2

Why Are Science and Technology Critical to America’s Prosperity in the 21st Century?

Since the Industrial Revolution, the growth of economies throughout the world has been driven largely by the pursuit of scientific understanding, the application of engineering solutions, and continual technological innovation.1 Today, much of everyday life in the United States and other industrialized nations, as evidenced in transportation, communication, agriculture, education, health, defense, and jobs, is the product of investments in research and in the education of scientists and engineers.2 One need only think about how different our daily lives would be without the technological innovations of the last century or so.

The products of the scientific, engineering, and health communities are, in fact, easily visible—the work-saving conveniences in our homes; medical help summoned in emergencies; the vast infrastructure of electric power, communication, sanitation, transportation, and safe drinking water we take for granted.3 To many of us, that universe of products and

|

1 |

Another point of view is provided in Box 2-1. |

|

2 |

S. W. Popper and C. S. Wagner. New Foundations for Growth: The U.S. Innovation System Today and Tomorrow. Santa Monica, CA: RAND Corporation, 2002. The authors state: “The transformation of the U.S. economy over the past 20 years has made it clear that innovations based on scientific and technological advances have become a major contributor to our national well being.” P. ix. |

|

3 |

One study argues that “there has been more material progress in the United States in the 20th century than there was in the entire world in all the previous centuries combined,” and most of the examples cited have their basis in scientific and engineering research. S. Moore and J. L. Simon. “The Greatest Century That Ever Was: 25 Miraculous Trends of the Last 100 Years.” Policy Analysis No. 364. Washington, DC: Cato Institute, December 15, 1999. |

|

BOX 2-1 Another Point of View: Science, Technology, and Society For all the practical devices and wonders that science and technology have brought to society, it has also created its share of problems. Researchers have had to reapply their skills to create solutions to unintended consequences of many innovations, including finding a replacement for chlorofluorocarbon-based refrigerants, eliminating lead emissions from gasoline-powered automobiles, reducing topsoil erosion caused by large-scale farming, researching safer insecticides to replace DDT, and engineering new waste-treatment schemes to reduce hazardous chemical effluents from coal power plants and chemical refineries. |

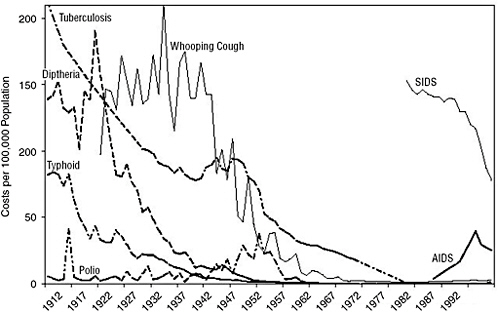

services defines modern life, freeing most of us from the harsh manual labor, infectious diseases, and threats to life and property that our forebears routinely faced. Now, few families know the suffering caused by smallpox, tuberculosis (TB), polio, diphtheria, cholera, typhoid, or whooping cough. All those diseases have been greatly suppressed or eliminated by vaccines (Figure 2-1).

We enjoy and rely on world travel, inexpensive and nutritious food, easy digital access to the arts and entertainment, laptop computers, graphite tennis rackets, hip replacements, and quartz watches. Box 2-2 lists a few examples of how completely we depend on scientific research and its application—from the mighty to the mundane.

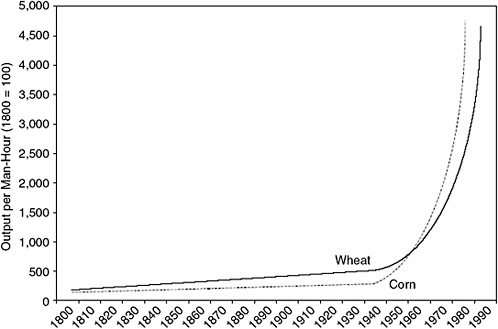

Science and engineering have changed the very nature of work. At the beginning of the 20th century, 38% of the labor force was needed for farm work, which was hard and often dangerous. By 2000, research in plant and animal genetics, nutrition, and husbandry together with innovation in machinery had transformed farm life. Over the last half-century, yields per acre have increased about 2.5 times,4 and overall output per person-hour has increased fully 10-fold for common crops, such as wheat and corn (Figure 2-2). Those advances have reduced the farm labor force to less than 3% of the population.

Similarly, the maintenance of a house a century ago without today’s labor-saving devices left little time for outside enjoyment or work to produce additional income.

The visible products of research, however, are made possible by a large

FIGURE 2-1 Incidence of selected diseases in the United States throughout the 20th century. The 20th century saw dramatic reductions in disease incidence in the United States.

NOTES: Sudden Infant Death Syndrome (SIDS) rate is per 100,000 live births. AIDS definition was substantially expanded in 1985, 1987, and 1993. TB rate prior to 1930 is estimated as 1.3 times the mortality rate.

SOURCES: S. Moore, J. L. Simon, and the CATO Institute. “The Greatest Century That Ever Was: 25 Miraculous Trends of the Past 100 Years.” Policy Analysis No. 364, December 15, 1999. Pp. 1-32. Based on Historical Statistic of the United States, Series B 149, B 291, B 299-300, B 303; Health, United States, 1999, Table 53; and American SIDS Institute. Available at: http://www.sids.org/.

enterprise mostly hidden from public view—fundamental and applied research, an intensively trained workforce, and a national infrastructure that provides risk capital to support the nation’s science and engineering innovation enterprise. All that activity, and its sustaining public support, fuels the steady flow of knowledge and provides the mechanism for converting information into the products and services that create jobs and improve the quality of modern life. Maintaining that vast and complex enterprise during an age of competition and globalization is challenging, but it is essential to the future of the United States.

