Accounting for Growth in the Information Age

Dale W. Jorgenson

Harvard University

1. THE INFORMATION AGE*

1.1. Introduction

The resurgence of the American economy since 1995 has outrun all but the most optimistic expectations. Economic forecasting models have been seriously off track and growth projections have been revised repeatedly to reflect a more sanguine outlook.1 It is not surprising that the unusual combination of more rapid growth and slower inflation touched off a strenuous debate about whether improvements in America’s economic performance could be sustained.

The starting point for the economic debate is the thesis that the 1990s are a

mirror image of the 1970s, when an unfavorable series of “supply shocks” led to stagflation—slower growth and higher inflation.2 In this view, the development of information technology (IT) is one of a series of positive, but temporary, shocks. The competing perspective is that IT has produced a fundamental change in the U.S. economy, leading to a permanent improvement in growth prospects.3 The resolution of this debate has been the “killer application” of a new framework for productivity measurement summarized in Paul Schreyer’s (2001) OECD Manual, Measuring Productivity.

A consensus has emerged that the development and deployment of information technology is the foundation of the American growth resurgence. A mantra of the “new economy”—faster, better, cheaper—captures the speed of technological change and product improvement in semiconductors and the precipitous and continuing fall in semiconductor prices. The price decline has been transmitted to the prices of products that rely heavily on semiconductor technology, like computers and telecommunications equipment. This technology has also helped to reduce the cost of aircraft, automobiles, scientific instruments, and a host of other products.

Swiftly falling IT prices provide powerful economic incentives for the substitution of IT equipment for other forms of capital and for labor services. The rate of the IT price decline is a key component of the cost of capital, required for assessing the impacts of rapidly growing stocks of computers, communications equipment, and software. Constant quality price indexes are essential for identifying the change in price for a given level of performance. Accurate and timely computer prices have been part of the U.S. National Income and Product Accounts (NIPA) since 1985. Unfortunately, important information gaps remain, especially on trends in prices for closely related investments, such as software and communications equipment.

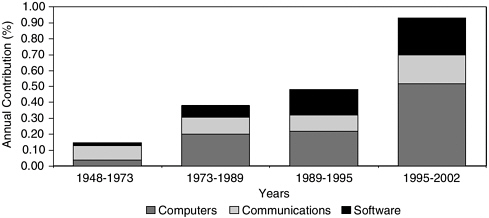

Capital input has been the most important source of U.S. economic growth throughout the postwar period. More rapid substitution toward information technology has given much additional weight to components of capital input with higher marginal products. The vaulting contribution of capital input since 1995 has boosted growth by close to a percentage point. The contribution of investment in IT accounts for more than half of this increase. Computers have been the predominant impetus to faster growth, but communications equipment and software have made important contributions as well.

The accelerated information technology price decline signals faster productivity growth in IT-producing industries. In fact, these industries have been a rapidly rising source of aggregate productivity growth throughout the 1990s. The IT-producing industries generate less than 5 percent of gross domestic income,

but have accounted for nearly half the surge in productivity growth since 1995. However, it is important to emphasize that faster productivity growth is not limited to these industries.

The dramatic effects of information technology on capital and labor markets have already generated a substantial and growing economic literature, but many important issues remain to be resolved. For capital markets the relationship between equity valuations and growth prospects merits much further study. For labor markets more research is needed on investment in information technology and substitution among different types of labor.

1.2. Faster, Better, Cheaper

Modern information technology begins with the invention of the transistor, a semiconductor device that acts as an electrical switch and encodes information in binary form. A binary digit or bit takes the values zero and one, corresponding to the off and on positions of a switch. The first transistor, made of the semiconductor germanium, was constructed at Bell Labs in 1947 and won the Nobel Prize in Physics in 1956 for the inventors—John Bardeen, Walter Brattain, and William Shockley.4

The next major milestone in information technology was the co-invention of the integrated circuit by Jack Kilby of Texas Instruments in 1958 and Robert Noyce of Fairchild Semiconductor in 1959. An integrated circuit consists of many, even millions, of transistors that store and manipulate data in binary form. Integrated circuits were originally developed for data storage and retrieval and semiconductor storage devices became known as memory chips.5

The first patent for the integrated circuit was granted to Noyce. This resulted in a decade of litigation over the intellectual property rights. The litigation and its outcome demonstrate the critical importance of intellectual property in the development of information technology. Kilby was awarded the Nobel Prize in Physics in 2000 for discovery of the integrated circuit; regrettably, Noyce died in 1990.6

1.2.1. Moore’s Law

In 1965 Gordon Moore, then Research Director at Fairchild Semiconductor, made a prescient observation, later known as Moore’s Law.7 Plotting data on

|

4 |

On Bardeen, Brattain, and Shockley, see: http://www.nobel.se/physics/laureates/1956/. |

|

5 |

Petzold (1999) provides a general reference on computers and software. |

|

6 |

On Kilby, see: http://www.nobel.se/physics/laureates/2000/. On Noyce, see: Wolfe (2000), pp. 17-65. |

|

7 |

Moore (1965). Ruttan (2001), pp. 316-367, provides a general reference on the economics of semiconductors and computers. On semiconductor technology, see: http://euler.berkeley.edu/~esrc/csm. |

memory chips, he observed that each new chip contained roughly twice as many transistors as the previous chip and was released within 18-24 months of its predecessor. This implied exponential growth of chip capacity at 35-45 percent per year! Moore’s prediction, made in the infancy of the semiconductor industry, has tracked chip capacity for 35 years. He recently extrapolated this trend for at least another decade.8

In 1968 Moore and Noyce founded Intel Corporation to speed the commercialization of memory chips.9 Integrated circuits gave rise to microprocessors with functions that can be programmed by software, known as logic chips. Intel’s first general purpose microprocessor was developed for a calculator produced by Busicom, a Japanese firm. Intel retained the intellectual property rights and released the device commercially in 1971.

The rapidly rising trends in the capacity of microprocessors and storage devices illustrate the exponential growth predicted by Moore’s Law. The first logic chip in 1971 had 2,300 transistors, while the Pentium 4 released on November 20, 2000, had 42 million! Over this 29 year period the number of transistors increased by 34 percent per year. The rate of productivity growth for the U.S. economy during this period was slower by two orders of magnitude.

1.2.2. Semiconductor Prices

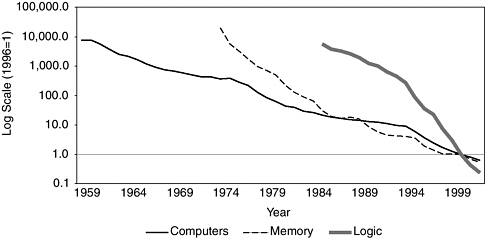

Moore’s Law captures the fact that successive generations of semiconductors are faster and better. The economics of semiconductors begins with the closely related observation that semiconductors have become cheaper at a truly staggering rate! Figure 1.1 gives semiconductor price indexes constructed by Bruce Grimm (1998) of the Bureau of Economic Analysis (BEA) and employed in the U.S. National Income and Product Accounts since 1996. These are divided between memory chips and logic chips. The underlying detail includes seven types of memory chips and two types of logic chips.

Between 1974 and 1996 prices of memory chips decreased by a factor of 27,270 times or at 40.9 percent per year, while the implicit deflator for the gross domestic product (GDP) increased by almost 2.7 times or 4.6 percent per year! Prices of logic chips, available for the shorter period 1985 to 1996, decreased by a factor of 1,938 or 54.1 percent per year, while the GDP deflator increased by 1.3 times or 2.6 percent per year! Semiconductor price declines closely parallel Moore’s Law on the growth of chip capacity, setting semiconductors apart from other products.

Figure 1.1 also reveals a sharp acceleration in the decline of semiconductor prices in 1994 and 1995. The microprocessor price decline leapt to more than 90

percent per year as the semiconductor industry shifted from a three-year product cycle to a greatly accelerated two-year cycle. This is reflected in the 2000 Update of the International Technology Road Map for Semiconductors,10 prepared by a consortium of industry associations. Ana Aizcorbe, Stephen Oliner, and Daniel Sichel (2003) have identified and analyzed break points in prices of microprocessors and storage devices.

