3

Benchmarking of Materials Science and Engineering R&D

This chapter reviews the outcomes of an earlier National Academies materials benchmarking study and considers the current status with a snapshot assessment of the status of each materials subfield.

In 1993, the Committee on Science, Engineering, and Public Policy (COSEPUP) of the National Academy of Sciences, the National Academy of Engineering, and the Institute of Medicine issued the report Science, Technology, and the Federal Government: National Goals for a New Era (the Goals report). In that report, COSEPUP recommended that the United States aim to be among the world leaders in all major fields of science so that it could quickly apply and extend advances in science wherever they occur. In addition, the report recommended that the United States maintain clear leadership in fields that are tied to national objectives, that capture the imagination of society, or that have a multiplicative effect on other scientific advances. To measure international leadership, COSEPUP recommended the establishment of independent panels that would conduct comparative international assessments of the scientific accomplishments in particular research fields. COSEPUP believed that these panels should consist of researchers who worked in the specific fields under review (both in the United States and abroad), people who worked in closely related fields, and research users who followed the fields closely.

In response, three panels were established to conduct evaluations of mathematics, materials science and engineering, and immunology. Each panel wrote its

own individual report.1 The individual reports were submitted to COSEPUP and published in a single report with an overview by COSEPUP.2 The resulting benchmarking study on materials science is of particular interest to this report, which requires an understanding of the status of MSE R&D in the United States relative to the rest of the world.3

THE 2000 BENCHMARKING REPORT

In 1997 COSEPUP organized a benchmarking experiment that resulted in the 2000 benchmarking report. The experiment was carried out for three fields—mathematics, materials, and immunology—to learn if research leadership in a field could be assessed in a timely fashion at a reasonable cost. It examined the position of U.S. research in the selected field relative to research being carried out in other regions/countries; predicted relative U.S. future status based on the observed trends; and identified the key determinants of U.S. performance in the fields. Assessment tools for the studies in all three research fields were these:

-

A “virtual” congress, with each panel asked to identify key invitees to a hypothetical international congress convened to address five or six hot topics. The aim was to identify the best of the best researchers from around the world and then use the information to construct tables ranking countries by the number of nominated invitees;

-

Citation and journal analysis;

-

Quantitative data such as the number of graduate students and subfield funding;

-

Prize analysis; and

-

Analysis of actual international congress speakers.

In considering the likely future U.S. position in research relative to other countries, the panels considered the intellectual quality of its researchers and its ability to attract talented researchers; its ability to strengthen interdisciplinary research; and its ability to maintain strong, research-based graduate education and a strong technological infrastructure. The panels considered cooperation among the government, industrial, and academic sectors and increased competition from European and other countries. They also looked at the evolution of federal support for research.

The report of the materials benchmarking panel4 addressed the following subfields: biomaterials, composites, magnetic materials, metals, electronic and optical-photonic materials, superconducting materials, polymers, and catalysts. The panel determined that the United States was among the world leaders in all the subfields of materials science and engineering research and the leader in some subfields, although not in the field as a whole. An area of U.S. weakness in most subfields was materials synthesis and processing. Increasingly, the panel said, U.S. researchers were relying on specialty materials suppliers in Europe and Japan for bulk crystals and other specialty materials. The United States was identified as the “clear leader” in biomaterials and as the “leader” in metals and electronic-photonic materials. However, the lead in electronic-photonic materials was characterized as “endangered” because of cutbacks in industrial exploratory research. The panel concluded while the United States had once been preeminent in magnetic materials, at the time of the benchmarking it was “one of several leaders” in that subfield. In addition, the panel warned that U.S. leadership in composites, catalysts, polymers, and biomaterials was likely to be eroded because of the high priorities given to these subfields by other countries.

The panel concluded that the health of MSE R&D was dependent on researchers coming from other countries and that there was, accordingly, an associated risk of those countries building their own infrastructures and becoming more attractive as locations for internationally mobile researchers. The panel also concluded that a key determinant of U.S. leadership in MSE was its innovation system—that is, the entrepreneurial abilities of its researchers and the influence of its diverse economy. In addition, the panel said that the nation was strong in MSE by virtue of its intellectual and human diversity and its ability to draw intellectually from the entire science and engineering research infrastructure. The benchmarking panel warned that the ability of the United States to capitalize on its leadership opportunities could be undermined by shifting federal and industry priorities, a potential reduction in access to foreign talent, and deteriorating facilities for materials char-

acterization. Of particular concern was inadequate funding to modernize major research facilities in the United States and to plan and build the new facilities needed to maintain research leadership.

The panel wrote that the U.S. position, “among the world leaders,” was likely to slip in some areas of MSE. The reasons varied but included the globalization of research and the growth of other economies. The panel predicted that the United States could be expected to continue supporting materials science and picked out, among others, nanostructured materials and intelligent materials as exciting emerging areas of study. In addition, the panel opined that the United States would “never want to lose its current strength in aerospace and defense, which are important not only to U.S. security but for the stability of the post-cold-war world.”

SNAPSHOTS OF THE CURRENT STATUS OF MATERIALS SUBFIELDS

As well as experimenting with the benchmarking process itself and analyzing the then-current status of U.S. research in each of the materials subfields, the 2000 benchmarking report pondered possible future developments for each of the subfields. To assess the impacts of today’s level of globalization on MSE R&D, the predictions of that report are presented herein alongside a current snapshot of benchmarking analysis for each of the subfields.5 The predictions from the 2000 benchmarking report are summarized in the bulleted introduction to each section.6

Biomaterials

-

The 2000 benchmarking report stated that U.S. strength relative to other countries in basic and applied biomaterials research was likely to erode in the near and longer term for several reasons, including European and Asian (Japan, Singapore) investment, the cost and complexity of obtaining from

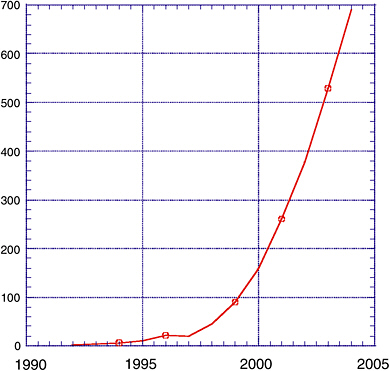

FIGURE 3.1 Total number of papers published in 1994, 1996, 1998, 2001, and 2003 with “biomaterials” in the title, worldwide. Of these, close to 60 percent originated in the United States. SOURCE: Scifinder Scholar database.

-

the Food and Drug Administration (FDA) approval for new biomaterials for in vivo use, and the litigious climate in the United States.

Biomaterials7 research in the United States has grown over the past half decade as it has worldwide, and the United States is still in a leadership position although there are increasingly strong and focused efforts going on throughout the world. Much of the growth in biomaterials research in the United States was catalyzed by rapid growth in the number and size of U.S. biomedical engineering departments, catalyzed by a focused infusion of money from federal, state, and private sources. One indicator of this growth is the large increase in the number of biomaterials publications in the later 20th and early 21st century, as shown in Figure 3.1.