ENSURING ECONOMIC WELL-BEING

Knowledge acquired and applied by scientists and engineers provides the tools and systems that characterize modern culture and the raw materials

|

BOX 2-2 Twenty Great Engineering Achievements of the 20th Century Electricity: steam turbine generators; long-distance, high-voltage transmission lines; pulverized coal; large-scale electric grids Automotive: machine tools, assembly line, self-starting ignition, balloon tire, safety-glass windshield, electronic fuel injection and ignition, airbags, antilock brakes, fuel cells Aeronautics: aerodynamic wing and fuselage design, metal alloys and composite materials, stressed-skin construction, jet propulsion, fly-by-wire control systems, collision warning systems, Doppler weather radar Water supply and distribution: chlorination, wastewater treatment, dams, reservoirs, storage tanks, tunnel-boring equipment, computerized contaminant detection, desalination, large-scale distillation, portable ultraviolet devices Electronics: triodes, semiconductors, transistors, molecular-beam epitaxy, integrated circuits, digital-to-optical recording (CD-ROM), microprocessors, ceramic chip carriers Radio and television: alternators, triodes, cathode-ray tubes, super heterodyne circuits, AM/FM, videocassette recorders, flat-screen technology, cable and high-definition television, telecommunication satellites Agriculture: tractors, power takeoff, rubber tires, diesel engines, combine, corn-head attachments, hay balers, spindle pickers, self-propelled irrigation systems, conservation tillage, global-positioning technology Computers: electromechanical relays; Boolean operations; stored programs; programming languages; magnetic tape; software, supercomputers, minicomputers, and personal computers; operating systems; the mouse; the Internet Telephony: automated switchboards, dial calling, touch-tone, loading coils, signal amplifiers, frequency multiplexing, coaxial cables, microwave signal transmission, switching technology, digital systems, optical-fiber signal transmission, cordless telephones, cellular telephones, voice-over-Internet protocols Air conditioning and refrigeration: humidity-control technology, refrigerant technology, centrifugal compressors, automatic temperature control, frost-free cooling, roof-mounted cooling devices, flash-freezing Highways: concrete, tar, road location, grading, drainage, soil science, signage, traffic control, traffic lights, bridges, crash barriers Aerospace: rockets, guidance systems, space docking, lightweight materials for vehicles and spacesuits, solar power cells, rechargeable batteries, satellites, freeze-dried food, Velcro Internet: packet-switching, ARPANET, e-mail, networking services, transparent peering of networks, standard communication protocols, TCP/IP, World Wide Web, hypertext, web browsers |

|

Imaging: diagnostic x-rays, color photography, holography, digital photography, cameras, camcorders, compact disks, microprocessor etching, electron microscopy, positron-emission tomography, computed axial tomography, magnetic-resonance imaging, sonar, radar, sonography, reflecting telescopes, radiotelescopes, photodiodes, charge-coupled devices Household appliances: gas ranges, electric ranges, oven thermostats, nickel-chrome resistors, toasters, hot plates, electric irons, electric motors, rotary fans, vacuum cleaners, washing machines, sewing machines, refrigerators, dishwashers, can openers, cavity magnetrons, microwave ovens Health technology: electrocardiography; heart–lung machines; pacemakers; kidney dialysis; artificial hearts; prosthetic limbs; synthetic heart valves, eye lenses, replacement joints; manufacturing techniques and systems design for large-scale drug delivery; operating microscopy; fiber-optic endoscopy; laparoscopy; radiologic catheters; robotic surgery Petroleum and petrochemical technology: thermal-cracking oil refining; leaded gasoline; catalytic cracking; oil byproduct compounds; synthetic rubber; coal tar distillation byproduct compounds, plastics, polyvinyl chloride, polyethylene, synthetic fibers; drilling technologies; drill bits; pipelines; seismic siting; catalytic converters; pollution-control devices Lasers and fiber optics: maser, laser, pulsed-beam laser, compact-disk players, barcode scanners, surgical lasers, fiber optic communication Nuclear technology: nuclear fission, nuclear reactors, electric-power generation, radioisotopes, radiation therapy, food irradiation High-performance materials: steel alloys, aluminum alloys, titanium superalloys; synthetic polymers, Bakelite, Plexiglas; synthetic rubbers, neoprene, nylon; polyethylene, polyester, Saran Wrap, Dacron, Lycra spandex fiber, Kevlar; cement, concrete; synthetic diamonds; superconductors; fiberglass, graphite composites, Kevlar composites, aluminum composites SOURCE: G. Constable and B. Somerville. A Century of Innovation: Twenty Engineering Achievements That Transformed Our Lives. Washington, DC: Joseph Henry Press, 2003. |

for economic growth and well-being. The knowledge density of modern economies has steadily increased, and the ability of a society to produce, select, adapt, and commercialize knowledge is critical for sustained economic growth and improved quality of life.5,6 Robert Solow demonstrated that pro-

FIGURE 2-2 US farm labor productivity from 1800 to 2000. There was a 100-fold increase in US farm labor output, much of it brought about by advancements in science and technology.

SOURCE: S. Moore, J. L. Simon, and the CATO Institute. “The Greatest Century That Ever Was: 25 Miraculous Trends of the Past 100 Years.” Policy Analysis No. 364, December 15, 1999. Pp. 1-32.

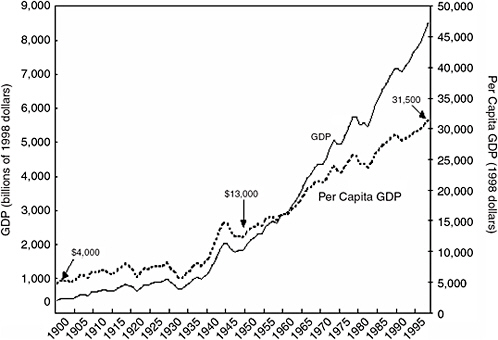

ductivity depends on more than labor and capital.7 Intangible qualities— research and development (R&D), or the acquisition and application of knowledge—are crucial.8 The earlier national commitment to make a substantial public investment in R&D was based partly on that assertion (Figure 2-3).