1.2.3. Constant Quality Price Indexes

The behavior of semiconductor prices is a severe test for the methods used in the official price statistics. The challenge is to separate observed price changes between changes in semiconductor performance and changes in price that hold performance constant. Achieving this objective has required a detailed understanding of the technology, the development of sophisticated measurement techniques, and the introduction of novel methods for assembling the requisite information.

Ellen Dulberger (1993) introduced a “matched model” index for semiconductor prices. A matched model index combines price relatives for products with the same performance at different points of time. Dulberger presented constant quality price indexes based on index number formulas, including the Fisher (1922) ideal index used in the in the U.S. national accounts.11 The Fisher index is the geometric average of the familiar Laspeyres and Paasche indexes.

Erwin Diewert (1976) defined a superlative index number as an index that exactly replicates a flexible representation of the underlying technology (or preferences). A flexible representation provides a second-order approximation to an arbitrary technology (or preference system). A. A. Konus and S. S. Byushgens (1926) first showed that the Fisher ideal index is superlative in this sense. Laspeyres and Paasche indexes are not superlative and fail to capture substitutions among products in response to price changes accurately.

Grimm (1998) combined matched model techniques with hedonic methods, based on an econometric model of semiconductor prices at different points of time. A hedonic model gives the price of a semiconductor product as a function of the characteristics that determine performance, such as speed of processing and storage capacity. A constant quality price index isolates the price change by holding these characteristics of semiconductors fixed.12

|

10 |

On International Technology Roadmap for Semiconductors (2000), see: http://public.itrs.net/. |

|

11 |

See Landefeld and Parker (1997). |

|

12 |

Triplett (2003) has drafted a manual for the OECD on constructing constant quality price indexes for information technology and communications equipment and software. |

Beginning in 1997, the Bureau of Labor Statistics (BLS) incorporated a matched model price index for semiconductors into the Producer Price Index (PPI) and since then the national accounts have relied on data from the PPI. Reflecting long-standing BLS policy, historical data were not revised backward. Semiconductor prices reported in the PPI prior to 1997 do not hold quality constant, failing to capture the rapid semiconductor price decline and the acceleration in 1995.

1.2.4. Computers

The introduction of the Personal Computer (PC) by IBM in 1981 was a watershed event in the deployment of information technology. The sale of Intel’s 8086-8088 microprocessor to IBM in 1978 for incorporation into the PC was a major business breakthrough for Intel.13 In 1981 IBM licensed the MS-DOS operating system from the Microsoft Corporation, founded by Bill Gates and Paul Allen in 1975. The PC established an Intel/Microsoft relationship that has continued up to the present. In 1985 Microsoft released the first version of Windows, its signature operating system for the PC, giving rise to the Wintel (Windows-Intel) nomenclature for this ongoing collaboration.

Mainframe computers, as well as PC’s, have come to rely heavily on logic chips for central processing and memory chips for main memory. However, semiconductors account for less than half of computer costs and computer prices have fallen much less rapidly than semiconductor prices. Precise measures of computer prices that hold product quality constant were introduced into the NIPA in 1985 and the PPI during the 1990s. The national accounts now rely on PPI data, but historical data on computers from the PPI, like the PPI data on semiconductors, do not hold quality constant.

Gregory Chow (1967) pioneered the use of hedonic techniques for constructing a constant quality index of computer prices in research conducted at IBM. Chow documented price declines at more than twenty percent per year during 1960-1965, providing an initial glimpse of the remarkable behavior of computer prices. In 1985 the Bureau of Economic Analysis incorporated constant quality price indexes for computers and peripheral equipment constructed by IBM into the NIPA. Triplett’s (1986) discussion of the economic interpretation of these indexes brought the rapid decline of computer prices to the attention of a very broad audience.

The BEA-IBM constant quality price index for computers provoked a heated exchange between BEA and Edward Denison (1989), one of the founders of national accounting methodology in the 1950s and head of the national accounts at BEA from 1979 to 1982. Denison sharply attacked the BEA-IBM methodology

and argued vigorously against the introduction of constant quality price indexes into the national accounts.14 Allan Young (1989), then Director of BEA, reiterated BEA’s rationale for introducing constant quality price indexes.

Dulberger (1989) presented a more detailed report on her research on the prices of computer processors for the BEA-IBM project. Speed of processing and main memory played central roles in her model. Triplett (1989, 2003) has provided exhaustive surveys of research on hedonic price indexes for computers. Gordon (1989, 1990) gave an alternative model of computer prices and identified computers and communications equipment, along with commercial aircraft, as assets with the highest rates of price decline.

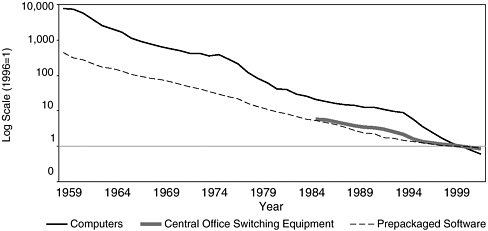

Figure 1.2 gives BEA’s constant quality index of prices of computers and peripheral equipment and its components, including mainframes, PCs, storage devices, other peripheral equipment, and terminals. The decline in computer prices follows the behavior of semiconductor prices presented in Figure 1.1, but in much attenuated form. The 1995 acceleration in the computer price decline parallels the acceleration in the semiconductor price decline that resulted from the changeover from a three-year product cycle to a two-year cycle in 1995.

1.2.5. Communications Equipment and Software

Communications technology is crucial for the rapid development and diffusion of the Internet, perhaps the most striking manifestation of information technology in the American economy.15 Kenneth Flamm (1989) was the first to compare the behavior of computer prices and the prices of communications equipment. He concluded that the communications equipment prices fell only a little more slowly than computer prices. Gordon (1990) compared Flamm’s results with the official price indexes, revealing substantial bias in the official indexes.

Communications equipment is an important market for semiconductors, but constant quality price indexes cover only a portion of this equipment. Switching and terminal equipment rely heavily on semiconductor technology, so that product development reflects improvements in semiconductors. Grimm’s (1997) constant quality price index for digital telephone switching equipment, given in Figure 1.3, was incorporated into the national accounts in 1996. The output of communications services in the NIPA also incorporates a constant quality price index for cellular phones.

Much communications investment takes the form of the transmission gear, connecting data, voice, and video terminals to switching equipment. Technolo-

|

14 |

Denison cited his 1957 paper, “Theoretical Aspects of Quality Change, Capital Consumption, and Net Capital Formation,” as the definitive statement of the traditional BEA position. |

|

15 |

General references on the economics of the Internet are Choi and Whinston (2000) and Hall (2002). On Internet indicators see: http://www.internetindicators.com/. |

gies such as fiber optics, microwave broadcasting, and communications satellites have progressed at rates that outrun even the dramatic pace of semiconductor development. An example is dense wavelength division multiplexing (DWDM), a technology that sends multiple signals over an optical fiber simultaneously. Installation of DWDM equipment, beginning in 1997, has doubled the transmission capacity of fiber optic cables every 6-12 months.16

Mark Doms (2004) has provided comprehensive price indexes for terminals, switching gear, and transmission equipment. These have been incorporated into the Federal Reserve’s Index of Industrial Production, as described by Carol Corrado (2003), but are not yet included in the U.S. National Income and Product Accounts. The analysis of the impact of information technology on the U.S. economy described below is based on the national accounts and remains incomplete.

Both software and hardware are essential for information technology and this is reflected in the large volume of software expenditures. The eleventh comprehensive revision of the national accounts, released by BEA on October 27, 1999, re-classified computer software as investment.17 Before this important advance, business expenditures on software were treated as current outlays, while personal and government expenditures were treated as purchases of nondurable goods. Software investment is growing rapidly and is now much more important than investment in computer hardware.

