveries (Mowery, et al., 2001).

Contributing to the rise in patenting, particularly in genomics, is the intensification of defensive patenting. An executive with a biotechnology firm compared its patenting strategy with that of Japanese firms in industries such as telecommunications or semiconductors: “We have a defensive patent program in genomics. It is the same as in the Japanese electronics industry. There they patent every nut and screw on a copier, camera, and build a huge portfolio, so Sony never sues Panasonic and Panasonic never sues Sony. There is a little of that going on in genomics. That way, if an IP issue ever arose, we have some cards in our hand.” A respondent from a large pharmaceutical firm made a similar comment about their motives for patenting research tools: “I supposed because we see everyone else doing it in part. Sort of like the great Oklahoma Land Rush. If you don’t do it you’re not going to have any place to set up a tent, eventually.” Overall, about a third of our industry respondents claimed to be increasing their pat-

enting of gene sequences, assays, and other research tools as a response to the patenting of others to ensure freedom to operate (see also Henry et al., 2002).14

Thus we observe many patents (especially on research tools) owned by different parties with different agendas. In short, the patent landscape has indeed become more complex—although not as complex as suggested by some. Nonetheless, conditions may indeed be conducive to a tragedy of the anticommons.

Preconditions for Restricted Access to Upstream Discoveries

Our second concern is that restrictive assertion or licensing of patents on research tools—especially foundational upstream discoveries upon which subsequent research must build (such as transgenic mice, embryonic stem cells, or knowledge of a potential drug target)—may undermine the advance of biomedical research. As suggested above, the key condition for this concern holds— namely, that research tools are now commonly patented. One R&D manager, for example, states that, “there has been a pronounced surge in patenting of research tools, previously more freely available in the public domain.” Academic scientists we interviewed affirmed this view, observing a shift from a regime in which findings were more likely to be placed in the public domain with no IP protection.

We do not have patent data on research tools and upstream discoveries per se, but a hallmark of the advance in molecular biology and related fields over the past two decades is a proliferation in new techniques and methods that are inputs into the discovery process. In addition to recombinant DNA, prominent examples include polymerase chain reaction (PCR) and Taq polymerase, OncoMouse and cre-lox technology, and countless discoveries of genes and proteins that can either be used to develop therapeutics (EPO, for example) or offer promising targets for small-molecule drugs (such as the COX-2 enzyme for pain, CCR5 receptor for HIV, or telomerase for cancer).

Restricted access to upstream technology becomes a greater concern and more limiting on downstream research activity as the claims on the upstream patents are interpreted more broadly. The complaint about Human Genome Sciences asserting its patent over the HIV receptor illustrates the concern that patent holders are able to exercise control over a broad area even when their own upstream invention is narrow and there is very little disclosed about the utility of the invention (Marshall, 2000a). At the time of the patent application, Human Genome Sciences (HGS) knew only that they had found the gene for something that was a chemokine receptor. Later work published by NIH scientists detailed how

this receptor (CCR5) worked with HIV, making this a very important drug target. Those who discovered the utility of this receptor for AIDS research and drug development filed patents, only to find that Human Genome Sciences’ “latent” discovery had priority. The concern is that knowledge of the reach of HGS’s patent could have deterred subsequent research exploring the role of the gene and the associated receptor.

Another way in which the absence of a clear written description may allow upstream patents to directly affect subsequent research is via “reach-through” patent claims (as distinct from license agreements that include royalties on the product discovered using a research tool). Here, the patent claims the target and any compound that acts on the target to produce the desired effect, without describing what those compounds are. A commonly cited case is the University of Rochester’s patent on the COX-2 enzyme, which includes claims on drugs that inhibit the enzyme.15 This claim is the basis of the lawsuit against Searle for patent infringement.16 Again, if the patentholder is given broad rights to exclude others from pursuing research in this area, we could have the problem of no one in fact possessing the innovation (in this case, a COX-2 inhibitor), and greatly reduced incentives for non-patentholders to explore possible uses of the innovation.

Thus there is a proliferation of patents on upstream discoveries and tools, and how those patents affect downstream discovery depends heavily on the breadth of claims. Although the USPTO has permitted broad claims to issue, there remains the question of how the courts will evaluate those claims.

Evidence of an Anticommons in Biomedical Research

Given that the preconditions for an anticommons seem to exist, we turn to our findings on the incidence and nature of the different impediments to biomedical research that an anticommons may pose. These include breakdowns in negotiations over rights, royalty stacking, and “excessive” license fees.

|

15 |

USP 6,048,850: “A method for selectively inhibiting PGHS-2 activity in a human host, comprising administering a non-steroid compound that selectively inhibits activity of the PGHS-2 gene product to a human host in need of such treatment.” The compounds claimed include (but are not limited to): “nucleic acid encoding PGHS-2 and homologues, analogues, and deletions thereof, as well as antisense, ribozyme, triple helix, antibody, and polypeptide molecules as well as small inorganic molecules; and pharmaceutical formulations and routes of administration for such compounds.” |

|

16 |

Recently, the U.S. District Court for Western New York dismissed the University of Rochester’s complaint, reasoning that the description of the discovery in the school’s patent lacked the clarity necessary to support an infringement claim [University of Rochester v. G.D. Searle & Co., Inc., No. 00-CV-6161L., 2003 WL 759719 (W.D.N.Y. Mar. 5, 2003)]. The University of Rochester indicated an intention to appeal the case. See http://www.urmc.rochester.edu/pr/news/news.cfm?ID=198 |

