2

Slowing the Growth of Energy Consumption

It is wrong to think of the nation’s energy troubles as simply difficulties in energy supply. The real problem is finding a new balance between energy supply and energy demand, consistent with generally satisfactory overall economic performance.* The generally rising real price of energy lends advantage to higher investments in both supply and conservation. The economic, environmental, and political trade-offs between these two coordinate efforts are not perfectly understood, but it is clear that in many activities throughout the economy it is cheaper now to invest in saving a Btu than in producing an additional one. As prices rise in the coming decades, more such opportunities will appear.

Until only the past few years, falling real prices and the availability of new sources made energy supplies seem virtually inexhaustible. The cheapness of energy fostered buildings, consumer products, industrial processes, and personal habits that used energy in ways that are by today’s standards—and by tomorrow’s no doubt even more—inefficient.

During this period the prices consumers paid for energy did not fully reflect its costs to society (as they still do not, though some steps have been made). Some resource costs and diverse social costs were borne by society at large rather than directly by the producers and users of energy. Subsidies, for example, were applied to the production and use of various

|

* |

See statement 2–1, by R.H.Cannon, Jr., Appendix A. |

energy resources, and many of the environmental and other social impacts of producing and using energy were simply unaccounted for.

The underpricing of energy encouraged rapid increases in the use of our most convenient and irreplaceable fossil fuels. At the same time, it provided inadequate incentives to search for additional supplies or substitutes. It is precisely because of this cheap-energy climate, and the consumption patterns it fostered, that there is now so much room for improvement in the efficiency of energy use before we shall begin to feel any serious economic penalties. Transportation (particularly via highway vehicles), comfortably warm or cool buildings, and industrial heat can be provided by much less energy than has been customary. In the future, if current trends in the cost of energy continue, the amount of energy consumed to provide a given economic product will gradually decrease. As the economy moves toward a new economic balance between the costs of energy and those of capital, labor, and other factors of production, it will surely come to produce goods and services with much improved energy efficiency.

DETERMINANTS OF ENERGY DEMAND

Energy is an intermediate good, valued not for itself but for the services it can provide. The amounts and kinds of energy needed to perform a given set of tasks are not fixed but vary from time to time and place to place, depending on a number of technological, economic, and demographic variables. The most important independent variables in this case are the level of economic activity, measured by the gross national (or gross domestic) product,1 and the relative prices of energy in its various forms. These in turn influence the composition of GNP and the efficiency with which energy is used. Secondary influences are provided by such factors as climate and the geographical distribution of population and industry.*

A useful measure of the energy intensity of a society is the ratio of its energy consumption to its economic output, measured in dollars of constant purchasing power. This ratio is expressed for convenience as energy/GDP or energy/GNP. Among the advanced industrial societies it varies by a factor of about 2. The United States energy-to-output ratio is one of the highest.

Some, but not all, of this difference is due to geographical and demographic differences. European configurations of industry and settlement, for example, are more compact than those of this country, and

|

* |

See statement 2–2, by J.P.Holdren, Appendix A. |

transport distances are correspondingly shorter. International variations in this ratio depend most importantly, however, on the price of energy, as it influences the efficiency with which energy is used. Most nations tax energy and energy-consuming equipment in ways calculated to induce efficiency, and such policies have tended to constrain energy consumption. For example, Western European countries have generally taxed gasoline to price levels double those in the United States, and have instituted purchase taxes on automobiles more or less scaled to their fuel consumption. This has resulted in cars with better fuel economy, in heavier use of public transportation, and generally in fewer miles driven per vehicle per year. Higher fuel prices have induced Western European and Japanese industries also to be relatively economical of energy, and to take advantage of technical innovations in energy efficiency that in this country have been of little or no economic benefit until recently.

From the end of World War II until the 1973–1974 OPEC price rise, the real prices of most forms of energy declined steadily, as energy producers took advantage of economies of scale and technical innovation, as well as subsidies like the oil depletion allowance. Declining real prices stimulated demand for energy in all countries, including the United States. Still, the U.S. energy/GNP ratio declined from 1920 until 1945 and then remained fairly constant until very recently, when signs of a further decline began to appear as a consequence of rising prices.

The abrupt oil price rise after the 1973 embargo and the accompanying rise in the prices of other fuels have brought about declines in the energy-to-output ratios of all the industrial nations. However, the full effects on energy consumption have not yet been seen. This is because energy, as an intermediate good, depends on durable goods such as furnaces, automo biles, refrigerators, or buildings to provide its ultimate service. The economy’s adjustment to higher energy prices thus depends largely on the replacement of capital goods and consumer durables with more efficient models as the old ones reach the ends of their useful lives, and only secondarily on such immediate consumer responses as driving less or turning thermostats down.

The response of energy consumption to changes in price is usually specified by a number called the price elasticity of demand, defined as the ratio of a percentage change in consumption to the percentage change in the price of energy that evokes it. Thus, if a 10 percent price rise evokes a 5 percent decrease in consumption, we speak of a price elasticity of demand for energy of −0.5. Because it takes time for consumption to adjust fully to a new price level, economists refer to short-term and long-term elasticities, with implied lags for adjustment. The values of price elasticities are usually deduced from historical data, from international or interregional comparisons, and from microeconomic estimates and engineering

analyses of the feasibility and costs of substituting new, more efficient ways of using energy. These estimates are subject to large uncertainties, and their values have been much debated.

The response of U.S. energy consumption to the OPEC price rise of 1973–1974, for example, is compatible with a wide range of different models. It is equally consistent with a small long-term elasticity and a short adjustment time or a large long-term elasticity and a long adjustment time. Yet the energy consumption for 2010 extrapolated using these two models could vary by almost a factor of 2.2 This matter is pursued further in a later section of this chapter, which describes the CONAES Modeling Resource Group’s econometric analysis of just this question. It is enough to say here that the elasticity value one chooses makes the difference between negligible and profound reduction in GNP growth as a result of large reductions in the energy intensity of the economy. The larger the price elasticity in absolute value, the more it is possible to moderate energy demand without depressing economic growth.

ENERGY PRICES AND EXTERNALITIES

Two obvious questions arise from the foregoing discussion: What is the likely future course of energy prices, and to what extent are they subject to control by policy?

In addressing these questions it is important to realize that the historical decline in the price of energy, due to technical refinements, economies of scale, and neglect of social costs, was reinforced by a variety of direct and indirect subsidies to energy producers and consumers. Examples are the oil depletion allowance, income tax treatment of foreign royalties, and special tax treatment of drilling expenses. This is a complex and controversial question, however. Some policies—notably the oil import quotas of the late 1950s and the oil production controls imposed by the Texas Railroad Commission (applied until the late 1960s)—acted as countervailing factors, tending to raise prices.

Whatever the magnitude of the effect, it is clear that the low price of energy has encouraged consumption and discouraged production and exploration for new supplies. Even after the OPEC price rise, the entitlement policies of the federal government (which spread the costs of imported oil relatively evenly over the domestic market), along with the continuation of price controls on domestic oil and gas, provided effective subsidies to imported oil.

The trend begun in the late 1960s toward incorporating more of the environmental and other social costs of energy into its price is likely to continue pushing prices up. The need to search for and produce energy resources in increasingly inaccessible areas, often in hostile environments,

will also contribute to the upward trend, as will the ability of foreign producers to demand higher prices in an oil market that belongs more and more to the sellers. Energy in most forms is likely to rise in price faster than the rate of general inflation, and consumption will therefore tend to grow more slowly relative to GNP than in the past.

THE ROLE OF MANDATORY STANDARDS

Tax, tariff, and price control policies, as we have seem, are important influences on the demand for energy. But energy consumption can also be molded directly—for example, by the imposition of mandatory standards for the efficiency of energy-using equipment (miles-per-gallon standards for automobiles, thermal performance requirements for new buildings, and so on).