Parker and Grimm (2000) describe the new estimates of investment in software. BEA distinguishes among three types of software—prepackaged, custom, and own-account software. Prepackaged software is sold or licensed in standardized form and is delivered in packages or electronic files downloaded from the Internet. Custom software is tailored to the specific application of the user and is delivered along with analysis, design, and programming services required for customization. Own-account software consists of software created for a specific application. However, only price indexes for prepackaged software hold performance constant.

Parker and Grimm (2000) present a constant quality price index for prepackaged software, given in Figure 1.3. This combines a hedonic model of prices for business applications software and a matched model index for spreadsheet and word processing programs developed by Oliner and Sichel (1994). Prepackaged software prices decline at more than ten percent per year over the period 1962-1998. Since 1998 the BEA has relied on a matched model price index for all prepackaged software from the PPI; prior to 1998 the PPI data do not hold quality constant.

BEA’s prices for own-account and custom software are based on programmer wage rates. This implicitly assumes no change in the productivity of computer programmers, even with growing investment in hardware and software to support the creation of new software. Custom and own-account software prices are a weighted average of prepackaged software prices and programmer wage rates with arbitrary weights of 75 percent for programmer wage rates and 25 percent for prepackaged software. These price indexes do not hold the software performance constant and present a distorted picture of software prices, as well as software output and investment.

1.2.6. Research Opportunities

The official price indexes for computers and semiconductors provide the paradigm for economic measurement. These indexes capture the steady decline in IT prices and the recent acceleration in this decline. The official price indexes for central office switching equipment and prepackaged software also hold quality constant. BEA and BLS, the leading statistical agencies in price research, have carried out much of the best work in this area. However, a critical role has been played by price research at IBM, long the dominant firm in information technology.18

It is important to emphasize that information technology is not limited to applications of semiconductors. Switching and terminal equipment for voice, data, and video communications have come to rely on semiconductor technology and the empirical evidence on prices of this equipment reflects this fact. Transmission gear employs technologies with rates of progress that far outstrip those of semiconductors. This important gap in our official price statistics has been filled by constant quality price indexes for all types of communications equipment constructed by Doms (2004), but these indexes have not been incorporated into the national accounts.

Investment in software is more important than investment in hardware. This was essentially invisible until BEA introduced new measures of prepackaged, custom, and own-account software investment into the national accounts in 1999. This is a crucial step in understanding the role of information technology in the American economy. Unfortunately, software prices are a statistical blind spot with only prices of prepackaged software adequately represented in the official system of price statistics. The daunting challenge that lies ahead is to construct constant quality price indexes for custom and own-account software.

1.3. Impact of Information Technology

In Section 2, I consider the “killer application” of the new framework for productivity measurement—the impact of information technology (IT) on economic growth. Despite differences in methodology and data sources, a consensus has emerged that the remarkable behavior of IT prices provides the key to the surge in U.S. economic growth after 1995. The relentless decline in the prices of information technology equipment and software has steadily enhanced the role of IT investment. Productivity growth in IT-producing industries has risen in importance and a productivity revival is under way in the rest of the economy.

A substantial acceleration in the IT price decline occurred in 1995, triggered by a much sharper acceleration in the price decline of semiconductors, the key component of modern information technology. Although the decline in semiconductor prices has been projected to continue for at least another decade, the recent acceleration may be temporary. This can be traced to a shift in the product cycle for semiconductors from 3 years to 2 years as a consequence of intensifying competition in markets for semiconductor products.

In Section 3, I show that the surge of IT investment in the United States after 1995 has counterparts in all other industrialized countries. It is essential to use comparable data and methodology in order to provide rigorous international comparisons. A crucial role is played by measurements of IT prices. The U.S. national accounts have incorporated measures of IT prices that hold performance constant since 1985. Schreyer (2000) has extended these measures to other industrialized countries by constructing “internationally harmonized prices.”19

I have shown that the acceleration in the IT price decline in 1995 triggered a burst of IT investment in all of the G7 nations—-Canada, France, Germany, Italy, Japan, the U.K., as well as the U.S.20 These countries also experienced a rise in productivity growth in the IT-producing industries. However, differences in the relative importance of these industries have generated wide disparities in the impact of IT on economic growth. The role of the IT-producing industries is greatest in the U.S., which leads the G7 in output per capita. Section 3 concludes.

2. AGGREGATE GROWTH ACCOUNTING

2.1. The Role of Information Technology

At the aggregate level IT is identified with the outputs of computers, communications equipment, and software. These products appear in the GDP as investments by businesses, households, and governments along with net exports to

the rest of the world. The GDP also includes the services of IT products consumed by households and governments. A methodology for analyzing economic growth must capture the substitution of IT outputs for other outputs of goods and services.

While semiconductor technology is the driving force behind the spread of IT, the impact of the relentless decline in semiconductor prices is transmitted through falling IT prices. Only net exports of semiconductors, defined as the difference between U.S. exports to the rest of the world and U.S. imports appear in the GDP. Sales of semiconductors to domestic manufacturers of IT products are precisely offset by purchases of semiconductors and are excluded from the GDP.

Constant quality price indexes, like those reviewed in the previous section, are a key component of the methodology for analyzing the American growth resurgence. Computer prices were incorporated into the NIPA in 1985 and are now part of the PPI as well. Much more recently, semiconductor prices have been included in the NIPA and the PPI. The official price indexes for communications equipment do not yet reflect the important work of Doms (2004). Unfortunately, evidence on the price of software is seriously incomplete, so that the official price indexes are seriously misleading.

2.1.1. Output

The output data in Table 2.1 are based on the most recent benchmark revision of the national accounts, updated through 2002.21 The output concept is similar, but not identical, to the concept of gross domestic product used by the BEA. Both measures include final outputs purchased by businesses, governments, households, and the rest of the world. Unlike the BEA concept, the output measure in Table 2.1 also includes imputations for the service flows from durable goods, including IT products, employed in the household and government sectors.

The imputations for services of IT equipment are based on the cost of capital for IT described in more detail below. The cost of capital is multiplied by the nominal value of IT capital stock to obtain the imputed service flow from IT products. In the business sector this accrues as capital income to the firms that employ these products as inputs. In the household and government sectors the flow of capital income must be imputed. This same type of imputation is used for housing in the NIPA. The rental value of renter-occupied housing accrues to real estate firms as capital income, while the rental value of owner-occupied housing is imputed to households.

Current dollar GDP in Table 2.1 is $11.3 trillions in 2002, including imputations, and real output growth averaged 3.46 percent for the period 1948-2002. These magnitudes can be compared to the current dollar value of $10.5 trillions in

|

21 |

See Jorgenson and Stiroh (2000b), Appendix A, for details on the estimates of output. |

2002 and the average real growth rate of 3.36 percent for period 1948-2002 for the official GDP. Table 2.1 presents the current dollar value and price indexes of the GDP and IT output. This includes outputs of investment goods in the form of computers, software, communications equipment, and non-IT investment goods. It also includes outputs of non-IT consumption goods and services as well as imputed IT capital service flows from households and governments.

The most striking feature of the data in Table 2.1 is the rapid price decline for computer investment, 15.8 percent per year from 1959 to 1995. Since 1995 this decline has increased to 31.0 percent per year. By contrast the relative price of software has been flat for much of the period and began to fall only in the 1980s. The price of communications equipment behaves similarly to the software price.

The top panel of Table 2.2 summarizes the growth rates of prices and quantities for major output categories for 1989-1995 and 1995-2002. Business investments in computers, software, and communications equipment are the largest categories of IT spending. Households and governments have also spent sizable amounts on computers, software, communications equipment and the services of information technology. Figure 2.1 shows that the share of software output in the GDP is largest, followed by the shares of computers and communications equipment.