Since Solow’s pioneering work, the economic value of investing in science and technology has been thoroughly investigated. Published estimates of return on investment (ROI) for publicly funded R&D range from 20 to 67% (Table 2-1). Although most early studies focused on agriculture, recent work shows high rates of return for academic science research in the

|

7 |

R. M. Solow. “Technical Change and the Aggregate Production Function.” The Review of Economics and Statistics 39(1957):312-320; R. M. Solow. Investment and Technical Progress. In Arrow, Karlin & Suppes, eds. Mathematical Models in Social Sciences, 1960. For more on Solow’s work, see http://nobelprize.org/economics/laureates/1987/index.html. |

|

8 |

Solow, 1957. |

FIGURE 2-3 Gross domestic product during the 20th century. In the 20th century, US per capita gross domestic product (GDP) rose almost 7-fold.

SOURCE: S. Moore, J. L. Simon, and the CATO Institute. “The Greatest Century That Ever Was: 25 Miraculous Trends of fhe Past 100 Years.” Policy Analysis, No. 364, December 15, 1999. Pp. 1-32.

aggregate (28%),9 and slightly higher rates of return for pharmaceutical products in particular (30%).10 Modern agriculture continues to respond, and the average return on investment for public funding of agricultural research for member countries of the Organisation for Economic Cooperation and Development (OECD) is estimated at 45%.11

Starting in the middle 1990s, investments in computers and information technology started to show payoffs in US productivity. The economy grew faster and employment rose more than had seemed possible without

|

9 |

E. Mansfield. “Academic Research and Industrial Innovation.” Research Policy 20(1991): 1-12. |

|

10 |

A. Scott, G. Steyn, A. Geuna, S. Brusoni, and W. E. Steinmeuller. “The Economic Returns of Basic Research and the Benefits of University-Industry Relationships.” Science and Technology Policy Research. Brighton: University of Sussex, 2001. Available at: http://www.sussex.ac.uk/spru/documents/review_for_ost_final.pdf. |

|

11 |

R. E. Evenson. Economic Impacts of Agricultural Research and Extension. In B. L. Gardner and G. C. Rausser, eds. Handbook of Agricultural Economics Vol. 1. Rotterdam: Elsevier, 2001. Pp. 573-628. |

TABLE 2-1 Annual Rate of Return on Public R&D Investment

|

Studies |

Subject |

Rate of Return to Public R&D (percent) |

|

Griliches (1958) |

Hybrid corn |

20-40 |

|

Peterson (1967) |

Poultry |

21-25 |

|

Schmitz-Seckler (1979) |

Tomato harvester |

37-46 |

|

Griliches (1968) |

Agriculture research |

35-40 |

|

Evenson (1968) |

Agriculture research |

28-47 |

|

Davis (1979) |

Agriculture research |

37 |

|

Evebsib (1979) |

Agriculture research |

45 |

|

Davis and Peterson (1981) |

Agriculture research |

37 |

|

Mansfield (1991) |

All academic science research |

28 |

|

Huffman and Evenson (1993) |

Agricultural research |

43-67 |

|

Cockburn and Henderson (2000) |

Pharmaceuticals |

30+ |

|

SOURCE: A. Scott, G. Steyn, A. Geuna, S. Brusoni, W. E. Steinmeuller. “The Economic Returns of Basic Research and the Benefits of University-Industry Relationships.” Science and Technology Policy Research. Brighton: University of Sussex, 2001. Available at: http://www.sussex.ac.uk/spru/documents/review_for_ost_final.pdf. |

||

fueling inflation. Policy-makers previously focused almost entirely on changes in demand as the determinant of inflation, but the surge in productivity showed that changes on the supply side of the economy could be just as important and in some cases even more important.12 Such data serve to sustain the US commitment to invest substantial public funds in science and engineering.13

Of equal interest are studies of the rate of return on private investments in R&D.14 The return on investment to the nation is generally higher than is the return to individual investors (Table 2-2).15 One reason is that knowledge tends to spill over to other people and other businesses, so research results diffuse to the advantage of those who are prepared to apply them.

TABLE 2-2 Annual Rate of Return on Private R&D Investment

|

Researcher |

Estimated Rate of Return % |

|

|

Private |

Social |

|

|

Nadiri (1993) |

20-30 |

50 |

|

Mansfield (1977) |

25 |

56 |

|

Terleckyj (1974) |

29 |

48-78 |

|

Sveikauskas (1981) |

7-25 |

50 |

|

Goto-Suzuki (1989) |

26 |

80 |

|

Bernstein-Nadiri (1988) |

10-27 |

11-111 |

|

Scherer (1982, 1984) |

29-43 |

64-147 |

|

Bernstein-Nadiri (1991) |

15-28 |

20-110 |

|

SOURCE: Center for Strategic and International Studies. Global Innovation/National Competitiveness. Washington, DC: CSIS, 1996. |

||

Those “social rates of return”16 on investments in R&D are reported to range from 20 to 100%, with an average of nearly 50%.17 As a single example, in recent years, graduates from one US university have founded 4,000 companies, created 1.1 million jobs worldwide, and generated annual sales of $232 billion.18

