3

The High-Performance Fiber Industries

The carbon and high-performance organic fiber industries have developed from the 1960s to the present. An understanding of their history is important to understanding the future of these highly volatile industries.

THE CARBON FIBER INDUSTRY

1969 to 1989—The First 20 Years

High-strength carbon fiber came out of the development laboratories in Japan, England, and the United States in the late 1960s. The initial fibers were very expensive (more than $400 per pound), but in the early 1970s, continuous processes were developed and the cost declined steadily over the next decade. The Air Force Materials Laboratory took the lead in U.S. government-sponsored material development and hardware demonstration. By the late 1970s, materials were used in the production of primary structures for military aircraft and missiles. These applications were followed by selective use in commercial aircraft.

For 20 years, between 1969 and 1989, the carbon fiber industry had phenomenal technological success and double-digit annual growth in aerospace and defense, with additional use in sports equipment and some limited use in automotive and industrial applications. This growth attracted many large international companies into the industry. The vision was that continued growth in military and commercial aircraft use would be followed by a very large industrial market by the year 2000. However the engine that had powered this success, the U.S. Department of Defense, had stalled.

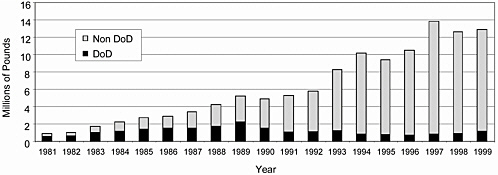

During this period, usage by DoD peaked in 1989, and in 1990—with the collapse of the U.S.S.R. and the end of the Cold War—and after 20 years of growth, the DoD market started to decline. In 1990, DoD usage was only 40 percent of what it was in 1989. Figure 3.1 shows the U.S. carbon fiber usage from 1981 for DoD and non-DoD applications. Table 3.1 shows that the cumulative usage for DoD between 1991 and 1995 based on the 1991 forecast, was down 78 percent from 1987 projections.

These forecasts made in the late 1980s, driven by DoD demand, were the justification for major capacity expansions around the world. Table 3.1 shows that as a result of these perceived market opportunities, worldwide carbon fiber production capacity increased by 45 percent from 1989 to 1990.

In 1985, after several years of study based on continuing assessment of weapons system production needs for composite materials, the Department of Defense was found to be unacceptably dependent on foreign industry for PAN-based (polyacrylonitrile-based) carbon fiber. Virtually all military aircraft, current and prospective generations of strategic missiles, and certain spacecraft were expected to use composite materials in some form. Defense production requirements for PAN-based carbon fiber were projected to increase dramatically in the foreseeable future. However, there were no domestic PAN-based carbon fiber sources qualified at that time for use in military systems. Because classified programs were also dependent on foreign industrial sources of PAN-based carbon fiber to achieve time-critical missions, the potential for supply denial, even under peacetime conditions, was unacceptable. In

TABLE 3.1 DoD Carbon Fiber Usage (millions of pounds)

|

|

1991 |

1992 |

1993 |

1994 |

1995 |

Cumulative |

|

1987 forecast |

4.84 |

6.09 |

7.09 |

6.97 |

6.67 |

31.66 |

|

Actual |

0.95 |

1.10 |

1.30 |

1.64 |

1.86 |

6.85 |

|

Reduction |

3.89 |

4.99 |

5.79 |

5.33 |

4.81 |

24.81a |

|

a Down from 1987 forecast by 78 percent |

||||||

December 1987 Congress passed Public Law 100-202 directing the Secretary of Defense to ensure that a minimum of 50 percent of the PAN precursor for carbon fibers would be procured from domestic sources by 1992 provided that 15 percent was procured from domestic sources by 1988-1989, 20 percent by 1990, and 25 percent by 1991.

The Department of Defense implemented the law through a policy memorandum and two Defense Federal Acquisition Regulation Supplement (DFARS) clauses. In July 1999, the Under Secretary of Defense for Acquisition issued a policy memorandum directing military departments to use 100 percent domestic PAN on all major weapons that had not yet entered production. This legislation is still in force today.

