1

The Psychosocial Needs of Cancer Patients

CHAPTER SUMMARY

Fully 41 percent of all Americans can expect to be diagnosed with cancer at some point in their life. They and their loved ones can take some comfort from the fact that over the past two decades, substantial progress in the early detection and treatment of multiple types of cancer has significantly extended the life expectancy of patients to the point that many people diagnosed with cancer can be cured, and the illness of many others can be managed as a chronic disease. Even so, people with cancer face the risk of substantial and permanent physical impairment, disability, and inability to perform routine activities of daily living, as well as the psychological and social problems that can result from the diagnosis and its sequelae.

Additionally worrisome, the remarkable advances in biomedical care for cancer have not been matched by achievements in providing high-quality care for the psychological and social effects of cancer. Numerous cancer survivors and their caregivers report that cancer care providers did not understand their psychosocial needs, failed to recognize and adequately address depression and other symptoms of stress, were unaware of or did not refer them to available resources, and generally did not consider psychosocial support to be an integral part of quality cancer care.

In response to a request from the National Institutes of Health, this report puts forth a plan delineating actions that cancer care providers, health policy makers, educators, health insurers, health plans, researchers and research sponsors, and consumer advocates should take to better respond to the psychological and social stresses faced by people with cancer, and thereby maximize their health and health care.

THE REACH OF CANCER

More than ten and a half million people in the United States live with a past or current diagnosis of some type of cancer (Ries et al., 2007); 1.4 million1 Americans are projected to receive a new diagnosis of cancer in 2007 alone (Jemal et al., 2007). Reflecting cancer’s reach, 1 in 10 American households now includes a family member who has been diagnosed or treated for cancer within the past 5 years (USA Today et al., 2006), and 41 percent of Americans can expect to be diagnosed with cancer at some point in their life (Ries et al., 2007).

While more than half a million Americans will likely die from cancer in 20072 (Jemal et al., 2007), numerous others are being effectively treated and will survive cancer-free for many years. Still others will have a type of cancer that is chronic and that will need to be controlled by intermittent or continuous treatment, not unlike patients with heart disease or diabetes.

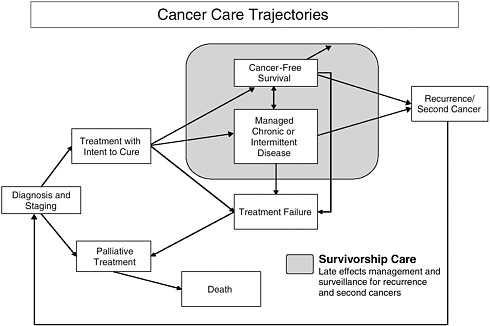

Although cancers historically have not been thought of as such, they increasingly meet the definition of chronic diseases: “They are permanent, leave residual disability, are caused by nonreversible pathological alteration, require special training of the patient for rehabilitation, or may be expected to require a long period of supervision, observation, or care” (Timmreck, 1987:100).3 As described in the next section, many of the more than 100 specific types of cancer frequently leave patients with residual disability and/or nonreversible pathological alteration, and require long periods of supervision, observation, or care. Treatment protocols by themselves for some cancers—such as breast, prostate, and colon cancer (among the most common types of cancers)—can last months; individuals on certain oral chemotherapeutic regimens for breast cancer or some forms of leukemia sometimes remain on chemotherapy for years. Even after completing treatment, cancer survivors (particularly survivors of pediatric cancers) often require care from multiple specialists and primary care providers to manage the long-term sequelae of the illness and its treatment. Thus the trajectories of various cancers vary according to the type of cancer, stage at diagnosis, and other factors (see Figure 1-1).

In addition to coping with the worry and stress brought about by their diagnosis, patients with cancer and their families must cope with the stresses induced by physically demanding (and also often life-threatening) treatments for the illness and the permanent health impairment and

FIGURE 1-1 Cancer care trajectories.

SOURCE: Adapted from IOM and NRC, 2006.

disability, fatigue, and pain that can result, even when there are no longer any signs of the disease. These effects contribute to emotional distress and mental health problems among cancer patients, and together can lead to substantial social problems, such as the inability to work and reduced income. These effects are magnified in the presence of any psychological and social stressors that predate the onset of cancer, such as low income, lack of health insurance, and weak or absent social supports. Indeed, physical, psychological, and social stressors are often intertwined, both resulting from and contributing to each other.

These effects of cancer and its treatment are also influenced by the physical and developmental age of patients and their caregivers. More than half (approximately 60 percent) of individuals who have ever been diagnosed with cancer are age 65 or older; 39 percent are young and middle-aged adults aged 20–64; and 1 percent are age 19 or younger (NCI, undated). Among the large portion of older adults within the population living with cancer, experts in cancer care and aging note that there is great heterogeneity. Although “health and well-being, social circumstances, living arrangements, and age-related changes resulting in diminished psychologic

and physical functioning vary by individual and not by chronological age” (Yancik and Ries, 2000:17), older adults with cancer are more likely to present with a preexisting chronic disease and increased functional impairment and disability, which can compound the stresses imposed by cancer (Hewitt et al., 2003). Evidence also indicates that older adults are at greater risk than younger adults for difficulties with health-related decision making (Finucane et al., 2002). Taken together, older adults may have greater need for psychosocial services. At the other end of the age continuum, the great cognitive, emotional, and developmental (as well as physical) variations among children affect the extent to which they can fully understand the implications of their disease and be involved in treatment decision making, how they cope with the physical pain and distress accompanying cancer and its treatment, and the resources available to help them cope (Patenaude and Kupst, 2005).

CANCER-INDUCED PHYSICAL STRESSORS

Health Impairment, Disability, Fatigue, and Pain

As a result of advances in early detection and treatment, in the past two decades the 5-year survival rate for the 15 most common cancers has increased for all ages—from 43 to 64 percent for men and from 57 to 64 percent for women (Jemal et al., 2004). However, these improvements in survival are sometimes accompanied by permanent damage to patients’ physical health. In addition to the damage caused by the cancer itself, the side effects of chemotherapy, radiation, hormone therapy, surgery, and other cancer treatments often lead to substantial permanent impairment of several organ systems, with resultant disability (Aziz and Rowland, 2003; Oeffinger and Hudson, 2004).

Impairment and Disability

Compared with people without a history of cancer, adults with cancer (or with a history of cancer) more frequently report having fair or poor health (30 percent), other chronic medical conditions (42 percent), one or more limitations in the ability to perform activities of daily living (11 percent), other functional disabilities (58 percent), and (among those under age 65) an inability to work because of a health condition (17 percent) (Hewitt et al., 2003). These numbers may reflect in part the older age of individuals with a diagnosis of cancer; 61 percent of those with a history of cancer are more than 65 years of age (IOM and NRC, 2006). Yet one-third of those with a history of cancer who report limitations in activities of daily living or other functional areas identify cancer as the cause of their limitation,

and cancer survivors in all age groups report higher rates of chronic illness compared with their counterparts with no history of the illness. National Health Interview Survey (NHIS) data from 1998, 1999, and 2000 indicate that a medical history of cancer at least doubles an individual’s likelihood of poor health and disability. Individuals with a history of cancer also have significantly higher rates of other chronic illnesses, such as cardiovascular disease. When cancer and another chronic illness co-occur, poor health and disability rates are 5 to 10 times higher than otherwise expected (Hewitt et al., 2003).

