4

Energy Efficiency

The United States is the world’s largest consumer of energy. In 2006, it was responsible for some 20 percent of global primary energy consumption, while its closest competitor, China, used 15 percent (IEA, 2009). But given the energy-security concerns over oil imports, recent volatility in energy prices, and the greenhouse gas emissions associated with energy consumption, using energy more efficiently has become an important priority. Fortunately, the potential for higher energy efficiency1 is great.

This chapter focuses on the technologies that could increase energy efficiency over the next decade. It describes their state of development, the potential for their use, and their associated performance, costs, and environmental impacts. For these technologies to make a difference, however, they will have to be widely adopted. Hence, the chapter also addresses the sometimes formidable barriers to achieving such market penetration (see Box 4.1 for examples) and the experience that has been gained with policies and programs aimed at overcoming these barriers.

In fact, continued technological advances make energy efficiency a dynamic resource. When new efficient or otherwise advanced technologies reach the market, they hold the potential for reducing the then current level of energy use or moderating its growth. This chapter reviews some of these advanced technologies—some of which could become available and cost-effective in the

|

BOX 4.1 Why Energy Efficiency Opportunities Aren’t More Attractive to Consumers and Businesses Why don’t consumers and businesses take greater advantage of cost-effective energy efficiency opportunities? If so much energy can be saved, why doesn’t everyone do it, especially when the cost savings over time tend to well outweigh the initial costs? The answer is complex, as there is no one reason for this seeming behavior gap. Each of this chapter’s sector discussions, as well as the policy discussion at the end of the chapter, identify factors—commonly called barriers—that impede the full uptake of energy efficiency technologies and measures. They fall into several categories, but the following examples illustrate how some of them affect decisions:

|

2020–3035 timeframe and beyond—and the research and development (R&D) needed to support their development.

ENERGY USE IN THE UNITED STATES AND THE POTENTIAL FOR IMPROVED ENERGY EFFICIENCY

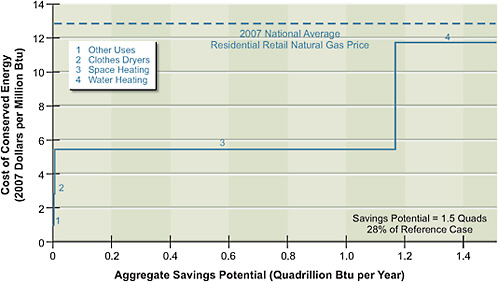

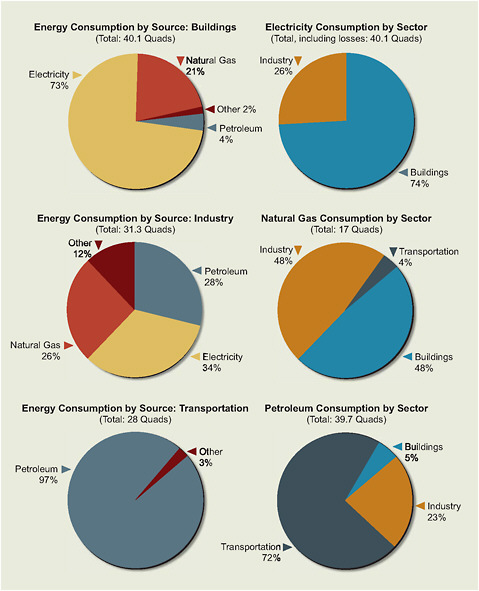

In 2008, the United States used 99.4 quadrillion Btu (quads) of primary energy (see Figure 4.1). About 31 percent of this total was consumed in industry,

More details on how barriers such as these play out in the buildings, transportation, and industrial sectors are given later in this chapter. |

28 percent in transportation activities, and about 41 percent in the myriad activities and services associated with residential and commercial buildings. Figure 4.2 provides more detail, breaking out energy consumption by source and sector and also defining “primary” energy.

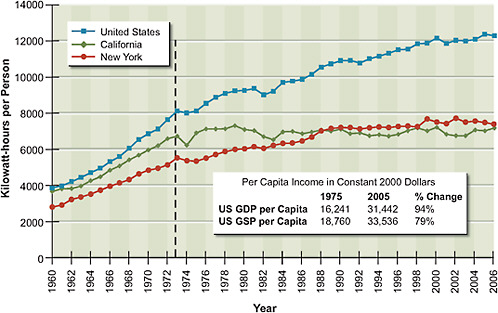

Energy use in the United States has grown steadily since 1949, with the exception of a dip in the mid-1970s during the oil crisis. Energy consumption today is double what it was in 1963 and 40 percent higher than it was in 1975 (the low point following the oil crisis). But there has also been progress in increasing the efficiency of energy use. The nation’s energy use per dollar of gross domes-

FIGURE 4.1 Total U.S. energy use by sector, 2008 (quadrillion Btu, or quads).

Notes: For each sector, “total energy use” is direct (primary) fuel use plus purchased electricity plus apportioned electricity-system losses. Economy wide, total U.S. primary energy use in 2008 was 99.4 quads.

Source: EIA, 2009a, as updated by EIA, 2009b.

tic product (GDP) has been cut in half since 1973, with about 70 percent of that decline resulting from improvements in energy efficiency (IEA, 2004). Nevertheless, the absolute amount of energy used continues to rise.

Yet the potential for higher energy efficiency is large, as illustrated by two points. First, despite the impressive gains made by the United States over the last 30 years, almost all other developed nations use less energy per capita and less energy per dollar of GDP (see Table 4.1 and Figure 1.5 in Chapter 1). Denmark’s levels of usage, for example, are about half on both measures. While there are structural variations that account for part of this gap, some 50 percent of it results from differences in energy efficiency (Weber, 2009).

The second point is that a greater number of energy-efficient and cost-effective technologies are available today to supply such services as lighting, heating, cooling, refrigeration, transport, and computing—all of which are needed throughout the economy and constitute the underlying driver of the demand for energy. Hundreds of realistic and demonstrated technologies, some already

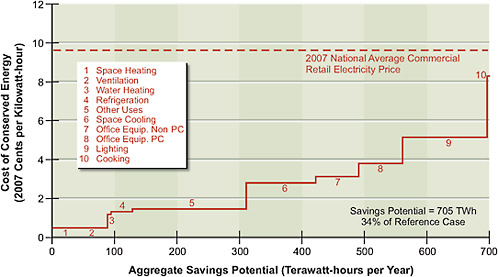

FIGURE 4.2 U.S. energy consumption by source and end-use sector, 2008 (quads).