2.1.2. Capital Services

This section presents capital estimates for the U.S. economy for the period 1948 to 2002.22 These begin with BEA investment data; the perpetual inventory method generates estimates of capital stocks and these are aggregated, using service prices as weights. This approach, originated by Jorgenson and Zvi Griliches (1967), is based on the identification of service prices with marginal products of different types of capital. The service price estimates incorporate the cost of capital.23

The cost of capital is an annualization factor that transforms the price of an asset into the price of the corresponding capital input. This includes the nominal rate of return, the rate of depreciation, and the rate of capital loss due to declining prices. The cost of capital is an essential concept for the economics of information technology,24 due to the astonishing decline of IT prices given in Table 2.1.

|

22 |

See Jorgenson and Stiroh (2000b), Appendix B, for details on the estimates of capital input. |

|

23 |

Jorgenson and Yun (2001) present the model of capital input used in the estimates presented in this section. BLS (1983) describes the version of this model employed in the official productivity statistics. For recent updates, see the BLS multifactor productivity website: http://www.bls.gov/mfp/home.htm. Hulten (2001) surveys the literature. |

|

24 |

Jorgenson and Stiroh (1995), pp. 300-303. |

The cost of capital is important in many areas of economics, especially in modeling producer behavior, productivity measurement, and the economics of taxation.25 Many of the important issues in measuring the cost of capital have been debated for decades. The first of these is incorporation of the rate of decline of asset prices into the cost of capital. The assumption of perfect foresight or rational expectations quickly emerged as the most appropriate formulation and has been used in almost all applications of the cost of capital.26

The second empirical issue is the measurement of economic depreciation. The stability of patterns of depreciation in the face of changes in tax policy and price shocks has been carefully documented. The depreciation rates presented by Jorgenson and Stiroh (2000b) summarize a large body of empirical research on the behavior of asset prices.27 A third empirical issue is the description of the tax structure for capital income. This depends on the tax laws prevailing at each point of time. The resolution of these issues has cleared the way for detailed measurements of the cost of capital for all assets that appear in the national accounts, including information technology equipment and software.28

The definition of capital includes all tangible assets in the U.S. economy, equipment and structures, as well as consumers’ and government durables, land, and inventories. The capital service flows from durable goods employed by households and governments enter measures of both output and input. A steadily rising proportion of these service flows are associated with investments in IT. Investments in IT by business, household, and government sectors must be included in the GDP, along with household and government IT capital services, in order to capture the full impact of IT on the U.S. economy.

Table 2.3 gives capital stocks from 1948 to 2002, as well as price indexes for total domestic tangible assets and IT assets—computers, software, and communications equipment. The estimate of domestic tangible capital stock in Table 2.3 is $45.9 trillions in 2002, considerably greater than the estimate by BEA. The most important differences reflect the inclusion of inventories and land in Table 2.3.

Business IT investments, as well as purchases of computers, software, and communications equipment by households and governments, have grown spectacularly in recent years, but remain relatively small. The stocks of all IT assets

combined account for only 3.79 percent of domestic tangible capital stock in 2002. Table 2.4 presents estimates of the flow of capital services and corresponding price indexes for 1948-2002.

The difference between growth in capital services and capital stock is the improvement in capital quality. This represents the substitution towards assets with higher marginal products. The shift toward IT increases the quality of capital, since computers, software, and communications equipment have relatively high marginal products. Capital stock estimates fail to account for this increase in quality and substantially underestimate the impact of IT investment on growth.

The growth of capital quality is slightly less than 20 percent of capital input growth for the period 1948-2002. However, improvements in capital quality have increased steadily in relative importance. These improvements jumped to 46.1 percent of total growth in capital input during the period 1995-2002, reflecting very rapid restructuring of capital to take advantage of the sharp acceleration in the IT price decline. Capital stock has become progressively less accurate as a measure of capital input and is now seriously deficient.

Figure 2.2 gives the IT capital service flows as a share of gross domestic income. The second panel of Table 2.2 summarizes the growth rates of prices and quantities of capital inputs for 1989-1995 and 1995-2002. Growth of IT capital services jumps from 12.58 percent per year in 1989-1995 to 18.33 percent in 1995-2002, while growth of non-IT capital services increases from 1.91 percent to 3.01 percent. This reverses the trend toward slower capital growth through 1995.

2.1.3. Labor Services

This section presents estimates of labor input for the U.S. economy from 1948 to 2002. These incorporate individual data from the Censuses of Population for 1970, 1980, and 1990, as well as the annual Current Population Surveys. Constant quality indexes for the price and quantity of labor input account for the heterogeneity of the workforce across sex, employment class, age, and education levels. This follows the approach of Jorgenson, Gollop, and Fraumeni (1987).29

The distinction between labor input and labor hours is analogous to the distinction between capital services and capital stock. The growth in labor quality is the difference between the growth in labor input and hours worked. Labor quality reflects the substitution of workers with high marginal products for those with low marginal products. Table 2.5 presents estimates of labor input, hours worked, and labor quality.

|

29 |

See Jorgenson and Stiroh (2000b), Appendix C, for details on the estimates of labor input. Gollop (2000) discusses the measurement of labor quality. |

The value of labor expenditures in Table 2.5 is $6.6 trillions in 2002, 58.7 percent of the value of output. This share accurately reflects the concept of gross domestic income, including imputations for the value of capital services in household and government sectors. As shown in Table 2.7, the growth rate of labor input decelerated to 1.50 percent for 1995-2002 from 1.64 percent for 1989-1995. Growth in hours worked rose from 1.08 percent for 1989-1995 to 1.16 percent for 1995-2002 as labor force participation increased and unemployment rates declined.

The growth of labor quality has declined considerably since 1995, dropping from 0.55 percent for 1989-1995 to 0.33 percent for 1995-2002. This slowdown captures well-known demographic trends in the composition of the workforce, as well as exhaustion of the pool of available workers. Growth in hours worked does not capture these changes in labor quality growth and is a seriously misleading measure of labor input.

2.2. The American Growth Resurgence

The American economy has undergone a remarkable resurgence since the mid-1990s with accelerating growth in output, labor productivity, and total factor productivity. The purpose of this section is to quantify the sources of growth for 1948-2002 and various sub-periods. An important objective is to account for the sharp acceleration in the growth rate since 1995 and, in particular, to document the role of information technology.

The appropriate framework for analyzing the impact of information technology is the production possibility frontier, giving outputs of IT investment goods as well as inputs of IT capital services. An important advantage of this framework is that prices of IT outputs and inputs are linked through the price of IT capital services. This framework successfully captures the substitutions among outputs and inputs in response to the rapid deployment of IT. It also encompasses costs of adjustment, while allowing financial markets to be modeled independently.

As a consequence of the swift advance of information technology, a number of the most familiar concepts in growth economics have been superseded. The aggregate production function heads this list. Capital stock as a measure of capital input is no longer adequate to capture the rising importance of IT. This completely obscures the restructuring of capital input that is such an important well-spring of the growth resurgence. Finally, hours worked must be replaced as a measure of labor input.

2.2.1. Production Possibility Frontier

The production possibility frontier describes efficient combinations of outputs and inputs for the economy as a whole. Aggregate output Y consists of out-

puts of investment goods and consumption goods. These outputs are produced from aggregate input X, consisting of capital services and labor services.

Productivity is a “Hicks-neutral” augmentation of aggregate input. The production possibility frontier takes the form:

where the outputs include non-IT investment goods In and investments in computers Ic, software Is, and communications equipment It, as well as non-IT consumption goods and services Cn and IT capital services to households and governments Cc. Inputs include non-IT capital services Kn and the services of computers Kc, software Ks, and telecommunications equipment Kt, as well as labor input L.30 Productivity is denoted by A.

The most important advantage of the production possibility frontier is the explicit role that it provides for constant quality prices of IT products. These are used as deflators for nominal expenditures on IT investments to obtain the quantities of IT outputs. Investments in IT are cumulated into stocks of IT capital. The flow of IT capital services is an aggregate of these stocks with service prices as weights. Similarly, constant quality prices of IT capital services are used in deflating the nominal values of consumption of these services.

Another important advantage of the production possibility frontier is the incorporation of costs of adjustment. For example, an increase in the output of IT investment goods requires foregoing part of the output of consumption goods and non-IT investment goods, so that adjusting the rate of investment in IT is costly. However, costs of adjustment are external to the producing unit and are fully reflected in IT prices. These prices incorporate forward-looking expectations of the future prices of IT capital services.