Breakdowns

Perhaps the most extreme expression of an anticommons tragedy is the existence of multiple rights holders spawning a breakdown in negotiations over rights that lead to an R&D project’s cessation. We find almost no evidence of such breakdowns. Although idiosyncratic (because of the role played by policymakers and the absence of clear commercial value), the case of beta-carotene-enhanced rice (GoldenRice™) shows that the holding of IP by numerous parties need not defeat the development and commercialization of an innovation. Indeed, the complexity of this case is quite extreme, involving as many as 70 pieces of IP and 15 pieces of technical property spread over 31 institutions (Kryder et al., 2000).17 Although there was strong interest in this product from international aid agencies, they required general IP clearance before the product could be developed. After about a year of negotiations, Monsanto, Zeneca, and others agreed to provide royalty-free licenses for the development and distribution of this innovation in third world countries.18

Beyond the case of GoldenRice™, we asked respondents and searched the literature to identify cases in which projects were stopped because of an inability to obtain access to all the necessary intellectual property rights. In brief, respondents reported that negotiations over access to necessary IP from many rights holders rarely led to a project’s cessation. Of the 55 respondents who addressed this issue (representing all three sectors), 54 could not point to a specific project stopped because of difficulties in getting agreement from multiple IP owners (the anticommons problem). For example, one respondent indicated that about a quarter of his firm’s projects were terminated in the past year. Of these, none were terminated because of any difficulties with the in-licensing of tools. Instead, the key factors included pessimism about technical success and the size of the prospective market. One biotechnology executive stated: “I am hard pressed to think of a piece of research that we haven’t done because of blocked access to a research tool. We have dropped products because others were ahead in proprietary position, but that is different.”19

A particular concern raised by Heller and Eisenberg (1998) and the National Research Council (1997, Ch. 5) was the prospect that, by potentially increasing the number of patent rights corresponding to a single gene, patents on expressed sequence tags (ESTs) would proliferate the number of claimants to prospective drugs and increase the likelihood of bargaining breakdowns. Our respondents suggested that this has not occurred. The key concern was that patents on the partial sequence might give the patentholder rights to the whole gene or the associated protein, or at least that the patent might block later patents issued on the gene or the protein [as Doll (1998) of the USPTO suggested]. Our respondents from industry and from the USPTO reflected, however, the view of Genentech’s Dennis Henner who testified before Congress that EST patents do not dominate the full gene sequence patent, the protein, or the protein’s use; these are separate inventions.20 Also, although the existence of large numbers of EST patents may have had the potential to create anticommons problems, the new utility and written description guidelines implemented by the USPTO will now likely prevent many EST patents from issuing and will grant those that do issue only a narrow scope of claims. In addition, it is likely that already-issued EST patents will be narrowly construed by the courts. Thus the consensus is that the storm over ESTs has largely passed.

Royalty Stacking

Another way in which multiple claimants on research tool IP may block drug discovery and development is the stacking of license fees and royalties to the point of overwhelming the commercial value of a prospective product. Most of our respondents reported that royalty stacking did not represent a significant or pervasive threat to ongoing R&D projects. One respondent said that, although stacking is a consideration, “I can’t think of any example where someone said they did not develop a therapeutic because the royalty was not reasonable.” We only heard of one instance in which a project was stopped because of royalty stacking. We were told, however, that, in this case, there were too many claimants to royalty percentages because of carelessness by a manager, who had given away royalty percentages without carefully accounting for prior agreements.21 One of our other biotechnology respondents suggested, however, that “the royalty burden can become onerous” and that the stacking of royalties “comes up pretty regularly now” with the proliferation of IP. Even here, the respondent said that no projects had ever been stopped because of royalty stacking. Overall, about

|

20 |

Testimony before House Judiciary Committee, 7/13/00, htttp://www.house.gove/judiciary/henn0713.htm. |

|

21 |

We also had one respondent, an IP lawyer, who said such cases where projects were stopped existed, but client privilege prevented the respondent from giving details. |

half of our respondents complained about licensing costs for research tools, although nearly all of those concerned about licensing costs also went on to say that the research always went forward.

Royalty stacking does not represent a significant threat to ongoing R&D projects for several reasons. First, and principally, the total of fees paid, as discussed below, typically does not push projects into a loss. Second, in the minority of cases in which the stacking of fees threatens a loss, compromises tend to be struck, often in the form of royalty offsets across the various IP holders. One respondent stated, “All are sensitive and aware of the stacking phenomenon so there is a basis for negotiation, so that you don’t have excessive royalties.” Finally, in the few cases in which such a problem might emerge, it also tends to be anticipated.22 One firm executive we interviewed said they had a corporate-level committee that reviewed all such requests to make sure such problems do not occur.