Survivors of childhood cancer similarly have much higher than average rates of chronic illness beginning in their early or middle adult years. A retrospective study of more than 10,000 adults who had been diagnosed with certain cancers4 before age 21 and who survived at least 5 years after diagnosis found that 62 percent of those between the ages of 18 and 48 (mean age 26.6 years) had at least one chronic health condition; 27 percent had a condition that was severe, life-threatening (e.g., kidney failure or need for dialysis, seizure disorder, congestive heart failure), or disabling. This was on average 17.5 years after diagnosis (range 6–31 years). Even 30 years after diagnosis, almost three-fourths had a chronic health condition; more than 40 percent had a condition that was severe, life-threatening, disabling, or fatal; and 39 percent had multiple conditions. None of these estimates include mental health problems (Oeffinger et al., 2006).

Cognitive impairment also is found in some children and adults treated for cancer. Studies of children treated for acute lymphoblastic leukemia and brain tumors (the two most common childhood cancers), for example, indicate that impairment of cognitive abilities (e.g., attention and concentration, working memory, information processing speed, sequencing ability, and visual–motor integration) is common (IOM and NRC, 2003; Butler and Mulhern, 2005). These late effects of cancer and treatment can contribute to problems in reading, language development, and ability to perform complex mathematics. Children can have difficulties doing work in the classroom and require more time to complete homework. They can also have problems in such areas as handwriting, organizing material on a page, lining up columns for arithmetic problems, and being able to complete computer-readable standardized testing forms—all of which can affect school performance and learning. Even if cancer survivors are initially asymptomatic at reentry to school, neurocognitive deficits may develop years later (IOM and NRC, 2003).

Cognitive impairment has also been documented in adults. Although the cause of such impairment (dubbed “chemobrain” by some cancer survivors)

is not yet clear, women treated with chemotherapy for breast cancer, for example, show subtle declines in global cognitive functioning, most particularly in language skills (e.g., word-finding ability), short-term memory, and spatial abilities; lesser impairment is found in their working and long-term memory and their speed of information processing (Stewart et al., 2006). Similar impairment of verbal memory and other executive cognitive functions has been found in adults treated for lung, colorectal, lymphoma, and other types of cancer; however, different types of cancer and their treatment vary in their cognitive effects (Anderson-Hanley et al., 2003).

Fatigue

Fatigue is the most frequently reported symptom of cancer and is identified as causing the greatest interference with patients’ daily activities, although estimates of rates of fatigue among individuals with cancer vary greatly (ranging, for example, from 4 percent in breast cancer patients prior to the start of chemotherapy to 91 percent in breast cancer patients after surgery and chemotherapy and before bone marrow transplantation). Prevalence rates are difficult to interpret, however, because there is no consensus on a standard definition of fatigue, and studies use different criteria for defining its presence and severity. Fatigue is theorized to arise from a complex combination of poorly understood physical and psychological effects of illness that may be different in each patient (Carr et al., 2002). Nonetheless, it is widely recognized as a frequent side effect of both cancer and its treatment. It is different from the fatigue experienced by healthy individuals in that it persists even after rest and sleep. A 2002 review of the evidence by the Agency for Healthcare Research and Quality (AHRQ) found that mechanisms of cancer-related fatigue have been poorly explored, and current treatment options for fatigue are limited5 (Carr et al., 2002). Fatigue among non-ill individuals generally is manifested by compromised problem solving, decreased motivation and vigor in the completion of required tasks, and overall diminished capacity for work (IOM, 2004). These effects are reported by patients with cancer as well, who also report that fatigue interferes with their physical and mental functioning (Carr et al., 2002).

Pain

An estimated one-third to one-half of patients undergoing active treatment for cancer experience pain resulting from the illness, its treatment, or co-occurring illnesses. This pain often is not fully eliminated despite the administration of analgesics and other therapies, in part because it is often undertreated. Moreover, pain may continue to be a problem even when there is no longer any sign of cancer. AHRQ’s 2002 evidence review documented the contribution of cancer-related pain to fatigue, impaired function, and a range of other psychosocial dimensions of health (Carr et al., 2002).

Limitations in Activities of Daily Living

The physical impairments and disabilities, as well as fatigue and pain, experienced by patients with cancer often lead to an inability to perform the routine activities of daily living that most people take for granted. Activities of daily living are defined as those age-appropriate physical and cognitive activities that individuals generally perform for themselves as part of their daily self-care. For adults, these include such activities as bathing, using the toilet, dressing, preparing meals, and feeding oneself. Instrumental activities of daily living include such tasks as using a telephone, shopping, paying bills, and using transportation. In the United States, adults with a prior diagnosis of cancer6 are more likely than those of similar age, sex, and educational level without such a diagnosis to report needing help with activities of daily living (Yabroff et al., 2004). NHIS data for 1998–2000 show that cancer survivors without any other chronic illnesses were more than twice as likely as individuals without a history of cancer or other chronic illness to report limitations in their ability to perform activities of daily living and significantly more likely to have other functional limitations (Hewitt et al., 2003). Long-term survivors of childhood cancer are at particular risk. Nearly 20 percent of more than 11,000 such individuals (median age 26, range 5–56) diagnosed between 1970 and 1986 who survived 5 years or more reported limitations in activities such as lifting heavy objects; running or participating in strenuous sports; carrying groceries; walking uphill or climbing a flight of stairs; walking a block; or eating, dressing, bathing, or using the toilet. These limitations occurred at nearly twice the rate found in their siblings without cancer. Fewer (3, 7, and 8 percent, respectively) reported limitations in ability to eat, bathe, dress, or get around their home by themselves; perform everyday household chores; or hold a job or attend school. However, these rates were five to six times higher than those seen in their siblings without cancer (Ness et al., 2005).

PSYCHOSOCIAL PROBLEMS

The emotional stress of living with a diagnosis of cancer and its treatment, fear of recurrence, and the distress imposed by living with the day-to-day physical problems described above can create new or worsen preexisting psychological distress for people living with cancer, their families, and other informal caregivers. Physical and psychological impairments can also lead to substantial social problems, such as the inability to work or fulfill other normative social roles.

Emotional, Mental Health, and Developmental Problems

Emotional and Mental Health Problems

Although the majority of cancer patients and their families have normal psychological functioning (Kornblith, 1998), distressed psychological states are common in individuals with cancer. The prevalence of psychological distress varies by type of cancer, time since diagnosis, degree of physical and role impairment, amount of pain, prognosis, and other variables. In one U.S. comprehensive cancer center’s study of nearly 4,500 patients aged 19 and older, the prevalence of significant psychological distress ranged from 29 to 43 percent for patients with the 14 most common types of cancer7 (Zabora et al., 2001). These rates are consistent with those found in subsequent studies of diverse populations with cancer that have reported high rates of psychological symptoms meeting criteria for such clinical diagnoses as depression, adjustment disorders, and anxiety (Spiegel and Giese-Davis, 2003; Carlsen et al., 2005; Hegel et al., 2006). Studies have also documented the presence of symptoms meeting the criteria for post-traumatic stress disorder (PTSD) and post-traumatic stress symptoms (PTSS) in adults and children with cancer, as well as in the parents of children diagnosed with the illness (Kangas et al., 2002; Bruce, 2006). Indeed, experiencing a life-threatening medical illness or observing it in another to whom one is close can be a qualifying event for PTSD according to the American Psychiatric Association’s Diagnostic and Statistical Manual of Mental Disorders (DSM-IV-TR) (APA, 2000).