Although return-on-investment data vary from study to study, most economists agree that federal investment in research pays substantial economic dividends. For example, Table 2-3 shows the large number of jobs and revenues created by information-technology manufacturing and services—an industry that did not exist until the recent past. The value of public and private investment in research is so important that it has been

|

16 |

“Social rate of return” is defined in C. I. Jones and J. C. Williams. “Measuring the Social Return to R&D.” Working Paper 97002. Stanford University Department of Economics, 1997. Available at: http://www.econ.stanford.edu/faculty/workp/swp97002.pdf#search=‘R&D%20social%20rate%20of%20return. They state, “One can think of knowledge as an ‘asset’ purchased by society, held for a short period of time to reap a dividend, and then sold. The return can then be thought of as a sum of a dividend and a capital gain (or loss). … The dividend associated with an additional idea consists of two components. First, the additional knowledge directly raises the productivity of capital and labor in the economy. Second, the additional knowledge changes the productivity of future R&D investment because of either knowledge spillovers or because subsequent ideas are more difficult to discover.” Pp. 6-8. |

|

17 |

M. I. Nadiri. “Innovations and Technological Spillovers.” Economic Research Reports, RR 93-31. New York: C. V. Starr Center for Applied Economics, New York University Department of Economics, August 1993. Nadiri adds, “The channels of diffusion of the spillovers vary considerably and their effects on productivity growth are sizeable. These results suggest a substantial underinvestment in R&D activity.” |

|

18 |

W. M. Ayers. MIT: The Impact of Innovation. Boston, MA: Bank Boston, 2002. Available at: http://web.mit.edu/newsoffice/founders/Founders2.pdf. |

TABLE 2-3 Sales and Employment in the Information Technology (IT) Industry, 2000

|

|

NAICS Code |

Sales Revenues ($ billions) |

Number of Jobs (1,000) |

|

|

IT Manufacturing |

||||

|

|

Computer and peripheral equipment |

3341 |

110.0 |

190 |

|

|

Communications equipment |

3342 |

119.3 |

291 |

|

|

Software |

5112 |

88.6 |

331 |

|

|

Semiconductors and other electronic components |

3344 |

168.5 |

621 |

|

IT Services |

||||

|

|

Data processing services |

5142 |

42.9 |

296 |

|

|

Telecommunications services |

5133 |

354.2 |

1,165 |

|

SOURCE: National Research Council. Impact of Basic Research on Industrial Performance. Washington, DC: The National Academies Press, 2003. |

||||

described as “fuel for industry.”19 The economic contribution of science and technology can be understood by examining revenue and employment figures from technology- and service-based industries, but the largest economic influence is in the productivity gains that follow the adoption of new products and technologies.20

CREATING NEW INDUSTRIES

The power of research is demonstrated not only by single innovations but by the ability to create entire new industries—some of them the nation’s most powerful economic drivers.

Basic research on the molecular mechanisms of DNA has produced a new field, molecular biology, and recombinant-DNA technology, or gene splicing, which in turn has led to new health therapies and the enormous growth of the biotechnology industry. The potential of those developments for health and healthcare is only beginning to be realized.

Studies of the interaction of light with atoms led to the prediction of stimulated emission of coherent radiation. That, together with the quest for a device to produce high-frequency microwaves, led to the development of

the laser, a ubiquitous device with uses ranging from surgery, precise machining, and nuclear fusion to sewer alignment, laser pointers, and CD and DVD players.

Enormous economic gains can be traced to research in harnessing electricity, which grew out of basic research (such as that conducted by Michael Faraday and James Maxwell) and applied research (such as that by Thomas Edison and George Westinghouse). Furthermore, today’s semiconductor integrated circuits can be traced to the development of transistors and integrated circuits, which began with basic research into the structure of the atom and the development of quantum mechanics by Paul Dirac, Wolfgang Pauli, Werner Heisenberg, and Erwin Schrodinger21 and was realized through the applied research of Robert Noyce and Jack Kilby.

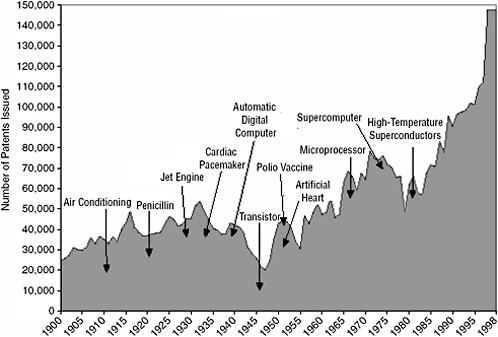

In virtually all those examples, the original researchers did not—or could not—foresee the consequences of the work they were performing, let alone its economic implications. The fundamental research typically was driven by the desire to answer a specific question about nature or about an application of technology. The greatest influence of such work often is removed from its genesis,22 but the genius of the US research enterprise has been its ability to afford its best minds the opportunity to pursue fundamental questions (Figures 2-4, 2-5, 2-6).