Licensing Fees for Research Tools

Although obtaining systematic data on the cost of patented research tools is difficult, half of our respondents provided enough information to allow us to approximate the range of such costs. The norm for total royalty payments for the various input technologies associated with a given drug development program is in the range of 1 to 5 percent of sales, and somewhat higher for exclusive licenses. Occasionally, royalty demands were 10 percent or higher, and these were described in such terms as “high” or “ridiculous.” Firms (especially the large pharmaceutical firms) also license particular technologies—such as using a gene for screening or a vector or microarrays—for a fee ranging from $10,000 to $200,000. These fees (especially for genes) were often described (by both those buying and those selling such technologies) as small amounts that large pharmaceutical firms paid as insurance both to ensure freedom to operate and to avoid the cost of litigation. The cost of patented reagents could be two to four times as much as do-it-yourself versions (or, in the case of Taq polymerase, buying from an unlicensed vendor), although the overall cost to the project is generally small (at most a few percent).

Large pharmaceutical firms have also been licensing access to genomic databases, and these database fees are often tens of millions of dollars and occasionally over $100 million (Science, 1997). In 1997, for access to its database, Incyte

was reported to be charging $10 million to Upjohn and almost $16 million to Pfizer, as well as undisclosed amounts to eight other firms. These deals also include “low single-digit” royalties for use of patented genes in drug development. Four pharmaceutical firms paid between $44 million and $90 million each to Millennium to access their data and research tools for identifying disease genes. In 1998, Bayer agreed to a deal in which they would pay up to $465 million to Millennium to have Millennium identify 225 new drug targets within 5 years (Malakoff and Service, 2001).

Overall, our respondents noted that, although these costs were higher than before the surge in research tool patents, they believed them to be within reason largely because the productivity gains conferred by the licensed research tools were thought to be worth the price. The case of Human Genome Sciences’ database is illustrative. In 1993, SmithKline signed a deal for exclusive access for $125 million. By 1996, the database had already “saturated SmithKline with [drug-target] opportunities,” according to Human Genome Sciences’ Haseltine. Therefore, the partners extended access to the database to three other firms, who contributed a total of $140 million (Cohen, 1997). One scientist at a large pharmaceutical firm characterized the return to paying for access to Incyte’s database as follows:

The richness in Incyte’s database is quite impressive. If you are just stuck with the things in the public database, the map is interesting, it is exciting, but it is a lot harder.… I was telling my family recently that I probably could have done my 4 year 8 month Ph.D. in about 6 months with today’s technology…. it is that big of a technology revolution.23

Thus, although the development and patenting of research tools and upstream discoveries are imposing costs on downstream users, some of those users believe that their research is substantially more productive as a consequence.

Our interviews suggested, however, that although these costs were seen as manageable by large pharmaceuticals firms, and even by established biotech

firms, small start-up firms and university labs noted that such costs could be prohibitive, in effect making it impossible for them to license particular research tools. This issue of restricted access due to high prices was prominently raised in the National Academy’s workshop on IP and biomedical innovation (National Research Council, 1997). One of our respondents suggested that, for example, “DNA chips are a high-investment technology. Very small labs can’t afford to do it. When the technology is out of reach of small labs, they have to collaborate. But this collaboration generally means giving up IP rights. The technology forces collaboration because barriers to entry are high.” This sentiment was echoed by university researchers we talked with. This was one justification for the “do-it-yourself” solution of making patented laboratory technology without paying royalties (Marshall, 1999b).24 Similarly, the manager of a small biotech start-up told us that Incyte’s licensing terms for access to their gene database was several times the firm’s whole annual budget. They were forced to rely on the public databases, a viable but second-best solution. One solution for universities has been the development of core facilities to share expensive resources such as chip-making facilities or high-throughput screening.

Some firms (particularly genomics firms) holding rights over research tools did, however, offer discounted terms for university and government researchers. Celera, for example, licenses their database to firms for about $5 million to $15 million per year and to university labs for about $7,500 to $15,000 (Service, 2001). In 2000, Incyte began allowing single-gene searches of its database for free, with a charge of $3,000 or more for ordering sequences or physical clones, making its database more accessible to small users (Science, 2000). Myriad also offers a discount rate (less than half the market rate) for academics doing NIH-funded research on breast cancer (Blanton, 2002).

In this section, we have considered the costs of licensing research tool IP— but only the out-of-pocket, monetary costs. Costs can, however, also take non-monetary forms. The most prominent of these for university researchers are publication restrictions, which we did not examine.25

Projects Not Undertaken and Broader Determinants of R&D

Although the number of ongoing R&D projects stopped because of an anticommons problem is small, it is possible that firms avoid stacking and other difficulties in accessing IP rights by simply not undertaking a project to begin with. As a practical matter, it is difficult to measure the extent to which projects were not started or redirected because of patent-related concerns. In brief, although redirecting projects to invent around research tool patents was common, it was relatively rare for firms to move to a new research area (perhaps a new disease, or even a very different way of approaching a disease) because of concerns over one or more research tool patents. Of the 11 industry respondents who did mention IP as a cause for redirecting their research, seven, however, were primarily concerned with IP on compounds, not on research tools.26 An IP attorney with a large biotech firm suggested that patents on research tools were rarely determinative, reporting that in the “scores of projects” that his firm considered undertaking over the years, he could remember only one where such patent rights dissuaded them from undertaking the project. Another biotech firm’s lawyer, while reporting that they had never stopped an ongoing project because of license stacking, stated that considerations of patents on both compounds and research tools did preempt projects:

We start very early on… to assess the patent situation. When the patent situation looks too formidable, the project never gets off the ground.… Once you are well into development, you get patent issues, but not the show stopper that you would identify early on.