Even patients who do not develop clinical syndromes may experience worries, fears, and other forms of psychological stress that cause them significant distress. Chronic illness can bring about guilt, feelings of loss of control, anger, sadness, confusion, and fear (Charmaz, 2000; Stanton et al., 2001). Anxiety, mood disturbance, fear of recurrence, concerns about body

image, and communication and other problems with family members are common in cancer patients as well (Kornblith, 1998). Patients may also experience more generalized worry; fear for the future; inability to make plans; uncertainty and a heightened sense of vulnerability; and other worries, such as about the possible development of a second cancer, changes in sexual function and reproductive ability, and changes in one’s role within the family and other relationships (IOM and NRC, 2006). Moreover, cancer patients can face spiritual and existential issues involving their faith, their perceived relationship with God, and the possibility and meaning of death. Some cancer survivors report feelings of anger, isolation, and diminished self-esteem in response to such stress (NCI, 2004).

Family members also have psychological needs (Lederberg, 1998). The diagnosis of a life-threatening illness for a family member creates fear of losing the loved one and concern about the suffering he or she will endure. Family members’ psychological distress can be as severe as that of the patient. A meta-analysis of studies of psychological distress in both patients and their informal caregivers (predominantly spouses or partners) found that the psychological distress of patients and their informal caregivers generally was parallel over time, although when the patient received treatment, caregivers experienced more distress than the patient (Hodges et al., 2005). Studies of partners of women with breast cancer (predominantly husbands, but also “significant others,” daughters, friends, and others) find that partners’ mental health correlates positively with the anxiety, depression, fatigue, and symptom distress of women with breast cancer and that the effects are bidirectional (Segrin et al., 2005, 2007). Thus, helping family members to manage their distress may have a beneficial effect on the distress level of patients.

Stress is particularly great for parents of children with cancer. Studies consistently have shown that parents have higher rates of PTSD and PTSS than either their children or adult cancer survivors, suggesting that the experience of parenting a child with cancer may be more traumatic than actually having the illness (Bruce, 2006). Children of cancer patients also are a vulnerable group, with frequent psychological problems, acting-out behaviors, and problems in school (Lederberg, 1998). Moreover, siblings of pediatric cancer patients may experience their own fears and anxieties, and may receive less attention from parents while their brother or sister is in treatment.

Family members (predominantly) and friends of individuals with cancer often provide substantial amounts of emotional and logistical support and hands-on personal and nursing care to their loved ones (Kotkamp-Mothes et al., 2005; Maly et al., 2005). The estimated value of their nonreimbursed care and support exceeds $1 billion annually (Hayman et al., 2001). Further, when their loved ones experience acute or long-term inability to care

for themselves or to carry out their roles in the family, family members often step in to take up these roles. Taking on these responsibilities requires considerable adaptation (and readaptation as the course of the disease changes) on the part of family members. These experiences can add to the stress resulting from concern about the ill family member. Indeed, this stress, especially in caregivers compromised by morbidity accompanying their own aging, can be so substantial that caregivers are afflicted more by depression, other adverse health effects, and death than are patients themselves (Schultz and Beach, 1999; Kurtz et al., 2004). Caregivers who provide support to their spouse and report caregiving strain are 63 percent more likely to die within 4 years than those who do not provide care to their spouse or who provide care but report no strain (Schultz and Beach, 1999).

High stress levels in family caregivers also can interfere with their ability to provide the emotional or logistical support patients need. This can exacerbate the patient’s stress and lead to the cascading consequences of elevated stress described above. Because of the changes and necessary adaptation in the family brought about by the caregiving needs of the patient, family members are sometimes considered “second-order patients” (Lederberg, 1998).

Developmental Problems

As individuals mature, they typically master and apply certain behavioral skills in their daily life. These skills include, for example, achieving self-sufficiency and physical, emotional, financial, and social independence from parents; engaging in satisfying personal relationships of varying intimacy and in meaningful work; and performing other normative social roles. The effects of cancer and its treatment can interrupt and delay the activities in which individuals typically engage to develop these skills, or can require temporarily or permanently giving up the skills and activities. As a result, individuals can experience a range of problems manifested as developmental delays, regression, or inability to perform social roles. Cancer-induced inability to perform normative activities can occur at any age. Older adults, for example, can face unplanned retirement, limitations in grandparenting abilities, inability to act as caregiver to others in their family, or limitations in their ability to work.

Children who experience numerous and prolonged hospitalizations at critical developmental periods are at particular risk for developmental problems (IOM and NRC, 2003). Adolescents can face a significant loss of independence and disruption of their social relationships at a time when they should be developing social and relationship skills critical to successful functioning in adulthood (NCI, 2004). Physical changes resulting from cancer and its treatment—such as hearing loss and vision problems; endocrine

disturbances resulting in short stature, delayed puberty, and reproductive problems; and impaired sexual functioning—also can occur at any age and interfere with successful development. Adolescents and adult cancer survivors report difficulties in knowing how to plan for the future, for example, in establishing educational and career aspirations (NCI, 2004). Adolescents and young adults may have less work experience because of their illness and be at a competitive disadvantage in the labor market. This situation can be compounded if their illness or treatment causes disfigurement or requires some accommodation in the workplace. Revealing a history of cancer to a prospective employer may result in discrimination. Research has also identified some limitations in the social functioning of school-age cancer survivors (IOM and NRC, 2003). Children may return to their social network at school and beyond without hair, with amputations, or with weight gain or other physical changes resulting from their disease or its treatment. They also may have developmental problems that require attention and need help in reentering social relationships.

Social Problems

The physical and psychological problems described above can be exacerbated by or produce significant new social problems. Financial stress resulting from low income, the cost of health care, or a lack of health insurance, as well as reduced employment and income, can result in substantial stress. While the fundamental resolution of such social problems is beyond the abilities of health care providers,8 evidence described below and in the next chapters shows why attention to these problems is an integral part of good-quality health care and how they can be addressed within the constraints of clinical practices.

Financial Stress

In 2003, nearly one in five (12.3 million) people with chronic conditions9 lived in families that had problems paying medical bills (Tu, 2004); 63 percent of these individuals also reported problems in paying for rent, their mortgage, transportation, and food as a result of medical debt (May and Cunningham, 2004). Consistent with these findings, CancerCare, a nonprofit agency supporting individuals with cancer, reports that of those to whom it provides financial grants to pay for transportation, 18 and 11

percent, respectively, cited skipping medications or canceling a medical appointment in the past 3 months because of financial problems. The 2006 National Survey of U.S. Households Affected by Cancer also found that one in four families in which a member of the household had cancer in the past 5 years said the experience led the patient to use up all or most of his or her savings; 13 percent had to borrow money from their relatives to pay bills; and 10 percent were unable to pay for basic necessities such as food, heat, or housing. Seven percent took out another mortgage on their home or borrowed money, and 3 percent declared bankruptcy. Eight percent delayed or did not receive care because of the cost. As would be expected, the financial consequences were worse for those without health insurance: more than one in four delayed or decided not to get treatment because of its cost; 46 percent used all or most of their savings to pay for treatment; 41 percent were unable to pay for basic necessities; and 6 percent filed for bankruptcy (USA Today et al., 2006). About 5 percent of the 1.5 million American families who filed for bankruptcy in 2001 reported that medical costs associated with cancer contributed to their financial problems (Himmelstein et al., 2005).

Not surprisingly, members of the American Society of Clinical Oncology (ASCO), the Oncology Nursing Society (ONS), and the Association of Oncology Social Work (AOSW) report financial needs as a frequent subject of patient inquiries (Matthews et al., 2004). The American Cancer Society (ACS) and CancerCare both receive and respond to a large number of patient requests for financial assistance. In fiscal year 2006, 3,482 patients contacting CancerCare received $1,812,206 for unmet financial needs such as child care, home care, and living expenses. In the first 8 months of fiscal year 2007, 2,069 received $727,745 in such financial assistance. In fiscal year 2006, the ACS responded to 41,378 requests for financial assistance to help patients manage the costs of durable medical equipment (3,713), medications (13,013), prosthetics (128), rent (459), scholarships (2,141), utilities (657), wigs (1,674), other medical expenses (1,763), and other needs (17,830). Both agencies report that requests for financial assistance are one of the most common reasons people contact them, and often there are not enough resources to meet these needs.10,11

Financial needs can arise from the high costs of medical treatment, drugs, and other health support needs, such as medical supplies that are not covered by insurance and/or are beyond an individual’s income level. This financial stress is compounded when a patient suffers a job loss, is not working during periods of treatment, or lacks health insurance.