In 1989, after 20 years of development, approximately 40 percent of the global market was concentrated in the United States. In Japan, Taiwan, and Korea, the total usage was approximately equal to that of the United States, but it was predominantly for sports equipment. However, there were emerging developments in automotive and industrial markets in Japan. The European market was about one-half the size of the U.S. market and was predominantly commercial aircraft.

The carbon fiber industry entered the 1990s with a major overcapacity condition, demand less than one-half capacity, and a declining U.S. DoD market.

1990 to Present

The worldwide overcapacity and decline in the DoD market led to major reductions in carbon fiber prices and renewed application development. In 1990, DoD usage was at about 1 million pounds annually and no major growth was predicted. The industry strategy was to broaden commercial aircraft use, develop the sports equipment market, and seek industrial applications.

Starting in 1995 there was major industry consolidation:

-

1995—Hexcel merges with Ciba Composites,

-

1998—Hercules sells carbon fiber and prepreg business to Hexcel,

FIGURE 3.1. Carbon fiber use in the United States. DATA SOURCE: Suppliers of Advanced Composites Materials Association (SACMA). 1999. Unpublished data provided to the committee prior to the dissolution of the organization.

TABLE 3.2 Worldwide Advanced Composite Carbon Fiber Shipments for 1992-1997

|

Year |

Pounds |

U.S. Dollars |

|

1992 |

13,002,812 |

374,100,000 |

|

1993 |

14,598,544 |

384,900,000 |

|

1994 |

17,423,452 |

461,400,000 |

|

1995 |

19,714,671 |

489,240,000 |

|

1996 |

20,672,741 |

469,240,000 |

|

1997 |

25,964,530 |

621,410,000 |

|

SOURCE: Suppliers of Advanced Composite Materials Association (SACMA). 1999. Unpublished data provided to the committee prior to the dissolution of the organization. |

||

-

1997—R.K. Textiles sells carbon fiber business to SGL,

-

1997—DuPont sells advanced composites business to Fiberite,

-

1997—Fiberite sells prepreg business to CYTEC,

-

2001—BP Amoco sells carbon fiber business to CYTEC, and

-

2004—Toho Tenax announces plans to acquire Fortafil Fibers to establish domestic manufacturing base.

In 1997, Suppliers of Advanced Composite Materials Association (SACMA) carbon fiber statistics (Table 3.2) showed that world carbon consumption had reached 26 million pounds.1 Modest expansions in capacity had been made in the 1990s, bringing the world capacity to approximately 26 million pounds (considering product mix). In the 1990s there was also renewed interest in carbon fiber manufactured from large commercially available tows in an attempt to lower the cost.

Analysis of the 1997 SACMA data shows the following:

-

Consumption in 1997 was 26 million pounds, more than 5 million pounds greater than in 1996, a better than 25 percent increase—the largest increase in the history of carbon fiber;

-

DoD usage was up 55 percent over 1996 reaching 1.3 million pounds, representing 9 percent of the U.S. market and 5 percent of the world market;

-

Commercial aerospace usage was 4.7 million pounds, up 2.8 million pounds over 1996, or a 77 percent increase;

-

Commercial aerospace usage was 6.5 million pounds, or 25 percent of the total market;

-

Worldwide sports equipment usage was 9 million pounds, or 35 percent of the total market;

-

Worldwide industrial usage was 31 percent of the total market;

-

Worldwide automotive usage was 4 percent of the total market; and

-

U.S. consumption was 55 percent of total market.

From 1994 to 1997, the growth in the commercial aerospace market, the sporting equipment market, and the industrial markets created a much-improved scenario for the carbon fiber industry. In 1997, the industry was at capacity, carbon fiber was in very short supply, and the bottom line for most carbon fiber manufacturers was healthy. To cope with the fiber shortfall, all of the major carbon fiber manufacturers expanded their capacities. The projected world carbon fiber capacity by 1999 was expected to be approaching 50 million pounds, again leaving demand less than one-half of capacity.

In 1999 the industry experienced another slowdown in the major markets:

-

A major slowdown in the sporting goods market,

-

A major slowdown in the use of chopped carbon in molding compounds,

-

Reduction of personnel in major prepreg and carbon fiber companies, and

-

Boeing commercial aircraft deliveries peaking in 1999 at 620; forecasted deliveries for 2000 were for 480 aircraft.