While the focus on biomaterials research in academia is increasing, the nature of the research is changing. By the end of the 1970s many common materials, including polyethylene, poly(ethylene terephthalate), and several stainless steel and titanium alloys were approved for in vivo use by the FDA. Devices based on these materials have served the medical community well but have finite—on average, years to more than a decade—lifetimes. The materials, for the most part nonresorbable in nature, are the mainstay of the medical device industry. The difficulty and cost of bringing new materials through the FDA has led to a focus on modifying already approved materials for specific biomedical applications rather than introducing new materials, so that, since the 1970s, few new biomaterials have been commercialized. The complexity, in particular with respect to regulatory and other nonscience aspects, of introducing a new material into the marketplace has shifted clinical evaluation of new materials or devices to Asia or Europe. The reality, though, is that the United States is the largest market for medical devices in the world, so no matter where the initial research and clinical verification might be done, products with significant market potential ultimately are qualified for use in the United States, no matter how costly or difficult the process. The net result has been a rapid globalizing of biomaterials research rather than a diminishment of the U.S. effort.

Also contributing to the growth of U.S. biomaterials research is the commercial success of several materials-enabled devices, most notably drug-eluding stents and replacement spinal disks. In both devices materials must be matched to function, so biomaterials expertise is a fundamental need in the R&D teams bringing the device to commercial fruition. Another factor contributing to growth is that the materials being used are limiting the performance of many biomedical devices—for example, short-term degradation of electrical signals from implanted devices as a result of the body’s reaction to implanted electrodes and conductors. The burgeoning of interest in tissue engineering and stem cells is stimulating the study of biomaterials as a source of improved scaffolds for cell growth and differentiation. Finally, there is increasing focus on materials for biosensors and biochips and on how the study of materials can complement the study of cell biology and molecular biology.

While the quantity of biomaterials research is large and growing, most of the work is highly observational. Little is understood about cellular or tissue response to material structure, from the nano through the macro, and there is a debate between the materials and biology communities about whether the material per se is a factor. Most existing biologically relevant materials, from metals through polymers, were approved for in vivo use decades ago, and modern research examines how surface chemical modification and gross device architecture affects efficacy. There is an opportunity to apply the classical principles of materials science to the

biomaterials area with the expectation of both scientific and clinical success. The science of biomaterials is changing. What was once the dominant challenge—the development of new materials—has given way to a new one: the creation of an optimized interface between synthetic and biological systems. There is no evidence that U.S. leadership is threatened in any of these areas.

Ceramics

-

The 2000 benchmarking report noted that, with the exception of research in electromechanical systems and coatings, the relative U.S. position in ceramics was in decline. Japan and Germany were predicted to continue to be highly competitive in the engineering of ceramics. The report also projected a potential for U.S. leadership in areas concerned with functional electronic ceramics, such as self-assembly materials and multilayer ferrite processing. Areas where the United States was among the world leaders and where the United States should maintain position in the future included three-dimensional nanoporous silicates, microwave dielectrics, and electrophoretic preparation of thin films. The United States was not expected to seriously challenge the Japanese leadership position in integrated micro-magnetics.

Since the last benchmarking of ceramics R&D, major changes in the profession and the domestic industry have continued. The use of ceramic materials continues to grow, and they remain critical components of many larger materials systems and commercial products. The field of ceramics has continued to expand and is providing new opportunities and challenging the traditional view of technical ceramics. For example, work on ceramic materials for electronic devices has significantly expanded into both thin films and nanostructured materials, and the need for higher performance wireless systems has pushed the ceramics field to develop new microwave materials. Similarly, an earlier focus on passive optics is being replaced by a focus on active optics, such as optical amplifiers, and efforts in bioceramics and in ceramics for power sources, sensors, filters, and the like are rapidly expanding.

Ceramic materials for electronic substrates and for use in high-wear applications remain key commercial applications. However, since the 2000 benchmarking report, the primary areas of commercial and R&D growth for ceramics have been ceramic armor, fuel cells, and nanostructured materials. Ceramic armor is nearly as tough as more traditional metals with only a fraction of the weight. This property makes ceramic materials attractive for both personal and vehicular armor. Fuel-cell research, a priority of the government’s energy program, is driven by the

high cost and uncertain supply of fossil fuels. Ceramics also play a critical role in the commercialization of the government’s hydrogen energy initiative.8 Nanostructured ceramic materials are beginning to find a wide array of industrial, electronic, and biological uses. Other prominent or emerging areas in ceramics R&D include ultra-high-temperature ceramics for hypersonics; diamond and diamond-like films; ferroelectrics and piezoelectrics; ceramics with structured porosity; rapid prototyping and direct write processing techniques; and nonlinear optics.

The late 1980s and early/mid-1990s are viewed by some as having been the pinnacle of U.S. R&D in ceramics, with the focus on high-temperature superconductivity research and the emergence of large government programs on advanced structural ceramics. Since the late 1990s, the domestic industry has seen continued consolidation and dramatically increased competition from China and other Asian nations. In the 2000 benchmarking report, Japan was noted as “sharing the R&D leadership” role with the United States, and Japan remains a strong force in ceramics R&D. However, since the 2000 report, Korea has emerged as an important player in ceramics R&D and China is beginning to emerge as one. Western Europe, notably Germany, continues to play a major role in R&D for ceramics. It appears the U.S. share of worldwide ceramics R&D is decreasing. Many traditional ceramic areas like small electrical insulators and other lightweight, easy-to-ship materials have been especially affected. Additionally, the majority of the traditional university programs in ceramic engineering and science have merged into larger materials science and engineering programs.

While the United States has active programs for the study of ceramic materials, international competition is strong and becoming stronger. Even though U.S.-based industries continue to conduct the majority of their R&D activities within the United States, there is evidence that ceramics R&D, like manufacturing, is becoming a global enterprise. For example, East European countries and Russia have emerged as leaders in research on nonoxide glasses, with portions of the R&D activity being funded by the local governments, but U.S.-based industry has also recognized the expertise and has supported some of the R&D there. With other nations likely to continue to grow their domestic ceramics programs, foreign expertise in ceramics will strengthen.

Composites

-

Basic research into composites at U.S. universities was identified in the 2000 benchmarking report as having come to a standstill as a result of the

|

8 |

See, for example, the Department of Energy (DOE) report Basic Research Needs for the H2 Economy (2004). Available at http://www.sc.doe.gov/BES. |

-

Department of Defense decision to strictly curtail university research funding in metal, polymer, and ceramic matrix composites. The panel warned that if that situation persisted, the United States would forfeit its leadership role in composites.