Lack of or Inadequate Health Insurance

An estimated 44.8 million Americans (15.3 percent of the population) were without health insurance in 2005 (U.S. Census Bureau, 2007), and many more have only modest insurance coverage coupled with an income level that limits their ability to pay out-of-pocket health care costs (May and Cunningham, 2004; Tu, 2004). The rate of uninsurance among cancer survivors is no higher than that among the general population (and is in fact a bit lower—11.3 percent among the nonelderly),12 and among nonaged cancer survivors also is comparable to that observed in populations with other chronic illnesses, such as cardiovascular disease (12.1) and diabetes (12.6) (IOM and NRC, 2006). However, these figures offer little comfort. The adverse effects of no or inadequate insurance are well documented and include poorer health prior to receipt of care, delayed or no treatment, failure to get needed prescription medications, and worse outcomes of medical treatment for people with cancer as well as other diseases (IOM, 2002; Tu, 2004; IOM and NRC, 2006).

Further, analysis of the 2003 national Community Tracking Study Household Survey found that a majority of chronically ill working-age adults who reported health care cost and access problems had private health insurance. Thirteen percent of those with private insurance had out-of-pocket health care costs (not including costs for insurance premiums) that exceeded 5 percent of their income, and 16 percent lived in families that had problems paying their medical bills. Among those who were privately insured but had low income, more than one-third had problems paying their medical bills. Among the privately insured with such problems, 10 percent went without needed medical care, 30 percent delayed care, and 43 percent failed to fill needed prescriptions because of cost concerns (Tu, 2004). The National Survey of U.S. Households Affected by Cancer found that 10 percent of individuals with health insurance reached the limit of their insurance coverage, and 6 percent lost their coverage as a result of having cancer (USA Today et al., 2006).

Because health insurance in the United States for those under age 65 is most often obtained through employers, problems with health insurance are affected by problems with employment (Himmelstein et al., 2005). If an individual loses his or her job because of cancer, he or she also runs the risk of losing health insurance coverage—and income.

Reduced Employment and Income

In its review of studies of cancer and employment, the 2006 Institute of Medicine (IOM) report From Cancer Patient to Cancer Survivor: Lost in Transition found that the effect of having cancer on employment has not been well studied across all types of cancer. Nevertheless, studies across different types of cancers and populations have consistently shown that significant portions of individuals (7 to 70 percent across studies [Spelten et al., 2002]) stop working or experience a change in employment (reduction in work hours, interruption of work, change in place of employment) after being diagnosed or treated for cancer (IOM and NRC, 2006), with implications for their income. Data from the 2000 NHIS reveal that in the United States, adults aged 18 and older with a prior diagnosis of cancer13 were less likely than individuals of similar age, sex, and educational levels to have had a job in the past month, were more likely to have limitations in the amount or type of work they could do because of health problems, and (among those with jobs) had fewer days of work in the past year (Yabroff et al., 2004). In another analysis of NHIS data from 1998–2000, 17 percent of individuals with a history of cancer reported being unable to work, compared with 5 percent of those without such a history (Hewitt et al., 2003). A retrospective cohort study carried out in five medical centers in Pennsylvania and Maryland with 1,435 cancer survivors aged 25–62 who were working at the time of their diagnosis in 1997–1999 found 41 and 39 percent of males and females, respectively, stopped working during cancer treatment. Although most (84 percent) returned to work within the 4 years after diagnosis (73 percent within the first 12 month after diagnosis), a significant minority (16 percent) did not do so. Of those who returned to work in the first year, 11 percent quit for cancer-related reasons within the next 3 years. Overall, 13 percent quit working for cancer-related reasons within 4 years of diagnosis (Short et al., 2005). Individuals whose jobs require manual labor or make other physical demands and those with head and neck cancers, cancers of the central nervous system, and stage IV blood and lymphatic cancers appear to be especially at risk for reductions in employment (Spelten et al., 2002; Short et al., 2005). The late effects of the illness or its treatment in survivors of childhood cancer can also prevent many from working (Ness et al., 2005; de Boer et al., 2006).

These changes in employment patterns can be a function of shifting priorities and values after diagnosis, a desire for retirement (consistent with the older age of most cancer patients), or changes in one’s employer having nothing to do with the employee (IOM and NRC, 2006). However, many individuals with cancer report that changes in their employment or their

ability to work are a function of changes in their health resulting from their cancer diagnosis (IOM and NRC, 2006).

OBSTACLES TO MANAGING PSYCHOSOCIAL STRESSORS

In multiple focus groups and interviews, patients with a wide variety of chronic illnesses, such as diabetes, arthritis, heart disease, chronic obstructive lung disease, depression, and asthma, have identified pain, fatigue, problems with mobility, poor communication with physicians (with resultant poor understanding of their illness and how to manage it), depression and other negative emotions, stress, lack of family support, financial problems, loss of a job, and lack of health insurance as obstacles to managing their illness and health (Wdowik et al., 1997; Riegel and Carlson, 2002; Bayliss et al., 2003; Jerant et al., 2005). Patients were often unaware of resources available to help them overcome these problems, but when they were aware, limitations in mobility, fatigue, pain, transportation problems, cost issues, and lack of insurance prevented them from taking advantage of these resources (Jerant et al., 2005). Cancer patients and their health care providers offer similar reports of these social and psychological obstacles (IOM and NRC, 2003, 2004; NCI, 2004), which add to the suffering created by the illness, prevent adherence to prescribed treatments, and interfere with patients’ ability to manage their illness and their health. These problems and the effects of failing to address them are magnified in especially vulnerable and disadvantaged populations, such as those living in poverty; those with low literacy; members of cultural minorities; and those over age 65, who are more likely than younger individuals to experience the compounding effects of other chronic conditions that occur with aging.

Some of these stressors (described in the preceding sections) can come about as a consequence of cancer, others can predate the illness, while still others are imposed by the health care system itself. Although not all individuals treated for cancer face these problems, individuals who do so need the knowledge, skills, and abilities to manage them and function at their highest possible level. When these resources are not available, the ability to manage one’s illness and health is decreased.

Lack of Information, Knowledge, and Skills Needed to Manage the Illness

Members of ASCO, ONS, and AOSW report that information and education about cancer are the support services most frequently requested by their patients (Matthews et al., 2004). Patients similarly rate information needs pertaining to their illness and treatments as very important (Boberg et al., 2003). Yet over the past three decades research has consistently documented many patients’ and family members’ dissatisfaction with the

information and education they receive (Chapman and Rush, 2003) and how their health care providers communicate with them (Epstein and Street, 2007). While research has not yet yielded a comprehensive road map for how best to provide the full array of information needed at various times during and after cancer treatment, it has illuminated several characteristics of the effective provision of information. For example, information should be tailored to each patient’s expectations and preferences (e.g., much detailed information in advance versus less information provided on an as-needed basis), as well as to the patient’s individual diagnosis and clinical situation. Evidence also indicates that patients’ wide range of information needs (e.g., information specific to their type and stage of cancer, treatment, prognosis, rehabilitation, achievement and maintenance of maximal health, coping, and financial/legal concerns) change over time, for example, during and after treatment (Rutten et al., 2005; Epstein and Street, 2007). Further, anxiety decreases satisfaction with information provided. Anxiety and other side effects of the illness and its treatment, such as pain, need to be controlled if information is to be useful (Chapman and Rush, 2003). However, evidence indicates that measures to control such side effects, as well as more basic practices to meet patients’ information needs effectively, are not employed; many patients continue to have insufficient information to help them manage their illness and health (Eakin and Strycker, 2001; Boberg et al., 2003; Skalla et al., 2004; Mallinger et al., 2005). Fifteen percent of respondents to the 2006 National Survey of U.S. Households Affected by Cancer said they had had the experience of leaving a doctor’s office without getting answers to important questions about their illness (USA Today et al., 2006).