Note: Does not include consumption in the electric power sector. Electricity includes delivered electricity as well as the allocated losses incurred in the generation, transmission, and distribution of electricity. “Delivered” energy refers to the electricity delivered to a site plus the fuels used directly on site (e.g., natural gas for heating water). This measure does not account for the losses incurred in generating, transmitting, and distributing the electricity. Delivered energy plus these losses is referred to as “primary” energy.

Source: EIA, 2009a, as updated by EIA, 2009b.

TABLE 4.1 Energy Use in 2006, per Capita and per Dollar of GDP (2000 Dollars)

|

|

Million Btu per Person |

Btu per Dollar of GDP |

|

Denmark |

161 |

4971 |

|

Germany |

178 |

7260 |

|

Japan |

179 |

4467 |

|

France |

181 |

7767 |

|

United States |

335 |

8841 |

|

Source: DOE, 2006b. |

||

commercial and some just beginning to enter the market, can provide these services more efficiently than is the case today, and they can collectively save large amounts of energy.

This chapter documents the AEF Committee’s review of the performance, costs, and environmental impacts—primarily greenhouse gas emissions2—of energy-efficient technologies and processes that are currently ready for implementation; technologies that need some further development; and scientific concepts that promise major efficiency improvements in the future. The assessment followed the traditional organization of energy use into three sectors: buildings (both residential and commercial), transportation, and industry. Further, each was considered over three timeframes—the present to 2020, 2020 to 2035, and 2035 to 2050. The first period received major attention because so many cost-effective technologies are ready for implementation today or will be ready within a few years.

The committee examined the available energy efficiency literature and performed additional analyses with primary data. The committee was able to estimate energy efficiency supply curves for electricity and natural gas in the residential and commercial sectors, showing the amount of energy that could be saved over a range of costs. In the transportation sector, the committee focused on alternative technologies that could power the nation’s cars and light trucks. By estimating the costs and energy savings associated with each technology as R&D improved

it over time, and the timeframes in which specific technologies can be expected to penetrate the market, the committee was able to develop illustrative scenarios of how total energy consumption could evolve. Confronted with myriad, diverse manufacturing industries, the committee focused on the five most energy-intensive industries. The committee examined other technologies, although in less detail.

For each sector, comparisons were made to a baseline, or business-as-usual, case in order to derive the potential for energy savings. For the buildings and industrial sectors, this was the reference-case scenario of the U.S. Energy Information Administration’s (EIA’s) Annual Energy Outlook 2007 or 2008 (EIA, 2007a, 2008161). For the transportation sector, a committee-directed baseline was derived. In all cases, though, the study estimates the level of energy-efficiency improvement beyond the baseline or reference case. More details can be found in the report titled Real Prospects for Energy Efficiency in the United States (NAS-NAE-NRC, 2009).

ENERGY EFFICIENCY IN RESIDENTIAL AND COMMERCIAL BUILDINGS

Energy Use in U.S. Buildings

In 2006, the United States had approximately 81 million single-family homes, 25 million multifamily housing units, 7 million mobile homes, and 75 billion square feet of floor space contained within 5 million commercial buildings (EIA, 2008). The building stock is long-lived; homes last 100 years or more, commercial buildings often last 50 years or more, and appliances used in buildings last 10 to 20 years. In 2008, residential and commercial buildings accounted for 73 percent of total electricity use in the United States and 40 percent of total primary energy use (Figures 4.1 and 4.2).

Use of delivered energy in the residential sector increased by 15 percent from 1975 to 2005, and in the commercial sector it grew by 50 percent. Meanwhile, primary energy grew by 46 percent and 90 percent, respectively, in the residential and commercial sectors. Despite these increases, energy “intensity”—energy use per unit of service or activity—decreased over that time span.

In the residential sector, on-site energy intensity, measured as energy use per household, fell by about 33 percent during 1978–2001, while primary energy use per household declined by 20 percent. In the commercial sector, on-site energy intensity, measured as energy use per square foot of floor area, dropped by about

20 percent during 1979–2003, while primary energy use per square foot decreased by 6 percent. The difference between on-site and primary-energy-use growth rates was due to growing electrification, which engendered sizable generating, transmitting, and distributing losses.

Factors that have affected energy use in buildings over the last several decades include increased electrification, population shifts to milder climates, growing penetration of appliances and electronics, larger home sizes, smaller households, growing household incomes, and dramatic improvements in the energy efficiency of appliances and other equipment. The last item is a key factor in the decline in energy intensity of buildings over the past 30 years. For example, the average electricity use of new refrigerators sold in 2007 was 71 percent less than that of new refrigerators sold in 1977 (AHAM, 2008), despite their becoming larger and having more features.

Significant energy efficiency gains have also been made in lighting. Sales and use of compact fluorescent lamps, which consume about 75 percent less electricity per unit of light output than incandescent lamps consume, have greatly increased in the past decade. In commercial buildings, energy-efficient fluorescent lighting fixtures containing T8 fluorescent lamps and high-frequency electronic lamp ballasts use 15–30 percent less energy per unit of light output than do older fixtures with T12 lamps and electromagnetic ballasts. These devices also have been used increasingly in recent years, as periodic surveys by the EIA attest. However, a large fraction of commercial buildings still have not embraced common energy efficiency measures such as energy management and control systems.

The adoption of ENERGY STAR®-labeled products has also grown substantially in recent years. For example, the construction and certification of ENERGY STAR® new homes increased from about 57,000 in 2001 to 189,000 in 2006, or 11.4 percent of all new homes built that year.

Energy Efficiency Improvement in Buildings

Many studies, whether on the local, regional, national, or global levels, have estimated the potential for improved energy efficiency in buildings.3 For the most part, these efforts evaluate the quantity of savings that could be realistically

achieved as a function of the cost of the saved energy, and they generally show consistent findings despite differences in assumptions and approaches.

Across the two building sectors, the studies demonstrate a median technical potential for improved energy efficiency of 33 percent for electricity (32 percent for the residential sector and 36 percent for the commercial sector) and 40 percent for natural gas (48 percent for residential and 20 percent for commercial), after accounting for energy prices and implementation barriers. The median cost-effective and achievable potential is 24 percent for electricity (26 percent for residential and 22 percent for commercial). For natural gas, this measure is 9 percent (9 percent for residential and 8 percent for commercial), but it could increase considerably as gas prices rise or could decrease as gas prices fall.