There are reasons to believe that such standards will be necessary in some cases to encourage economically rational demand responses to higher energy prices. This is because most energy-consuming equipment embodies trade-offs between initial costs and lifetime energy consumption; in general one must use extra insulation, larger heat exchangers, or the like to reduce the amount of energy consumed in performing the given task. This increases the initial cost, in exchange for future savings in energy costs. Consumers tend to be more influenced by first cost than by prospective operating costs. Where this is true, they have less economic incentive to purchase equipment on the basis of its energy consumption, even if that would be economically advantageous over its lifetime.* Mandatory standards applied to manufacturers and calculated to minimize life cycle costs (at some increase in initial cost) could serve the need for conservation while actually saving money for consumers in the long term.†

DEMAND AND CONSERVATION PANEL RESULTS

The Demand and Conservation Panel of this study developed a range of energy demand projections for the period 1975–2010.3 They vary from a long-term decrease in per capita energy consumption to a large increase, and were the products of a series of scenarios embodying different assumptions about movements in energy prices. The prices assumed are those experienced by the consumer at the point of consumption and include the effects of any taxes or subsidies. These prices could also be

|

* |

See statement 2–3, by H.Brooks, Appendix A. |

|

† |

See statement 2–4, by E.J.Gornowski, Appendix A. |

regarded as surrogates for various nonprice conservation policies, although no correspondence between prices and policies was actually worked out.

Scenarios of this kind, it should be noted, are not predictions. They are rather the results of calculations based on simplified models of the economy and on more or less plausible and self-consistent assumptions about the future. The panel’s four basic scenarios depend on a 2 percent average annual real GNP growth rate between 1975 and 20104 corresponding to a real GNP in 2010 twice that in 1975. A variant explored the implications of a 3 percent growth rate, corresponding to a 2010 GNP 2.8 times as high as in 1975. (Table 2–1 traces, for reference, the growth of GNP in the United States from 1945 to 1975.)* The use of GNP as a measure of public welfare, of course, has its limitations. The appendix to this chapter discusses them briefly and offers an approach to a more accurate measure.

The basic assumptions included population growth to 279 million people in 2010, labor-force participation somewhat higher than today’s, and other assumptions about key economic variables, including a substantial decline below the historical (pre-1970) rate of increase in labor productivity. Table 2–2 gives the central features of the scenarios, including price assumptions and energy consumption values resulting from them. (For a more detailed account of these assumptions see chapter 11 and the report of the Demand and Conservation Panel.)

In general the movement of primary energy prices tends to be greater than that of prices to the consumer. For example, the 100 percent rise in average primary energy prices between 1970 and 1978 corresponds to only a 30 percent average increase in final energy prices. The Demand and Conservation Panel scenario with the highest annual rate of secondary energy real-price increase uses a value of 4 percent. This is slightly less than the rate experienced between 1972 and 1978 and substantially less than that experienced between 1972 and 1979 (including the 1978–1979 price rises). However, it is hard to make a plausible case that rates of increase significantly greater than this could be sustained out to 2010.

The scenario analysis was made under the assumption that most characteristics of the national economy will behave in the coming decades much as they have in the past. The kinds of goods and services purchased by a consumer with a given income, for example, were assumed to change little, as were general attitudes and ways of life, although shifts in purchasing habits associated with increased affluence were accounted for.

|

‡ |

Statement 2–5, by R.H.Cannon, Jr.: Over the 33-yr period 1946 to present, GNP follows a 3.4 percent growth line remarkably closely. Using 2 percent here predestined dangerously low energy demand projections. |

|

* |

Statement 2–6, by R.H.Cannon, Jr.: Table 2–1 simply displays short-term variations. See my previous note. |

TABLE 2–1 Past Economic Growth in the United States

|

Year |

GNP (billions of 1975 dollars)a |

Five-Year Average Growth Rate (percent) |

|

1945 |

679 |

|

|

|

|

0.0 |

|

1950 |

679 |

|

|

|

|

4.2 |

|

1955 |

833 |

|

|

|

|

2.4 |

|

1960 |

937 |

|

|

|

|

4.7 |

|

1965 |

1178 |

|

|

|

|

3.0 |

|

1970 |

1368 |

|

|

|

|

2.1 |

|

1975 |

1516 |

|

|

aSource: U.S. Department of Commerce, The National Income and Product Accounts of the United States, 1929–1974: Statistical Tables, Bureau of Economic Analysis (Washington, D.C.: U.S. Government Printing Office (003–010–00052–9), 1976). |

||

Fuel price elasticities used in certain analyses of the transportation and buildings sectors are extrapolations consistent with historical data and with engineering projections for each price. No major technical breakthroughs are assumed. The panel used engineering and microeconomic methods in each of the three key sectors of energy use (buildings and appliances, industry, and transportation) to determine likely changes in energy intensities and overall sectoral energy consumption as responses to changes in price. Each of the sectors was analyzed separately, and the results were integrated into a total demand projection using input-output techniques to ensure internal consistency. Over the first decade of its projections, the panel used in addition conventional econometric analysis, which relies heavily on empirical evidence from the recent past and from international comparisons. Consumption, price, income, and other data were used in calculations that reflect the characteristics of existing capital stock, population, and economic activity.

In the panel’s scenarios for 2010, the ratio of energy use to GNP ranged from half its 1975 value to about 20–30 percent higher. The panel found this entire range to be consistent with a level of GNP substantially greater than the present one.4 In physical terms this would be accomplished by consumers’ substituting capital for energy (e.g., insulation for fuel) or vice versa, depending on whether energy were cheap or costly, scarce or

TABLE 2–2 Scenarios of Energy Demand: Totals

|

Scenarioa |

Average Delivered Energy Price in 2010 as Multiple of Average 1975 Price (1975 dollars)b |

Average Annual GNP Growth Rate (percent) |

Energy Conservation Policy |

Energy Consumption (quads) |

|||||

|

Buildings |

Industry |

Transportation |

Total |

Lossesc |

Primary consumptiond |

||||

|

Actual 1975 |

— |

|

— |

16 |

21 |

17 |

54 |

17 |

71 |

|

A* (2010) |

4 |

2 |

Very aggressive, deliberately arrived at reduced demand requiring some life-style changes |

6 |

26 |

10 |

42 |

16 |

58 |

|

A (2010) |

4 |

2 |

Aggressive; aimed at maximum efficiency plus minor life-style changes |

10 |

28 |

14 |

52 |

22 |

74 |

|

B (2010) |

2 |

2 |

Moderate; slowly incorporates more measures to increase efficiency |

13 |

33 |

20 |

66 |

28 |

94 |

|

B′ (2010) |

2 |

3 |

Same as B, but 3 percent average annual GNP growth |

17 |

46 |

27 |

90 |

44 |

134 |

|

Ce (2010) |

1 |

2 |

Unchanged; present policies continue |

20 |

39 |

26 |

85 |

51 |

130 |

|

aScenario D is not included in this table; its price assumption (a one-third decrease by 2010) appears implausible. bOverall average; assumptions by specific fuel type were made reflecting parity and supply; price increases were assumed to occur linearly over time. cLosses include those due to extraction, refining, conversion, transmission, and distribution. Electricity is converted at 10,500 Btu/kWh: coal is converted to synthetic liquids and gases at 68 percent efficiency. dThese totals include only marketed energy. Active solar systems provide additional energy to the buildings and industrial sectors in each scenario. Total energy consumption values are 63, 77, 96, and 137 quads in scenarios A, A*, B, and C, respectively. eThe Demand and Conservation Panel did not develop a scenario combining the assumptions of unchanging price and 3 percent average GNP growth. If scenario B′ is used as an approximate indicator, such an assumption would entail a primary energy demand of about 175 quads. |

|||||||||

abundant (Scarcity and abundance in this context can be thought of as induced by taxes, subsidies, or regulations, as well as by realizations of the actual quantities of various resources available.) Outside this range, the Demand and Conservation Panel hesitated to offer statements based on its analyses. But at some point not far below the lowest energy scenarios examined, appreciable reductions in GNP should be expected.