Related to these findings, members of ASCO, ONS, and AOSW reported that support groups were the second most frequent subject of patient inquiries about support services (Matthews et al., 2004). Peer support programs in which people communicate and share experiences with others having a common personal experience are strong mechanisms for building one’s “self-efficacy”—the belief that one is capable of carrying out a course of action to reach a desired goal (Bandura, 1997). Self-efficacy is a critical determinant of how well knowledge and skills are obtained and is an excellent predictor of behavior. There is also evidence that self-efficacy is key to individuals’ successful self-management of a range of chronic illnesses, resulting in improved health outcomes (Lorig et al., 2001; Lorig and Holman, 2003). However, although peer support programs are widespread, providers are not always aware of these resources and often do not refer patients to them (IOM, 2007). Failure to refer patients to these services is associated with their low use (Eakin and Strycker, 2001).

Insufficient Logistical Resources

Even when patients have the information, knowledge, and skills to cope with their illness, a lack of logistical and material resources, such as transportation, medical equipment, and supplies, can prevent their use. As described above, the high costs of medical care (for those with and without health insurance), together with work reductions and job loss with a concomitant decrease in income, can make obtaining the needed resources difficult if not impossible. Families, friends, and other informal sources of support can provide or help secure many of these resources (Eakin and Strycker, 2001), but sometimes such sources are unavailable or overwhelmed by patients’ needs. Oncology physicians, nurses, and social workers report that transportation in particular is a “paramount concern” of patients (Matthews et al., 2004:735).

Lack of Transportation

In a 2005 survey, members of AOSW identified transportation as the third greatest barrier14 to patients and their families receiving good-quality cancer care (AOSW, 2006). The inability to get to medical appointments, the pharmacy, the grocery store, health education classes, peer support meetings, and other out-of-home resources can hinder health care, illness management, and health promotion. Indicative of this problem, ACS reports receiving more than 90,000 requests for transportation services in 2006.15 CancerCare reports that 14,919 patients requested and were provided $3,005,679 in financial grants in fiscal year 2006 to pay for transportation. These grants (typically $100–200) were used for transportation to cancer-related medical appointments (47 percent), pharmacies or other places to pick up medications (27 percent), other medical or mental health appointments or an emergency room (8 percent), case management/client advocacy appointments (1 percent), and other destinations (17 percent). In the first 8 months of fiscal year 2007, 10,102 patients received $1,621,282 to help pay for transportation.16

Weak Social Support

Also, as described above, patients’ informal social supports (family members and friends) provide substantial emotional, informational, and logistical support. When an individual has sufficient family members or other informal supports, such as neighbors, friends, or church groups,

they can perform or assist the patient in performing necessary tasks. When these informal supports are lacking, the effects of psychosocial problems are compounded.

Inattention and Lack of Support from the Health Care System

Despite the adverse effects of the psychosocial problems described above, patients report that these problems are not well addressed as part of their oncology care. At multiple meetings held across the nation with the President’s Cancer Panel in 2003 and 2004, cancer survivors of all ages reported that many health care providers “still do not consider psychosocial support an integral component of quality cancer care and may fail to recognize, adequately treat, or refer for depression, anger and stress in cancer survivors, family members or other caregivers” (NCI, 2004:27). Numerous survivors and caregivers also testified that many cancer care providers did not understand their psychosocial needs, often were unaware of available resources, and/or did not provide referrals to those resources. Consistent with these reports, 28 percent of respondents to the National Survey of U.S. Households Affected by Cancer reported that they did not have a doctor who paid attention to factors beyond their direct medical care, such as a need for support in dealing with the illness (USA Today et al., 2006). A number of studies have shown that physicians substantially underestimate oncology patients’ psychosocial distress (Fallowfield et al., 2001; Keller et al., 2004; Merckaert et al., 2005). Inattention to psychosocial problems on the part of oncology providers has also been reported by cancer survivors in focus groups (IOM, 2007) and other studies (Maly et al., 2005).

Two prior IOM reports (IOM, 2000, 2001) underscore that the vast majority of problems in the quality of health care are not the result of poorly motivated, uncaring, or unintelligent health care personnel, but instead result from numerous barriers to high-quality health care in the systems that prepare clinicians for their work and structure their work practices. Some of these barriers occur at the level of the patient’s interaction with the clinician (e.g., poor communication between the patient and his/her health care providers, multiple demands on clinicians’ time17),

|

17 |

There is little evidence on the extent to which time is/is not sufficient to address patients’ psychosocial issues. Information on both sides of the issue appears to be anecdotal. For example, examples of oncology practices described in Chapter 5 suggest that psychosocial problems can be significantly addressed. Others report that time is insufficient. One qualitative study (Bodenheimer et al., 2004) of physicians organizations’ use of care management processes found that in organizations with strong leadership and a quality-focused culture, the most frequently mentioned barriers to care management—inadequate finances, payers not rewarding quality, inadequate information technology, and resistance or overwork of physicians—did not prevent the adoption of care management processes. Sites mentioning physician |

some at the level of interactions among different clinicians serving the same patient (e.g., poor coordination of care across providers), some within the organization in which care is delivered (e.g., inadequate work supports, such as information technology), and some in the environment external to the delivery of care (e.g., reimbursement arrangements that financially penalize the provision of good-quality care) (Berwick, 2002).18 Barriers at all four of these levels have been identified as potentially contributing to health care providers’ failure to respond appropriately to cancer patients’ psychosocial needs and are addressed in succeeding chapters.

Clinicians may not inquire about psychosocial problems because of inadequate education and training (including inadequate clinical practice guidelines) in these issues (IOM and NRC, 2004), a lack of awareness of services available to address these needs (Matthews et al., 2002), or a lack of knowledge about how to integrate attention to psychosocial health needs into their practices. The 2004 IOM report Meeting Psychosocial Needs of Women with Breast Cancer called particular attention to the fact that much of cancer care has shifted from inpatient to ambulatory care settings. A great deal has been written about the way in which ambulatory care practices have been constructed in the past, and the fact that their structures and work design processes need to undergo fundamental change if effective care for chronic illnesses and support for individuals’ management of those illnesses is to be provided (IOM, 2001; Bodenheimer et al., 2002).

Aspects of the external environment that surrounds the delivery of health care—such as reimbursement and purchasing strategies and regulatory and quality oversight structures—also have been identified as mechanisms that as yet do not support the delivery of psychosocial health care (NCI, 2004; IOM, 2006; NCCN, 2006). Moreover, even when psychosocial problems are identified and services sought, shortages and maldistribution of health care professionals with needed expertise can be a barrier to care. In rural and other geographically remote areas, for example, there is limited availability of mental health care practitioners (IOM, 2006).

The role of cancer patients and their caregivers in securing and using appropriate psychosocial health services also may need attention.