These studies have limitations, however, and care must be taken in their use. The question, How much efficiency is available at what price? is not well framed because “available” is ambiguous for several reasons. Among them are the timeframe over which the potential applies, the level of incentive required, and the motivation of society. In addition, the studies can underestimate the potential because of biases that might, among other things, exclude new and emerging technologies, hold technology static, or fail to consider nonenergy benefits. Conversely, the studies may overestimate savings by being excessively optimistic about energy efficiency potential.

Nevertheless, the potential for cost-effective energy efficiency improvements in buildings is large. And the prospects for savings will grow as new technologies become available, existing technologies are refined, and energy efficiency measures begin to be implemented in an integrated manner—often, with synergistic effects (such as those that can result from a whole-building approach to building design).

Approaches to Understanding Efficiency Potential

Analysts have developed a variety of ways to investigate the technologies and design principles that could make buildings more efficient. The two most important are the integrated approach and the technology-by-technology approach.

Integrated Approach

An integrated (also known as a whole-building or system-wide) approach to improving energy efficiency considers the energy consumption, and the set of improvements that could save energy, for entire buildings. It accounts for the ability to reduce energy use through design considerations—such as incorporation of

day lighting or reorientation or strategic placement of equipment to reduce heating and cooling loads—as well as through high-efficiency systems and equipment.

For residential buildings, a whole-house approach using a cost-effectiveness criterion can result in savings of 50 percent or more in heating and cooling and 30–40 percent reductions in total energy use. This conclusion is supported by the fact that more than 8,000 single-family households applied for the federal tax credit for 50 percent savings during its first year of availability. For 2008, the number of qualifying homes grew to more than 23,000, about 4.6 percent of all homes built. There are examples in Europe of new residences that have achieved even lower levels of energy consumption.4

For commercial buildings, several studies have reviewed the small but growing number of structures that have achieved 50 percent reductions in the energy needed for heating, cooling, and water heating. Most of these buildings have relied on

-

High-efficiency electrical lighting systems, which use state-of-the-art lamps, ballasts, and luminaires (complete lighting fixtures)

-

Luminaires chosen to provide the desired amount of lighting in the right places, coupled with the use of natural day lighting and associated controls that limit electrical lighting correspondingly

-

Fenestration (window) systems that reduce heat gains while providing daylight

-

Heating, ventilation, and air-conditioning controls that provide effective operation of the system during part-load conditions.

A few low-energy buildings have also made use of such on-site generation options as combined heat and power (CHP) systems5 or solar photovoltaic (PV) systems.6

This whole-building approach is usually applied to new buildings, but in some cases it can be used to identify the potential for system-wide savings in existing buildings.

|

4 |

See, for example, www.businessweek.com/globalbiz/content/apr2007/gb20070413_167016.htm. |

|

5 |

Combined heat and power (CHP) units transform a fuel (generally natural gas) into electricity and then use the remaining heat for applications such as space and hot-water heating or industrial and commercial processes. |

|

6 |

See the “Getting to Fifty” website, www.newbuildings.org/gtf. |

End-Use and Technology Approach

Some integrated approaches—for example, strategic placement of ductwork—are most easily applied to new buildings. A second approach, useful for existing buildings, relies on the one-by-one review of major categories of energy use and consideration of the types of efficiency measures and technologies that could be applied to them. For example, efficiency in the provision of space heating and cooling could be raised by upgrading furnaces, using variable-speed motors, reducing leakage, increasing insulation, and applying other measures, most of which could be incorporated into existing buildings.

This technology-by-technology approach can be carried out on as detailed or disaggregated a level as desired. A drawback is that it misses the kinds of integrated measures that can be identified with the whole-building approach.

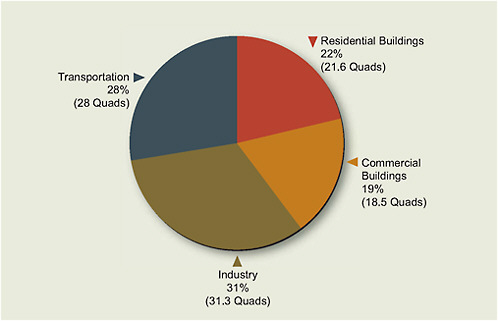

Potential for Efficiency Improvement: Conservation Supply Curves

Developing conservation supply curves, which have been used widely in analyses of energy use in buildings to display the results of technology-by-technology or measure-by-measure assessments, involves evaluating a comprehensive list of measures that could be taken and ranking them in order of the cost of conserved energy (CCE).7 Each measure is evaluated not in isolation but in the context of the measures that have already been taken. Most of the studies reviewed for this report relied on the technology-by-technology approach to develop supply curves for both residential and commercial buildings. To reconcile the results across studies, this report integrates and updates these data to produce new conservation supply curves that can be applied at the national level.

The reference-case scenario of the EIA’s Annual Energy Outlook 2007 (EIA, 2007a) is used as the baseline for this analysis,8 which mostly involves technolo-

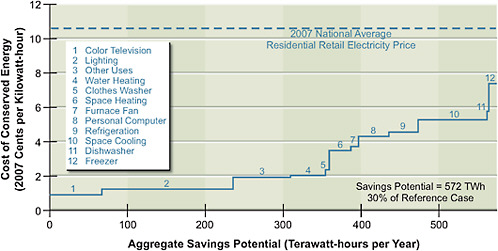

FIGURE 4.3 Residential electricity savings potential, 2030.

Source: Brown et al., 2008.

gies that are widely available in the market and well proven. Embedded in the scenario is the assumption that energy efficiency will improve over time in response to market forces as well as to codes and standards. Under these conditions, residential electricity use is projected to increase by an average of 1.4 percent per year, and commercial electricity use by 1.9 percent per year, over the period from 2006 to 2030. The potential for energy savings that is computed here is above and beyond that embodied in the baseline used for the analysis.