As recognized in the 2000 benchmarking report, U.S. leadership in composites was once unchallenged. Composites as a concept were actively pursued under Project Forecast, a 1963 DOD initiative that identified a number of technologies of such importance that sustained and significant funding was warranted. The 1960s through the 1980s, which saw substantial funding and activity in the subfield, resulted in the development of composites for projects such as the F-22 fighter jet and orbital satellite systems that are currently being spun off into systems for infrastructure, offshore oil, wind energy, transportation, and so on. Since then, the leadership position has been challenged—not least of all because of European investments in the commercial and military aerospace industries.

Europe has moved to the front line of composites manufacturing and modeling, particularly in polymeric composites. The decline of the U.S. ballistic missile program and reentry systems has led to a decline in carbon-carbon composites programs in the United States. Other countries, such as France, Korea, Taiwan, China, and Japan, continue to have active programs. While U.S. professional societies9 and standards organizations10 in the subfield continue to be prominent, their dominance is being challenged by their European counterparts. It is interesting to note that today the largest composites trade show in the world is held in Paris, not in the United States.

Composites may be the first step toward the next generation of materials, components, and structures, and continued understanding of their potential will result in significant system-level payoffs for multiple applications. However, to date, developments in composites have only scratched the surface of their potential, with acceptance having been achieved for only the very basic laminates and materials solutions still not designed to take advantage of the anisotropic and tailorable nature of composites. Hence there are many potential growth areas.

Nanotailored composites are one area of promise. Since composites are all about the joining together of dissimilar constituents and interfaces, the ability to characterize and engineer at the nanoscale will open up a new suite of multifunc-

tional composites for rapid insertion. The tailorability of composites also holds great promise. There is potential for tailoring multiple constituents for multifunctional response in three-dimensional space; tailoring through hybrid constituents; tailoring through bio-inspiration; and tailoring through asymmetric architectures and gradient morphologies. Accurate analysis capabilities will help predict material behavior at a level that allows innovative material design and engineering such as three-dimensional, complex, and hybrid composites (as opposed to simple laminates). Such tailorability could increase damage tolerance and reduce processing, joining, and fastening costs. The ability to accurately understand and predict composite behavior in complex environments will help move beyond the current practice of applying conservative safety factors and relying on empiricism. There is also great potential for multifunctionality, including designing the composite to perform structurally as well as handle other specific tasks—for example, thermal management and electrical management; monitoring and sensing; or providing shape morphing.

Without a long-term investment in composites research in the United States, the industry will stagnate and eventually become uncompetitive with foreign companies that have maintained active research programs. The economic impact for commercial aerospace products can be great. For example, the Boeing 787 (Dreamliner) has a clear opportunity to dominate Airbus products primarily owing to its large percentage of composites, which results in lighter weight and allows it to fly more passengers, and increased passenger comfort (higher cabin humidity), enabled by the corrosion resistance of the composites. Japanese fibers and prepregs are well known to have tighter distributions of properties, which increases design allowables and improves manufacturing.

The decline of U.S. leadership in composites research has been accompanied by fewer government- and industry-funded programs and an erosion of the academic base in the subfield. Key researchers are thought to be leaving the area and going into other fields where research is better supported. Program changes in federal agencies that support composites research, such as NASA and parts of the Navy, along with tight budgets, have led to a decrease in U.S. activity. Industry has pulled much funding away from R&D for new materials technologies.11 Existing platforms and programs suffer from being risk-averse—that is, from wanting to use existing materials—and manufacturers do not want to disrupt production to insert new materials. This places a cap on development.

Today there are fewer U.S. commercial carbon-carbon manufacturers and far fewer companies providing oxidation coatings than there were 10 years ago. As a

result, there is little work ongoing to address sustainment and replacement of the shuttle fleet’s carbon-carbon leading edge or next-generation carbon-carbon components for space or air applications. Today, the large commercial and defense programs are outsourcing production and supporting R&D overseas—for instance, in the Joint Strike Fighter program and the Boeing Company’s Dreamliner program. In the United States, there is little work on computational or experimental benchmarks to accelerate insertion/certification.

In summary, the evidence presented here, along with the literature and patent data elsewhere in this report, suggests that the United States risks being unable to exploit the promise of composites because of the significant and continuing decline of its leadership in the subfield.

Magnetic Materials

-

In the 2000 benchmarking report, the United States was described as “catching up with the leaders in international research on magnetic materials and magnetism.” The panel found that the vitality of magnetic recording and the phenomenon of colossal magnetoresistance were starting to produce a renaissance in fundamental magnetism research in the United States.

The 2000 report did not address some areas in magnetic materials research that have become important to the field in the last 5 years. These include research on “hard” ferromagnets for more efficient, smaller, and lighter electric generators and motors; research on “soft” ferromagnets to decrease coercivities and for use in more efficient transformers that consume less energy; research on ferrites for improved high-frequency operation (especially for radar); and research on magneto-optic materials for information storage. More recently, there has been an increase in research into biomagnetism and materials for magnetic refrigeration. The biomagnetism area includes targeted drug delivery; detection and separation of antigens; magnetically improved magnetic resonance imaging (MRI) resolution in localized areas; localized control of biological or cellular activity; and magnetic heating probes for local thermal treatment.

Hard ferromagnet activity is centered in the United States and Europe (Germany), while Japan and Europe are the main centers of activity in soft ferromagnets. Centers of excellence in biomagnetism are found in the United States, Canada, Australia, and Europe, and magnetic cooling work is going on in the United States, Canada, Japan, Europe, Russia, China, and Hong Kong.

The United States is leading in magnetic refrigeration materials, with Europe (Netherlands) being a close second and the Pacific Rim in third place. This area of research is becoming such a hot area that a special session at the Magnetism and

Magnetic Materials Conference in November 2004 was devoted to it. Research in this area promises to find alternative cooling technologies.

In hard ferromagnets, Europe (Germany, in particular) and the United States share the leadership in recent research. Since the United States lacks the raw elements (rare earth elements, in particular) for permanent magnets, its permanent magnet industry is almost nonexistent. U.S. leadership in this area derives from the large number of users of permanent magnets here and their search for better materials in order to reduce the cost and weight of existing permanent magnets. In soft ferromagnets, Japan has the lead, with Europe (Germany) and the United States following. The Japanese have been particularly industrious at developing nanocomposites from rapidly solidified materials to create very low coercivity materials, especially for higher frequency operation. There are no U.S. manufacturers of soft ferromagnetic materials, but there are lots of U.S. users.

The United States is leading in magnetostriction materials, which are important mainly because of their application to microelectromechanical systems (MEMS) devices. The materials of most recent interest are FeGa alloys and alloys of GdGeSi, both of which have been found to possess large magnetostriction effects. Germany is quickly incorporating magnetostrictive materials into devices, including MEMS devices, and probably leads in that area. Japan is leading in research in magneto-optic materials for information storage, with the United States in second place, and the United States and Japan are probably tied for leadership in the area of giant magnetoresistance (GMR) devices, with Europe being a close second. However, with the sale by IBM of its magnetic recording activities to Hitachi, the only remaining U.S. manufacturer of magnetic recording devices is Seagate Corp. Leadership in this field of research will mean continued access to the large magnetic recording market.