The second feast and famine cycle had started again at an overall market growth rate of 10 percent; supply would exceed demand for nearly 5 years.

The forecasted growth did occur. At the beginning of 2004, the industry was again at capacity for carbon fiber manufactured from SAF precursor. Major growth has occurred in industrial markets and in use by Airbus, starting with the development of the A380. The forecasted delivery of 40 aircraft per year and 58,000 pounds of carbon fiber per aircraft would represent a demand for 2.2 million pounds of carbon fiber per year. Boeing is also planning a new aircraft that is estimated to use 50 percent carbon composites.2 The wind energy industry, established for more than 30 years, is showing some renewed interest in carbon fiber, especially in Europe for large wind turbine blades. The offshore oil industry is testing some prototype carbon composite structures. To meet this rising demand, Toray has completed a 4-million-pound expansion, and another 4-million-pound increase in capacity is under way, with half of this capacity established in U.S. operations.

In the United States, the number of unmanned air vehicles and the use of carbon fiber composites are growing. The surface Navy has been actively developing composites with a focus on fiberglass. However, the Navy is now showing interest in carbon for proposed new programs such as DD(X) and the littoral combat ship. This interest in carbon fiber has accelerated because of the carbon composite Visby corvette developed by Kockums AB and the Swedish Navy. These DoD applications should take advantage of lower-cost, commercially available carbon fibers developed for commercial markets. Based on the stated program requirements, current fiber properties will meet the needs of these programs.

Trends in Pitch- and Rayon-based Carbon Fibers

The nameplate worldwide production capacity3 for pitch-based carbon fiber in 2004 was about 6.3 million pounds, compared with about 73.5 million pounds for PAN-based carbon fiber (both small and large tow), as shown in Table 3.3. Official figures of actual demand for pitch-based carbon fiber were not available, but in 1999, it was estimated that the demand for these fibers was on the order of thousands of pounds, rather than millions of pounds.4 There will likely be an increased demand for pitch-based carbon fibers in the future to satisfy the needs of thermostructural applications. In the United States, the demand for pitch-based fibers is limited to carbon-carbon brake applications, which were initiated in the 1970s, and limited thermal management applications in satellites and aerospace applications.

ConocoPhillips built an 8 million-pound-per-year capacity manufacturing plant for pitch-based fiber that was scheduled to begin production in 2002.5 The process used a melt-blowing technique to convert a “solvated” mesophase pitch into a randomly oriented fiber mat. In this type of process the precursor is melted and extruded from a spinneret. At the point of extrusion, a high-velocity gas stream, flowing nearly parallel to the extrudate, draws and quenches the filament. The solvent in the ConocoPhilllips precursor was rapidly dried in the first stages of stabilization, yielding a discontinuous mesophase pitch fiber with a relatively high melting point (around 400°C). This allowed the fiber mat to be stabilized at a higher temperature, greatly reducing the time needed for this step of the process. As a result, the ConocoPhillips process was continuous from melt spinning through carbonization. The goal was to produce a high-modulus, intermediate-strength, discontinuous pitch fiber for a wide range of applications

such as electronics, automotive brakes, and infrastructure. However, a failure to meet market expectations caused management to shut down the process and dispose of the equipment.

Demand for rayon-based fibers varied between 100,000 and 1 million pounds (45,000 and 450,000 kg) in the 1990s depending on fluctuations in stockpiling and use by the Department of Defense (DoD) and National Aeronautics and Space Administration (NASA). There has been no immediate demand for new rayon production designated for aerospace use, and there is no longer a qualified domestic source of these fibers.6

Observations on History

The carbon fiber industry has experienced significant growth over the past 30 years, reaching a worldwide market of more than 40 million pounds in 2004. Significant improvements were made in fiber properties, and major cost reductions have been achieved. Carbon fiber prices based on SAF precursor have fluctuated with capacity and market conditions. The price of standard-modulus (32 Mpsi) SAF carbon fiber reached an all-time low of $5.25 per pound in 2003. The emergence of affordable SAF carbon fiber with less variability in properties represents significant competition for textile-based carbon fiber in commercial and DoD applications. Table 3.3 describes the current production capacity.