Although we have no systematic data on projects never pursued, our findings on the absence of breakdowns is consistent with the notion that there are relatively few cases where otherwise commercially promising projects are not undertaken because of IP on research tools. Consider Heller’s (1998) original article on the anticommons, which paints a vivid image of empty buildings in Moscow, unrented because the various owners and claim holders that could “veto” a rental arrangement were many and had trouble coming to agreement. Our analogue to an “empty building” is, of course, an R&D project that is stopped midway. However, if the argument that the proliferation of IP is generating an “anticommons” is correct, it follows that the rational anticipation of such difficulties would prevent the construction of some (or many) buildings. Likewise, some R&D projects may not be undertaken if firms anticipate difficulty in negotiating cost-effective access to the required IP. However, absent any visible empty buildings (i.e., ob-

served stopped projects), it is unlikely that the anticipation of breakdowns in negotiations or an excessive accumulation of claims (i.e., license stacking) prevented construction (i.e., undertaking the R&D project).27

Our interviews suggested that the main reasons why projects were not undertaken reflected considerations of technological opportunity, demand, and internal resource constraints, with expected licensing fees or “tangles” of rights on tools playing a subordinate role, salient only for those projects which were commercially less viable. One industrial respondent affirmed that, although other considerations were key, royalty stacking could affect decisions at the margin: “I don’t want to say a worthwhile therapeutic was not developed because of stacking problems. But if we have two equally viable candidates, then we choose based on royalties.” One biotechnology respondent was explicit, however, about the greater importance of expected demand and technological opportunity: “At the preclinical stage, you find you have 10 candidates, and you can afford to continue work on 3. The decision is a complex prediction based on the potential for technical success, the cost of manufacturing, the size of the market, what you can charge, what you need to put in for royalties. I am not familiar with royalty stacking being the deciding factor. The probability of technical success and the size of market are key.” This last remark also implies that the firm had more viable opportunities than it had the resources to pursue. Indeed, complaints about resource constraints as impediments to progress on promising research were more common than complaints about IP. As one research manager from a pharmaceutical firm put it: “What we find limiting in our process is the number of chemists we can bring to bear. That is the most limiting resource we have. We have more targets than we have chemists to work on them.”28

The notion that opportunities often exceed the ability of firms to pursue them suggests that, at least under some circumstances, the social cost of not pursuing projects because of IP considerations may not be as great as one might suppose.29 Indeed, four of our industry respondents expressed the view that redirection of research effort toward areas less encumbered by patents was not terribly costly for their firm or others because the technological opportunities in molecular biology and related fields were so rich and varied. As one biotech respondent put it, “There are lots of targets, lots of diseases.” Some respondents have suggested that the value of targets has actually declined substantially because companies can’t exploit all of the targets they have, and so firms are more willing to license some of their targets, or abandon some of their patents and let the inventions shift to the public domain, because maintaining large portfolios of low-value patents is expensive. On the other hand, one can also argue that even in the presence of rich opportunities, shifting may be costly to the extent that diminishing the number of firms trying to achieve some technical objective makes success less likely.

Evidence of Restricted Access to Upstream Discoveries and Tools

Although biomedical research does not appear to be especially vulnerable to breakdowns over IP negotiations, restricted access to important research tools— especially foundational upstream discoveries—can potentially impede innovation in a field. Moreover, this has occurred in other settings (Merges and Nelson, 1990). Our question is whether the restrictions on access to such upstream discoveries, through, for example, exclusive licensing, has impeded biomedical innovation. As noted above, in contrast to the prospect of an anticommons, this is not a problem of accessing multiple rights but one of accessing relatively few— perhaps even one—patent on a key tool or discovery.

In its report, “Intellectual Property Rights and Research Tools in Molecular Biology,” the NRC (1997) provided a series of case studies on the uses of patents covering a small number of important research tools in molecular biology where the question of restricted access was considered. In the case of the Cohen-Boyer technology for recombinant DNA developed at Stanford University and the University of California—“arguably the defining technique of modern molecular biology” (NRC, 1997, p. 40)—the three patents were broadly licensed on a nonexclusive basis on a sliding scale, providing the basis for the creation of the biotechnology industry as we know it. The license was available for about $10,000

per year plus a royalty of 0.5 to 3 percent of sales (Hamilton, 1997). Stanford and UC eventually had several hundred licensees, and the patent generated an estimated $200 million for the universities.