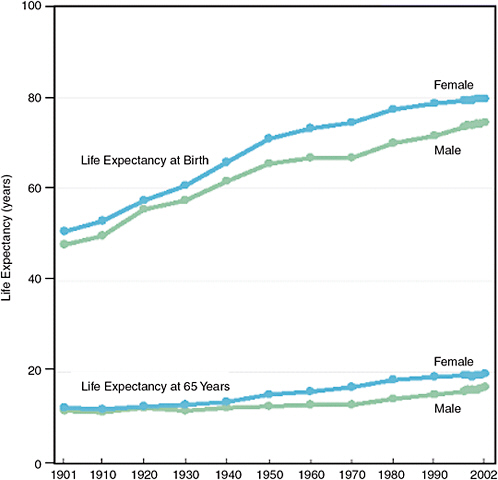

PROMOTING PUBLIC HEALTH

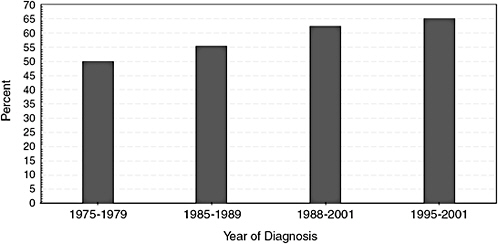

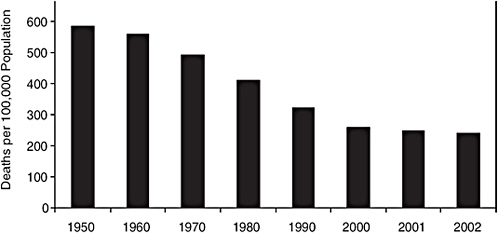

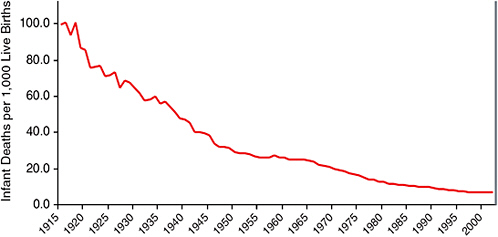

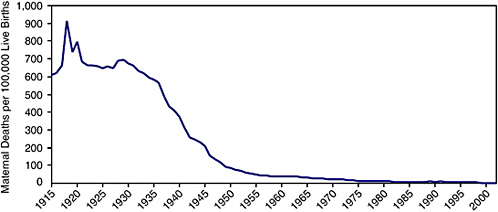

One straightforward way to view the practical application of research is to compare US life expectancy (Figure 2-7) in 1900 (47.3 years)23 with that in 1999 (77 years).24 Our cancer and heart-disease survival rates have improved (Figure 2-8), and accidental-death rates and infant and maternal mortality (Figure 2-9) have fallen dramatically since the early 20th century.25

Improvements in the nation’s health are, of course, attributable to many factors, some as straightforward as the engineering of safe drinking-water supplies. Also responsible are the large-scale production, delivery, and storage

FIGURE 2-4 Number of patents granted by the United States in the 20th century with examples of critical technologies.

SOURCE: S. Moore, J. L. Simon, and the CATO Institute. “The Greatest Century That Ever Was: 25 Miraculous Trends of the Past 100 Years.” Policy Analysis No. 364, December 15, 1999. Pp. 1-32.

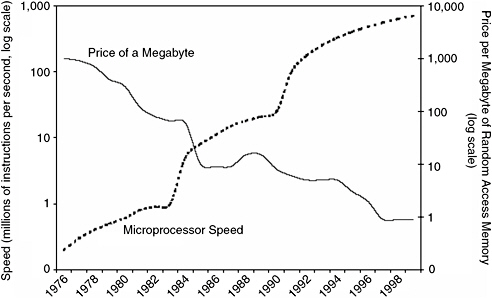

FIGURE 2-5 Megabyte prices and microprocessor speeds, 1976-2000. Moore’s law maintained: megabyte prices decrease as microprocessor speeds increase.

SOURCE: S. Moore, J. L. Simon, and the CATO Institute. “The Greatest Century That Ever Was: 25 Miraculous Trends of the Past 100 Years.” Policy Analysis No. 364, December 15, 1999. Pp. 1-32.

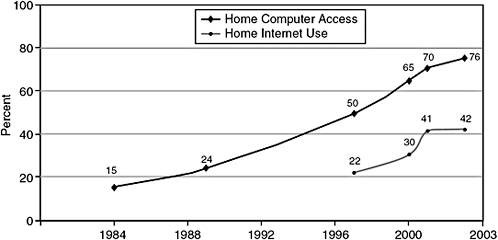

FIGURE 2-6 Percentage of children ages 3 to 17 who have access to a home computer and who use the Internet at home, selected years, 1984-2001. Many US children have access to and use computers and the Internet.

SOURCE: Child Trends Data Bank. Available at: http://www.childtrendsdatabank.org/figures/78-Figure-2.gif.

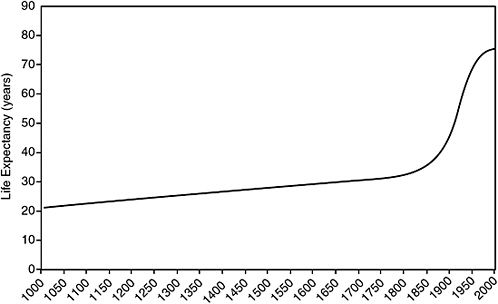

FIGURE 2-7A Life expectancy at birth, 1000-2000. Life expectancy has increased, particularly in the last century.

SOURCE: S. Moore, J. L. Simon, and the CATO Institute. “The Greatest Century That Ever Was: 25 Miraculous Trends of the Past 100 Years.” Policy Analysis No. 364, December 15, 1999. Pp. 1-32.

FIGURE 2-7B Life expectancy at birth and at 65 years of age, by sex, in the United States, 1901-2002. Life expectancy has increased in the United States, particularly in the last century.

SOURCE: Center for Disease Control and Prevention, National Center for Health Statistics, National Vital Statistic System.

of nutritious foods and advances in diagnosis, pharmaceuticals, medical devices, and treatment methods.26

Medical research also has brought economic benefit. The development of lithium as a mental-health treatment, for example, saves $9 billion in health costs each year. Hip-fracture prevention in postmenopausal women at risk for osteoporosis saves $333 million annually. Treatment for

FIGURE 2-8A Five-year relative cancer survival rates for all ages, 1975-1979, 1985-1989, 1988-2001, and 1995-2001.

SOURCE: Surveillance, Epidemiology, and End Results (SEER) Program (www.seer.cancer.gov) SEER*Stat Database: Incidence—SEER 9 Regs Public-Use, November 2004 Sub (1973-2002), National Cancer Institute, DCCPS, Surveillance Research Program, Cancer Statistics Branch, released April 2005, based on the November 2004 submission.

FIGURE 2-8B Heart disease mortality, 1950-2002.

SOURCE: National Center for Health Statistics. Health, United States, 2005. Table 29. Available at: http://www.cdc.gov/nchs/data/hus/hus05.pdf.

FIGURE 2-9A Infant mortality, 1915-2000.