The panel’s analysis assumed that large variations in the energy required per unit output were compatible with a given level of labor productivity. That this will be so is not certain; there is no available research to indicate the possible effect of energy intensity on labor productivity.

Capital requirements for the entire economy were shown to be relatively constant for all scenarios; investment simply shifts between energy production and energy conservation. (In practice, if there are large shifts in the required allocation of capital, there may be temporary bottlenecks of capital availability to particular sectors for institutional reasons.) Actually, the panel found that at present it takes considerably less capital to save a Btu than to produce one. As the more productive opportunities for saving energy are exploited, this will become less generally true.

The following sections, based on the work of the Demand and Conservation Panel and others, describe this study’s assessments of the opportunities for conservation over the next several decades within the framework of the demand scenarios.

TRANSPORTATION

Energy savings in transportation can be achieved through modest investments in existing technology and improved management. The greatest such savings can be realized in automobiles, aircraft, and freight trucks. Because of the typically dispersed U.S. settlement patterns, the energy-saving potential of mass transportation, particularly fixed-rail transit, is far less, except over periods longer than the 35 years considered in this study.

In total, it may be possible to halve the energy requirement per passenger- or ton-mile in the United States over the next 25–35 years. This could offset the large expected increase in the amount of transportation, and in turn lead to total energy consumption of, for example, 27 quadrillion Btu (quads) for transportation in the Demand and Conservation Panel’s scenario B′, in which real energy prices double and GNP rises by an annual average of 3 percent (corresponding to a total GNP 2.8 times higher in 2010 than in 1975). Under the scenario A assumptions that real energy prices quadruple and GNP growth averages 2 percent, total energy consumption for transportation in 2010 could be as low as 14 quads, below the present total of 17 quads.

Automobiles

The automobile offers the greatest single opportunity to improve the energy efficiency of the U.S. transportation system. The fuel economy of the automobile fleet could be raised to 30–37 miles per gallon by 2010 for less than a 10 percent increase in manufacturing costs (in constant dollars).5 The fuel-efficient automobile fleet for 2010 would consist of light, energy-conserving, 2-, 5-, and 6-passenger cars with performance, comfort, and safety similar to those of 1975 cars except for lower acceleration and somewhat smaller interior size. Energy savings much beyond this, however, would involve major advances in technology, compromises in performance, or higher costs. The fuel savings themselves should be considered in context; steady improvements in fleet fuel economy over the next few years must be achieved, but at the same time efforts must be made to meet increasingly stringent standards for engine emissions. Gains toward one make gains toward the other more difficult.

The potential for energy conservation in replacing today’s automobiles with more efficient ones after their 10–15 years on the road is so great that total annual fuel consumption by automobiles could remain relatively constant over the next 30 years, over which time the total national mileage driven can be expected to increase by 50–100 percent.

The total cost of owning and operating an automobile, however, is not very sensitive to fuel economy, and even a well-informed buyer may find little to prefer in a fuel-efficient car. Thus, fuel economy standards must augment the incentives of the marketplace if the potential energy savings are to be realized.* Other policies might include one or more of the following: allowing the price of gasoline to rise toward its free-market value; advertising accurate miles-per-gallon figures for each model; setting yearly registration fees by vehicle efficiency or weight; taxing new cars according to fuel efficiency; and enacting a gradual rise in gasoline taxes.

Electric vehicles offer some opportunity to moderate the demand for petroleum in the transportation sector, if the electricity is generated from sources other than oil. They may offer other advantages too—for example, shifting pollution from the vehicle to the power plant and raising the off-peak demand for electricity. Available electric vehicles have important limitations (such as range), but may with improvement find an appropriate market, such as driving within metropolitan areas. The energy-conserving potential of electric vehicles depends on the availability and costs of liquid fuels, on institutional and environmental issues, and on the development of high-energy-density batteries. Their attractiveness for a growing number of

|

* |

Statement 2–7, by E.J.Gornowski: My statement 2–4, Appendix A, also applies here. |

applications may be considerably enhanced in the future if (as is likely) the cost of liquid fuels rises more rapidly than the cost of electricity (on a percentage basis). This advantage is not fully reflected in the scenario projections presented here, which assume that the price of electricity rises almost as rapidly as the price of liquid fuel.

Air Travel

The efficiency of the passenger aircraft fleet could be improved 40 percent by 2010.6 This would require aircraft industry investments in development; airline purchases of more efficient airplanes; scheduling and pricing policies that increase load factors (passengers per plane trip); and additional improvements in traffic management. Some of these developments are already occurring as a result of recent airline deregulation and the consequent fleet expansion and rise in load factors.

An interagency task force of the federal government estimates that the research and development required to introduce fuel-conserving jet and turboprop engines, lighter structures with associated control systems, and improved design for laminar-flow control and aerodynamics, all of which would cost $670 million, could make possible savings of 2 billion barrels of oil between 1980 and 2005—$25 billion at 1976 oil prices.7 The airlines’ incentive to invest in fuel-efficient aircraft and management practices depends on favorable long-term prospects for air traffic and profit, as well as on forecasts of the price of fuel and attendant policies.

If the design and load factor improvements described were introduced, new aircraft in 2010 might consume 3180 Btu per passenger-mile, as against 7630 Btu in 1975. If a passenger load factor 44 percent above the 1975 values is included,8 then even at quadrupled energy prices (scenario A), the per capita air travel demand would increase 58 percent. The total energy consumed in scenario A would be 1.0 quad, compared to a 1975 consumption of 1.2 quads.9 For a doubling of energy prices (scenario B), demand would increase from 745 to 1800 passenger-miles per capita, and total energy consumption would be 1.6 quads.

Truck and Rail Freight

Freight-hauling trucks built in the future can be made 30 percent more fuel-efficient by using turbocharged diesel engines, improved axles, radial tires, and declutching fans.10 Some of these options are now being installed in freight trucks. Lighter tractors designed for aerodynamic efficiency would represent an additional 10 percent gain. The fuel economy of the truck fleet can be improved by installing diesel engines in medium- and

light-duty trucks, but this opportunity to conserve fuel depends on resolution of the air quality issues associated with diesel emissions.

The 7–14 percent savings in fuel that can be realized in trucks by conservative driving may not be achieved even at much higher fuel prices, since the costs of labor and capital substantially outweigh that of fuel in the truck freight business, where both wages and depreciation of equipment are time dependent and revenue is distance dependent. Any fuel-conserving measure that increases the time per trip incurs costs in wages and capital that fuel savings would be hard pressed to match.11

Removal of Interstate Commerce Commission restrictions on commodities, routes, and backhauls would allow the trucking industry to plan for fully loaded round trips, improving the industry’s load factor.12

Railroads, which account for about 1 percent of national energy consumption, are highly energy efficient for long-haul freight. A shift of long-distance freight transportation from truck to rail could be accomplished by major changes in regulatory policies, to allow, for example, the formation of integrated transportation companies free to seek optimum combinations of truck and rail freight through competition.

Energy Demand Projections for Transportation in 2010

Table 2–3 sets out demand for energy by the transportation sector in 2010 under the Demand and Conservation Panel’s scenario assumptions. Improvements in energy intensity assumed under the conditions of each scenario are included for ready comparison.

In scenario C, the real price of energy remains constant, but even so the energy intensities of all forms of transportation drop, consistent with historical patterns under falling real prices for energy. Prevailing standards for improvement in automobile fuel economy are assumed to be met, and as automobile travel begins to reach saturation (in cars per owner, minutes spent in automobiles daily, etc.), air travel claims a larger percentage of expenditures for passenger transportation.