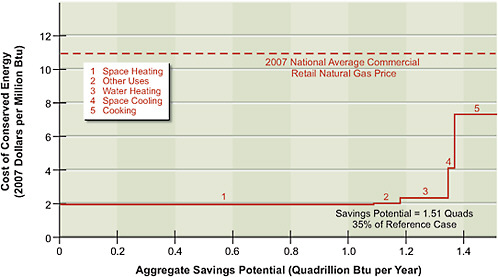

Figures 4.3 through 4.6 are the supply curves developed for this study. They illustrate the potential for energy efficiency improvements over the period 2010–2030 in the residential and commercial sectors for electricity and natural gas. The x-axis shows the total reduction in 2030 energy consumption, while the y-axis shows the CCE in fuel-specific units. Each step on the curve represents the total savings for a given end-use for all the cost-effective efficiency measures analyzed to that point. These plots are referred to as supply curves because they indicate how much energy savings is available for a given cost, with the CCE calculated as

FIGURE 4.6 Commercial natural gas savings potential, 2030.

Source: Brown et al., 2008.

the weighted average of savings for all the measures in that end-use cluster. (The CCE here is given in terms of delivered energy.)

Table 4.2 compares the average CCE with the national average retail energy price. The analysis indicates that the projected baseline energy use in 2030 can be reduced by about 30–35 percent at a cost less than current average retail energy prices. That the results show an average CCE well below the retail energy prices in all areas means that adopting efficiency measures is very cost-effective for households and businesses: the average CCE for electricity-savings measures is only about one-quarter of the average retail electricity price. Of course, factors such as local energy prices and weather will influence cost-effectiveness in any particular location.

For the entire buildings sector, the cumulative capital investment needed between 2010 and 2030 is estimated to be about $440 billion to achieve annual energy-bill savings in 2030 of nearly $170 billion. These savings result in an average simple payback period of 2½ years, or savings over the life of the measures that are nearly 3.5 times larger than the investment required. (This analysis considers only the cost [or incremental cost] of the efficiency measures to purchasers; it does not include the costs of policies and programs aimed at increasing the adoption of the measures.)

TABLE 4.2 Comparison of Average Cost of Conserved Energy in Residential and Commercial Buildings with National Average Retail Energy Price, 2007

Advanced Technologies and Integrated Approaches

Advanced technologies for buildings promise large additional increases in efficiency. Most are available today but await further development and cost reduction. They include discrete technologies such as solid-state lighting, advanced windows, and high-efficiency air-conditioning equipment as well as the full integration of technologies into new and highly efficient buildings, both residential and commercial. These technologies demonstrate that energy efficiency is a dynamic resource—new and improved alternatives now under development will reach the marketplace in the future, thereby increasing the potential for energy efficiency and energy savings. (This review does not include many promising advanced technologies related to building materials, design, and appliances.)

Solid-State Lighting

Unlike compact fluorescent lights (CFLs), light-emitting diodes (LEDs) are point light sources that require no warm-up period, do not contain mercury, and are readily dimmable. They are increasingly available today. The best white LEDs are now more efficient than fluorescent lamps are. White LEDs are expected to reach 150 lumens per watt, more than twice the efficiency of CFLs (Craford, 2008).

Cost is the primary issue with LEDs, but it is decreasing rapidly, and this trend is expected to continue. For example, a 1000-lumen LED source that costs around $25 (wholesale) today is projected by the U.S. Department of Energy (DOE) to cost $2 in 2015 (DOE, 2008).

Highly Integrated Cooling Systems

Cooling is one of the largest users of energy in residential and commercial buildings, responsible for about 10 percent of total U.S. electricity consumption and 25–30 percent of total peak electricity demand (DOE, 2007b; Koomey and Brown, 2002). Cooling demand could be reduced or eliminated entirely in some climates by combining existing measures—such as highly efficient building envelopes, shading, reflective surfaces and roofs, natural ventilation, and thermal storage—with emerging technologies that are designed to supplement or replace vapor compression-based cooling with low-energy, thermally driven cooling approaches. These technologies include indirect and indirect-direct evaporative cooling, solar-thermal cooling systems, and thermally activated desiccants. Each option has already been used commercially as an individual component, but further R&D and commercial demonstration projects are needed to develop the technologies as integrated systems boasting optimized performance.

Technologies to Reduce Energy Consumption in Home Electronics

Consumer products dealing with information processing are responsible for about 13 percent of residential electricity use (Roth and McKenney, 2007; EIA, 2008). Numerous efficiency improvements have already been incorporated into them, and many observe ENERGY STAR® specifications, but energy use continues to increase in a few important products such as flat-panel televisions and set-top boxes. Strategies to reduce the energy used by consumer electronics include improving power supplies; designing smaller and more efficient circuitry; incorporating automatic power-down features, allowing products on a network to operate at a low-power sleep level without losing network connectivity; and designing “power strips” to manage energy consumption in clusters of products. These strategies are already evident in a few products but have had minimal impact on energy use to date. The efficiency of the products themselves can be expected to increase as the devices become ever smaller, and with the development of new materials and other advances that can reduce energy demands.

Advanced Window Technologies

Windows are responsible for about 2.7 quads of energy use annually in homes and about 1.5 quads in the commercial sector—primarily from the losses through energy leakage that they allow—and they affect another 1.0 quad of potential

lighting energy savings (Apte and Arasteh, 2006). Advances have largely been made by reducing the heat-transfer coefficient (U-value) of windows through the use of low-emissivity (low-E) coatings and by reducing the solar-heat-gain coefficient (SHGC) via spectrally selective low-E coatings. The U-value is the primary determinant of winter heat loss; the SHGC is the primary determinant of summer cooling loads.

Two new window-technology advances, now available in niche markets, could have far-reaching implications if they became mainstream products and systems. The first is highly insulating “superwindows” that achieve U-values in the range of 0.1–0.2, as compared with a typical U-value of 0.5 for double-glazing and 0.35–0.4 for the ENERGY STAR® windows currently being sold in cold climates. The second advance is a new generation of dynamic products that reduce cooling loads and electric illumination when daylighting is available in commercial buildings. The full penetration of these advanced technologies into the building stock, which could take decades, might shift the role of windows in buildings to being approximately “energy neutral.”