SOURCE: National Center for Health Statistics. National Vital Statistics Reports (53)5:Table 11. Available at: http://www.cdc.gov/nchs/products/pubs/pubd/nvsr/53/53-21.htm.

FIGURE 2-9B Maternal mortality, 1915-2000.

SOURCE: National Center for Health Statistics: National Vital Statistics Reports (53)5:Table 11. Available at: http://www.cdc.gov/nchs/products/pubs/pubd/nvsr/53/53-21.htm.

testicular cancer has resulted in a 91% remission rate and annual savings of $166 million.27

CARING FOR THE ENVIRONMENT

Advances in our understanding of the environment have led to better systems to promote human health and the health of our planet. Weather satellites, global positioning systems, and airborne-particle measurement technologies also have helped us to monitor and mitigate unexpected environmental problems. Unfortunately, some of these problems have been the consequence of unexpected side-effects of technological advances. Fortunately, in many cases additional technological understanding was able to overcome unintended consequences without forfeiting the underlying benefits.

Water Quality

Early in the 20th century, when indoor plumbing was rare, wastewater often was dumped directly into streets and rivers. Waterborne diseases— cholera, typhoid fever, dysentery, and diarrhea—were rampant and among the leading causes of death in the United States. Research and engineering for modern sewage treatment and consequent improvements in water quality have dramatically affected public and environmental health. Water-pollution controls have mitigated declines in wildlife populations, and research into wetlands and riparian habitats has informed the process of engineering water supplies for our population.

Automobiles and Gasoline

In the 1920s, engineers discovered that adding lead to gasoline caused it to burn more smoothly and improved the efficiency of engines. However, they did not predict the explosive growth of the automobile industry. The widespread use of leaded gasoline resulted in harmful concentrations of lead in the air,28 and by the 1970s the danger was apparent. New formulations developed by petrochemical researchers not requiring the use of lead

|

27 |

W. D. Nordhaus. The Health of Nations: The Contribution of Improved Health and Living Standards. New York: Albert and Mary Lasker Foundation, 1999. Available at: http://www.laskerfoundation.org/reports/pdf/economic.pdf; L. E. Rosenberg. “Exceptional Returns: The Economic Value of America’s Investment in Medical Research.” Research Enterprise 177(2000):368-371. |

|

28 |

US Congress House of Representatives Committee on Science, 1998, p. 38. |

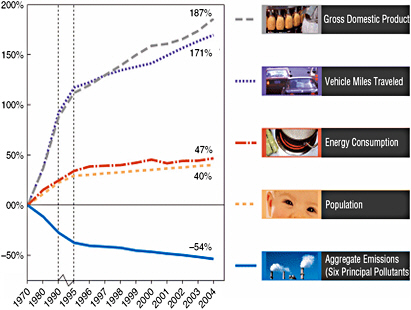

FIGURE 2-10 Comparison of growth areas and air pollution emissions, 1970-2004. US air quality has improved despite increases in gross domestic product, vehicle miles traveled, and energy consumption since the 1970s.

SOURCE: US Environmental Protection Agency. Air Emissions Trends—Continued Progress Through 2004. Available at: http://www.epa.gov/airtrends/2005/econemissions.html.

have resulted in vastly reduced emissions and improved air quality (Figure 2-10). Parallel advances in petroleum refining and the adoption and improvement of catalytic converters increased engine efficiency and removed harmful byproducts from the combustion process. Those achievements have reduced overall automobile emissions by 31%, and carbon monoxide emissions per automobile are 85% lower than in the 1970s.29

Refrigeration

In the early 1920s, scientists began working on nontoxic, nonflammable replacements for ammonia and other toxic refrigerants then in use. In 1928, Frigidaire synthesized the world’s first chlorofluorocarbon (CFC), trademarked as Freon. By the 1970s, however, it had become clear that CFCs contribute to losses in the atmosphere’s protective layer of ozone. In

1974, scientists identified a chain reaction that begins with CFCs and sunlight and ends with the production of chlorine atoms. A single chlorine atom can destroy as many as 100,000 ozone molecules. The consequences could be long-lasting and severe, including increased cancer rates and global warming.30

In 1987, the Montreal Protocol began a global phase-out of CFC production. That in turn provided the market force that fueled the development of new, non-CFC refrigerants. Although the results of CFC use provide an example of the unintended negative consequences of technology, the response demonstrates the influence of science in diagnosing problems and providing effective solutions.

Agricultural Mechanization

Advances in agriculture have vastly increased farm productivity and food production. The food supply for the world’s population of more than 6 billion people comes from a land area that is 80% of what was used to feed 2.5 billion people in 1950. However, injudicious application of mechanization also led to increased soil erosion. Since 1950, 20% of the world’s topsoil has been lost—much of it in developing countries. Urban sprawl, desertification, and over-fertilization have reduced the amount of arable land by 20%.31 Such improvements as conservation tillage, which includes the use of sweep plows to undercut wheat stalks but leave roots in place, have greatly reduced soil erosion caused by traditional plowing and have promoted the conservation of soil moisture and nutrients. Advances in agricultural biotechnology have further reduced soil erosion and water contamination because they have reduced the need for tilling and for use of pesticides.

IMPROVING THE STANDARD OF LIVING

Improvements attributable to declining mortality and better environmental monitoring are compounded by gains made possible by other advances in technology. The result has been a general enhancement in the quality of life in the United States as viewed by most observers.