PURPOSE, SCOPE, AND ORGANIZATION OF THIS REPORT

Recognizing the impact on cancer patients and their families of unaddressed psychosocial problems, the National Institutes of Health’s (NIH) Office of Behavioral and Social Sciences Research asked the IOM to empanel a committee to conduct a study of the delivery of the diverse psychosocial services needed by these patients and their families in community settings. The committee was tasked with producing a report that would

-

Describe how the broad array of psychosocial services needed by cancer patients is provided and what barriers exist to accessing such care.

-

Analyze the capacity of the current mental health and cancer treatment system to deliver psychosocial care, delineate the resources needed to deliver this care nationwide, and examine available training programs for professionals providing psychosocial and mental health services.

-

Recommend ways to address these issues and an action plan for overcoming the identified barriers to cancer patients’ receiving the psychosocial services they need.

A more detailed description of the tasks to be carried out by the committee and the methods used for the study is provided in Appendix B. Of note, this study builds on several prior IOM reports on cancer care, as well as those of other authoritative bodies (see Appendix C). This report is unique, however, in that it focuses exclusively on the delivery of psychosocial health services, and does so across all types of cancer. In shaping its scope of work, the committee took into particular consideration two recent IOM reports addressing the quality of care for cancer survivors. First, the report of the Committee on Cancer Survivorship: Improving Care and Quality of Life entitled From Cancer Patient to Cancer Survivor: Lost in Transition (IOM and NRC, 2006) well articulated how high-quality care (including psychosocial health care) should be delivered after patients complete their cancer treatment. The IOM report Childhood Cancer Survivorship: Improving Care and Quality of Life similarly addressed survivorship for childhood cancer (IOM and NRC, 2003). For this reason, the committee that conducted the present study chose to focus on how psychosocial services should be delivered during active treatment of cancer. The recommendations made in this report complement those of the two prior reports on cancer survivorship, and can be implemented for cancer survivors who

have completed treatment in a manner consistent with the vision articulated in those reports. Second, two recent reports addressed palliative care: Improving Palliative Care for Cancer (IOM and NRC, 2001) and When Children Die: Improving Palliative and End-of-Life Care for Children and Their Families (IOM, 2003b). For this reason, the additional considerations involved in providing end-of-life care are not addressed in this report.

Finally, NIH directed the committee to give higher priority to in-depth as opposed to a broader array of less detailed analyses and recommendations, and noted that, given the complexity of this study, it might not be possible to thoroughly explore diversity and health disparity issues. Especially in the identification of successful models for the delivery of psychosocial services, NIH asked that the committee focus on generic models that should be promoted, with the understanding that some of these models might need to be modified to reach underserved communities. Thus, although the committee considered differences in the impact of cancer and the attendant needs of those who are socially disadvantaged, issues pertaining to health disparities (also addressed comprehensively in the recent IOM report Unequal Treatment: Confronting the Racial and Ethnic Disparities in Health Care [IOM, 2003a]) are not specifically addressed in this report.

With respect to the committee’s charge to address “psychosocial services to cancer … families …” (emphasis added), the committee notes that the word “family” can mean many different things to different people; can be shaped by personal beliefs and personal, ethical, and religious values; and can have legal and political implications. The committee did not attempt to define “family” but aimed to describe what is known about cancer’s effects on families as the term is variously used in qualitative and quantitative research. Most of this research has focused on the effects of cancer on spouses, parents, siblings, and children of individuals with cancer. Another large body of research focuses on “caregivers” of individuals with cancer or other illnesses. This research documents that while most caregivers are spouses and adult children of ill individuals, many other individuals, such as close friends, neighbors, and individuals from places of worship, also act as caregivers. Thus, this report incorporates research findings about “families” and “caregivers.” When these words are used, we provide information on how the words are used in the research reviewed. Because of the size of this literature, and consistent with the committee’s desire to address a subset of critical issues in depth, while family distress is addressed in this report, it was not possible to fully examine all of the issues families/caregivers face when a loved one is diagnosed with cancer.

The unique contributions of this report are that it

-

provides an explicit definition of psychosocial health services. Although the term “psychosocial services” is frequently used, the

-

committee found that it is used inconsistently and sometimes not at all. This inconsistency has confounded the conduct and interpretation of research on psychological and social problems that seriously interfere with patients’ health care, as well as efforts to address those problems. The definition formulated by the committee and its conceptual and empirical underpinnings are presented in Chapter 2.

-

identifies discrete services that are encompassed by the term psychosocial health care, evidence that supports their effectiveness, and issues needing additional research (discussed in Chapters 3 and 8).

-

identifies a generic, conceptually and evidence-based model for ensuring the delivery of psychosocial health services (Chapter 4) and strategies for implementing this model in community settings with varying levels of resources (Chapter 5). In its work, the committee interpreted “community care” to mean care delivered in settings other than in-patient care sites.19

-

identifies the support needed from policy makers in the purchasing, oversight, and regulatory arenas to facilitate routine attention to psychosocial health needs in cancer care and the delivery of psychosocial health services when needed (Chapter 6).

-

identifies the knowledge, skills, and abilities needed by the workforce to implement the model for psychosocial health care, and examines how the education and training of the workforce can be improved to provide them (Chapter 7).

-

identifies a research agenda to help improve psychosocial health care (Chapter 8).

Together, the recommendations presented in this report and proposed means of evaluating their successful implementation (also in Chapter 8) constitute an action plan for overcoming the identified barriers to cancer patients’ receipt of the psychosocial health services they need in community settings.

REFERENCES

Anderson-Hanley, C., M. L. Sherman, R. Riggs, V. B. Agocha, and B. E. Compas. 2003. Neuropsychological effects of treatments for adults with cancer: A meta-analysis and review of the literature. Journal of the International Neuropsychological Society 9(7):967–982.

AOSW (Association of Oncology Social Work). 2006. Member survey report. The Association of Oncology Social Work. http://www.aosw.org/docs/MemberSurvey.pdf (accessed August 17, 2007).

APA (American Psychiatric Association). 2000. Diagnostic and statistical manual of mental disorders, text revision (DSM-IV-TR). 4th ed. Washington, DC: APA.

Aziz, N. M., and J. H. Rowland. 2003. Trends and advances in cancer survivorship research: Challenge and opportunity. Seminars in Radiation Oncology 13(3):248–266.

Bandura, A. 1997. Self-efficacy: The exercise of control. New York: W.H. Freeman.

Bayliss, E. A., J. F. Steiner, D. H. Fernald, L. A. Crane, and D. S. Main. 2003. Description of barriers to self-care by persons with comorbid chronic diseases. Annals of Family Medicine 1(1):15–21.

Berwick, D. M. 2002. A user’s manual for the IOM’s quality chasm report. Health Affairs 21(3):80–90.

Boberg, E. W., D. H. Gustafson, R. P. Hawkins, K. P. Offord, C. Koch, K.-Y. Wen, K. Kreutz, and A. Salner. 2003. Assessing the unmet information, support and care delivery needs of men with prostate cancer. Patient Education and Counseling 49(3):233–242.

Bodenheimer, T., E. H. Wagner, and K. Grumbach. 2002. Improving primary care for patients with chronic illness: The chronic care model, part 2. Journal of the American Medical Association 288(15):1909–1914.

Bodenheimer, T., M. C. Wang, T. Rundall, S. M. Shortell, R. R. Gillies, N. Oswald, L. Casalino, and J. C. Robinson. 2004. What are the facilitators and barriers in physician organizations’ use of care management processes? Joint Commission Journal on Quality and Safety 30(9):505–514.

Bruce, M. 2006. A systematic and conceptual review of posttraumatic stress in childhood cancer survivors and their parents. Clinical Psychology Review 26(3):233–256.

Butler, R. W., and R. K. Mulhern. 2005. Neurocognitive interventions for children and adolescents surviving cancer. Journal of Pediatric Psychology 30(1):65–78.