The second case was that of polymerase chain reaction (PCR) technology, which “allows the specific and rapid amplification of DNA or targeted RNA sequences,” and Taq polymerase, which is the enzyme used in the amplification. The technology was also key to subsequent innovation. It “…had a profound impact on basic research not only because it makes many research tasks more efficient but also because it …made feasible …experimental approaches that were not possible before” (NRC, 1997). In addition to being a discovery tool, the technology also provides a commercial product in the form of diagnostic tests. Developed by Cetus Corporation, the technology was sold to Roche in 1991 for $300 million. As the NRC (1997) reports, the controversy over the sale of the technology has been primarily over the amount of the licensing fees and the fees charged for the material (Taq polymerase) itself. Although Roche licensed the technology widely, particularly to the research community, they did charge high royalty rates on their licenses for diagnostic service applications. Also, small firms complained about Roche’s fees for applications of the technology outside of diagnostics, which ranged between $100,000 and $500,000 initially with a royalty rate of 15 percent. The high price likely restricted access for some, especially small biotech firms.30

The CellPro case, described in detail by Bar-Shalom and Cook-Deegan (2002),31 also illustrates the potential for the owners of upstream patents to block development of cumulative systems technologies (cf. Merges and Nelson, 1994). Johns Hopkins University’s Curt Civin discovered an antibody (My-10) that selectively binds to an antigen, CD34, found on stem cells but not on more differentiated cells. In 1990, Hopkins was awarded a patent that claims all antibodies that recognize CD34. Baxter obtained an exclusive license. The chief rival was CellPro, a company founded in 1989 based on two key technologies: one a method for using selectively binding antibodies to enrich bone marrow stem cells or deplete tumor cells, and the other an unpatented antibody, 12-8, that also binds to CD34, although in a different class of antibodies from Civin’s My-10 and recognizing a different epitope (binding site) on CD34. CellPro combined these two discoveries with other innovations and know-how to produce a cell separator instrument for use in cancer therapies, particularly bone marrow transplants.

Baxter offered CellPro a nonexclusive license for $750,000 plus a 16 percent royalty.32 CellPro felt this was uneconomic and, armed with a letter from outside counsel saying that CellPro’s technology did not infringe and that the patent was probably invalid, decided to move forward with development and to sue to invalidate the patent. Although the jury ruled in CellPro’s favor, the Markman decision reopened the case and the judge ruled for Baxter, assessing treble damages totaling $7.6 million, as well as $8 million in legal fees.33 The court also ordered license terms similar to (though somewhat higher than) existing licenses, a royalty of over $1,000 per machine. CellPro lost the appeal and went bankrupt. Baxter allowed sales of CellPro’s machine until its own instrument (which Baxter was developing all through this) received FDA approval. In the end, the technology did not prove to be widely effective, and more successful rival technologies were developed by others.

From our perspective, the main lesson of the CellPro case is that, to the degree that upstream patents are broadly interpreted, IP holders can use this broad claim to prevent others from engaging in the subsequent development needed to bring the patented technology to market. This is troubling when the patent owner or exclusive licensee cannot effectively develop the technology in a timely fashion, which was the case with Baxter, which was at least 2 years behind CellPro in bringing a product to market.34

Another case was that of the Harvard OncoMouse, licensed by Harvard exclusively to DuPont. The OncoMouse contained a recombinant activated oncogene sequence that permitted it to be employed both as an important model system for studying cancer and permitting early-stage testing of potential anticancer drugs. After years of negotiations, NIH and DuPont finally signed a memo of understanding in January 2000 that, among other things, permitted relatively unencumbered distribution of the technology from one academic institution to another, although under specific conditions.35 Although this agreement was the cause of relief on the part of academic researchers, DuPont has just recently begun asserting its patent against selected institutions (Neighbour, 2002). The diffi

|

32 |

Baxter also licensed the patents to two other firms, for $750,000 and 8 percent royalties. These figures illustrate the cost for the license terms for a component of a therapeutic system, with the top of this scale probably at the high end, because CellPro was reluctant to take the terms and Nexell could not profitably produce a product under its terms. |

|

33 |

This provides an example of the scale for legal fees involved in such a case (see below). |

|

34 |

Bar-Shalom and Cook-Deegan (2002) also suggest that royalty stacking may have made the technology economically unfeasible. Hopkins had licensed to B-D, which in turn licensed to Baxter, which in turn licensed to others, with each taking a share of the rents. However, in this case, the license stacking was all on the same technology being passed from hand to hand. Thus, this was not a tragedy of the anticommons, but one of a proliferation of middlemen. |

|

35 |

In 1998, NIH announced an agreement with DuPont covering cre-lox technology (see MOU at http://ott.od.nih.gov/textonly/cre-lox.htm). In January, 2000, NIH announced an agreement covering OncoMouse (see MOU at http://ott.od.nih.gov/textonly/oncomous.htm). |

culty is that although the initial press release suggested that these nonpaying rights to use the OncoMouse covered nonprofit recipients of NIH funding, the actual agreement stated that DuPont would make available similar rights to nonprofit NIH grantees “under separate written agreements.” Because most universities have not asked for those rights, they stand outside of the agreement, and DuPont has begun to approach some of them, claiming that they are infringing Harvard’s patent rights and must take a license from DuPont. The difficulty is that these new license agreements, although also nonpaying in principle, go well beyond the earlier understanding and make a series of stringent demands. Under the proposed agreement, for example, universities cannot use the technology in industry-sponsored research without the sponsor taking a commercial license, notwithstanding the content or intent of the sponsored research (Neighbour, 2002). It is unclear at this point, however, what success DuPont will have or how NIH and other institutions will respond.