Leadership in biomagnetism remains unclear as the field continues to grow in importance. It is also too early to tell how much impact magnetism will have in this area. Magnetism presently plays a strong role in the separation of biological species from a solution so they can be quantitatively measured. In addition, MRI resolution can be improved by placing magnetic particles in the vicinity of the area being imaged. How useful magnetism will be in drug delivery (another area with potential) remains to be seen.

In summary, leadership in the subfield of magnetic materials is mixed, with the United States in the lead in some critical areas and among the leaders in others.

Metals

-

The 2000 benchmarking report concluded that “in all probability, the U.S. lead will remain, but that is not a certainty.” The panel concluded that the

-

United States’ position as the only remaining superpower would be the driving force behind much MSE national-security-based research. However, the panel believed that with the end of the cold war, this pressure would diminish in proportion to perceived threats to national security, shifting the burden for materials development to nondefense industries. Another force that was identified as likely to affect the U.S. position was the consolidation and globalization of industries from aerospace companies to automotive suppliers. “For these businesses, the issues of U.S. competitiveness and research and development leadership are much less important, because their playing field is the world and they will seek knowledge wherever it is to be found.”

Research into the production, processing, and development of metallic materials in the United States has continued to decline since 1998. Very little alloy development is being done by metal producers, which formerly did most of this work, and companies in the metal-consuming industries have also decreased their efforts. The very substantial decline in activity over 20 years or so is illustrated by the data in Table 3.1.

A continuing loss of trained personnel in metallurgy results in a concomitant loss of corporate expertise in producing, refining, processing, and applying the metals that remain the basic engineered material of industry. This problem is exacerbated by a decreasing emphasis in the education of “materials” students on the structure, properties, processing, and application of metallic materials, leading to concerns that there will be a shortage of well-prepared graduating students.

As productivity in industries like the steel industry and the foundry industry improved greatly, the relatively flat annual demand for steel and castings over the past two decades caused employment to decline. Employment opportunities in R&D have also declined, resulting in a significant decrease in the number of students pursing careers in metals R&D.

The 2000 benchmarking report stated that computer modeling of material processing was the strength of the U.S. industry. Indeed, some industries today are utilizing computer-based models of solidification and mechanical working, but it is not true that the United States is ahead of the rest of the world in this area. Developers and researchers in Japan and Europe have provided many of the models used in the metals industry for process modeling and control. A majority of presentations at the 2004 Materials Science and Technology Conference, sponsored by The Minerals, Metals and Materials Society (primarily a metallurgical society) and by the Association of Iron and Steel Technology (primarily steel makers), were by non-U.S. participants. This is another indication of the continuing decline in metals R&D in the United States. In summary, the evidence pre-

TABLE 3.1 The Loss of Metals-Related R&D Jobs in the United States Since 1980a

sented here and the literature and patent data reported in Chapter 2 suggest the United States appears to be losing its leadership, and there are no indications that this trend is going to be reversed any time soon.

Electronic and Optical-Photonic Materials

-

The 2000 benchmarking report predicted that research in electronics would continue to focus on materials and processes and that it would be conducted globally through international collaborations among industrial organizations. Industry partnerships with academia and government, along with focused centers at universities, were expected to continue to be vitally important to U.S. leadership in the now-global semiconductor industry. The panel predicted that as semiconductor technology approached the 100 nm scale, the United States and others would make these advances more or less equally, if not as partners. The panel concluded that the United States would continue its leadership position in compound semiconductors (GaAs, GaAlAs) and wide-band-gap semiconductors (SiC) for power devices and microwave transmitters. Europe was expected to continue to share leadership with the United States in electrical power distribution and motor control applications of power transistors. In the field of nanotechnology, the panel noted that the United States had traditionally been the leader in exploratory nanostructures, including quantum wires and dots, and that it shared the lead with Europe and Russia in mesoscopic physics. However, the United States had conceded commercial leadership in wide-band-gap photonics to Europe and Japan, and the Japanese enjoyed “a commanding lead” in GaN technology and the commercialization of photon-pumped, phosphor-coated ultraviolet emitters for displays. The Japanese were expected to dominate flat-panel-display technologies “well into the future.” Research support in II-VI (ZnSe) wide-band-gap lasers at U.S. universities was predicted to shift to support for nitride research. The Japanese were expected to dramatically improve the longevity and external efficiency of II-VI lasers and light-emitting diodes.

It is noteworthy that the terms “globalization,” “outsourcing,” and “internationalization” were not explicitly mentioned in the 2000 report’s section on electronic and photonic materials. In 2004 the electronics industry and its materials supply chain were moving toward a global processing and manufacturing infrastructure. Large electronic materials suppliers had globalized their manufacturing base and support labs. Electronic original equipment manufacturers (OEMs) were globalizing R&D labs to support regionalized manufacturing operations. The ra-

pidity of this change was not anticipated in the 2000 study, but there was an awareness that such changes were beginning.

In the 2000 report it was stated that the industrial strength of the U.S. materials science and engineering research community could not be compared meaningfully with that of a single country. The collaboration of university and industry researchers was noted as an important aspect of the U.S. innovation system. In particular, the benefit of individuals moving between the academic and industrial worlds was noted. It was further stated that the elimination of central research laboratories and of longer term, innovative research by many high-tech companies was making the technology transfer from universities more difficult. Today the U.S. electronics material industry’s R&D is being globalized to support a worldwide industrial base. It remains too early to say if the weakening of the U.S. industrial R&D base will weaken U.S. innovation in the field of electronic materials or if there are alternative pathways for the transfer of innovative technology, such as industrial research consortia.

The 2000 report noted that the “valley of death” between innovation and application was becoming critical as development cycles became shorter. It further noted that proactively addressing this weakness was crucial to continued economic competitiveness in areas that depend on new materials. In the United States, industrial consortia such as Sematech and the International Electronics Manufacturing Initiative (iNEMI) have been formed to define research needs and to pull research results across that valley. However, as the electronic industry globalizes we often see American innovation being implemented into processes and manufacturing in other regions of the world, particularly Asia.

Today the United States is leading in R&D of materials and processes for semiconductor devices, particularly for evolving complementary metal oxide semiconductor (CMOS) technology. An example would be strained silicon technology. However, Japan and Korea are leading in the R&D of materials for displays and optical memories. In the area of organic printed wiring board materials, the R&D leadership is moving from the United States and Europe to Asia. A similar pattern is starting in materials for electronics packaging.