In scenario B, prices for energy have climbed steadily to twice the 1975 levels by 2010, and in response the fuel efficiency of automobiles has doubled. Rail freight has expanded by 30 percent, truck freight has grown by 40 percent, and air freight has tripled.

In scenario A energy prices quadruple by 2010, and public policies accelerate the response to this energy conservation incentive. As a result, present federally mandated standards for automobile fuel efficiency are met and superseded by new standards. By the year 2000, advanced fuel-conserving technology (perhaps Brayton and Stirling engines) would begin to be used in new automobiles. Air travel would increase by about 60 percent, and under this intensified demand as well as public policies

TABLE 2–3 Scenarios of Energy Demand for Transportation

|

Scenarioa |

Average Delivered Energy Price in 2010 as Multiple of Average 1975 Price (1975 dollars) |

Energy Conservation Policy |

Energy Intensity by Application |

Total Demand Demand (quads) |

|

|

Application |

Intensityb |

||||

|

A* |

4 |

Very aggressive, deliberately arrived at reduced demand requiring some lifestyle changes |

|

|

10 |

|

A |

4 |

Aggressive; aimed at maximum efficiency plus minor life-style changes |

Automobile Light trucks and vans Air passenger Truck freight Air freight Rail freight |

37 mpg 30 mpg 0.42 0.60 0.60 0.91 |

14 |

|

B |

2 |

Moderate: slowly incorporates more measures to increase efficiency |

Automobile Light trucks and vans Air passenger Truck freight Air freight Rail freight |

27 mpg 21 mpg 0.45 0.80 0.60 0.97 |

20 |

|

B′ |

2 |

Same as B, but 3 percent average annual GNP growth |

|

|

27 |

|

C |

1 |

Unchanged; present policies continue |

Automobile Light trucks and vans Air passenger Truck freight Air freight Rail freight |

20 mpg 16 mpg 0.50 0.90 0.60 1.00 |

26 |

|

aScenario D is not included in this table; its price assumption (a one-third decrease by 2010) appears implausible. bFigures not followed by “mpg” refer to the ratios of new-equipment energy intensities in 2010 to those of 1975. |

|||||

encouraging conservation, perhaps two new generations of aircraft would be introduced by 2010, the last consuming only about half the fuel per seat-mile as the 1975 average. Airplane load factors would reach 70 percent (considered the maximum achievable). Truck freight would improve substantially in fuel efficiency and load factors. Despite significantly higher per capita use, the transportation sector would consume 18 percent less energy in 2010 than in 1975.

Scenario A* was used to test the possibility of reducing energy consumption to levels below those of scenario A, using the same price assumptions. This scenario includes assumed changes in tastes and preferences that produce reductions in energy consumption beyond those available from technological efficiencies. One change of this sort would be a shift to a more service-oriented economy, emphasizing lasting, repairable goods over disposable ones. Another would be a strong trend toward living and working in the same area, reducing by 10 min the time the average person spends in cars each day and yielding energy savings of 1 quad. Under the assumptions of this scenario, freight transportation would also be significantly reduced.* This scenario also includes improvements in the fuel efficiencies of military vehicles, which are not considered in other scenarios.

Although the energy consumption of our principal means of transportation can be moderated by technology and management for improved efficiency, another opportunity to achieve long-term conservation in transportation presents itself in new patterns of living, working, and recreation. These patterns will change regardless of energy prices and policy over the next 35 years, but comprehensive land-use policies combined with incentives and penalties could promote energy-conserving patterns. However, the concentration of metropolitan populations in the United States has been thinning since World War II, along with the concentration of jobs. These patterns have contributed to a general decline in the use of public transit as well as to increased automobile ownership and longer average trips. This trend would have to be reversed if significant energy savings were to be realized from new living patterns.13

It is difficult for a dispersed population to achieve significant energy savings through public transit. Direct shift of travel demand from the private auto to public transit has relatively little benefit in terms of energy conservation. Only when public transit, by altering settlement and industrial location patterns, reduces total travel demand (e.g., as measured by passenger-miles of travel per capita) can it have a significant impact on energy consumption.14

|

* |

See statement 2–8, by H.Brooks, Appendix A. |

Today, for example, 98 percent of the urban passenger-miles covered in this country are by private automobile, and urban travel accounts for half the fuel consumed by automobiles. Even if the use of public transit were 15 times greater and consumed no fuel at all, the overall savings in fuel would amount to only 15 percent if total travel demand remained the same.15 However, with the more fuel-efficient automobiles assumed in all scenarios except scenario IV, the difference in efficiency between private automobiles and rail or even bus transit per passenger-mile is small. The savings in energy consumption that might be achieved by fixed-rail mass transit depend directly on patterns of settlement and land use that run counter to the recent locational trends described above. Such changes could probably be realized only over a period of time well beyond that addressed in this study. Today buses, van pools, and car pools, because they can make flexible use of an already existing network of roads and highways, are the most effective means of reducing energy consumption in commuter travel.16

BUILDINGS AND APPLIANCES

The demand for energy by residential and commercial buildings is expected to grow more slowly from 1975 to 2010 than in the past few decades, as population growth slows and some demands become saturated. Rising energy prices, aided by mandatory building and appliance standards, could foster wider use of such well-known measures as heat pumps, better insulation for buildings, larger heat-exchange surfaces for air conditioners and refrigerators, and passive solar building design. Through these and similar conservation measures, the energy demand for buildings in 2010 could be below today’s level of 16.8 quads, despite a projected 30 percent increase in population and 63 percent increase in residential buildings.17

Existing technology could be incorporated in new buildings and appliances to reduce energy consumption substantially. For example, gas and oil heating systems have been built to use 30 percent less gas or oil than conventional designs, through improved combustion and heat transfer. Electric heat pumps for space heating deliver about 3 times more heat than electric resistance heaters per unit of electricity consumption, and can also be reversed for cooling. The energy consumption of refrigerators can be economically reduced (even at present electricity prices) by 50 percent through better design and construction. Well-insulated new single-family houses need 40 percent less heating than the average house built before 1970.18 An experimental program of retrofitting existing housing has demonstrated that in a New Jersey community nearly

one third of the energy required annually for space conditioning can be saved.19

More comprehensive energy-saving measures, such as community-based utility systems,20 are economically feasible but impractical today for a variety of reasons, including environmental restrictions, the difficulty of making connections with utilities, and developers’ reluctance to assume the burden of resolving technical complexities. Concentrated efforts to remove or reduce these institutional barriers could result in substantial additional energy savings in the buildings sector.

Economic considerations are likely to weigh more heavily than others in the decision to improve thermal integrity21 in buildings. But because many homeowners move frequently, and because the consumer who pays the bills for operating and maintaining a building does not usually make the design and construction decisions, any decision to improve efficiency must be encouraged by building code standards, financial incentives, and information campaigns. Builders have inadequate incentives to minimize life cycle costs; in fact, they tend to favor low initial costs instead. (Of the 1,455,000 single-family homes built in 1977, 904,000 were erected by developers for sale on the open market.)22

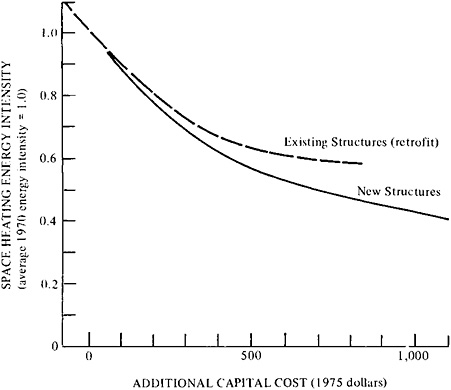

Retrofitting an existing structure for greater efficiency in energy use will not appear wise to many consumers, even as energy prices rise. Existing buildings offer less scope for energy conservation than do new ones, but some retrofit measures are generally economical. Caulking, increasing attic insulation to 6 in. and wall insulation to 3 1/2 in., adding foil insulation in the floor, and installing storm doors and windows are the best energy conservation investments. Together, they can reduce heating requirements by as much as 50 percent; savings on air conditioning would be somewhat less. Figure 2–1 illustrates the energy savings possible in new and retrofitted single-family residences as a function of incremental capital costs.