The most visible recent controversy over access to IP covering a foundational biomedical discovery is the case of embryonic stem cell technology.36 In brief, Geron funded the research of a University of Wisconsin developmental biologist, James Thompson, who in 1998 first isolated human embryonic stem cells and was issued a very broad patent. The Wisconsin Alumni Research Foundation (WARF), a university affiliate, held the patent and granted Geron exclusive rights to develop the cells into six tissue types that might be used to treat disease as well as options to acquire the exclusive rights to others. Another beneficiary of Geron support, Johns Hopkins University, also provided Geron with exclusive licenses on stem cell technology. In August 2001, WARF sued Geron— who had been trying to expand its rights to include an additional 12 tissue types— to be able to offer licensing rights to Geron’s competitors. In January 2002, a settlement was reached that narrowed Geron’s exclusive commercial rights to the development of only three types of cells—neural, heart, and pancreatic, gave it only nonexclusive rights to develop treatments based on three other cell types— bone, blood, and cartilage, and removed its option to acquire exclusive rights over additional cell types. Geron and WARF also agreed to grant rights free of charge to academic and government scientists to use the stem cell patents for research but not for commercial purposes.37 Companies wishing to use the stem cells for research purposes would, however, have to license the patents. Thus it would appear that although WARF would like to license the technology broadly,

Geron still retains control over key application areas of the technology and may well decide to pursue those applications itself. Indeed, David Greenwood, CFO and senior VP of Geron, noted that Geron did not have to allow others to develop products in the three areas where it retained exclusive rights. It is unclear, however, whether Geron’s now limited control of IP rights block others’ research on stem cell technology. According to one respondent, infringement of Geron’s IP is commonplace.38 Moreover, scientific advances in both adult stem cell technology and the use of unfertilized eggs to spawn stem cells may weaken the constraints imposed by Geron’s IP by broadening the access to the commercial development of noninfringing stem cell technology.

We have considered the question of research access to a small number of important upstream discoveries. Evidence from AUTM also suggests that, at least for licensing relationships between universities and small firms, access to relatively upstream discoveries—that is, the kind of discoveries that tend to originate from university labs—is commonly restricted. Specifically, in 1999, 90 percent of licenses to start-ups were exclusive, whereas only 39 percent of licenses to large firms were exclusive (AUTM, 2000). Similarly, in their study of licensing practices for genetic inventions, Henry et al. (2002) report that 68 percent of licenses granted by university and public labs were exclusive, whereas only 27 percent of licenses granted by firms were exclusive. However, only a minority of university-based discoveries are patented to begin with. Henry et al. (2002) [consistent with Mowery et al.’s prior (2001) results] find that only about 15 percent of university-based genetic discoveries are patented, with the vast majority going into the public domain without IP protection.

Even where universities employ restrictive licensing terms, however, it is not clear that such a practice diminishes follow-on discovery, at least when applied to smaller firms. One manager of a university-based start-up suggests that exclusive licensing to smaller biotech firms may actually advance follow-on discovery:

The traditional way universities did this [technology transfer] would be to go license a large company. Those kinds of agreement [include a]…minimal up front [fee] and small royalty, 1-2 percent. What the experience has been then is often the large company will work on it for a while but if it doesn’t look very promising, or they run into problems, which invariably they do…since they haven’t invested much in it, they don’t have a whole lot of motivation to stick with it. So, most of these licensing agreements that universities have done ended

up going nowhere. The idea the university had, and other universities are beginning to do this, is to create small companies like us where the small company has every motivation to develop it because it is the only intellectual property that they have. The university then has more control over the situation because they are an equity owner. Hopefully the small company can develop the molecule to the point where some real value would be achieved, …where we get somebody interested, and that somebody will take it over and eventually market it.

Restrictions on the Use of Targets

In our interviews, we heard widespread complaints from universities, biotechnology firms and pharmaceutical firms over patentholders’ assertion of exclusivity over an important class of research tools, namely “targets,” which refers to any cell receptor, enzyme, or other protein implicated in a disease, thus representing a promising locus for drug intervention. Our respondents repeatedly complained about a firm excluding all others from exploiting its target (in the anticipation of doing so itself) or, similarly, a firm or university licensing the target exclusively. About one-third of respondents (representing all three types of respondents) voiced concerns over patents on gene targets (for example, the COX-2 enzyme patent, the CCR5 HIV receptor patent, and the hepatitis C protease patent).

Before considering the degree to which the assertion and licensing of IP on targets may be restricting their use in downstream research, we should recall that, to the extent that patents on targets do confer effective exclusivity, even over the ability of other firms to conduct research on a particular disease, this is the purpose of a patent—to allow temporary exclusivity. Responding to complaints about restricted access to their patented targets, a respondent from a pharmaceuticals firm stated: “Your competitors find out that you’ve filed against anything they might do. They complain, ‘How can we do research?’ I respond, ‘It was not my intent for you to do research.’” Others also defended their rights to exclude rivals from their patented targets. More importantly, this right to assert exclusivity may confer a benefit in the form of increasing the incentives to do the research to discover the target to begin with, as well as incentives for follow-on investment to exploit the target. A key question, then, is whether those incentives can be protected while allowing reasonably broad access.39