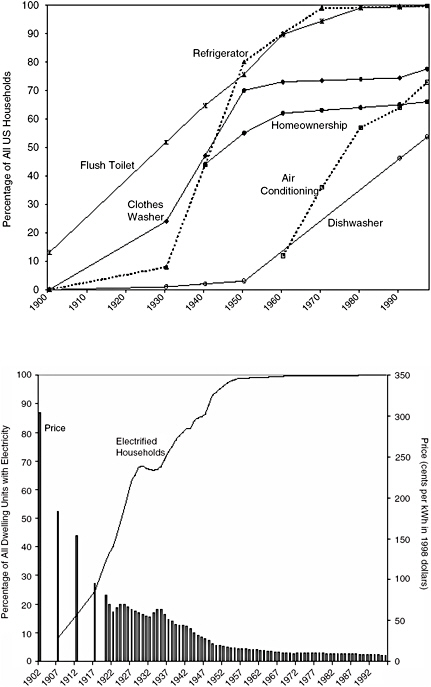

Electrification and Household Appliances

Advances in technology in the 20th century resulted in changes at home and in the workplace. In 1900, less than 10% of the nation was electrified; now virtually every home in the United States is wired (Figure 2-11).32 Most of us give little thought to the vast array of electrical appliances that surround us.

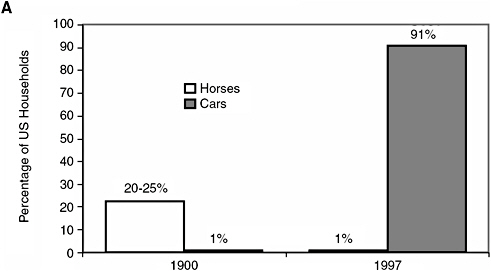

Transportation

As workers left farms to move to cities, transportation systems developed to get them to work and home again. Advances in highway construction in turn fueled the automotive industry. In 1900, one-fourth of US households had a horse, and many in urban areas relied on trolleys and trams to get to work and market. Today, more than 90% of US households own at least one car (Figure 2-12). Improvements in refrigeration put a refrigerator in virtually every home, and the ability to ship food across the country made it possible to keep those refrigerators stocked. The increasing speed, safety, and reliability of aircraft spawned yet another global industry that spans commercial airline service and overnight package delivery.

Communication

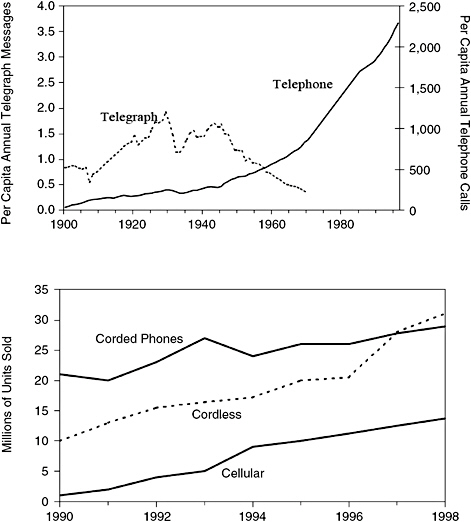

At the beginning of the 20th century slightly more than 1 million telephones were in use in the United States. The dramatic increase in telephone calls per capita over the following decades was made possible by advances in cable bundling, fiber optics, touch-tone dialing, and cordless communication (Figure 2-13). Cellular-telephone technology and voice-over-Internet protocols have added even more communication options. At the beginning of the 21st century, there were more than 300 million telephone communication devices and cellular telephone lines in the United States.

Radio and television revolutionized the mass media, but the Internet has provided altogether new ways of communicating. Interoperability between systems makes it possible to use one device to communicate by telephone, over the Internet, in pictures, in voice, and in text. The “persistent presence” that those devices make possible and the eventual widespread availability of wireless and broadband services will spawn another revolution in communication. At the same time, new R&D will be needed to

|

32 |

US Department of Labor. Report on the American Workforce, 2001. Washington, DC: US Department of Labor, 2001. Available at: http://www.bls.gov/opub/rtaw/pdf/rtaw2001.pdf. |

FIGURE 2-11 Improvement in US housing and electrification of US homes during the 20th century. The number of US homes with electricity, plumbing, refrigeration, and basic appliances soared in the middle of the 20th century.

SOURCE: S. Moore, J. L. Simon, and the CATO Institute. “The Greatest Century That Ever Was: 25 Miraculous Trends of the Past 100 Years.” Policy Analysis No. 364, December 15, 1999. Pp. 1-32.

FIGURE 2-12A Ground transportation: horses to horsepower, 1900 and 1997.

SOURCE: S. Moore, J. L. Simon, and the CATO Institute. “The Greatest Century That Ever Was: 25 Miraculous Trends of the Past 100 Years.” Policy Analysis No. 364, December 15, 1999. Pp. 1-32.

FIGURE 2-12B Air travel, United States, 1928-2002.

SOURCE: US Census Bureau. “Statistical Abstract of the United States.” Available at: http://www.census.gov/statab/hist/HS-41.pdf.

FIGURE 2-13 Modern communication, 1900-1998. More telephones than ever are used to make more calls per capita, thanks to enormous technological advances in a host of disciplines.

SOURCE: S. Moore, J. L. Simon, and the CATO Institute. “The Greatest Century That Ever Was: 25 Miraculous Trends of the Past 100 Years.” Policy Analysis No. 364, December 15, 1999. Pp. 1-32.

reduce the energy demands of the new devices and their sensor-net support infrastructures.

Disaster Mitigation

Structural design, electrification, transportation, and communication come together in coordinating responses to natural disasters. Earthquake engineering and related technologies now make possible quake-resistant

skyscrapers in high-risk zones. The 1989 Loma Prieta earthquake in central California caused 60 deaths and more than $6 billion in property damage, but occupants of the 49-story Transamerica Pyramid building in San Francisco were unharmed, as was the building itself, even though its top swayed from side to side by more than 1 foot for more than a minute.33 In December 1988, an earthquake in Georgia in the former USSR of the same magnitude as Loma Prieta led to the deaths of 22,000 people—illustrating the impact of the better engineered building protection available in California.