Low-Energy and Zero-Net-Energy New Homes

It is possible to construct homes that combine high levels of energy efficiency—in the building envelope, heating and cooling systems, and appliances—with passive and active solar features in order to approach zero-net-energy consumption.9

The whole-building approach described earlier is being used by the DOE to reach a zero-net-energy consumption goal. For example, two highly instrumented homes were built with the same floor plan in Lakeland, Florida, in 1998 (Parker et al., 2000). Over 1 year, the control home used 22,600 kWh of electricity. During that same year, the experimental home used only 6,960 kWh, a reduction of 70 percent. The experimental home also had solar PV production of 6,180 kWh. When this production is accounted for, the experimental home’s net energy use was only 780 kWh, about a 97 percent reduction relative to the control home.10

Low-Energy New Commercial Buildings

The best-performing commercial buildings in the country achieve energy-use reductions of 50 percent or more below standard practice by successfully integrating multiple “state-of-the-shelf” technologies11 (Turner and Frankel, 2008).12 This represents a huge opportunity for improved energy performance using existing and available technologies (Griffith et al., 2007). To achieve such high performance requires that integration, interaction, quality control, and monitoring be employed throughout the design, construction, and operation of the building.

Barriers to Improving Energy Efficiency in Buildings

Numerous barriers hinder the adoption of energy-efficient technologies in buildings. They vary in their relevance to particular situations and in the difficulty of their being overcome. Many of these barriers also apply to other sectors.

Environmental and social costs are usually not reflected in the price of energy. The price does include costs associated with meeting environmental standards, but other adverse environmental impacts, such as emissions of mercury or carbon dioxide, land disruption, and legal water contamination, are not factored in. Also, the costs incurred by society in defending sources and protecting shipments of oil and other energy imports are not included in energy prices. As a result, more fossil energy is used than would otherwise be the case.

Various types of fiscal policies may discourage investment in energy efficiency. For example, capital investments in commercial buildings must be depreciated over more than 30 years, while energy purchases can be fully deducted from taxable income the year they occur (Brown, 2001).

Some regulatory policies also discourage investment in energy efficiency. In particular, policies that allow public utilities to increase their profits by selling more electricity or natural gas are disincentives to effective utility energy efficiency programs (Carter, 2001). Many utilities also have applied tariffs and interconnection standards that discourage end users from adopting energy-efficient CHP

|

11 |

“State-of-the-shelf” technologies represent the state-of-the-art selection of technologies that are widely available (on the shelf) today. |

|

12 |

See also www.gettingtofifty.org for a searchable database of information about projects with energy performance targets that are 50 percent beyond the ASHRAE (American Society of Heating, Refrigerating and Air-Conditioning Engineers) standard 90.1-2001 (NBI, 2008). |

systems (Brooks et al., 2006a,b). Variabilities in the stringency and enforcement of building energy codes across states and localities constitute another barrier to energy efficiency in buildings (Brown et al., 2007).

Misplaced incentives, also known as split incentives or principal-agent problems, exist in numerous situations. The most visible example is in rental markets, where building owners are responsible for investment decisions but tenants pay the energy bills. Studies have revealed lower levels of energy efficiency in U.S. dwellings occupied by renters compared to those occupied by owners.

Misplaced incentives are found in new-construction markets as well, where decisions about building design and features are also made by people who are not responsible for paying the energy bills. Architects, builders, and contractors have an incentive to minimize first cost in order to win bids and maximize their profits (Koomey, 1990; Brown et al., 2007). Moreover, commercial leases are often structured so that the landlord allocates energy costs to tenants based on the amount of square footage leased rather than on the amount of energy used (Lovins, 1992).

It can take many years to inform and educate a large majority of households and businesses about energy efficiency options. For example, after nearly 8 years of active promotion and incentives for the use of compact fluorescent lamps, nearly one-third of households surveyed in the Pacific Northwest in late 2004 were still unaware of them (Rasmussen et al., 2005).

Lack of information is an even greater problem and a harder one to fix for individual end-uses. For example, when a tenant of a commercial building buys office equipment, its electricity usage is not individually metered. And not a single end-use in homes is ever metered separately. Householders have no direct information as to whether their computer or video game box or hair dryer is a big energy user or a trivial one.

Businesses tend to pay limited attention to energy use and energy-savings opportunities if energy costs are a small fraction of the total cost of owning or operating the business or factory—or if energy efficiency is not viewed as a priority by company management. As a result, many businesses limit energy efficiency investments to projects with payback periods of no more than 2 or 3 years (DeCanio, 1993; Geller, 2003).

Some highly efficient appliances or other energy efficiency measures are relatively new and still not widely available in the marketplace or not well supported by product providers (Hall et al., 2005). And some very effective energy efficiency

services, such as duct testing and sealing, and recommissioning of existing buildings, are not widely available in many parts of the country.13

Many households have limited resources and limited access to credit, which restricts their ability to invest in energy efficiency measures. In addition, some businesses (particularly small ones) have insufficient capital or borrowing ability.

Drivers for Improving Energy Efficiency in Buildings

Numerous factors—rising fuel and electricity costs, growing environmental awareness, increasing interest by consumers in cutting greenhouse gas emissions, the expanding number of “green” buildings, and corporate environmental initiatives—can help to overcome the barriers just described. Likewise, many energy efficiency measures provide nonenergy benefits that encourage their adoption. In addition, public policies—including building energy codes, appliance efficiency standards, and state and utility efficiency programs—are stimulating greater adoption of efficiency measures. See the section titled “Energy Efficiency Policies and Programs: Experience and Lessons Learned” (later in this chapter) for a review of experiences with some of these policies and programs.

Findings: Buildings

Studies taking several different approaches are consistent in finding the potential for large, cost-effective energy savings in buildings. Median predictions of achievable and cost-effective savings are 1.2 percent per year for electricity and 0.5 percent per year for natural gas, amounting to a 25–30 percent energy savings for the buildings sector as a whole over 20–25 years. The committee’s analysis suggests that baseline energy use can be reduced by 30–35 percent by 2030 at a cost less than current retail energy prices. If these savings were to be achieved, they would hold energy use in this sector about constant, in contrast to the current trend of continuing growth.

The full deployment of cost-effective energy-efficient technologies in buildings alone could eliminate the need to add to electricity generation capacity. Since the estimated electricity savings in buildings exceeds the EIA forecast for new net generation, implementing these efficiency measures would mean that no new

generation would be required except to address regional supply imbalances, to replace obsolete generation assets, or to substitute more environmentally benign generation sources. This conclusion assumes that electricity demand does not grow faster than the EIA forecast or that new demand does not require more generation capacity (e.g., electric vehicles are charged at night).

Studies of energy efficiency potential are subject to a number of limitations and biases. Factors such as not accounting for new and emerging energy efficiency technologies can lead these studies to underestimate energy-savings potential, particularly in the midterm and the long term. On the other hand, some previous studies have been overly optimistic about the cost and performance of certain efficiency measures, thereby overestimating energy-savings potential, particularly in the short term.