The American Society of Heating, Refrigeration, and Air Conditioning Engineers (ASHRAE) developed a new building code in 1975, setting out construction guidelines for energy-efficient buildings (ASHRAE-90–75). The Energy Policy and Conservation Act of 1975 (Public Law 94–163) requires that states adopt ASHRAE-90–75 or similar standards to be eligible for federal funding of state energy conservation plans. More stringent standards, based on performance, are being prepared and discussed.

High on the list of priorities in any program to accelerate improvements in existing buildings is accurate information for lending institutions, homeowners, and homebuyers on the advantages of retrofitting. Readily available loans, subsidies, and tax incentives can also stimulate retrofitting. A justification for such measures is that the whole society benefits from

reduced dependence on oil imports. An effective means of reducing energy consumption by existing buildings would be to require that they meet thermal efficiency standards at the time of resale. Such a measure has been introduced in Congress but not adopted.*

Energy Demand Projections for Buildings and Appliances in 2010

Table 2–4 sets out the improvements in energy intensity per unit of service that might be achieved under each of the Demand and Conservation Panel’s scenarios, along with the total energy demand by buildings and appliances.

In scenario C, real energy prices remain constant, with the exception of natural gas prices, which double to compensate for past underpricing. The lagged response to public policies now in force brings about improved efficiency in new buildings and appliances through 1980, and to some extent thereafter as older stocks are replaced. Small improvements are introduced in gas appliances, but electric resistance units (rather than heat pumps) continue to dominate electric space heating.

Under the conditions of scenario B, prices for energy double by 2010, with substantial effect in the buildings sector. Energy consumption in this sector decreases at an average annual rate of 0.6 percent (compared to an annual growth rate of 3 percent from 1950 to 1975), mainly because of the reduction in space heating requirements. Because of differences in assumed energy prices, the relative market share of electricity increases from 21 to 51 percent, while the natural gas share declines from 53 to 21 percent Electric heat pumps become cheaper and more efficient because of large-scale production and find widespread use. Solar energy finds a market toward the end of the period for water heating, space heating, and air conditioning. The energy efficiency of new air conditioners in 2010 is close to 10 Btu per watt-hour (compared to 6 Btu in 1975). Higher energy prices translate into increased expenditures for energy in buildings. However, the percentage of personal income spent for household fuel increases only moderately—from 3.1 in 1975 to 3.9 in 2010. The technologies to produce the higher efficiencies in this scenario are either on the market or achievable by well-known means.

Under scenario A, as energy prices quadruple by 2010, energy consumption in the buildings sector declines to 11 quads, from 16 quads in 1975. New energy-efficient appliances find ready markets, and solar energy begins to make a significant contribution near the end of the period: 25 percent of new air conditioners, 50 percent of new space heaters, and 70

|

* |

Statement 2–9, by E.J.Gornowski: My statement 2–4, Appendix A, also applies here. |

FIGURE 2–1 Space heating energy intensity of single-family residences (average 1970 energy intensity equals 1.0) as a function of increases in capital costs. Source: E.Hirst, J. Cope, S.Cohn, W.Lin, and R.Hoskins, An Improved Economic-Engineering Model of Residential Energy Use (Oak Ridge, Tenn.: Oak Ridge National Laboratory (ORNL/CON-8), 1977).

percent of new water heaters in 2010. Improved retrofit measures and construction practices contribute to the energy savings use in this scenario. Increasing income over the period helps ease the pinch of higher expenditures for fuel, but residential fuel expenditures rise from 3.1 percent of personal income to 4.9 percent.

Along with the improvements noted in scenario A, scenario A* assumes continued migration to sun belt states and acceleration of trends to multifamily residential units. These changes reduce heating and cooling requirements by about a third. Additional savings are achieved by the use of integrated utility systems in residential complexes to cogenerate electricity and heat.23

TABLE 2–4 Scenarios of Energy Demand for Buildings Sector

|

Scenarioa |

Average Delivered Energy Price in 2010 as Multiple of Average 1975 Price (1975 dollars) |

Energy Conservation Policy |

Energy Intensity by Application |

Total Demand (quads) |

|

|

Application |

Intensityb |

||||

|

A* |

4 |

Very aggressive, deliberately arrived at reduced demand requiring some life-style changes |

|

|

6 |

|

A |

4 |

changes Aggressive; aimed at maximum efficiency plus minor life-style changes |

Thermal integrity (heating) |

|

10 |

|

|

|

Residential |

0.63 |

|

|

|

|

|

Commercial |

0.42 |

|

|

|

|

|

Government and education |

0.35 |

|

|

|

|

|

Space conditioning |

|

|

|

|

|

|

Air conditioning |

0.66 |

|

|

|

|

|

Electric heating |

0.52 |

|

|

|

|

|

Gas and oil heating |

0.72 |

|

|

|

|

|

Refrigeration and freezing |

0.58 |

|

|

|

|

|

Lighting |

0.60 |

|

|

INDUSTRY

Industrial energy consumption per unit of output in the United States fell at an annual rate of about 1.6 percent from 1950 to 1970.24 Rising prices for energy will very likely accelerate this trend, as it becomes economical to apply known energy-saving technology in new industrial plants. (Overall, the energy required per unit output in U.S. industry fell by nearly 20 percent between 1973 and 1979.) Where no change in a basic industrial process is possible, somewhat smaller savings can be realized by building more efficient facilities. For example, a new cement manufacturing plant can be made 25 percent less energy intensive than today’s 20-yr-old average plant by capturing and using the high-temperature waste heat now released to the atmosphere.25)

The study’s assessment indicates that new plants in 2010 could consume an average of 40 percent less energy than existing plants with the same outputs.26 However, a third of today’s plants will probably still be in operation by 2010, and it is much more costly to retrofit existing plants than to build the same features into new plants. Furthermore, some of the industries that consume the most energy per unit output—such as petrochemicals—also show the greatest increases in demand (a trend that is likely to continue).27

In part this increased demand will be the result of substituting materials for one another to improve energy efficiency in -other products. For example, increasing the use of aluminum and plastics in automobiles will result in lifetime fuel savings considerably greater than the additional energy required to produce the materials, but this will, of course, be reflected in increased output of such materials. If the costs of improving old plants and the increasing demand for energy-intensive industries are taken into account, the overall energy savings that industry can achieve by 2010 will probably be no more than 30 percent, even for scenario A. Greater savings would require public policy measures to compel increased durability of equipment, so that a given amount of consumer service would be provided by a lower output of manufactured goods than at present

Opportunities for industry to conserve energy can be grouped into four categories.28

-

Improved housekeeping—operating and maintaining equipment at peak performance, turning out unneeded lights, and reducing heat losses—can quickly reduce energy use per unit of industrial output by 5–15 percent in a non-energy-intensive industry.

-

Waste-heat recovery and insulation—modest plant improvements to reduce heat loss and recover the higher-temperature waste-heat streams for use—typically can improve thermal efficiency by 5–10 percent in an

-

energy-intensive industry. Most of the nation’s industry could fully institute these improvements in less than 10 years.

-

Introducing new processes would improve the efficiency of energy use anywhere from 10 to 90 percent in aluminum smelting, uranium enrichment, refining operations, steel making, and other industries; because they generally require new production facilities and equipment, these measures will be introduced only gradually over several decades.