The aggregate production function employed, for example, by Kuznets (1971) and Solow (1957, 1960, 1970) and, more recently, by Jeremy Greenwood, Zvi Hercowitz, and Per Krusell (1997, 2000), Hercowitz (1998), and Arnold Harberger (1998) is a competing methodology. The production function gives a single output as a function of capital and labor inputs. There is no role for separate prices of investment and consumption goods and, hence, no place for constant quality IT price indexes for outputs of IT investment goods.

Another limitation of the aggregate production function is that it fails to incorporate costs of adjustment. Robert Lucas (1967) presented a production model with internal costs of adjustment. Fumio Hayashi (2000) shows how to identify these adjustment costs from Tobin’s Q-ratio, the ratio of the stock market value of the producing unit to the market value of the unit’s assets. Implementation of

this approach requires simultaneous modeling of production and asset valuation. If costs of adjustment are external, as in the production possibility frontier, asset valuation can be modeled separately from production.31

2.2.2. Sources of Growth

Under the assumption that product and factor markets are competitive producer equilibrium implies that the share-weighted growth of outputs is the sum of the share-weighted growth of inputs and growth in total factor productivity:

where ![]() and

and ![]() denote average value shares. The shares of outputs and inputs add to one under the additional assumption of constant returns,

denote average value shares. The shares of outputs and inputs add to one under the additional assumption of constant returns,

The growth rate of output is a weighted average of growth rates of investment and consumption goods outputs. The contribution of each output is its weighted growth rate. Similarly, the growth rate of input is a weighted average of growth rates of capital and labor services and the contribution of each input is its weighted growth rate. The contribution of productivity, the growth rate of the augmentation factor A, is the difference between growth rates of output and input.

Table 2.6 presents results of a growth accounting decomposition for the period 1948-2002 and various sub-periods, following Jorgenson and Stiroh (1999, 2000b). Economic growth is broken down by output and input categories, quantifying the contribution of information technology to investment and consumption outputs, as well as capital inputs. These estimates identify computers, software, and communications equipment as distinct types of information technology.

The results can also be presented in terms of average labor productivity (ALP), defined as y = Y/H, the ratio of output Y to hours worked H, and k = K/H is the ratio of capital services K to hours worked:

This equation allocates ALP growth among three sources. The first is capital deepening, the growth in capital input per hour worked, and reflects the capital-labor substitution. The second is improvement in labor quality and captures the

rising proportion of hours by workers with higher marginal products. The third is total factor productivity growth, which contributes point-for-point to ALP growth.

2.2.3. Contributions of IT Investment

Figure 2.5 depicts the rapid increase in the importance of IT services, reflecting the accelerating pace of IT price declines. In 1995-2002 the capital service price for computers fell 26.09 percent per year, compared to an increase of 32.34 percent in capital input from computers. While the value of computer services grew, the current dollar value was only 1.44 percent of gross domestic income in 2002.

The rapid accumulation of software appears to have different sources. The price of software services has declined only 1.72 percent per year for 1995-2002. Nonetheless, firms have been accumulating software very rapidly, with real capital services growing 14.27 percent per year. A possible explanation is that firms respond to computer price declines by investing in complementary inputs like software. However, a more plausible explanation is that the price indexes used to deflate software investment fail to hold quality constant. This leads to an overstatement of inflation and an understatement of growth.

Although the price decline for communications equipment during the period 1995-2002 is greater than that of software, investment in this equipment is more in line with prices. However, prices of communications equipment also fail to hold quality constant. The technology of switching equipment, for example, is similar to that of computers; investment in this category is deflated by a constant-quality price index developed by BEA. Conventional price deflators are employed for transmission gear, such as fiber-optic cables. This leads to an underestimate of the growth rates of investment, capital stock, capital services, and the GDP, as well as an overestimate of the rate of inflation.

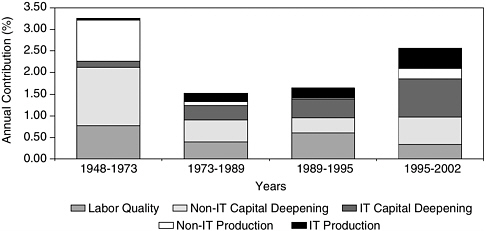

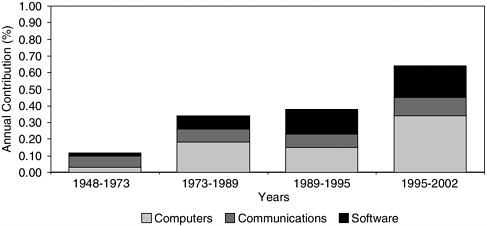

Figures 2.3 and 2.4 highlight the rising contributions of IT outputs to U.S. economic growth. Figure 2.3 shows the breakdown between IT and non-IT outputs for sub-periods from 1948 to 2002, while Figure 2.4 decomposes the contribution of IT into its components. Although the importance of IT has steadily increased, Figure 2.3 shows that the recent investment and consumption surge nearly doubled the output contribution of IT. Figure 2.4 shows that computer investment is the largest single IT contributor in the late 1990s, but that investments in software and communications equipment are becoming increasingly important.

Figures 2.5 and 2.6 present a similar decomposition of IT inputs into production. The contribution of these inputs is rising even more dramatically. Figure 2.5 shows that the contribution of IT now accounts for more than 48.0 percent of the total contribution of capital input. Figure 2.6 reveals that computer hardware is the largest component of IT, reflecting the growing share and accelerating growth rate of computer investment in the late 1990s.

Private business investment predominates in the output of IT, as shown by Jorgenson and Stiroh (2000b) and Oliner and Sichel (2000).32 Household purchases of IT equipment and services are next in importance. Government purchases of IT equipment and services, as well as net exports of IT products, must be included in order to provide a complete picture. Firms, consumers, governments, and purchasers of U.S. exports are responding to relative price changes, increasing the contributions of computers, software, and communications equipment.

Table 2.2 shows that the price of computer investment fell by 30.99 percent per year, the price of software fell by 1.31 percent, and the price of communications equipment dropped by 4.16 percent during the period 1995-2002, while non-IT investment and consumption prices rose by 2.02 and 1.79 percent, respectively. In response to these price changes, firms, households, and governments have accumulated computers, software, and communications equipment much more rapidly than other forms of capital.

2.2.4. Productivity

The price or “dual” approach to productivity measurement employed by Triplett (1996) makes it possible to identify the role of IT production as a source of productivity growth at the industry level.33 The rate of productivity growth is measured as the decline in the price of output, plus a weighted average of the growth rates of input prices with value shares of the inputs as weights. For the computer industry this expression is dominated by two terms: the decline in the price of computers and the contribution of the price of semiconductors. For the semiconductor industry the expression is dominated by the decline in the price of semiconductors.34

Jorgenson, Gollop, and Fraumeni (1987) have employed Domar’s (1961) model to trace aggregate productivity growth to its sources at the level of individual industries.35 More recently, Harberger (1998), William Gullickson and Michael Harper (1999), and Jorgenson and Stiroh (2000a, 2000b) have used the model for similar purposes. Productivity growth for each industry is weighted by the ratio of the gross output of the industry to GDP to estimate the industry contribution to aggregate productivity growth.

If semiconductor output were only used to produce computers, then its contribution to computer industry productivity growth, weighted by computer indus-

try output, would precisely offset its independent contribution to the growth of aggregate productivity. This is the ratio of the value of semiconductor output to GDP, multiplied by the rate of semiconductor price decline. In fact, semiconductors are used to produce telecommunications equipment and many other products. However, the value of semiconductor output is dominated by inputs into IT production.

The Domar aggregation formula can be approximated by expressing the declines in prices of computers, communications equipment, and software relative to the price of gross domestic income, an aggregate of the prices of capital and labor services. The rates of relative IT price decline are weighted by ratios of the outputs of IT products to the GDP. Table 2.8 reports details of this decomposition of productivity for 1989-1995 and 1995-2002; the IT and non-IT contributions are presented in Figure 2.7. The IT products contribute 0.47 percentage points to productivity growth for 1995-2002, compared to 0.23 percentage points for 1989-1995. This reflects the accelerating decline in relative price changes resulting from shortening the product cycle for semiconductors.