Semiconductor manufacturing is dominated by the United States, Europe, Japan, Taiwan, and Korea. Disk drive manufacturing is dominated by Singapore and Japan. Organic printed circuit board manufacturing for consumer products is moving to China from Japan, Taiwan, and Korea. Consumer electronics assembly has moved to China to be near the growing market and to take advantage of low-cost labor. In almost all cases, the global firms who provide materials are moving their development, manufacturing, and customer support functions close to the new manufacturing base.

Recently there has been rejuvenation in U.S. materials research to address the

projected end of Moore’s law and the scaling of CMOS devices. Many, including the International Technology Roadmap for Semiconductors (ITRS), anticipate that the traditional technology for cutting-edge devices will have fully evolved by 2015 and are looking for innovative solutions through new materials, new devices, or new architectures. The Semiconductor Research Corporation (SRC) has started a major new initiative in conjunction with the National Nanotechnology Initiative (NNI) and the NSF to focus on new nanostructures that might skirt this forecasted technology roadblock. These efforts will develop a new generation of researchers focused on new materials and structures for electronic devices. The iNEMI is road mapping the impact that these new nanodevices would have on the packaging and assembly of electronic devices. New electronic packaging will have to have micron-size leads and be capable of greatly enhanced heat transfer. Creative new material composites containing nanoparticles may provide the solution. They are being developed in many countries, and the technology is being bought or licensed from and by multinationals and start-ups around the world.

Another area of increased interest in the electronics community is sensors of all types: mechanical, fluidic, biological, chemical, radio frequency, and optical. Automotive, medical, consumer, and military end use electronics markets envision new products using inexpensive microsensors integrated with electronics processing. These sensors, called MEMs or “systems in package,” will use a variety of silicon, ceramic, and organic substrates and call for new materials, particularly organic or biological. There is strong research leadership in the United States, followed by Europe, in materials for this growing area.

In summary, the evidence presented here and the literature data in Chapter 2 suggest the situation in electronic and optical-photonic materials is mixed, with the United States leading in some areas and not in others, often determined by commercial and market factors.

Superconducting Materials

-

The 2000 benchmarking report concluded that the strong position of the United States in superconducting materials was not “assured.” It noted that while U.S. industrial research in the field lagged behind Japan’s, some small U.S. companies maintained world leadership in the design, manufacture, and characterization of long-length conductors, although the panel warned that “the shift in U.S. corporate research away from longer-term basic studies presents a question for the future.” The panel noted that the momentum at that time favored relative improvements in the U.S. leadership position in some areas (magnetic properties, flux transport measurements and imaging, thin-film processing, and cable development), but without contin-

-

ued strong federal investment in basic and applied research, that position would change. The panel concluded that the United States was poised, with strong processing and manufacturing capabilities and a growing talent pool, to capture a substantial segment of the superconducting market.

The mechanism for superconductivity in high-temperature superconductors (HTSCs) remains a very active research issue, although the technological breakthroughs made possible by the 1986 discovery are only beginning to be seen. There are both economic and military needs that are driving superconductivity research. In particular, the U.S. electricity supply system needs modernization and expansion to meet the needs of a growing economy and population. HTSC power technologies could play an important role, and electric utilities and large equipment manufacturers are planning R&D as well as installing and operating first-of-a-kind prototypes on their systems. Importantly, government funds are matched equally by private funds in the United States, which greatly increases the activity level. Similar pressures from growing electricity demand that might drive HTSC R&D here do not exist in Japan or Europe.

After it became apparent that wire technologies had to come first, the DOD reduced its R&D but closely tracked progress related to power applications. That changed with a 2002 determination by DOD that the second-generation (2G) wire being researched by DOE was “the critical component for several defense applications that require high electrical power and are essential to the national defense.” Since then, DOD has participated with DOE in pilot-scale manufacturing for 2G wire. DOD also recently funded development of superconducting motors for ship propulsion and superconducting generators for airborne weapons use. The defense market, while relatively small compared with the commercial power market, is becoming an important driver of research.

The United States has been at the forefront in elucidating fundamental HTSC physical properties and has enjoyed leadership in synthesis and processing, with Europe and Japan also mounting strong efforts in these areas. Modeling of flux pinning and other phenomena that affect magnetic and electrical properties continues to be a vital area for research worldwide. The discovery of new HTSCs has slowed, and the materials discovered in the 1980s remain important worldwide, even though materials with higher transition temperatures (Tc) have been found. The grand scientific challenge has become to discover room-temperature superconductors, which would have enormous theoretical implications and would broaden technological applications beyond those now possible with HTSCs.

First-generation (1G) HTSC wires were successfully developed in the early 1990s and sold in the United States and Japan. European companies also developed manufacturing capability, and a Chinese company was recently established

for this purpose. 1G wire is the only option now for power equipment development, but a 2G wire is expected to become available. The U.S. 2G leadership position is being challenged by a number of companies in Japan, Korea, China, and Europe. The United States continues to enjoy a leadership position in characterization and processing control technology for 2G wires and tapes. It has strong processing research capabilities at its national laboratories and excellent characterization facilities at DOE laboratories, universities, and the National Institute of Standards and Technology. Partnerships between government scientists and wire developers at U.S. companies increased recently, accelerating the availability of this important innovation. 2G wire research has been successful in many countries, and wires long enough to support power equipment development will likely be introduced in several countries before 2010. Applications needing higher magnetic fields—such as transformers, motors, and generators—are often put on hold to await the availability of 2G wires. Table 3.2 depicts the current status of 2G wire research worldwide.

DOE’s Superconductivity Partnerships with Industry program has facilitated a number of first-of-a-kind utility-scale projects for several important electric power technologies. Japan and Europe have also had comprehensive electric power technology programs, and Korea and China recently began projects. The United States appears to have a commanding lead in planned installation of HTSC cables on the electricity grid.12

Fault current limiters are an important technology that is being pursued in several countries. The U.S. project, led by SuperPower, will test a 138-kV class fault current limiter in an American Electric Power substation. Japan was expected to discontinue all ac equipment projects at the end of 2004, including several on fault current limiters. The world’s most powerful fault current limiter—a three-phase, 10-MVA device—was tested in Europe last year. There are motor and generator projects in the United States and Europe. The U.S. Navy is building HTSC ship-board propulsion motors with target ratings exceeding 30,000 hp. Rockwell Automation demonstrated a 1,500-hp motor and continues to develop the technology for larger class machines. Alstom is planning to operate a 250-kW machine in 2005. General Electric has built components for a 100-MVA-class generator but has delayed development pending availability of 2G wires. DOD is funding the development of high-speed HTSC generators for use on aircraft; these generators may use 2G wires. The U.S. transformer project led by Waukesha Electric Systems