Many advanced technologies, including LED lights, innovative window systems, new types of integrated cooling systems, and power-saving electronic devices, are either commercially available already or likely to become available within the next decade. Their availability will further increase the energy-savings potential in buildings. In addition, new homes and commercial buildings with low overall energy use have been demonstrated throughout the country. With appropriate policies and programs, they could become the norm in new construction.

There are substantial barriers to widespread energy efficiency improvements in buildings, but a number of factors are counteracting these barriers. Drivers of increased energy efficiency include rising energy prices; growing concern about global climate change and the resulting willingness of consumers and businesses to take action to reduce emissions; more consumers moving toward “green buildings”; and growing recognition of the significant nonenergy benefits offered by energy efficiency measures.

ENERGY EFFICIENCY IN TRANSPORTATION

Energy Use in the U.S. Transportation Sector

The U.S. transportation sector is varied and complex, consisting of vast networks of land, air, and marine vehicles that are owned and operated by combinations of

public and private entities. As a whole, the sector’s activities use about 28 percent of the nation’s primary energy supply (see Figure 4.1), including more than 70 percent of all the petroleum. U.S. transportation is almost entirely dependent on petroleum, 56 percent of which was imported in 2008. Transportation also has environmental impacts. For example, it is responsible for about a third of all U.S. CO2 emissions arising from energy use, as well as for significant fractions of other air pollutants.

Passenger transport is dominated by personal automobiles and aviation.14 (Mass transit and scheduled intercity rail and bus services play important roles in some regions, but overall, they account for a modest proportion of total passenger-miles.) On the freight side, trucking dominates both with respect to tons and value of shipments.15 Thus, highway travel, for passengers and freight alike, is the preponderant mode of transportation in the United States, accounting for about 75 percent of all transportation energy use. Consequently, efficiency gains in highway vehicles will have the greatest effect on the transportation sector’s total consumption of energy.16

The motivators for energy efficiency in commercial transportation differ from those for private transportation. Lifetime operating cost, and thus energy efficiency, is important to companies supplying passenger and freight transportation. The commercial transportation sector is so highly competitive that even small cost differentials among firms can have major impacts on their profitability and growth. In contrast, consumer purchases of motor vehicles are influenced by many factors, including vehicle comfort, style, and operating performance. Historically, vehicle fuel efficiency has not been a major factor in consumer decisions. In addition, although there are many reasons for consumer choice of vehicles, from 1980 until recently U.S. gasoline prices had been falling (after accounting for inflation), which encouraged consumers to buy (and manufacturers to offer) larger, more powerful, and heavier vehicles.

Transportation energy consumption is also influenced by the physical networks of infrastructure through which vehicles move; by the logistic, institutional,

|

14 |

Bureau of Transportation Statistics, National Transportation Statistics. Available at www.bts.gov/publications/national_transportation_statistics/. |

|

15 |

Ibid. |

|

16 |

Nonetheless, other modes, such as mass transit, intercity rail, and water, have important roles to play in bringing about more energy-efficient passenger and freight transportation, particularly if traffic is shifted to them from the more energy-intensive highway and aviation modes. |

commercial, and economic considerations that determine the types of vehicles selected and how they are used; and by the performance of the infrastructure itself (e.g., in managing congestion). Energy use in air transportation, for example, is influenced by air-traffic management, and energy use in freight transport is affected by the possibilities (or lack thereof) for intermodal transfers. The functioning of the underlying physical and economic systems, in other words, can foster—or in some cases hinder—energy efficiency.

Potential for Energy Efficiency Improvements in Passenger Transportation

Automobiles account for the vast majority of local and medium-distance passenger-trips17 (those under 800 miles); airlines dominate for longer trips.

Light-Duty Vehicles

Globally, the major motivators for energy efficiency in light-duty vehicles (LDVs) are fuel prices, vehicle fuel-economy regulation, personal preferences, and environmental concerns. In Europe, a long history of elevated fuel taxes has been a major reason that motorists there have put a high priority on fuel efficiency when purchasing automobiles. In the United States, the corporate average fuel-economy (CAFE) standards have been the main impetus for boosting vehicle efficiency. Falling real fuel prices from 1980 to 2005, however, encouraged consumers to purchase larger, more powerful, and heavier vehicles rather than to seek greater fuel economy. However, during periods of high fuel prices (such as those prevailing in mid-2008), U.S. consumers have demonstrated more interest in fuel economy.

Today, the average fuel economy of new vehicles sold in the United States is about 25 mpg (new cars average 27.5 mpg compared with 22.3 mpg for light trucks). The U.S. Energy Independence and Security Act of 2007 (EISA 2007; P.L. 110-140) requires that CAFE standards be set for LDVs for model years 2011 through 2020. This provision aims to ensure that, by 2020, the industry-wide CAFE for all new passenger cars and light trucks combined will be at least 35 mpg18—a 40 percent increase over today’s average of 25 mpg.

While fuel economy in the United States has not improved for almost 30

years, vehicle fuel efficiency has improved. But the efficiency gains have been offset by increases in vehicle size and performance (Lutsey and Sperling, 2005; An and DeCicco, 2007).19

Current technologies offer many fuel-economy improvements, which become increasingly attractive as fuel prices rise. Opportunities through 2020 will apply primarily to today’s vehicle fleet of spark-ignition (SI) engines, compression-ignition (CI) diesel engines, and hybrid-electric vehicles (HEVs), fueled with petroleum, biofuels, or other nonpetroleum hydrocarbon fuels. Annual incremental improvements to engines, transmissions, and nonpropulsion systems are expected to continue. During the subsequent decade, plug-in hybrid-electric vehicles (PHEVs), using electricity plus any of the above-mentioned fuels, may become a significant part of new vehicle sales. Longer-term, substantial sales of hydrogen fuel-cell vehicles (FCVs) and battery-electric vehicles (BEVs) are possible. What follows are summaries of the possible improvements in efficiency that can be expected from new technologies for LDVs.