2.2.5. Output Growth.

This section presents the sources of GDP growth for the entire period 1948 to 2002. Capital services contribute 1.75 percentage points, labor services 1.05 percentage points, and productivity growth only 0.67 percentage points. Input growth is the source of nearly 80.6 percent of U.S. growth over the past half century, while productivity has accounted for 19.4 percent. Figure 2.8 shows the relatively modest contributions of productivity in all sub-periods.

More than four-fifths of the contribution of capital reflects the accumulation of capital stock, while improvement in the quality of capital accounts for about one-fifth. Similarly, increased labor hours account for 68 percent of labor’s contribution; the remainder is due to improvements in labor quality. Substitutions among capital and labor inputs in response to price changes are essential components of the sources of economic growth.

A look at the U.S. economy before and after 1973 reveals familiar features of the historical record. After strong output and productivity growth in the 1950s, 1960s and early 1970s, the U.S. economy slowed markedly through 1989, with output growth falling from 3.99 percent to 2.97 percent and productivity growth declining from 1.00 percent to 0.29 percent. The contribution of capital input also slowed from 1.94 percent for 1948-1973 to 1.53 percent for 1973-1989. This contributed to sluggish ALP growth—2.93 percent for 1948-1973 and 1.36 percent for 1973-1989.

Relative to the period 1989-1995, output growth increased by 1.16 percent in 1995-2002. The contribution of IT production jumped by 0.27 percent, relative to 1989-1995, but still accounted for only 17.8 percent of the increased growth of output. Although the contribution of IT has increased steadily throughout the

period 1948-2002, there has been a sharp response to the acceleration in the IT price decline in 1995. Nonetheless, more than 80 percent of the increased output growth can be attributed to non-IT products.

Between 1989-1995 and 1995-2002 the contribution of capital input jumped by 0.80 percentage points, the contribution of labor input declined by 0.10 percent, and productivity accelerated by 0.45 percent. Growth in ALP rose 1.03 percent as more rapid capital deepening and growth in productivity offset slower improvement in labor quality. Growth in hours worked rose as labor markets tightened, while labor force participation rates increased.36

The contribution of capital input reflects the investment boom of the late 1990s as businesses, households, and governments poured resources into plant and equipment, especially computers, software, and communications equipment. The contribution of capital, predominantly IT, is considerably more important than the contribution of labor. The contribution of IT capital services has grown steadily throughout the period 1948-2002, but Figure 2.6 reflects the impact of the accelerating decline in IT prices.

After maintaining an average rate of 0.29 percent for the period 1973-1989, productivity growth dipped to 0.26 percent for 1989-1995 and then vaulted to 0.71 percent per year for 1995-2002. This is a major source of growth in output and ALP for the U.S. economy (Figures 2.8 and 2.9). Productivity growth for 1995-2002 is considerably higher than the rate of 1948-1973 and the U.S. economy is recuperating from the anemic productivity growth of the past two decades. More than half of the acceleration in productivity from 1989-1995 to 1995-2002 can be attributed to IT production, and this is far greater than the 3.80 percent share of IT in the GDP in 2002.

2.2.6. Average Labor Productivity

Output growth is the sum of growth in hours and average labor productivity. Table 2.7 shows the breakdown between growth in hours and ALP for the same periods as in Table 2.6. For the period 1948-2002, ALP growth predominated in output growth, increasing 2.23 percent per year, while hours worked increased 1.23 percent per year. As shown above, ALP growth depends on capital deepening, a labor quality effect, and overall productivity growth.

Figure 2.9 reveals the well-known productivity slowdown of the 1970s and 1980s, emphasizing the sharp acceleration in labor productivity growth in the late 1990s. The slowdown through 1989 reflects reduced capital deepening, declining labor quality growth, and decelerating growth in total factor productivity. The growth of ALP recovered slightly during the early 1990s with a slump in capital

deepening more than offset by a revival in labor quality growth and an up-tick in total factor productivity growth. A slowdown in hours combined with middling ALP growth during 1989-1995 to produce a further slide in the growth of output. In previous cyclical recoveries during the postwar period, output growth accelerated during the recovery, powered by more rapid growth of hours and ALP.

Accelerating output growth during 1995-2002 reflects modest growth in labor hours and a sharp increase in ALP growth.37 Comparing 1989-1995 to 1995-2002, the rate of output growth jumped by 1.16 percent—due to an increase in hours worked of 0.14 percent and an upward bound in ALP growth of 1.03 percent. Figure 2.9 shows the acceleration in ALP growth is due to capital deepening as well as faster total factor productivity growth. Capital deepening contributed 0.74 percentage points, counterbalancing a negative contribution of labor quality of 0.13 percent. The acceleration in total factor productivity growth added 0.45 percentage points.

2.2.7. Research Opportunities

The use of computers, software, and communications equipment must be carefully distinguished from the production of IT.38 Massive increases in computing power, like those experienced by the U.S. economy, have two effects on growth. First, as IT producers become more efficient, more IT equipment and software is produced from the same inputs. This raises productivity in IT-producing industries and contributes to productivity growth for the economy as a whole. Labor productivity also grows at both industry and aggregate levels.

Second, investment in information technology leads to growth of productive capacity in IT-using industries. Since labor is working with more and better equipment, this increases ALP through capital deepening. If the contributions to aggregate output are captured by capital deepening, aggregate productivity growth is unaffected.39 Increasing deployment of IT affects productivity growth only if there are spillovers from IT-producing industries to IT-using industries.

Jorgenson, Ho, and Stiroh (2004) trace the increase in aggregate productivity growth to its sources in individual industries. Jorgenson and Stiroh (2000a, 2000b) present the appropriate methodology and preliminary results. Stiroh (2002) shows that aggregate ALP growth can be attributed to productivity growth in IT-producing and IT-using industries.

2.3. Demise of Traditional Growth Accounting

2.3.1. Introduction

The early 1970s marked the emergence of a rare professional consensus on economic growth, articulated in two strikingly dissimilar books. Kuznets summarized his decades of empirical research in Economic Growth of Nations (1971).40 Solow’s book Growth Theory (1970), modestly subtitled “An Exposition,” contained his 1969 Radcliffe Lectures at the University of Warwick. In these lectures Solow also summarized decades of theoretical research, initiated by the work of Roy Harrod (1939) and Domar (1946).41

Let me first consider the indubitable strengths of the perspective on growth that emerged victorious over its many competitors in the early 1970s. Solow’s neo-classical theory of economic growth, especially his analysis of steady states with constant rates of growth, provided conceptual clarity and sophistication. Kuznets generated persuasive empirical support by quantifying the long sweep of historical experience of the United States and thirteen other developed economies. He combined this with quantitative comparisons among a developed and developing economies during the postwar period.

With the benefit of hindsight the most obvious deficiency of the traditional framework of Kuznets and Solow was the lack of a clear connection between the theoretical and the empirical components. This lacuna can be seen most starkly in the total absence of cross references between the key works of these two great economists. Yet they were working on the same topic, within the same framework, at virtually the same time, and in the very same geographical location—Cambridge, Massachusetts!

Searching for analogies to describe this remarkable coincidence of views on growth, we can think of two celestial bodies on different orbits, momentarily coinciding from our earth-bound perspective at a single point in the sky and glowing with dazzling but transitory luminosity. The indelible image of this extraordinary event has been burned into the collective memory of economists, even if the details have long been forgotten. The resulting professional consensus, now ob-

solete, remained the guiding star for subsequent conceptual development and empirical observation for decades.

2.3.2. Human Capital

The initial challenge to the framework of Kuznets and Solow was posed by Denison’s magisterial study, Why Growth Rates Differ (1967). Denison retained NNP as a measure of national product and capital stock as a measure of capital input, adhering to the conventions employed by Kuznets and Solow. Denison’s comparisons among nine industrialized economies over the period 1950-1962 were cited extensively by both Kuznets and Solow.