Patents on targets, if broad in scope and exploited on an exclusive basis, may preclude the benefits of different firms with distinctive capabilities and percep-

tions pursuing different approaches to the problem (cf. Nelson, 1961; Cohen and Klepper, 1992). For example, big pharmaceuticals firms have libraries of compounds that might affect the target. These libraries vary by firm and are either kept secret or patented. Thus, narrowing access to the target entails a social cost. The following quote from a large biotech firm summarizes the issue:

The problem is, a target is just that, a target, say, a receptor on a cell. If we did an exclusive license, and we’ve had that opportunity, the only compounds tested would be those in the chemical library of our licensee. Generally there is no chemical relation among the compounds that [act on this target]. The drugs work by occupying the reception site, for example. They [the licensee] throw all the compounds in their library and they may or may not have one that works well. The libraries vary a lot across firms. A lot are patented. Also large pharma companies have huge collections of compounds they’ve synthesized over the last 100 years that have never seen the light of day. With an exclusive license, the odds of finding an active drug, let alone the best, are not good. Therefore, we [the target owner] want the target technology broadly available. Broad licensing only makes economic sense in our view.

The problem of “limited lines of attack” may be greater when exclusive access to a set of targets is held by a smaller firm with limited capabilities, and, as noted above, much of the university licensing of biomedical innovations to small firms is on an exclusive basis. Although perhaps biased, a scientist from a large pharmaceutical firm described the broader capabilities of the large pharmaceutical firm to develop the potential of a target: “[Once the target had been identified], then, the power of the pharmaceutical company comes into play. You put an army of 50 molecular biologists and one-third of the medicinal chemists at [the firm] on this single problem.”

In addition to the constraints imposed by firms’ particular capabilities on the approaches taken to exploiting targets, there are also differences in firm strategies or approaches to drug development.40 The following quotation from a scientist at a small start-up highlights this problem:

Part of the problem that comes in here is that many of these firms are very specialized and many times somebody holds patents but they don’t do all the

applications feasible. So, what happens is they don’t think about doing something and many times the royalty is so high that other companies, small companies that come up with ideas, may not be able to come in and negotiate the license deal. So, it becomes, by default, what happens now. It’s not that the patent holder says the idea is great but I’m not going to let anybody do it. But, it never occurs to them.

Although limiting access to targets may well limit their exploitation, the question is how often this occurs. We do not have systematic data on the frequency with which this occurs. From interviews and secondary sources, however, we heard of a number of prominent examples of firms’ being accused of asserting exclusivity over (or allowing only limited access to) a target. One case that has garnered a lot of attention is Myriad and its patents on a breast cancer gene (BRCA1). Myriad has been accused of stifling research because it has been unwilling to broadly license diagnostic use of its patents (Blanton, 2002). Myriad counters that over a dozen institutions had been licensed to do tests and that “Myriad’s position is to not require a research license for anybody,” while reserving the right to decide whether particular uses are research or commercial (Bunk, 1999; Blanton, 2002). Myriad sent a letter threatening a lawsuit to the University of Pennsylvania to stop them from performing genetic tests, arguing that this was commercial infringement (see below). Chiron has also developed a reputation for aggressively enforcing its patents on research targets. Chiron has filed suits against four firms that were doing research on drugs that block the hepatitis C virus (HCV) protease (in addition to filing suits against three firms doing diagnostics), and some have claimed that these suits are deterring others from developing HCV drugs (Cohen, 1999). Chiron responded to this claim by pointing out that it had licensed its patent to five pharmaceutical companies for drug development work (as well as at least five firms for diagnostic testing) and that the firms being sued had refused a license on essentially the same terms, which included significant up-front payments as well as “reach-through” royalties on the drug.

Also mentioned by our respondents was the case of telomerase as a potential target for cancer drugs. One university scientist observed: “I’ve asked heads of discovery why they were not using telomerase as a target. The response was, ‘intellectual property.’” A scientist from a biotech firm suggested that Geron, the key IP owner, had been stymied in pursuing this because of the complexity of the

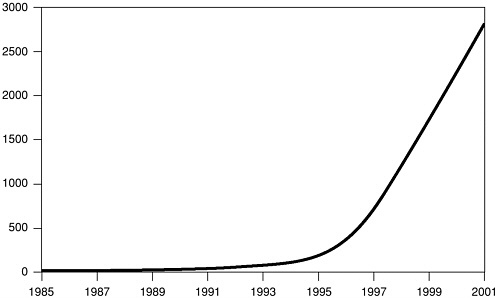

biology41 and had redirected their efforts toward stem cell research, which looked more promising. Upon investigation, we found that Geron had indeed established a substantial patent position, with 56 U.S. patents related to telomerase. However, we also found that there is a great deal of research being done on telomerase in universities (see Figure 1) and that at least three other firms (Amgen, Novartis, Boehringer Ingelheim) are reported to be pursuing telomerase as a target (Marx, 2002b). In addition, Geron presented the results of three separate studies on telomerase-based anticancer projects at the April 2002 meetings of the American Association for Cancer Research. Furthermore, Geron has formed a number of nonexclusive licensing agreements for the exploitation of telomerase, typically with small biotech firms possessing complementary technology. Thus, although

FIGURE 1 Cumulative citations for “Telomerase” in MEDLINE. Credit: C. Greider/Johns Hopkins University School of Medicine. Source: Marx (2002a).

we again see some evidence of researchers being excluded, we do not find a failure to exploit the target.