Engine Improvements in Light-Duty Vehicles

-

Gasoline spark-ignition engines. Technologies that improve the efficiency of gasoline SI engines, such as variable valve timing, cylinder deactivation, direct injection, and turbocharging with engine downsizing, could be deployed in large numbers over the next decade. Many of these are already being produced in low volumes. They have the potential to reduce fuel consumption20 in new vehicles, on average, by about 10–15 percent in the near term (through 2020) and an additional 15–20 percent over the longer term (15–20 years). It is expected that turbocharged but downsized gasoline engines will steadily replace a significant fraction of naturally aspirated (non-turbocharged) engines.

-

Diesel compression-ignition engines. Diesel CI engines offer about a 20–25 percent fuel consumption benefit over gasoline SI engines (when adjusted for the energy density of diesel fuel). There are opportunities for further efficiency improvements that could reduce the fuel consumption of new diesel-engine vehicles relative to current diesel vehicles by about 10 percent by 2020 and an additional 10–15 percent by 2030. New technologies are emerging for after-treatment that reduce emissions of particulate matter and nitrogen oxides to levels comparable to those of SI engines. The primary challenges for diesel engines in the United States are the added costs and fuel penalties (of about 3–6 percent) associated with those after-treatment systems (Bandivadekar et al., 2008; Johnson, 2008, 2009; Ricardo, Inc., 2008).

-

Gasoline hybrid-electric vehicles. HEVs combine an internal-combustion engine (ICE) with a battery-electric motor/generator system. Their primary efficiency benefits derive from smaller engines, regenerative braking, elimination of idling, and optimization of engine operating conditions. Hybrid vehicles span a range of technologies and fuel-economy levels. Diesel HEVs are also under development.

-

Plug-in hybrid-electric vehicles. PHEVs have larger batteries than regular hybrids do, and they can be recharged from an external source of electricity. They also require a larger electric motor and higher-capacity power electronics. Hybrid vehicles, including PHEVs, are designed to allow all-electric operation powered by the battery. The driving range with all-electric power depends on factors such as the size of the battery, the weight of the vehicle, and the driving cycle. Unlike a hybrid-electric vehicle, a PHEV’s external power connection can recharge the battery when the vehicle is at rest and plugged in; the internal combustion engine can also recharge the battery, provide power to the wheels, or both, extending vehicle range. The capacity of the battery and the distance of the trip(s) determine gasoline savings; current hybrids in commercial production have a range of less than 10 miles on all-electric power. The vast majority of U.S. vehicles are driven less than 40–60 miles per day in normal operation. Thus, a battery that can power the vehicle for 40 to 60 miles could substantially reduce petroleum consumption for this duty cycle. Commercial PHEVs with a variety of ranges on all-electric power will likely be introduced to the U.S. market over the next 5 years. However, success

-

for a mass-market vehicle with relatively long driving range on battery power alone (e.g., 40 miles or more) will require development of a low-cost, lightweight battery that can store the needed electricity and last for 10 years or more (Box 4.2).

-

Battery-electric vehicles. Successful development and deployment of PHEVs using advanced battery technology might lead to a battery suitable for BEVs (see Box 4.2). Although several models of BEVs are being introduced into the market today in low volumes, in the foreseeable future the only commercially viable BEVs may be small cars with modest performance expectations, such as “city BEVs.”

-

Hydrogen fuel-cell vehicles. Several scientific, engineering, and business challenges must be met before hydrogen FCVs can be successfully commercialized.21 The principal challenges are to increase the durability and lower the costs of fuel cells, achieve cost-effective storage of hydrogen in fueling stations and on board vehicles, and deploy a hydrogen supply and fueling infrastructure with low greenhouse gas emissions. These vehicles offer tremendous potential for reductions in oil imports and CO2 emissions in the long term (beyond 2035) but little opportunity for impact before 2020 because of the time required to address the technical and cost challenges and, subsequently, to achieve high-volume production.

Transmission Improvements in Light-Duty Vehicles

Automatic-transmission efficiency is likely to improve in the near term to midterm through increasing the number of gears and reducing losses in bearings, gears, sealing elements, and hydraulic systems. Seven- and eight-speed transmissions may become standard in the midterm. A continuously variable transmission (CVT) would in principle allow an engine to operate near its maximum efficiency, but its estimated actual efficiency improvement is lower than that expected for six- or seven-speed transmissions.

Nonpropulsion System Improvements in Light-Duty Vehicles

Improvements to nonpropulsion systems can involve better tires with lower rolling resistance, body designs that reduce aerodynamic drag, and reductions in vehicle weight. Weight reduction can be achieved by using lightweight materials, by redesigning vehicles, and by reducing vehicle size. A 10 percent reduction in vehicle weight can reduce fuel consumption by 5–7 percent, when accompanied by appropriate engine downsizing at constant performance (Bandivadekar et al., 2008).

Summary of Potential Improvements and Costs for Light-Duty Vehicles

Table 4.3 shows plausible reductions in fuel consumption and CO2 emissions stemming from evolutionary improvements in LDVs as well as the use of new vehicle types. Evolutionary improvements could reduce the fuel consumption of gasoline ICE vehicles by up to 35 percent over the next 25 years. While diesel engines will also improve, the gap between gasoline and diesel fuel consumption is likely to narrow. Hybrid vehicles—both HEVs and PHEVs—could deliver deeper reductions in fuel consumption, although they would still depend on gasoline or other liquid fuels. Vehicles powered by batteries and hydrogen fuel cells need not depend on hydrocarbon fuels; if they were to run on electricity or hydrogen, they could have zero tailpipe emissions of CO2 and other pollutants. If the electricity or hydrogen were generated without CO2 emissions, they would have the potential to reduce total life-cycle CO2 emissions dramatically.

Table 4.4 shows the approximate incremental retail price of different vehicle systems (including the costs of emission-control systems), as compared with a baseline 2005 gasoline-fueled ICE vehicle. The estimates shown in Table 4.4, when combined with the estimates of fuel-consumption reductions shown in Table 4.3, indicate that from the driver’s perspective evolutionary improvements in gasoline ICE vehicles are likely to prove the most cost-effective choice for reducing petroleum consumption and CO2 emissions. Given that these vehicles will be sold in large quantities in the near term, it is critical that efficiency improvements in these vehicles not be offset by increased power and weight. While the current hybrids appear less competitive than a comparable diesel vehicle, they are likely to become more competitive over time, in part because hybrids can deliver greater absolute emission reduction than diesel vehicles can.