However, Denison departed from the identification of labor input with hours worked by Kuznets and Solow. He followed his earlier study of U.S. economic growth, The Sources of Economic Growth in the United States and the Alternatives Before Us, published in 1962. In this study he had constructed constant quality measures of labor input, taking into account differences in the quality of hours worked due to the age, sex, and educational attainment of workers.

Kuznets (1971), recognizing the challenge implicit in Denison’s approach to measuring labor input, presented his own version of Denison’s findings.42 He carefully purged Denison’s measure of labor input of the effects of changes in educational attainment. Solow, for his part, made extensive references to Denison’s findings on the growth of output and capital stock, but avoided a detailed reference to Denison’s measure of labor input. Solow adhered instead to hours worked (or “man-hours” in the terminology of the early 1970s) as a measure of labor input.43

Kuznets showed that “… with one or two exceptions, the contribution of the factor inputs per capita was a minor fraction of the growth rate of per capita product.”44 For the United States during the period 1929 to 1957, the growth rate of productivity or output per unit of input exceeded the growth rate of output per capita. According to Kuznets’ estimates, the contribution of increases in capital input per capita over this extensive period was negative!

2.3.3. Solow’s Surprise

The starting point for our discussion of the demise of traditional growth accounting is a notable but neglected article by the great Dutch economist Jan

Tinbergen (1942), published in German during World War II. Tinbergen analyzed the sources of U.S. economic growth over the period 1870-1914. He found that efficiency accounted only a little more than a quarter of growth in output, while growth in capital and labor inputs accounted for the remainder. This was precisely the opposite of the conclusion that Kuznets (1971) and Solow (1970) reached almost three decades later!

The notion of efficiency or “total factor productivity” was introduced independently by George Stigler (1947) and became the starting point for a major research program at the National Bureau of Economic Research. This program employed data on output of the U.S. economy from earlier studies by the National Bureau, especially the pioneering estimates of the national product by Kuznets (1961). The input side employed data on capital from Raymond Goldsmith’s (1962) system of national wealth accounts. However, much of the data was generated by John Kendrick (1956, 1961), who employed an explicit system of national production accounts, including measures of output, input, and productivity for national aggregates and individual industries.45

The econometric models of Paul Douglas (1948) and Tinbergen were integrated with data from the aggregate production accounts generated by Abramovitz (1956) and Kendrick (1956) in Solow’s justly celebrated 1957 article, “Technical Change and the Aggregate Production Function. ” Solow identified “technical change” with shifts in the production function. Like Abramovitz, Kendrick, and Kuznets, he attributed almost all of U.S. economic growth to “residual” growth in productivity.46

Kuznets’ (1971) international comparisons strongly reinforced the findings of Abramovitz (1956), Kendrick (1956), and Solow (1957), which were limited to the United States.47 According to Kuznets, economic growth was largely attributable to the Solow residual between the growth of output and the growth of capital and labor inputs, although he did not use this terminology. Kuznets’ assessment of the significance of his empirical conclusions was unequivocal:

(G)iven the assumptions of the accepted national economic accounting framework, and the basic demographic and institutional processes that control labor supply, capital accumulation, and initial capital-output ratios, this major conclusion—that the distinctive feature of modern economic growth, the high rate of growth of per capita product is for the most part attributable to a high rate of growth in productivity—is inevitable.48

The empirical findings summarized by Kuznets have been repeatedly corroborated in investigations that employ the traditional approach to growth accounting. This approach identifies output with real NNP, labor input with hours worked, and capital input with real capital stock.49 Kuznets (1971) interpreted the Solow residual as due to exogenous technological innovation. This is consistent with Solow’s (1957) identification of the residual with technical change. Successful attempts to provide a more convincing explanation of the Solow residual have led, ultimately, to the demise of the traditional framework.50

2.3.4. Radical Departure

The most serious challenge to the traditional approach growth accounting was presented in my 1967 paper with Griliches, “The Explanation of Productivity Change.” Griliches and I departed far more radically than Denison from the measurement conventions of Kuznets and Solow. We replaced NNP with GNP as a measure of output and introduced constant quality indexes for both capital and labor inputs.

The key idea underlying our constant quality index of labor input, like Denison’s, was to distinguish among different types of labor inputs. We combined hours worked for each type into a constant quality index of labor input, using the index number methodology Griliches (1960) had developed for U.S. agriculture. This considerably broadened the concept of substitution employed by Solow (1957). While he had modeled substitution between capital and labor inputs, Denison, Griliches and I extended the concept of substitution to include different types of labor inputs as well. This altered, irrevocably, the allocation of economic growth between substitution and technical change.51

Griliches and I introduced a constant quality index of capital input by distinguishing among types of capital inputs. To combine different types of capital into a constant quality index, we identified the prices of these inputs with rental prices, rather than the asset prices used in measuring capital stock. For this purpose we used a model of capital as a factor of production I had introduced in my 1963 article, “Capital Theory and Investment Behavior.” This made it possible to incorporate differences among depreciation rates on different assets, as well as

variations in returns due to the tax treatment of different types of capital income, into our constant quality index of capital input.52

Finally, Griliches and I replaced the aggregate production function employed by Denison, Kuznets, and Solow with the production possibility frontier introduced in my 1966 paper, “The Embodiment Hypothesis.” This allowed for joint production of consumption and investment goods from capital and labor inputs. I had used this approach to generalize Solow’s (1960) concept of embodied technical change, showing that economic growth could be interpreted, equivalently, as “embodied” in investment or “disembodied” in productivity growth. My 1967 paper with Griliches removed this indeterminacy by introducing constant quality price indexes for investment goods.53

Griliches and I showed that changes in the quality of capital and labor inputs and the quality of investment goods explained most of the Solow residual. We estimated that capital and labor inputs accounted for 85 percent of growth during the period 1945-1965, while only fifteen percent could be attributed to productivity growth. Changes in labor quality explained thirteen percent of growth, while changes in capital quality another eleven percent.54 Improvements in the quality of investment goods enhanced the growth of both investment goods output and capital input; the net contribution was only two percent of growth.55

2.3.5. The Rees Report

The demise of the traditional framework for productivity measurement began with the Panel to Review Productivity Statistics of the National Research Council, chaired by Albert Rees. The Rees Report of 1979, Measurement and

Interpretation of Productivity, became the cornerstone of a new measurement framework for the official productivity statistics. This was implemented by the Bureau of Labor Statistics (BLS), the U.S. government agency responsible for these statistics.

Under the leadership of Jerome Mark and Edwin Dean the BLS Office of Productivity and Technology undertook the construction of a production account for the U.S. economy with measures of capital and labor inputs and total factor productivity, renamed multifactor productivity.56 The BLS (1983) framework was based on GNP rather than NNP and included a constant quality index of capital input, displacing two of the key conventions of the traditional framework of Kuznets and Solow.57

However, BLS retained hours worked as a measure of labor input until July 11, 1994, when it released a new multifactor productivity measure including a constant quality index of labor input as well. Meanwhile, BEA (1986) had incorporated a constant quality price index for computers into the national accounts—over the strenuous objections of Denison (1989). This index was incorporated into the BLS measure of output, completing the displacement of the traditional framework of economic measurement by the conventions employed in my papers with Griliches.58

The official BLS (1994) estimates of multifactor productivity have overturned the findings of Abramovitz (1956) and Kendrick (1956), as well as those of Kuznets (1971) and Solow (1970). The official statistics have corroborated the findings summarized in my 1990 survey paper, “Productivity and Economic Growth.” These statistics are now consistent with the original findings of Tinbergen (1942), as well as my paper with Griliches (1967), and the results I have presented in Section 2.2.

The approach to growth accounting presented in my 1987 book with Gollop and Fraumeni and the official statistics on multifactor productivity published by the BLS in 1994 has now been recognized as the international standard. The new framework for productivity measurement is presented in Measuring Productivity, a Manual published by the Organisation for Economic Co-Operation and Development (OECD) and written by Schreyer (2001). The expert advisory group for this manual was chaired by Dean, former Associate Commissioner for Productivity at the BLS, and leader of the successful effort to implement the Rees Report (1979).