TABLE 3.2 Second-Generation HTSC Wire Technology, December 2004

|

Country or Region/ Organization |

Length (m) |

Critical Current at 77 K (A/cm width) |

Substrate/ HTSC Deposition Process |

|

United States/ American Superconductor |

34 |

186 |

RABiTS/MOD |

|

|

10 |

272 |

|

|

|

Short samples |

~400 |

|

|

United States/SuperPower |

100 |

70 |

IBAD/PLD |

|

|

62 |

100 |

IBAD/MOCVD |

|

Japan/Sumitomo |

35 |

175 |

RABiTS/PLD |

|

|

105 |

NA |

RABiTS |

|

|

Short samples |

357 |

RABiTS/PLD |

|

|

10 |

130 |

RABiTS/MOD |

|

Japan/Showa Electric |

230 |

NA |

RABiTS (Ni-W) |

|

Japan/Fujikura |

105 |

126 |

IBAD/PLD |

|

|

Short samples |

~300 |

|

|

|

255 |

NA |

IBAD |

|

Japan/ISTEC |

45.8 |

182 |

IBAD/PLD |

|

|

8.6 |

119 |

IBAD/MOD |

|

|

220 |

NA |

IBAD |

|

|

Short samples |

413 |

IBAD/MOD |

|

Europe/THEVA |

1 |

422 |

ISD/Evaporation |

|

|

5 |

237 |

|

|

|

10 |

148 |

|

|

Europe/Edison Spa |

2 |

120 |

RABiTS/Coevaporation |

|

|

Short samples |

>200 |

|

|

Korea/KERI |

4 |

97 |

RABiTS/Coevaporation |

|

|

1 |

107 |

RABiTS/PLD |

was completed in 2004, with no follow-on device fabrication planned until 2G wire and appropriate cryogenic dielectrics became available. In Europe, Getra is building a small demonstration unit, and the Japanese have university-level activity.

In summary, U.S. scientists working on superconductivity are among the world leaders in nearly all component fields of superconducting materials. The United States, however, does not dominate in any, because other countries share or surpass the U.S. lead, often reflecting commercial realities.

Polymers

-

The 2000 benchmarking report noted the United States had paid less attention and given less funding than many other countries to polymer research and that it “could lose ground in relative terms if not in absolute terms.” The report noted the importance of polymer research to the U.S. positive trade balance in much of the chemical industry and that sustaining that balance would require the maintenance of U.S. world leadership in polymer research. The report also noted that environmental and life-cycle concerns were drivers for polymer research and development in Europe and were becoming drivers in the United States.

A review of polymer research in 2005 leads to an optimistic overall forecast for the field, consistent with the conclusions in 2000. There has been a resurgence of excitement over polymer science at a number of long-standing polymer departments at universities such as the University of Massachusetts at Amherst, Case Western Reserve University, and the University of Southern Mississippi, and many young faculty have been hired. In addition, researchers with a strong polymer science focus are now commonly found in the chemistry, chemical engineering, and materials science departments of leading U.S. universities such as the Massachusetts Institute of Technology (MIT), Cornell, the California Institute of Technology, the University of North Carolina, and the University of Texas. Similar trends are noted in Europe and Asia; the field is becoming more accepted by the classical science disciplines and is international in scope and distribution of skills.

The 2000 report also noted that much of the early research was done in U.S. industrial laboratories. This is becoming less and less the case: There is a strong trend at large U.S. polymer companies to substantially reduce the size of their early-stage research infrastructures and to refocus efforts to achieve shorter-term business/technical goals. A similar reshaping of the research infrastructure is also noted in Europe and Asia.

Long-term disruptive research (time to commercialization, 10 years or more) is being replaced by research with shorter-term goals (2- to 5-year programs or shorter). To an extent these trends are offset by research growth in the polymer user industry (computation, communication, medical devices) and the shifting of higher-risk, long-term research to start-up companies and university collaborations. While these trends suggest that significant levels of early-stage polymer research are continuing in the United States, the location of the engineering and scale-up infrastructure that can bring these ideas to commercial fruition, especially to serve large-volume markets, is unclear.

The 2000 benchmarking study noted the importance of the U.S. polymer in-

dustry for the positive balance of trade enjoyed by the U.S. chemical industry. That positive balance was seriously eroded in the first few years of the 21st century.13Table 3.3 summarizes the impact of the U.S. chemical industry on the balance of trade. From these data it is clear that while the chemical industry’s balance of trade has been eroding, the plastics (polymer) sector is the one bright spot. Clearly, for this to continue, there needs to be a steady stream of new products identified and commercialized by U.S. producers.

The 2000 benchmarking report noted that interest in biological approaches, in reducing environmental impacts, and in biomedical applications of materials provided opportunities for the polymer industry. With the cost of oil increasing and the cost of sugar (from corn, cane, and the like) decreasing, there is an increasing interest in polymers derived from biomass rather than petroleum. Major efforts in this area have been announced by DuPont, and a joint venture was set up between Dow Chemical and Cargill to commercialize corn-based polylactides as commodity plastics. The impact of the recent announcement that Dow Chemical has sold its share to Cargill is unclear, but the reception for the product to date has been significantly stronger in Asia than in the United States or Europe. The lactide polymers were initially developed as erodible polymeric biomaterials by Johnson and Johnson in the 1970s, and the center of research into sugar-derived polymers continues to reside in the United States. Assuming current world pricing trends in oil continue, this area offers research promise in the 21st century. Bioderived and bioinspired polymers are also attractive emerging areas of polymer research where the United States enjoys a leadership position.

Overall, the United States maintains a leadership position in polymer research, although longer-term, applied polymer research is shifting from the industrial to the academic sector. The challenge will be not only to maintain research leadership but also to reestablish a U.S. polymer research infrastructure that can successfully commercialize emerging products.

Catalysts

-

The 2000 benchmarking report concluded that the leading position of the United States relative to the rest of the world in the subfield of catalysts was “likely to lose ground as a result of the targeted funding aimed at growing capabilities in other countries.” The panel warned that catalysis research could stagnate in the United States without “stronger, better equipped re-

|

13 |

American Chemical Society, Globalization and the Chemical Industry, ACS Industry Pavilion (2002). Available at http://www.chemistry.org/portal/a/c/s/1/acsdisplay.html?DOC=industry\2002_global.html. |