Carlsen, K., A. B. Jensen, E. Jacobsen, M. Krasnik, and C. Johansen. 2005. Psychosocial aspects of lung cancer. Lung Cancer 47(3):293–300.

Carr, D., L. Goudas, D. Lawrence, W. Pirl, J. Lau, D. DeVine, B. Kupelnick, and K. Miller. 2002. Management of cancer symptoms: Pain, depression, and fatigue. AHRQ Publication No. 02-E032. Rockville, MD: Agency for Healthcare Research and Quality. http://www.ahrq.gov/downloads/pub/evidence/pdf/cansymp/cansymp.pdf (accessed November 2, 2006).

Chapman, K., and K. Rush. 2003. Patient and family satisfaction with cancer-related information: A review of the literature. Canadian Oncology Nursing Journal 13(2):107–116.

Charmaz, K. 2000. Experiencing chronic illness. In Handbook of social studies in health and medicine. Edited by G. L. Albrecht, R. Fitzpatrick, and S. C. Scrimshaw. Thousand Oaks, CA: Sage Publications.

de Boer, A. G., J. H. Verbeek, and F. J. van Dijk. 2006. Adult survivors of childhood cancer and unemployment: A metaanalysis. Cancer 107(1):1–11.

Eakin, E. G., and L. A. Strycker. 2001. Awareness and barriers to use of cancer support and information resources by HMO patients with breast, prostate, or colon cancer: Patient and provider perspectives. Psycho-Oncology 10(2):103–113.

Epstein, R. M., and R. L. Street. 2007. Patient-centered communication in cancer care: Promoting healing and reducing suffering. NIH Publication No. 07-6225. Bethesda, MD: National Cancer Institute.

Fallowfield, L., D. Ratcliffe, V. Jenkins, and J. Saul. 2001. Psychiatric morbidity and its recognition by doctors in patients with cancer. British Journal of Cancer 84(8):1011–1015.

Finucane, M. L., P. Slovic, J. H. Hibbard, E. Peters, C. K. Mertz, and D. G. MacGregor. 2002. Aging and decision-making competence: An analysis of comprehension and consistency skills in older versus younger adults considering health-plan options. Journal of Behavioral Decision Making 15(2):141–164.

Hayman, J. A., K. M. Langa, M. U. Kabeto, S. J. Katz, S. M. DeMonner, M. E. Chernew, M. B. Slavin, and A. M. Fendrick. 2001. Estimating the cost of informal caregiving for elderly patients with cancer. Journal of Clinical Oncology 19(13):3219–3225.

Hegel, M. T., C. P. Moore, E. D. Collins, S. Kearing, K. L. Gillock, R. L. Riggs, K. F. Clay, and T. A. Ahles. 2006. Distress, psychiatric syndromes, and impairment of function in women with newly diagnosed breast cancer. Cancer 107(12):2924–2931.

Hewitt, M., J. H. Rowland, and R. Yancik. 2003. Cancer survivors in the United States: Age, health, and disability. Journal of Gerontology 58(1):82–91.

Himmelstein, D. U., E. Warren, D. Thorne, and S. Woolhandler. 2005. Market watch: Illness and injury as contributors to bankruptcy. Health Affairs Web Exclusive: DOI 10.1377/hlthaff.W5.63.

Hodges, L. J., G. M. Humphris, and G. Macfarlane. 2005. A meta-analytic investigation of the relationship between the psychological distress of cancer patients and their carers. Social Science and Medicine 60(1):1–12.

IOM (Institute of Medicine). 2000. To err is human: Building a safer health system. L. T. Kohn, J. M. Corrigan, and M. S. Donaldson, eds. Washington, DC: National Academy Press.

IOM. 2001. Crossing the quality chasm: A new health system for the 21st century. Washington, DC: National Academy Press.

IOM. 2002. Care without coverage: Too little, too late. Washington, DC: National Academy Press.

IOM. 2003a. Unequal treatment: Confronting the racial and ethnic disparities in health care. B. D. Smedley, A. Y. Stith, and A. R. Nelson, eds. Washington, DC: The National Academies Press.

IOM. 2003b. When children die: Improving palliative and end-of-life care for children and their families. M. J. Field and R. E. Behrman, eds. Washington, DC: The National Academies Press.

IOM. 2004. Keeping patients safe: Transforming the work environment of nurses. A. E. K. Page, ed. Washington, DC: The National Academies Press.

IOM. 2006. Improving the quality of health care for mental and substance-use conditions. Washington, DC: The National Academies Press.

IOM. 2007. Implementing cancer survivorship care planning. Washington, DC: The National Academies Press.

IOM and NRC (National Research Council). 2001. Improving palliative care for cancer. Edited by K. M. Foley and H. Gelband. Washington, DC: National Academy Press.

IOM and NRC. 2003. Childhood cancer survivorship: Improving care and quality of life. M. Hewitt, S. L. Weiner, and J. V. Simone, eds. Washington, DC: The National Academies Press.

IOM and NRC. 2004. Meeting psychosocial needs of women with breast cancer. Edited by M. Hewitt, R. Herdman, and J. Holland. Washington, DC: The National Academies Press.

IOM and NRC. 2006. From cancer patient to cancer survivor: Lost in transition. M. Hewitt, S. Greenfield, and E. Stovall, eds. Washington, DC: The National Academies Press.

Jemal, A., L. X. Clegg, E. Ward, L. A. G. Ries, X. Wu, P. M. Jamison, P. A. Wingo, H. L. Howe, R. N. Anderson, and B. K. Edwards. 2004. Annual report to the nation on the status of cancer, 1975–2001, with a special feature regarding survival. Cancer 101(1):3–27.

Jemal, A., R. Siegel, E. Ward, T. Murray, J. Xu, and M. J. Thun. 2007. Cancer statistics, 2007. CA: A Cancer Journal for Clinicians 57(1):43–66.

Jerant, A. F., M. M. von Friederichs-Fitzwater, and M. Moore. 2005. Patients’ perceived barriers to active self-management of chronic conditions. Patient Education and Counseling 57(3):300–307.

Kangas, M., J. Henry, and R. Bryant. 2002. Posttraumatic stress disorder following cancer. A conceptual and empirical review. Clinical Psychology Review 22(4):499–524.

Keller, M., S. Sommerfeldt, C. Fischer, L. Knight, M. Riesbeck, B. Löwe, C. Herfarth, and T. Lehnert. 2004. Recognition of distress and psychiatric morbidity in cancer patients: A multi-method approach. European Society for Medical Oncology 15(8):1243–1249.

Kornblith, A. B. 1998. Psychosocial adaptation of cancer survivors. In Psycho-oncology. Edited by J. C. Holland. New York and Oxford: Oxford University Press.

Kotkamp-Mothes, N., D. Slawinsky, S. Hindermann, and B. Strauss. 2005. Coping and psychological well being in families of elderly cancer patients. Critical Reviews in Oncology-Hematology 55(3):213–229.

Kurtz, M. E., J. C. Kurtz, C. W. Given, and B. A. Given. 2004. Depression and physical health among family caregivers of geriatric patients with cancer—a longitudinal view. Medical Science Monitor 10(8):CR447–CR456.

Lederberg, M. S. 1998. The family of the cancer patient. In Psycho-oncology. Edited by J. C. Holland. New York and Oxford: Oxford University Press. Pp. 981–993.

Lorig, K., and H. Holman. 2003. Self-management education: History, definition, outcomes, and mechanisms. Annals of Behavioral Medicine 26(1):1–7.