-

Recycling saves energy in factories (for example, by burning wood and scraps in paper mills). Materials such as aluminum, paper, glass, and steel can be recovered for reprocessing, and this becomes economically more attractive as energy costs rise. A number of tax and regulatory policies, however, still favor the use of materials from virgin sources rather than recycled materials; a systematic effort to identify and eliminate such economic distortions would result in additional energy savings that are difficult to estimate at present.

Many industries can reduce their requirements for purchased electricity by the use of cogeneration. This involves the use of the high temperatures available from fuel combustion to generate electricity, with the lower temperature exhaust heat from the generator used for industrial process heat. This can be done, for example, by producing high-pressure steam to operate a steam turbine generator and then using the lower pressure exhaust steam as process steam, or by using combustion gases to operate a gas turbine or diesel generator and then using the exhaust gases to produce low-pressure steam in a waste-heat boiler. If the high-temperature heat can be generated from coal rather than oil or natural gas—for example by on-site medium-Btu coal gasifiers (chapter 4)—then not only is fuel used more efficiently, but scarce natural fluid fuels are conserved.

Cogenerating electricity and steam presents an attractive opportunity to conserve energy, because about 40 percent of industrial energy is used to produce low-pressure process steam. The additional fuel required for cogeneration is about half that required by the most efficient single-purpose utility plant. Cogeneration also produces fewer air pollutants and lower thermal discharges than conventional single-purpose systems, which consume and reject more energy for equivalent service. A number of existing cogeneration systems can be applied in a variety of plants and modified to accept any of a number of fuels.29 As fuel prices rise, the fuel savings resulting from cogeneration will offset the higher investment and operating costs in an increasing number of situations.

Economic and regulatory factors, together with industry reluctance, have discouraged cogeneration over the last 50 years. If all large-scale industrial demands for low-pressure steam were provided through cogeneration in 2010, around 10 quads of by-product electricity could be

generated.30 Nevertheless, we estimate that only 2–5 quads of electric power would actually be supplied by cogeneration in 2010.31 Indeed, strong new incentives and other public policies would be necessary to achieve even this level. The technological, economic, and institutional barriers to the replacement of existing systems with cogeneration, or even to the construction of new cogeneration systems, are formidable.

In spite of its advantages, industrial cogeneration has declined in the United States from supplying 30 percent of industrial electricity in the 1920s to about 8 percent today. Other industrialized countries practice more extensive cogeneration: West German industries, for example, supply 12 percent of their own electricity through cogeneration.32* Cogeneration declined in the United States as the real price of utility-generated electricity fell. Consequently, a huge stock of industrial equipment that cannot be adapted for cogeneration was installed. Today’s typical primary industrial boiler is fabricated inexpensively and fired by natural gas. It requires little or no operating attention or maintenance to supply reliable low-pressure steam; the design and operation of cogeneration systems, by contrast, require highly skilled personnel. Thus, the personnel costs associated with cogeneration, especially in smaller installations, tend to offset the fuel savings and make them economically less attractive.

Furthermore, the close coordination with an electric utility that would be needed by most cogeneration systems, for the sale of surplus cogenerated electricity and the purchase of backup power, might seem disadvantageous to the utility, since demands for heat and electricity often do not balance. Cogeneration may appear disadvantageous to industries that pay up to 3 times as much for the electricity they buy as the utilities pay them for the surplus electricity they sell. Some industries fear that selling cogenerated power may bring them under regulation by the federal and state agencies that regulate power generation, limiting their flexibility to make quick business decisions.

The other cogeneration possibility, so-called district heat—selling heat from utility stations—faces an uncertain market. Many customers would have to be found quickly to justify the commitment in additional capital for by-product steam marketing. The distribution system, particularly if it supplies steam, is difficult to operate, maintain, and meter. And just as with electricity, backup capacity must be provided.†

The economic penalty for scrapping existing energy systems to make

|

* |

Statement 2–10, by B.I.Spinrad: Most West German “cogeneration” is done by the coal industry. Electricity is the primary product, steam is the by-product, and the example is inappropriate. |

|

† |

See statement 2–11, by B.I.Spinrad, Appendix A. |

way for cogeneration can be minimized by careful planning and timing, taking into consideration the expected lifetime of existing equipment, tax advantages, and decisions to build new plants. Other barriers to cogeneration could be overcome by incentives like the following.

-

Priority consideration of cogeneration projects for scarce gas and oil when these fuels are required, and exemption from mandatory conversion to coal from natural gas for cogeneration facilities.†

-

Favorable financial incentives to install cogeneration facilities.

-

Revision of the Federal Power Act and Public Utility Holding Company Act to exclude or limit regulation of industries that sell surplus electrical power.

-

Commercialization of on-site medium-Btu coal gasification in conjunction with gas turbine generators to allow environmentally clean use of coal in cogeneration, thus enlarging the market for cogeneration facilities.

State regulatory commissions can identify opportunities for cogeneration and bring utilities and industries together to explore them. Educational programs could interest students and practicing engineers in cogeneration and train them to design and operate these systems.*

Energy Demand Projections for Industry in 2010

The Demand and Conservation Panel’s projections of total demand for energy in the industrial sector in 2010, exclusive of the energy-producing sector itself, are summarized in Table 2–5. The last column shows the total energy consumed by the industrial sector, measured at the entrance to the factory, as it were, and ignoring losses in the energy sector associated with providing the energy. These losses depend on the particular ways the energy is provided from the primary sources, and are shown in Tables 11–6 through 11–10 in chapter 11 for particular assumed supply mixes, as described in detail in that chapter. Table 2–5 shows only the mix of coal, oil, gas, and electricity consumed in the factory. The electricity component is computed under the assumption that no cogeneration over that used at present will be used in 2010.

|

† |

Statement 2–12, by B.I.Spinrad: So we solve our oil problem by not using coal (at admittedly lower efficiency). I consider this recommendation counterproductive for the problem that exists now. |

|

* |

See statement 2–13, by H.Brooks, Appendix A. |

TABLE 2–5 Scenarios of Energy Demand for Industry

|

Scenarioa |

Average Delivered Energy Price in 2010 as Multiple of Average 1975 Price (1975 dollars) |

Energy Conservation Policy |

Energy Intensity by Industry |

Total Demand (quads) |

|

|

Industry |

Intensityb |

||||

|

A* |

4 |

Very aggressive, deliberately arrived at reduced demand assuming some life-style changes |

|

|

26 |

|

A |

4 |

Aggressive; aimed at maximum efficiency plus minor life-style changes |

Agriculture |

0.85 |

28 |

|

|

|

Aluminum |

0.55 |

|

|

|

|

|

Cement |

0.60 |

|

|

|

|

|

Chemicals |

0.74 |

|

|

|

|

|

Construction |

0.58 |

|

|

|

|

|

Food |

0.66 |

|

|

|

|

|

Glass |

0.69 |

|

|

|

|

|

Iron and Steel |

0.72 |

|

|

|

|

|

Paper |

0.64 |

|

|

|

|

|

Other industry |

0.57 |

|

|

TO WHAT DEGREE WILL MODERATING THE CONSUMPTION OF ENERGY AFFECT THE NATIONAL ECONOMY?

One frequently encounters references to the fixed relationship between energy use and GDP or GNP, with the implication that any reduction in energy use entails a loss of output and hence a lower standard of living. Such an impression has been fostered by the fact that during the 20 years before 1973, energy consumption and economic output followed each other very closely in both Europe and the United States.

In the short run, energy demand and the output of the economy are indeed tightly coupled. Sudden shortages of energy are translated immediately into reduced output, as illustrated by the 1973 oil embargo, the 1977 natural gas shortage, and the 1978 coal strike. At a given time the structure of the economy is characterized by a production function, or input-output matrix, that relates outputs to inputs in a deterministic way. However, GNP includes only the final goods and services demanded by consumers and the capital equipment demanded by producers. Intermediate goods—the materials, commodities, and services used by industry in producing its final outputs—are not included in GNP, and in the long run the mix of these intermediate goods can change substantially in response to changes in prices and technology without changing the composition of final demand nearly as much. Thus, over the long term the same mix of outputs or GNP may be provided through a considerable variety in the mix of inputs, including energy.