A US Geological Survey radio system increases safety for cleanup crews during aftershocks. After Loma Prieta, workers in Oakland were given almost a half hour notice of aftershocks 50 miles away, thanks to the speed differential between radio and seismic waves.34

Weather prediction, enabled by satellites and advances in imaging technology, has helped mitigate losses from hurricanes. Early-warning systems for tornadoes and tsunamis offer another avenue for reducing the effects of natural disasters—but only when coupled with effective on-the-ground dissemination. As is the case for many technologies, this last step of getting a product implemented, especially in underserved areas or developing countries, can be the most difficult. Furthermore, as hurricane Katrina in New Orleans demonstrated, early warning is not enough—sound structural design and a coordinated human response are also essential.

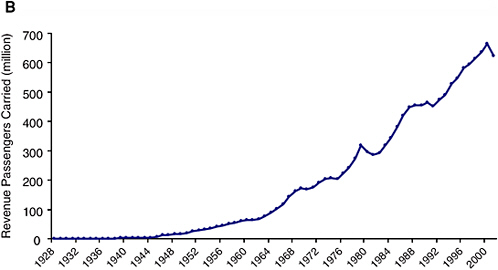

Energy Conservation

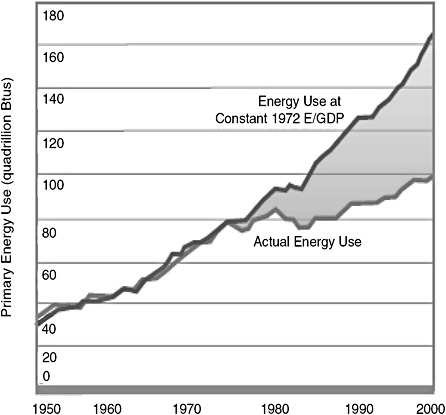

The last century saw demonstrations of the influence of technology in every facet of our lives. It also revealed the urgent need to use resources wisely. Resource reduction and recycling are expanding across the United States. Many communities, spurred by advances in recycling technologies, have instituted trash-reduction programs. Industries are producing increasingly energy-efficient products, from refrigerators to automobiles. Today’s cars use about 60% of the gasoline per mile driven that was used in 1972. With the advent of hybrid automobiles, further gains are now being realized. Similarly, refrigerators today require one-third of the electricity that they needed 30 years ago. In the 1990s, manufacturing output in the United States expanded by 41%, but industrial consumption of

|

33 |

US Geological Survey. Building Safer Structures. Fact Sheet 167-95. Reston, VA: USGS, June 1998. Available at: http://quake.wr.usgs.gov/prepare/factsheets/SaferStructures/SaferStructures.pdf. |

|

34 |

US Geological Survey. Speeding Earthquake Disaster Relief. Fact Sheet 097-95. Reston, VA: USGS, June 1998. Available at: http://quake.wr.usgs.gov/prepare/factsheets/Mitigation/Mitigation.pdf. |

FIGURE 2-14 US primary energy use, 1950-2000. The efficiency of energy use has improved substantially over the last 3 decades.

SOURCE: National Energy Policy Development Group. National Energy Policy. Washington, DC: US Government Printing Office, May 2001.

electricity grew by only 11%. The introduction and use of energy-efficient products have enabled the US economy to grow by 126% since 1973 while energy use has increased by only 30% (Figure 2-14).35 Those improvements in efficiency are the result of work in a broad spectrum of science and engineering fields.

UNDERSTANDING HOW PEOPLE LEARN

Today, an extraordinary scientific effort is being devoted to the mind and the brain, the processes of thinking and learning, the neural processes that occur during thought and learning, and the development of competence. The

revolution in the study of the mind that has occurred in recent decades has important implications for education.36 A new theory of learning now coming into focus will lead to very different approaches to the design of curriculum, teaching, and assessment from those generally found in schools today.

Research in the social sciences has increased understanding of the nature of competent performance and the principles of knowledge organization that underlie people’s abilities to solve problems in a wide variety of fields, including mathematics, science, literature, social studies, and history. It has also uncovered important principles for structuring learning experiences that enable people to use what they have learned in new settings. Collaborative studies of the design and evaluation of learning environments being conducted by cognitive and developmental psychologists and educators are yielding new knowledge about the nature of learning and teaching in a variety of settings.

SECURING THE HOMELAND

Scientific and engineering research demonstrated its essential role in the nation’s defense during World War II. Research led to the rapid development and deployment of the atomic bomb, radar and sonar detectors, nylon that revolutionized parachute use, and penicillin that saved battlefield lives. Throughout the Cold War the United States relied on a technological edge to offset the larger forces of its adversaries and thus generously supported basic research. The US military continues to depend on new and emerging technologies to respond to the diffuse and uncertain threats that characterize the 21st century and to provide the men and women in uniform with the best possible equipment and support.37

Just as Vannevar Bush described a tight linkage between research and security,38 the Hart–Rudman Commission a half-century later argued that security can be achieved only by funding more basic research in a variety of fields.39 In the wake of the 9/11 attacks and the anthrax mailings, it is clear that innovation capacity and homeland security are also tightly coupled.

There can be no security without the economic vitality created by innovation, just as there can be no economic vitality without a secure environment in which to live and work.40 Investment in R&D for homeland security has grown rapidly; however, most of it has been in the form of development of new technologies to meet immediate needs.

Human capacity is as important as research funding. As part of its comprehensive overview of how science and technology could contribute to countering terrorism, for example, the National Research Council recommended a human-resources development program similar to the post-Sputnik National Defense Education Act (NDEA) of 1958.41 A Department of Defense proposal to create and fund a new NDEA is currently being examined in Congress.42

CONCLUSION

The science and technology research community and the industries that rely on that research are critical to the quality of life in the United States. Only by continuing investment in advancing technology—through the education of our children, the development of the science and engineering workforce, and the provision of an environment conducive to the transformation of research results into practical applications—can the full innovative capacity of the United States be harnessed and the full promise of a high quality of life realized.