3. ECONOMICS ON INTERNET TIME

The steadily rising importance of information technology has created new research opportunities in all areas of economics. Economic historians, led by Chandler (2000) and Moses Abramovitz and Paul David (1999, 2001),59 have placed the information age in historical context. Abramovitz and David present sources of U.S. economic growth for the nineteenth and twentieth centuries. Their estimates, beginning in 1966, are based on the official productivity statistics published by the Bureau of Labor Statistics (1994).

The Solow (1987) Paradox, that we see computers everywhere but in the productivity statistics,60 has been displaced by the economics of the information age. Computers have now left an indelible imprint on the productivity statistics. The remaining issue is whether the breathtaking speed of technological change in semiconductors differentiates this resurgence from previous periods of rapid growth?

Capital and labor markets have been severely impacted by information technology. Enormous uncertainty surrounds the relationship between equity valuations and future growth prospects of the American economy.61 One theory attributes rising valuations of equities since the growth acceleration began in 1995 to the accumulation of intangible assets, such as intellectual property and organizational capital. An alternative theory treats the high valuations of technology stocks as a bubble that burst during the year 2000.

The behavior of labor markets also poses important puzzles. Widening wage differentials between workers with more and less education has been attributed to computerization of the workplace. A possible explanation could be that high-skilled workers are complementary to IT, while low-skilled workers are substitutable. An alternative explanation is that technical change associated with IT is skill-biased and increases the wages of high-skilled workers relative to low-skilled workers.62

Finally, information technology is altering product markets and business organizations, as attested by the large and growing business literature,63 but a fully satisfactory model of the semiconductor industry remains to be developed.64 Such

a model would derive the demand for semiconductors from investment in information technology in response to rapidly falling IT prices. An important objective is to determine the product cycle for successive generations of new semiconductors endogenously.

The semiconductor industry and the information technology industries are global in their scope with an elaborate international division of labor.65 This poses important questions about the American growth resurgence. Where is the evidence of a new economy in other leading industrialized countries? I have shown in Section 3 that the most important explanation is the relative paucity of constant quality price indexes for semiconductors and information technology in national accounting systems outside the U.S.

The stagflation of the 1970s greatly undermined the Keynesian Revolution, leading to a New Classical Counter-revolution led by Lucas (1981) that has transformed macroeconomics. The unanticipated American growth revival of the 1990s has similar potential for altering economic perspectives. In fact, this is already foreshadowed in a steady stream of excellent books on the economics of information technology.66 We are the fortunate beneficiaries of a new agenda for economic research that will refresh our thinking and revitalize our discipline.

REFERENCES

Abramovitz, Moses. 1956. “Resources and Output Trends in the United States since 1870” American Economic Review 46(1, March):5-23.

_____. 1986. “Catching Up, Forging Ahead, and Falling Behind” Journal of Economic History 46(2, June):385-406.

Abramovitz, Moses, and Paul David. 1999. “American Macroeconomic Growth in the Era of Knowledge-Based Progress: The Long-Run Perspective” in Robert E. Gallman and Stanley I. Engerman, eds. Cambridge Economic History of the United States. Cambridge: Cambridge University Press. pp. 1-92.

____ and _____. 2001. “Two Centuries of American Macroeconomic Growth from Exploitation of Resource Abundance to Knowledge-Driven Development.” Stanford: Stanford Institute for Economic Policy Research. Policy Paper No. 01-005. August.

Acemoglu, Daron. 2000. “Technical Change, Inequality, and the Labor Market” Journal of Economic Literature 40(1, March):7-72.

Aizcorbe, Ana, Stephen D. Oliner, and Daniel E. Sichel. 2003. Trends in Semiconductor Prices: Breaks and Explanations. Washington, D.C.: Board of Governors of the Federal Reserve System. July.

Baily, Martin N. 2002. “The New Economy: Post Mortem or Second Wind?” Journal of Economic Perspectives 16(1, Winter):3-22.

Baily, Martin N., and Robert J. Gordon. 1988. “The Productivity Slowdown, Measurement Issues, and the Explosion of Computer Power” Brookings Papers on Economic Activity 2:347-420.

Baily, Martin N. and Robert Z. Lawrence. 2001. “Do We Have a New E-conomy?” American Economic Review 91(2, May):308-313.

Becker, Gary S. 1993a. Human Capital. 3rd ed. Chicago: University of Chicago Press. (1st ed., 1964; 2nd ed., 1975).

_____. 1993b. “Nobel Lecture: The Economic Way of Looking at Behavior” Journal of Political Economy 101(3, June):385-409.

Berndt, Ernst R., and Jack Triplett, eds. 2000. Fifty Years of Economic Measurement. Chicago: University of Chicago Press.

Blades, Derek. 2001. Measuring Capital: A Manual on the Measurement of Capital Stocks, Consumption of Fixed Capital, and Capital Services. Paris: Organisation for Economic Co-operation and Development. April.

Bosworth, Barry P., and Jack Triplett. 2000. “What’s New About the New Economy? IT, Growth and Productivity.” Washington, D.C.: The Brookings Institution. October 20.

Brynjolfsson, Erik, and Lorin M. Hitt. 2000. “Beyond Computation: Information Technology, Organizational Transformation and Business Performance.” Journal of Economic Perspectives 14(4, Fall):23-48.

Brynjolfsson, Erik, and Brian Kahin, eds. 2000. Understanding the Digital Economy. Cambridge: The MIT Press.

Brynjolfsson, Erik, and Shinkyo Yang. 1996. “Information Technology and Productivity: A Review of the Literature.” Advances in Computers 43(1):179-214. February.

Bureau of Economic Analysis. 1986. “Improved Deflation of Purchase of Computers” Survey of Current Business 66(3):7-9. March.

_____. 1995. “Preview of the Comprehensive Revision of the National Income and Product Accounts: Recognition of Government Investment and Incorporation of a New Methodology for Calculating Depreciation” Survey of Current Business 75(9):33-41. September.

_____. 1999. Fixed Reproducible Tangible Wealth in the United States, 1925-94. Washington, D.C.: U.S. Department of Commerce.

Bureau of Labor Statistics. 1983. Trends in Multifactor Productivity, 1948-1981. Washington, D.C.: U.S. Government Printing Office.

_____. 1993. “Labor Composition and U.S. Productivity Growth, 1948-90” Bureau of Labor Statistics Bulletin 2426. Washington, D.C.: U.S. Department of Labor.

_____. 1994. “Multifactor Productivity Measures, 1991 and 1992.” News Release USDL 94-327. July 11.

Campbell, John Y., and Robert J. Shiller. 1998. “Valuation Ratios and the Long-run Stock Market Outlook” Journal of Portfolio Management 24(2):11-26. Winter.

Chandler, Alfred D., Jr. 2000. “The Information Age in Historical Perspective” in Alfred D. Chandler and James W. Cortada, eds. A Nation Transformed by Information: How Information Has Shaped the United States from Colonial Times to the Present. New York: Oxford University Press. pp. 3-38.

Choi, Soon-Yong, and Andrew B. Whinston. 2000. The Internet Economy: Technology and Practice. Austin: SmartEcon Publishing.

Chow, Gregory C. 1967. “Technological Change and the Demand for Computers” American Economic Review 57(5):1117-30. December.

Christensen, Clayton M. 1997. The Innovator’s Dilemma Boston: Harvard Business School Press.

Christensen, Laurits R., Dianne Cummings, and Dale W. Jorgenson. 1980. “Economic Growth, 1947-1973: An International Comparison,” in Kendrick and Vaccara, eds. New Developments in Productivity Measurement and Analysis. Chicago: University of Chicago Press. pp. 595-698.

Cole, Rosanne, Y.C. Chen, Joan A. Barquin-Stolleman, Ellen R. Dulberger, Nurthan Helvacian, and James H. Hodge. 1986. “Quality-Adjusted Price Indexes for Computer Processors and Selected Peripheral Equipment” Survey of Current Business 66(1):41-50. January.