Others have also complained about being blocked from working on targets because of restrictions imposed by patent holders. For example, The New York Times reported, “Peter Ringrose, chief scientific officer at Bristol-Myers, has said there are more than 50 proteins possibly involved in cancer that the company was not working on because the patent holders either would not allow it or were demanding unreasonable royalties” (The New York Times, Jan. 8, 2001, p. C2).

Ringrose’s complaint was reported, however, in the context of the announcement of a licensing pact between Bristol-Myers and Athersys, which has a technique for producing proteins without isolating the corresponding gene, allowing use of the protein as a target without infringing patents on the gene, and therefore allowing circumvention of patents on genetic targets. This last point raises a question about the degree to which third-party patents on targets can actually impede firms’ abilities to pursue R&D programs dedicated to particular therapies. We discuss this important issue below in the section on working solutions.

Costs and Delays

In this section we consider the transactions costs associated with gaining access to one or multiple patents or responding to third-party assertions.42 For instance, firms may avoid derailing in-house R&D projects but only by engaging in long and costly negotiations or litigation with IP holders. Firms may also invent around or conduct the R&D overseas, possibly at the cost of reducing R&D efficiency. Finally, IP holders may have to invest in monitoring the use of their IP, which, from a social welfare perspective, also constitutes a cost. Over a third of respondents (representing all three sectors) noted that dealing with research tool patents did cause delays and add to the cost of research.43

Litigation costs are likely to be a significant component of the social costs of the assertion and licensing of patents in biomedicine. Furthermore, biomedical patents are more likely to be litigated than are patents on other technologies (Lanjouw and Schankerman, 2001). Although estimates of litigation costs vary, estimates commonly ranged between $1 million-10 million for each side (see, for example, the discussion of the CellPro case above, where attorney fees were $8 million). One respondent from a biotech firm used the following comparison to put this into perspective:

[XX lawsuit] cost $8 million per year and it was not done in a year. Think about $8 million, about what a biotech could do for $8 million. You could get a lot of science done. Depending on your burn rate, you could easily run a fully dedicated drug discovery program for $8 million. You could have afforded a reasonable number of people to work on that project for that year without any question whatsoever. It wouldn’t surprise me that you could get in that position [because of a suit] that you would have to shut down a particular program.

In addition to these out-of-pocket expenses, we tried to estimate the opportunity cost of engaging in patent litigation. Out of the 16 industry respondents that addressed this issue, all but 1 suggested that litigation imposed a significant burden on the managers and scientists involved. In terms of actual work time, estimates were usually in terms of a few weeks over the course of a year for the individuals involved. Respondents also underscored the time spent worrying about the progress and outcome of the case. One respondent from a biotech described the process:

Going to court is risky any time.… Patentability is complicated. You spend a lot of money educating the jury. You have to go searching through notebooks. If you do decide to sue, you have to be committed. The CEO, CFO are involved. You pull in business people to evaluate. Senior management and the particular inventors spend copious amounts of time on it; it is a huge distraction. They are in deposition, practicing for depositions, researching, responding to interrogatories, providing information. In a year, it costs a couple of man months. The CEO is in deposition for a week. My firm’s experience has been that they want to ask everyone under the sun who was involved. I was tangentially involved and in deposition for a day and half. Duplicating all your files. Each page of your notebook, from 10 years ago, you have to find it, reproduce it. It is an enormous time sink and I think people underestimate it. Clients underestimate it. Even a winner may say, “If I knew then, I might say ‘No’.” Meantime, you are not doing science. Time not spent on new compounds, spent on what will they do in trial tomorrow.

About a third of our respondents addressed the question of negotiation delays or litigation, and nearly all of them felt that the process of sifting through a large number of potentially relevant patents and subsequent negotiations was very time consuming. One characterized the process as “complex, ongoing, and labor intensive,” but a cost of doing business. Another stated: “All these patents makes

research more expensive. It can slow it down, while you secure licenses.” One biotechnology executive suggested that about a third of his firm’s R&D projects suffer delays while licensing and related agreements are worked out. The above-cited quotation on reducing the stack of patents suggests that it commonly took about three or four weeks to sift through the patents potentially relevant to a project, often identifying somewhere between 5 and 20 that may be worth investigating intensively over the course of another three to six months. The respondent noted, however, that the research itself would typically be moving forward during this time. At this point, it would be typically determined that there are about three to six patents where agreements were required, and these negotiations could affect the progress and direction of the firm’s R&D. The costs of negotiations as well as those for reviewing potentially relevant patents can be substantial in absolute terms. One attorney responsible for evaluating research tool IP from a large pharmaceuticals firm provided estimates for the time attorneys were occupied with evaluating the IP of third parties and the time associated with actual negotiations that implied a total of $2 million in annual expenses.

Another respondent from a large pharmaceuticals firm suggested that the transactions costs associated with biotech IP were especially high. He gave the following metric: Lawyers in the small molecule division (of this firm) are responsible for about eight projects each, whereas those in the biotech division can only handle about two projects each, because of the greater complexity of dealing with input technologies in biotech-based projects.