TABLE 3.3 Trends in the Chemical Trade (million $)

|

Industry Subsector |

Exports |

Imports |

Trade Balance |

|||||||||

|

2001 |

2002 |

2003 |

2004a |

2001 |

2002 |

2003 |

2004a |

2001 |

2002 |

2003 |

2004a |

|

|

Organic chemicals |

16,424 |

16,408 |

20,103 |

25,026 |

29,712 |

30,365 |

32,887 |

35,522 |

–13,288 |

–13,957 |

–12,784 |

–10,496 |

|

Inorganic chemicals |

5,578 |

5,461 |

5,576 |

5,954 |

6,153 |

6,019 |

7,420 |

7,981 |

–575 |

–558 |

–1,844 |

–2,027 |

|

Plastics |

18,485 |

19,380 |

21,069 |

24,791 |

10,401 |

10,760 |

12,161 |

14,084 |

8,084 |

8,620 |

8,908 |

10,707 |

|

Fertilizers |

2,077 |

2,106 |

2,342 |

2,644 |

1,890 |

1,619 |

2,129 |

2,381 |

187 |

487 |

213 |

263 |

|

Pharmaceuticals |

15,031 |

15,773 |

17,776 |

23,438 |

18,628 |

24,749 |

31,517 |

34,740 |

–3,597 |

–8,976 |

–13,741 |

–11,302 |

|

Cosmetics |

5,825 |

5,871 |

6,558 |

7,396 |

3,750 |

4,235 |

5,611 |

6,805 |

2,075 |

1,636 |

947 |

591 |

|

Dyes and colorants |

3,782 |

3,861 |

4,138 |

4,576 |

2,478 |

2,357 |

2,481 |

2,686 |

1,304 |

1,504 |

1,657 |

1,890 |

|

Other |

12,382 |

12,347 |

12,987 |

14,514 |

5,927 |

6,167 |

6,858 |

8,027 |

6,455 |

6,180 |

6,129 |

6,487 |

|

Total |

79,584 |

81,207 |

91,549 |

108,338 |

78,939 |

86,271 |

101,054 |

112,226 |

645 |

–5,064 |

–9,505 |

–3,888 |

|

NOTE: The data presented show that while the balance of trade in the chemical industry has been eroding, the situation for plastics is the exception, showing a growing excess of exports over imports. a2004 estimate by Chemical and Engineering News. SOURCE: Bureau of the Census. |

||||||||||||

-

search centers where researchers can work together with common goals.” The report predicted that the United States would remain a world leader for the production of chemicals through catalytic reactions in the most energy-efficient, safe, and environmentally compatible way. However, university-based research would continue to suffer relative to industry research unless better equipment became available. The panel noted the need for continued investment in catalysis research targeted at encouraging innovation and allowing U.S. industry to participate in the growth of emerging markets.

As a technology, catalysis has for decades provided American business with leadership positions, largely in the refining of petroleum to fuels, the production of a host of chemicals and polymers, power generation, emissions controls, and so on. Since the 2000 report there have been big changes in the catalysis industry—that is, catalyst producers and the chemicals and petrochemicals industries. Globalization has played a role in these changes in a number of ways. Global conglomerates that are no longer so heavily involved in the U.S. market are rushing to participate in the growth in Asia, especially China, now a major importer and exporter of chemicals as well as the number 2 importer of oil in the world. Catalyst producers have undergone substantial consolidation, as have many companies and industries that use catalysts.14 The disruption in the U.S. industry as it becomes a commodity business has been accompanied by a reduction in the fundamental R&D these companies used to support or carry out. Catalysis research at companies in the United States has seen no significant growth since the 2000 report.

On the world scene, catalysis research continues to be a vibrant activity. Technical societies such as the Catalysis Society, with its regional organizations in the United States and abroad, continue to draw large numbers of scientists to meetings. Other forums, such as the American Chemical Society meetings and the American Institute of Chemical Engineering, are also active. Europe has developed outstanding centers of excellence. Highly respected catalyst R&D centers now exist in the Netherlands and in China.

A recent report by the U.S. International Trade Commission (ITC) concludes that catalysis in the United States has suffered greatly in the last 5 years.15 Both American industry and universities have deemphasized catalysis research in the face of budget tightening and seemingly more glamorous technologies (biotechnology, electronics, and so on). As the ITC trade report comments, “a substantial percentage of expenditures by U.S. companies for contract catalysis R&D is now spent overseas, whereas staffing in company-funded catalysis has been reduced as a result of increased focus on the bottom line, which has also led to reduced U.S. university enrollment in catalysis-related R&D; although new technology development is accelerating, market application development has not always kept pace.” The report also states that “U.S. universities are increasingly becoming a vehicle for research. Industry instead focuses on development and commercialization.” The ITC concludes, “U.S. leadership role in catalysis has been eroding, but U.S. is highly competitive.”

The foremost topics in catalysis continue to be environmental catalysis, fuel processing, selective oxidation, acid-base catalysis, biocatalysis, gas-to-liquids, production of hydrogen, asymmetric catalysis, photocatalysis, and chemical processing. Energy and the environment continue to be growth areas for catalysis R&D. Environmental legislation will continue to create a demand for new catalysts and catalytic processes. For example, regulations to reduce the sulfur content of gasoline and diesel fuel and limits on emissions from refineries will influence the refining catalyst business. Catalysis is seen by DOE to be critical to the development of a hydrogen economy. Catalysts are seen to provide the vital, crosscutting research needed, and they are viewed as “central to energy conversion.”16

Research at the nanoscale promises to provide new understanding of the structure-property relationships for catalytic processes, while use of Operando (in situ characterization techniques)-driven research allows monitoring working catalysis under actual process conditions. These approaches, in combination with high-throughput screening, provide new techniques and methodologies for the discovery and development of new catalysts and more energy-efficient chemical processes.

In summary, catalysis R&D in the United States reflects the commercial reality. As many of the major industries that use catalysts have refocused attention on serving overseas demand, catalysis research in the United States has suffered. Since

|

15 |

International Trade Commission, Report No. 3602, available at http://www.USITC.gov/ITTR.htm. |

|

16 |

DOE, Basic Research Needs for the Hydrogen Economy (2004), available at http://www.sc.doe.gov/BES. |

the 2000 report, the United States has seen a continued decline in its former dominance in catalysis technology. The evidence presented here and the patent and literature data presented in Chapter 2 suggest the United States is steadily losing its leadership of this critical technology, going from the world leadership position in the 1970s and 1980s to one now of collective leadership. However, many exciting areas for catalysis research remain and could sustain a healthy research base in catalysis.

Nanomaterials

-

The materials subfield of nanomaterials was not addressed as an individual subfield in the 2000 benchmarking report; in the section on electronic and optoelectronic materials, the report noted that in the field of nanotechnology, the United States had traditionally been a leader in exploratory nanostructures, including quantum wires and dots.