In the United States, none of the original manufacturers of carbon fiber was able to achieve the desired returns, and each exited the business. A number of companies have invested in the promise of high-strength carbon fiber; many of them are no longer in operation. Courtaulds in the United Kingdom ceased carbon fiber production in 1991, while Hercules sold its carbon fiber plant to Hexcel in 1996. The original Union Carbide carbon fiber operation is now owned by Cytec—after being part of AMOCO and British Petroleum.

The original Japanese companies—Toray, Toho, and Mitsubishi—all have substantial market shares in PAN and are still major participants. These three companies today represent almost 80 percent of the stated worldwide capacity for SAF-based carbon fiber. As of mid-2004, two Japanese companies had announced expansion plans. Toray will add 4 million pounds of new capacity at its Soficar plant in France in 2004 and 4 million pounds of carbon fiber capacity at its plant in Decatur, Alabama, along with the precursor capacity to support this expansion. Toho has also announced an additional 1,500-tonne expansion in Germany.

Without a special relationship with a large local market—such as the U.S. Department of Defense—success in the manufacture of an internationally traded material such as carbon fiber depends on achieving competitive quality and price. Toray's consistent investment in process technology improvements has enabled it to become the world leader in carbon fiber production. This has been achieved, despite periods of negligible profitability, because of the characteristics of the Japanese innovation system.7

In summary, the committee made the following observations:

-

In 2003, DoD accounted for approximately 4 percent of total world carbon fiber usage.

-

DoD has stated that the properties of available carbon fibers meet all of its current needs.

-

Any impact of the new technology on low-cost carbon fibers is at least 10 years away.

-

There is adequate installed capacity in North America to supply DoD needs for the next 10 years.

-

Near-term shortage of SAF carbon fibers will have no significant impact on DoD.

-

In cases where DoD is using a sole source, it often encourages a second supplier to develop an equivalent product.

-

Modifications in the specification requirements that ensure the measurement of necessary features while reducing the number of tests and the cost of testing would be desirable.

TABLE 3.3 Worldwide Pan-Based Carbon Fiber Capacities at the End of 2004 (millions of pounds)

|

|

Company |

Plant Location |

Nameplate Capacitya |

|

SAF tow |

Toray |

Japan |

10.4 |

|

Germany |

5.8 |

||

|

United States |

4.0 |

||

|

Toho |

Japan |

8.2 |

|

|

Germany |

4.2 |

||

|

Mitsubishi |

Japan |

7.0 |

|

|

United States |

3.3 |

||

|

Hexcel |

United States |

4.4 |

|

|

Cytec |

United States |

4.2 |

|

|

Formosa |

Taiwan |

3.9 |

|

|

Total SAF |

|

|

55.4b |

|

Textile tow |

Toho |

United States |

7.7 |

|

Aldila |

United States |

2.2 |

|

|

SGL (Sigri) |

Scotland |

4.2 |

|

|

Zoltek |

United States |

4.0 |

|

|

Total textile |

|

|

18.1 |

|

Combined total |

|

|

73.5 |

|

a Estimated 12k equivalent nameplate capacity b This total reflects an estimated 78 percent ownership of world SAF capacity by Japanese companies. SOURCE: Intertech. 2004. The Global Outlook for Carbon Fiber. Proceedings of a conference in Hamburg, Germany, October 18-20. Portland, Me.: Intertech Corporation. |

|||

-

New SAF capacity for commercial applications will provide an alternate source of affordable carbon fibers for DoD systems.

THE ORGANIC FIBER INDUSTRY

Historical Development

The high-performance organic fiber industry began with the commercial introduction of the m-aramid fiber Nomex in the late 1960s. It major applications included thermal and flame protection.

Since then, several classes of fibers have been commercialized: high-strength p-aramid fibers in the early 1970s; liquid crystalline polyester (LCP); ultrahigh-molecular-weight polyethylene (UHMWPE); and poly (p-phenylene-2,6-benzobisoxazole) (PBO) in 1990s. The most recent addition is M5® fiber, which is in the final stages of development.