The historical record of the energy/GNP ratio in the United States reveals that the relation has not been constant over time.33 Comparing the prevailing ratios of different industrialized nations also presents some intriguing similarities and differences.34 The reverse causal link—from energy use to GNP—has been directly examined through the work of the Modeling Resource Group of the Synthesis Panel.35 The work of this group has been extended by the Energy Modeling Forum of the Electric Power Research Institute36 and others.37 This work supports qualitatively the conclusions of the Modeling Resource Group, with certain qualifications that will be mentioned later.

THE INFLUENCE OF GNP ON ENERGY USE

The direct effect of GNP on the consumption of energy is obvious. If the output of goods and services increases in all industries during a period of little change in relative energy prices and technology, the needed input of

energy increases as well. The increase is roughly proportional to the increase in GNP if total expenditures remain distributed in the same proportions among the various goods and services produced. In mature economies such as that of the United States, energy consumption may in fact grow slightly less than proportionately to GNP because of the gradual shift toward services, which are less energy intensive than material goods. Conversely, in developing economies, energy consumption tends to grow faster than GNP because of the increasing proportion of energy-intensive heavy industries. Thus the composition of consumption tends to change with changes in GNP, and energy intensity is not uniform. Even if energy prices remain constant, therefore, energy consumption and GNP do not necessarily change proportionately as GNP grows.

The economy can adjust over time to reduce energy consumption per unit of GNP significantly, if the reduction is accomplished by improving the energy efficiency of a unit of economic output. Changes in the price of energy are important influences in inducing higher efficiencies. Thus, the causal link from GNP to energy use may be modified by cost-saving technological change, often driven by changes in the real (constant-dollar) price of energy. If the incremental cost of the capital and labor required to save energy is less than the cost of the energy saved (suitably discounted to present value), the corresponding technological change will be made; the result will be less energy consumption per unit of GNP. This effect, of course, is subject to a considerable time lag, corresponding to the time it takes for capital equipment to reach the end of its useful life and be replaced. (Of course, the “useful life” of a piece of energy-consuming equipment is in part determined by the price of energy.) Such cost-saving innovation may also come about simply because a new technology is more cost effective for other reasons, with the energy savings an incidental by-product. It is this latter effect that probably accounts for the decline of the U.S. energy/GNP ratio between the 1920s and the 1950s, which occurred despite declining real energy prices. A substantial increase in the real price of energy evokes an additional conservation effect by increasing the prices of energy-intensive goods and services seen by the ultimate consumers, who in response tend to curtail their direct or indirect use of energy. Consumers will shift away from goods and services that are energy intensive in their production or supply, toward others that serve similar purposes with less energy input. The extent of these substitutions will in general be larger the higher the component of energy cost in the price of the good or service. Some substitutions may be made very quickly, but again most depend on some turnover of capital or consumer durables.

THE HISTORICAL TRENDS

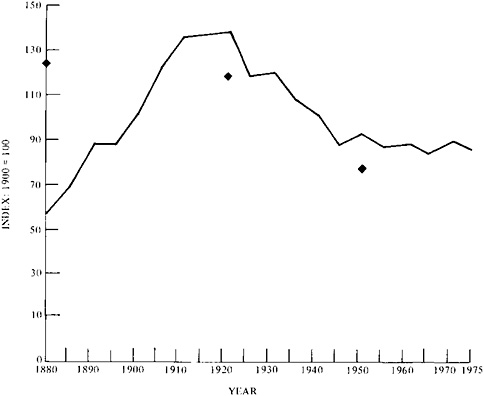

The historical pattern in consumption of purchased energy per dollar of U.S. GNP is shown in index number form (with 1900 as 100) in Figure 2–2 for the period 1885–1975. Throughout this period, the value of energy resources at the point of production has generally accounted for only a few percent of total GNP. Thus, the input-output relationship involved is between a small input (3.1–4.5 percent of GNP) and a very large—and heterogeneous—output. Under these circumstances, it would not be surprising if the relation of energy to national output were to exhibit major changes, especially over long periods. From the late nineteenth century to the second decade of the twentieth century, energy consumption persistently grew more rapidly than GNP. From the end of World War I until the mid-1940s, it grew persistently more slowly than GNP. From 1945 to 1973, numerous short-term fluctuations occurred, with no persistent upward or downward trend.

Four groups of factors should be considered for their parts in explaining these long-term trends; the composition of national output, the thermal efficiency of energy use, the composition of energy consumption, and the behavior of energy prices in relation to those of consumer durables, producer durables, and other energy-using goods.

Composition of National Output

Energy requirements per dollar value of product vary for different types of production. It is therefore reasonable to expect that if the goods and services constituting national output undergo significant change, energy consumption per unit of national product will change with it. To measure the historical effects of this factor in detail requires a quantitative record well beyond anything that is now in hand. Nevertheless, some general points can be made. First, in the period prior to World War I, development of such basic industries as the railroads and iron and steel production dominated national economic growth. Heavier energy consumption relative to national output was thus associated (as might be expected) with the stronger influence of heavy industry. The 1920–1945 period was one in which lighter manufacturing and the broad services component of national output grew rapidly, and the corresponding decline in energy consumption relative to national product was a result.

Thermal Efficiency of Energy Use

The term “thermal efficiency” is used here to mean the ratio between primary energy input and useful energy output. Two cases of increased thermal efficiency are of considerable importance. One is the sharp

FIGURE 2–2 An index (1900=100) of energy consumed per dollar of real gross national product for the United States from 1880 to 1980 shows successive trends of rise, decline, and stability. This plot excludes fuel wood, whose consumption exceeded that of coal into the 1880s. Single-year points that do include fuel wood are indicated for 1880, 1920, and 1950. Source: Adapted from Sam H.Schurr, Joel Darmstadter, Harry Perry, William Ramsay, and Milton Russell, Energy in America’s Future: The Choices Before Us, Resources for the Future (Baltimore, Md.: Johns Hopkins University Press, 1979). Copyright 1979 by Resources for the Future, Inc.; all rights reserved.

increase over time in the efficiency of converting fuels into electricity, in which there was a decline from almost 7 lb of coal per kilowatt-hour generated in 1900 to 3 lb in 1920, and less than 1 lb by the mid-1950s (but little change since then). The other striking case is the replacement of steam power by diesel power in railroad locomotives in the 1940s and 1950s, a change characterized by an almost sixfold improvement in the efficiency of fuel use.

Measurements of changes in thermal efficiency on an economy-wide basis are not available; however, these two cases cover major areas of energy consumption. Similar changes, not so readily documented, affected

space heating as coal furnaces were replaced by oil- and gas-burning furnaces in residential and commercial use. Railroads, electric power plants, and space heating together accounted for large amounts of energy consumption, and improvements in their thermal efficiencies must have been very important in molding the trends shown in Figure 2–2.

Composition of Energy Consumption

Changes in energy consumption characterized by the expanding use of new energy forms appear to be of major importance. Growth in the use of electricity and internal combustion fuels appears to have been particularly significant.

During the period of declining energy consumption relative to GNP, the consumption of electricity grew far more rapidly than that of other energy forms. From 1920 to 1955, for example, electricity consumption increased more than tenfold while that of all other energy only doubled.

Two subtle points about electrification are essential to a proper understanding of the relationship between energy and GNP. One pertains to the question of thermal efficiency as compared to the economic efficiency of energy use. Compared to other ways of using fuel, generating electricity is thermally inefficient; it takes an average of 3 Btu of fuel to produce 1 Btu of electricity. However, the peculiar characteristics of electricity have made possible the performance of tasks in entirely new ways.