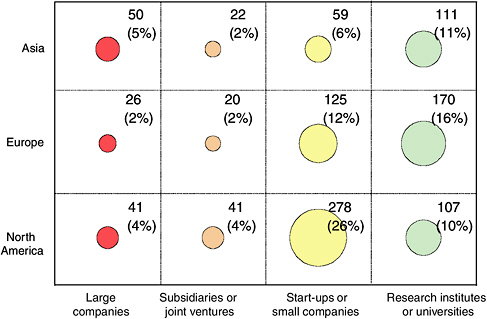

Of all of the areas of nanotechnology, the subarea of nanomaterials is widely expected to grow most rapidly. For one thing, the number of nanoparticle companies in the world increased from fewer than 20 to more than 200 between 2002 and 2004. Nanomaterial technology is moving faster than other nanotechnologies because of where nanomaterials fit in the product value chain. Figure 3.2, from the Nanotechnology Opportunity Report,17 illustrates the differences between nanotechnology strategies from region to region. The United States has only a modest lead in nanomaterials, a lead that is not likely to last long. This situation can be attributed to the nature of nanotechnology innovation in the United States compared with other parts of the world. In fact, the United States is the near-term innovation leader, with the largest investment in start-ups and small companies, and this position gives it an early lead in generating intellectual property. However, although entrepreneurial activity in the United States is impressively fast-paced, it might turn out to be inefficient, because the nanomaterials technologies have not been developed in ways that are suited to small companies or start-ups. Meanwhile, in Europe, greater investment is being directed toward fundamental R&D at universities and other research institutions, a strategy that may bring more significant breakthroughs in nanomaterials design synthesis in the long term. Asia—China, Japan, and Korea in particular—has adopted and integrated nano-

|

17 |

See Científica, The Nanotechnology Opportunity Report (2003), available at http://www.cientifica.com/html/NOR/NORV2.htm. The report profiles over 800 nanotechnology companies, research groups, and investors worldwide. |

FIGURE 3.2 Global competition. Players by type in competing economic blocs in the nanotechnology sector. Size of the circle is proportional to the number of actors in the field. SOURCE: Científica and Jaakko Pöyry Consulting.

technology research into large commercial enterprises. The Asian strategy may ultimately lead to profitable manufacturing of nanostructured materials.

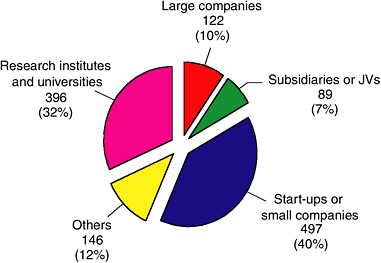

Figure 3.3, also from the Nanotechnology Opportunity Report, shows the distribution of nanotechnology R&D among various kinds of organizations. Table 3.4 shows the growth in select nanomaterials research areas, according to the cumulative number of publications found using the Los Alamos National Laboratory FlashPoint Multidatabase literature search tool. Literature analyses such as these reveal the maturity of nanomaterials research and point to some of the hot topics. Growth has been relatively uniform across the areas of nanomaterials research, although some more mature areas are growing more slowly.

Clearly there is ongoing and growing excitement about nanoscience in the international research community, but the sources of financial support for nanotechnology indicate how the resources are being channeled into the development of commercial products. It is largely through commercialization that nanomaterials and nanotechnology will impact quality of life and economic prosperity.

FIGURE 3.3 Distribution of entities contributing to nanotechnology development in the world. SOURCE: Científica and Jaakko Pöyry Consulting.

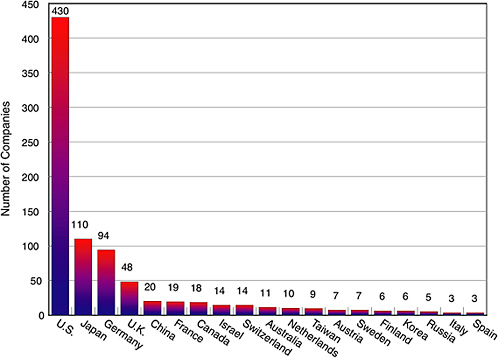

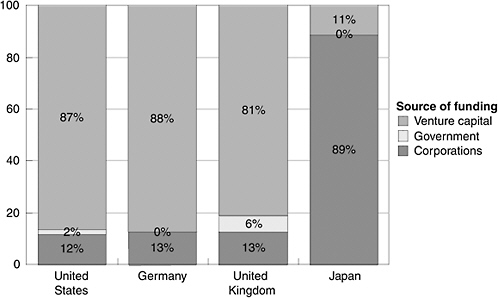

All sources of capital for nanotechnology are growing, with the global pattern for this growth one indication of where nanotechnology is headed. The United States remains the global leader in the number of corporations engaged in nanotechnology, as shown in Figure 3.4. The corporate investment in nanotechnology worldwide totaled $2.0 billion in 2001; by 2003, it had exceeded $2.8 billion. In the same time period, government investment increased from about $2.0 billion to $3.0 billion. Government investment in Japan in nanotechnology research is growing more rapidly and catching up with analogous U.S. and European investments. Figure 3.5 shows that venture capital is the most significant source of support for

TABLE 3.4 Growth in Select Nanomaterials Research Areas

FIGURE 3.4 Companies active in the nanosector, grouped by country of origin. SOURCE: Científica and Jaakko Pöyry Consulting.

nanotechnology in Western countries such as the United States, the United Kingdom, and Germany. The venture community is playing a critical role in the growth of nanomaterials commercialization in the United States. In contrast, corporate investment dominates nanotechnology commercialization in Japan. We can therefore expect the incorporation of nanotechnology in existing corporate products in Asia, while in the United States we should see a greater proliferation of novel nanomaterials and nanotechnologies that come from highly innovative start-up companies.

In summary, while the United States leads global activity in nanomaterials and nanotechnology as measured by the number of corporations engaged in the subfield, it is too early to say which region of the world, if any, is going to show clear leadership as this field matures. The use of nanotechnology in many electronic and optical-photonic materials and devices means the U.S. position in both MSE subfields will remain interconnected.

FIGURE 3.5 Sources of capital for nanotechnology in four countries, through end 2002. SOURCE: Científica and Jaakko Pöyry Consulting.

CURRENT STATUS OF MSE R&D

According to the benchmarking reported here, the United States is still the leader or among the leaders in research in fields where the domestic process or manufacturing industry is leading or strong. It appears that when an industry begins to move to other regions of the world, there are two different models: (1) the growth of an industry outside the United States leads to a decline in domestic research and (2) a proactive industry forms a strategy, and the strong materials R&D base in the United States is sustained. Catalysis is an example of a subfield where U.S. research declined along with the global growth of the petroleum and chemical industry and its relative decline in the United States. Electronic materials for CMOS and magnetic disk drives are examples where the manufacturing industry moves to another region but the industry has acted proactively to maintain the strong materials R&D base in the United States.

The benchmarking evidence in this chapter and the patent and literature evidence from Chapter 2 make it clear that the increasing international and transnational activity in MSE R&D is impacting U.S. MSE R&D and its standing in the world. In this regard, the committee offers two conclusions.

Conclusion. Globalization of MSE R&D is proceeding rapidly, in line with broader trends toward globalization. As a result of increasing international trade and investment, the emergence of new markets, and the growth of the Internet and the global communications system, MSE R&D in the United States is an internationalized activity with a diverse set of international partners.

Conclusion. The globalization of MSE R&D is narrowing the technological lead of the United States.