Lorig, K. R., P. Ritter, A. L. Stewart, D. S. Sobel, B. W. Brown, A. Bandura, V. M. Gonzalez, D. D. Laurent, and H. R. Holman. 2001. Chronic disease self-management program—2-year health status and health care utilization outcomes. Medical Care 39(11): 1217–1223.

Mallinger, J. B., J. J. Griggs, C. G. Shields. 2005. Patient-centered care and breast cancer survivors’ satisfaction with information. Patient Education and Counseling 57(3):342–349.

Maly, R. C., Y. Umezawa, B. Leake, and R. A. Silliman. 2005. Mental health outcomes in older women with breast cancer: Impact of perceived family support and adjustment. Psycho-Oncology 14(7):535–545.

Matthews, B. A., F. Baker, and R. L. Spillers. 2002. Health care professionals’ awareness of cancer support services. Cancer Practice 10(1):36–44.

Matthews, B. A., F. Baker, and R. L. Spillers. 2004. Oncology professionals and patient requests for cancer support services. Supportive Care in Cancer 12(10):731–738.

May, J. H., and P. J. Cunningham. 2004. Tough trade-offs: Medical bills, family finances and access to care. Washington, DC: Center for Studying Health System Change.

Merckaert, I., Y. Libert, N. Delvaux, S. Marchal, J. Boniver, A.-M. Etienne, J. Klastersky, C. Reynaert, P. Scalliet, J.-L. Slachmuylder, and D. Razavi. 2005. Factors that influence physicians’ detection of distress in patients with cancer. Can a communication skills training program improve physicians’ detection? Cancer 104(2):411–421.

NCCN (National Comprehensive Cancer Network). 2006. Distress management. NCCN clinical practice guidelines in oncology V.I.2007. http://www.nccn.org/professional/physicians_gls/PDF/distress.pdf (accessed January 17, 2007).

NCI (National Cancer Institute). 2004. Living beyond cancer: Finding a new balance. President’s cancer panel 2003–2004 annual report. Bethesda, MD: Department of Health and Human Services, National Institutes of Health. http://deainfo.nci.nih.gov/ADVISORY/pcp/pcp03-04/Survivorship.pdf (accessed May 4, 2006).

NCI. undated. Estimated U.S. cancer prevalence. http://cancercontrol.cancer.gov/ocs/prevalence/prevalence.html#age (accessed August 14, 2007).

Ness, K. K., A. C. Mertens, M. M. Hudson, M. M. Wall, W. M. Leisenring, K. C. Oeffinger, C. A. Sklar, L. L. Robison, and J. G. Gurney. 2005. Limitations on physical performance and daily activities among long-term survivors of childhood cancer. Annals of Internal Medicine 143(9):639–647.

Oeffinger, K. C., and M. M. Hudson. 2004. Long-term complications following childhood and adolescent cancer: Foundations for providing risk-based health care for survivors. CA: A Cancer Journal for Clinicians 54(4):208–236.

Oeffinger, K. C., A. C. Mertens, C. A. Sklar, T. Kawashima, M. M. Hudson, A. T. Meadows, D. L. Friedman, N. Marina, W. Hobbie, N. S. Kadan-Lottick, C. L. Schwartz, W. Leisenring, L. L. Robison, for the Childhood Cancer Survivor Study. 2006. Chronic health conditions in adult survivors of childhood cancer. New England Journal of Medicine 355(15):1572–1582.

Patenaude, A., and M. Kupst. 2005. Psychosocial functioning in pediatric cancer. Journal of Pediatric Psychology 30(1):9–27.

Riegel, B., and B. Carlson. 2002. Facilitators and barriers to heart failure self-care. Patient Education and Counseling 46(4):287–295.

Ries, L., D. Melbert, M. Krapcho, A. Mariotto, B. Miller, E. Feuer, L. Clegg, M. Horner, N. Howlader, M. Eisner, M. Reichman, B. Edwards, eds. 2007. SEER cancer statistics review, 1975–2004 National Cancer Institute. http://seer.cancer.gov/csr/1975_2004/ (accessed June 6, 2007).

Rutten, L. J., N. K. Arora, A. D. Bakos, N. Aziz, and J. Rowland. 2005. Information needs and sources of information among cancer patients: A systematic review of research (1980–2003). Patient Education and Counseling 57(3):250–261.

Schultz, R., and S. R. Beach. 1999. Caregiving as a risk factor for mortality: The caregiver health effects study. Journal of the American Medical Association 282(23):2215–2219.

Segrin, C., T. A. Badger, P. Meek, A. M. Lopez, E. Bonham, and A. Sieger. 2005. Dyadic interdependence on affect and quality-of-life trajectories among women with breast cancer and their partners. Journal of Social and Personal Relationships 22(5):673–689.

Segrin, C., T. Badger, S. M. Dorros, P. Meek, and A. M. Lopez. 2007. Interdependent anxiety and psychological distress in women with breast cancer and their partners. PsychoOncology 16(7):634–643.

Short, P. F., J. J. Vasey, and K. Tunceli. 2005. Employment pathways in a large cohort of adult cancer survivors. Cancer 103(6):1292–1301.

Skalla, K. A., M. Bakitas, C. T. Furstenberg, T. Ahles, and J. V. Henderson. 2004. Patients’ need for information about cancer therapy. Oncology Nursing Forum 31(2):313–319.

Spelten, E. R., M. A. G. Sprangers, and J. H. A. M. Verbeek. 2002. Factors reported to influence the return to work of cancer survivors: A literature review. Psycho-Oncology 11(2):124–131.

Spiegel, D., and J. Giese-Davis. 2003. Depression and cancer: Mechanism and disease progression. Biological Psychiatry 54(3):269–282.

Stanton, A. L., C. A. Collins, and L. A. Sworowski. 2001. Adjustment to chronic illness: Theory and research. In Handbook of Health Psychology. Mahwah, NJ: Lawrence Erlbaum Associates.

Stewart, A., C. Bielajew, B. Collins, M. Parkinson, and E. Tomiak. 2006. A meta-analysis of the neuropsychological effects of adjuvant chemotherapy treatment in women treated for breast cancer. The Clinical Neuropsychologist 20(1):76–89.

Timmreck, T. C. 1987. Dictionary of health services management. 2nd ed. Owings Mills, MD: National Health Publishing.

Tu, H. T. 2004. Rising health costs, medical debt and chronic conditions. Issue Brief No. 88. Washington, DC: Center for Studying Health System Change.

U.S. Census Bureau. 2007. Census Bureau revises 2004 and 2005 health insurance coverage estimates. Washington, DC: U.S. Department of Commerce.

USA Today, Kaiser Family Foundation, and Harvard School of Public Health. 2006. National survey of households affected by cancer: Summary and chartpack. Menlo Park, CA, and Washington, DC: USA Today, Kaiser Family Foundation, and Harvard School of Public Health. http://www.kff.org/Kaiserpolls/upload/7591.pdf (accessed April 24, 2007).

Wdowik, M. J., P. A. Kendall, and M. A. Harris. 1997. College students with diabetes: Using focus groups and interviews to determine psychosocial issues and barriers to control. The Diabetes Educator 23(5):558–562.

Yabroff, K. R., W. F. Lawrence, S. Clauser, W. W. Davis, and M. L. Brown. 2004. Burden of illness in cancer survivors: Findings from a population-based national sample. Journal of the National Cancer Institute 96(17):1322–1330.

Yancik, R., and L. A. G. Ries. 2000. Aging and cancer in America. Hematology/Oncology Clinics in North America 14(1):17–23.

Zabora, J., K. Brintzenhofeszoc, B. Curbow, C. Hooker, and S. Piantadosi. 2001. The prevalence of psychological distress by cancer site. Psycho-Oncology 10(1):19–28.