Electrification during the 1910s, 1920s, and 1930s increased the overall productive efficiency of the economy, particularly in manufacturing, where the use of electric motors freed the manufacturing industries from the rigid conditions imposed by the steam engine. (For example, electric motors can be switched on only when actually needed.) It allowed factories in addition to be reorganized into more logical sequences and layouts. This greatly enhanced manufacturing productivity—yielding greater returns per unit of labor and capital employed—and thus the productivity of the total economy.

Through its positive effects on productivity, electrification also enhanced the productivity of energy use, resulting in a decline in the amount of raw energy required per unit of national output. Taken together, improvement in the thermal efficiency of electricity generation and the enhancement of productivity due to the use of electricity were major factors in the decline of the energy/GNP ratio following World War I.

The internal combustion engine, powered by liquid fuels, played a somewhat analogous role by allowing mechanization of agriculture, a development that contributed significantly to the rising productivity of the American economy. The growth of truck transportation at the same time

made possible the movement of industry away from sites dictated by the location of railroad facilities or waterways.

Changes in production techniques made possible by changes in the composition of energy output have thus enhanced the efficiency with which energy itself has been employed as a factor of production. The broad downward trend in the energy/GNP ratio characterizing much of the historical record would, of course, have been even sharper if the thermal efficiency with which energy had been used in automotive transportation had also shown sharp increases.

The Behavior of Prices

It is of interest to examine the behavior of energy prices during the period of persistent long-term decline in the amount of energy consumed in relation to GNP. In general, the prices of the basic fuels in constant dollar terms fell during the two decades following 1920. Thus, energy consumption relative to GNP was declining even while energy prices were falling. This runs counter to the kind of behavior that would be predicted if the price of energy were the primary factor in explaining how much energy is used in relation to other factors of production in yielding the national output. Obviously, other forces have been of overriding importance, particularly changes in technology and in the composition of economic output.

Some General Conclusions About the Historical Record

Since the end of World War II, the numerous short-term fluctuations have more or less canceled to yield a record of comparative constancy in the ratio over the entire period. In the 35-yr period from 1920 to 1955 (35 years is chosen because this study tried to look ahead 35 years), the decline in energy consumption relative to GNP was about 35 percent. This decline was accompanied by fundamental transformations in the energy forms used in such major applications as railroad transportation, electric power generation, and space heating. A case can be made that the 35 percent decline would have been even sharper if energy prices had been rising at the same time instead of generally falling.

INTERNATIONAL COMPARISONS

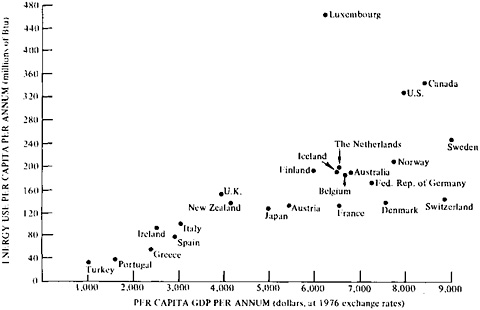

Figure 2–3 displays correlations between energy use and gross domestic product38 in different nations. In general, countries with high GNP’s use large amounts of energy, and those with low GDP’s use small amounts.

GDP is composed of inherently different elements in different countries,

FIGURE 2–3 Correlation between per capita energy use and gross domestic product per annum for various industrialized countries. Source: Data from OECD Observer, OECD Member Countries 1978 Ed., 14th Year, no. 91 (March 1978):20–21.

and these differences as well as others are apparent in the fine structure of the figure, where some of the variation in energy/GDP ratios from country to country can be found within the gross overall correlation already noted between energy and GDP. Sweden, for example, has a per capita GDP comparable to that of the United States, but consumes only 75 percent as much energy per capita, despite the fact that it specializes in inherently energy-intensive industry (steel, paper, metals). Canada and the United States, where energy prices have in the past been markedly lower than elsewhere, are well above the line for most industrialized countries, while Sweden, West Germany, and Japan are well below.39 This variation is important, because reducing the energy/GDP ratio of the United States by, say, 30 percent could make an important contribution to reducing imports of oil.

Comparative international energy analysis points to a variety of reasons for differences between the United States and countries such as West Germany and Sweden. Some, such as patterns of automotive use, appear to be significantly influenced by differences in land areas and the locational patterns of population and industry—particularly the generally greater distances between homes and workplaces or markets in the United States. Other differences stem from years of response to low energy prices in the

United States and higher prices elsewhere. Overall, about 40 percent of the difference between the United States and other industrialized countries can be explained by structural and geographical differences, and the remainder by lower end-use efficiency in the United States.40

Transportation

The greatest difference in energy use among nations is in the transportation sector, especially in the use of automobiles. For example, not only do American passenger cars use about 50 percent more fuel per passenger-mile than European cars, but Americans also drive more than Europeans. A greater percentage of total miles driven in the United States can be attributed to urban, rather than intercity, driving; the foreign energy mix includes more public transit. These differences result partly from the much higher cost (because of taxes) of buying and operating cars abroad, and partly from the compact structure and organization of European cities. European countries have followed policies of high gasoline taxes as well as excise taxes on automobiles assessed by weight or fuel consumption. Their response to the oil embargo was to raise these taxes.

Freight transportation also contributes to the higher energy/GDP ratio of the United States (though the U.S. freight system is the world’s most efficient in terms of energy used per ton-mile) because of the large size of the country and the need for long-distance moving of bulk commodities, such as ores, coal, and grains. In West Germany, for example, the ratio of ton-miles of freight to dollars of GNP is only 40 percent of that in the United States.41

Industry

The U.S. industrial sector forms a smaller fraction of total GNP than those of most other industrial countries, but the overall energy efficiency of its processes is relatively low. Sweden uses about 85 percent as much energy per unit of production, reflecting newer technology and design attention to historically higher fuel prices.42

Households

American households consume more energy than foreign ones relative to income, even if one adjusts for climate. The difference is in space heating and cooling. The single-family homes typical of the United States, and practices that developed in periods of low fuel prices—for example, heating unoccupied rooms and maintaining higher winter temperatures—account for some of the difference. Per square foot of living space, Sweden

appears to consume half as much energy in space heating to achieve similar internal comfort under comparable climatic conditions.43

Implications

Although the influences of a great many factors have been left unexamined, these international comparisons suggest that the energy policies and practices in other countries deserve a closer look, to determine which differences are inherent in geographical and structural characteristics and which might be subject to policy influence, at least in the long run. Because of grossly different geographical circumstances and patterns of industrial and residential location in North America, it would be misleading to conclude that we could simply imitate European per capita energy consumption, but close study of energy consumption in other countries suggests that somewhat more than half the difference is amenable to influence by policy.

ECONOMETRIC STUDIES BY THE MODELING RESOURCE GROUP

The Modeling Resource Group of the CONAES Synthesis Panel, in examining the relation between energy consumption and economic growth, experimented with six computer models that attempt to characterize the response of the economy to various kinds of energy policy.44 The policy variables considered included moratoria or production limits on various energy sources, such as might be fostered by environmental concerns; relaxation of environmental standards now applied to coal and nuclear technologies; and “non-price-induced” energy conservation (due to mandatory standards, public education, and so on). The results suggest substantial flexibility in the ratio of energy consumed to economic output, and thus little relative reduction in economic growth over the next 35 years if energy conservation measures take effect smoothly and gradually enough for the economy to respond rationally.

As inputs to the models, the Modeling Resource Group used “base-case” values (with higher and lower variants) for GNP growth, the costs of major energy supplies (and the availability of the resources and technologies on which they depend), the price and income elasticities of demand for energy, discount rates, and the like.