Like the carbon fiber industry, developments in organic fiber technology during the 1970s and 1980s enabled the use of lightweight polymer-matrix composites in military and commercial applications. Unlike the carbon fiber industry, however, growth in the high-performance organic fiber industry was driven from the beginning by a combination of military and commercial, aerospace and non-aerospace applications. The unusual combination of mechanical, thermal, flame, and other properties found in most of the high-performance organic fibers, as well as the ability to tailor these properties to specific needs, has enabled this wide range of applications.

Demand for High-Performance Organic Fibers

Demand for high-performance organic fibers grew steadily from the late 1970s to the mid-1990s due to the large number of commercial applications. Between 1980 and 1995, the rate of growth in

consumption volume for p-aramids and m-aramids reached 6 to 7 percent. These two fiber types represent more than 90 percent of worldwide demand for high-performance organic fibers and can therefore be used as a good approximation of general consumption trends. By 2002, the demand for p-aramid alone had risen to approximately 90 million pounds, more than two times the demand for PAN-based carbon fiber.8

Production Capacity and Price for High-Performance Organic Fibers

In the mid-1990s, substantial production capacity existed for high-performance organic fibers in the United States, Europe, and Japan. Worldwide production capacity in 1994 was estimated to be approximately 132 million pounds, with the largest capacity (72 million pounds) located in the United States.9p-Aramid fibers accounted for the largest production capacity (89 million pounds), followed by m-aramids (36.1 million pounds), UHMPEs (approximately 5 million pounds), LCPs (approximately 1.1 million pounds), and PBOs (0.4 million pounds).

Current Status and Trends of the Organic Fiber Industry

The high-performance organic fiber industry has grown steadily in recent decades. From the beginning, the industry’s dependence on high-volume commercial applications, rather than DoD applications, has contributed to this stability. Demand for high-performance organic fibers remains high, as a result of their broad range of applications, and there is potential for future growth. Installed production capacity is significantly larger than that for carbon fibers, and although it was adequate to meet the needs in the past, the committee sees indications of reaching the limits of existing capacity. New applications that are being developed will be able to take advantage of incremental increases in existing production capabilities but should anticipate major investment decisions in this industry in the next 5 to 10 years. The continuing tailoring of products to applications leads to a fragmentation of existing production capability, and thus, analysis of total capacity may result in misleading conclusions.

In the case of high-performance organic fibers, developments will continue to be driven by the commercial sector. DoD represents a small portion of the total organic fiber market, but an important one for products tailored to its applications. As such, DoD may be able to continue to take advantage of the base created by commercially driven developments, but it will have to take its specialized uses into account. Future DoD usage will likely have a significant impact on the development and commercialization of the new fiber, M5.

Investments Plans Announced in 2004 by DuPont and Honeywell

DuPont has disclosed plans to expand production of its high-performance DuPont Kevlar p-aramid. DuPont plans to invest more than $70 million in this project and is beginning the equipment procurement process. The expansion will increase global Kevlar capacity by more than 10 percent. The project is scheduled to come online in phases between late 2005 and the first half of 2006. The specific expansion locations will be finalized as required to meet the projected start-up dates. This is the fourth expansion that DuPont has made in Kevlar p-aramid capacity since 2000 due to growing customer demand for this high-strength fiber that supports global safety and performance applications. In addition to these expansions, DuPont continues to increase capacity by optimizing the productivity of existing assets through the use of Six Sigma processes. Between 2000 and 2003, DuPont completed three Kevlar high-performance fiber expansion projects at its Richmond, Virginia, Vancouver, British Columbia, and Maydown, Northern Ireland, facilities. The 2003 expansion and the latest announced expansion both incorporate proprietary New Fiber Technology (NFT) developed and patented by DuPont.

Honeywell announced a $20 million investment to boost production of Spectra fiber to meet increased demand from the North American armor industry. Honeywell expects to make several similar-sized investments in Honeywell Performance Products over the next few years to boost Spectra fiber production. The current investment will take place at Spectra fiber manufacturing facilities in the

Richmond, Virginia, area. This expansion is expected to be completed in the second quarter of 2005. The additional production will be devoted primarily to meeting U.S. military requirements. This Richmond-area build-out is independent of a previously announced Spectra fiber manufacturing operation intended to support the global marketplace. Additional capacity for domestic fiber is also being added by Dyneema.