PHEVs, BEVs, and FCVs appear to be more costly alternatives for reducing petroleum consumption and CO2 emissions. Among these three technologies,

|

BOX 4.2 Status of Advanced Battery Technology Lead acid batteries were invented in the 19th century and are still the standard battery technology in vehicles today. The GM EV1, a production battery-electric vehicle (BEV), used this battery technology as recently as 1999, and then transitioned to the nickel-metal hydride (NiMH) battery. The next generation of batteries, based on lithium-ion chemistry, is widely deployed in consumer electronic devices. Of course, the power and energy storage requirements of these devices are much smaller than those of electric vehicles. Hybrid-electric vehicles (HEVs) require batteries with high power (commonly stated in units of watts per kilogram). Plug-in HEVs (PHEVs) and BEVs require significant energy storage (along with sufficient power). Today’s batteries have an energy storage capacity of 150–200 Wh/kg. A typical vehicle consumes approximately 0.25 kWh per mile in all-electric mode. Typical electric motors that can propel a vehicle require power ranging between 50 and 150 kW. Chemistries Table 4.2.1 summarizes the promising advanced battery chemistries and their performance characteristics. Significant amounts of research and development are being devoted to promising new versions of the chemistries of cathode materials, anode materials, and electrolytes, as well as to manufacturing processes. TABLE 4.2.1 Lithium-ion Battery Cathode Chemistries

|

|||||||||||||||||||||||||||||||||||||||||||||

|

Performance and Cost Targets The U.S. Advanced Battery Consortium (USABC) has established a set of long-term performance goals for electrochemical energy storage devices:

In addition, goals were established for battery life in terms of the number of 80 percent discharge cycles. Meeting these goals is likely to be required for widespread commercialization of electrically powered vehicles. Lithium-ion batteries currently lead in energy density (Wh/kg) metric and have an average annual improvement rate of 3.7 percent. Lead-acid batteries lead in the cost of stored energy ($/kWh) at $50/kWh and have an average annual reduction rate of around 3 percent. However, lead-acid batteries are unable to satisfy the battery life requirements for PHEVs and BEVs. Today’s lithium-ion batteries that have the cycle life desired for automotive applications cost between $500/kWh and $1000/kWh. The cost target (in $/kWh) is currently viewed as the greatest challenge for lithium-ion battery technology. Industry Developments The lithium-ion consumer electronics market is currently at around 2 billion units annually. The volume of lithium-ion batteries in automotive applications, however, is very small. Frost & Sullivan (2008) predict a 19.6 percent compound annual growth rate for shipments of HEV batteries, as well as a smaller but rapidly growing market for PHEV and BEV batteries. An auto battery alliance has been promoted by the U.S. Department of Energy’s Argonne National Laboratory and includes 3M, ActaCell, All Cell Technologies, Altair Nanotechnologies, EaglePicher, EnerSys, Envia Systems, FMC, Johnson Controls-Saft, MicroSun, Mobius Power, SiLyte, Superior Graphite, and Townsend Advanced Energy. All major vehicle manufacturers have partnered with major battery manufacturers: Ford with Johnson Controls-Saft, General Motors with LG Chem, Chrysler with General Electric, Toyota with Panasonic/Sanyo, Nissan with NEC via the Automotive Energy Supply joint venture, and Honda with GS Yuasa. Specialists anticipate that it may be 10 to 20 years before advanced battery technology can reach the USABC performance and cost targets. |

TABLE 4.3 Potential Reductions in Petroleum Use and Greenhouse Gas Emissions from Vehicle Efficiency Improvements over the Next 25 Years

|

Propulsion System |

Vehicle Petroleum Consumption (gasoline equivalent)a |

Greenhouse Gas Emissionsa |

||

|

Relative to Current Gasoline ICE |

Relative to 2035 Gasoline ICE |

Relative to Current Gasoline ICE |

Relative to 2035 Gasoline ICE |

|

|

Current gasoline |

1 |

— |

1 |

— |

|

Current turbocharged gasoline |

0.9 |

— |

0.9 |

— |

|

Current diesel |

0.8 |

— |

0.8 |

— |

|

Current hybrid |

0.75 |

— |

0.75 |

— |

|

2035 gasoline |

0.65 |

1 |

0.65 |

1 |

|

2035 turbocharged gasoline |

0.57 |

0.89 |

0.57 |

0.88 |

|

2035 diesel |

0.55 |

0.85 |

0.55 |

0.85 |

|

2035 HEV |

0.4 |

0.6 |

0.4 |

0.6 |

|

2035 PHEV |

0.2 |

0.3 |

0.35–0.45 |

0.55–0.7 |

|

2035 BEVb |

— |

— |

0.35–0.5 |

0.55–0.8 |

|

2035 HFCVb |

— |

— |

0.3–0.4 |

0.45–0.6 |

|

Note: These estimates assume that vehicle performance and size (acceleration and power-to-weight ratio) are kept constant at today’s levels. BEV, battery-electric vehicle; HEV, hybrid electric vehicle; HFCV, hydrogen fuel-cell vehicle; ICE, internal-combustion engine; PHEV, plug-in hybrid vehicle. aGreenhouse gas emissions from the electricity used in 2035 PHEVs, 2035 BEVs, and 2035 HFCVs are estimated from the projected U.S. average electricity grid mix in 2035. Greenhouse gas emissions from hydrogen production are estimated for hydrogen made from natural gas. bThe metric “vehicle petroleum consumption” is not applicable to vehicles powered by batteries and hydrogen fuel cells. Estimated greenhouse gas emissions are those resulting from production of the needed electricity and hydrogen. Source: Bandivadekar et al., 2008. |

||||

PHEVs are likely to become more widely available in the near term to midterm, whereas BEVs and FCVs are high-volume alternatives for the midterm to long term.

Deployment of Light-Duty Vehicle Technologies

To have a significant effect on fuel use in the vehicle fleet and on associated CO2 emissions, advanced-technology vehicles must garner a sizable market share. Generally, however, a decade or more elapses in developing a technology to a stage that it can be deployed, introduced on a commercial vehicle, and then achieve significant sales. There are also technical constraints on the speed with which the

TABLE 4.4 Estimated Additional Cost to Purchaser of Advanced Vehicles Relative to Baseline 2005 Average Gasoline Vehicle

market shares of advanced technologies can grow, such as the need for breakthroughs in battery performance and for a hydrogen-distribution infrastructure.

Table 4.5 shows the AEF Committee’s judgment, based on the constraints just outlined, of the extent to which these advanced vehicle technologies could plausibly penetrate the new LDV market in the United States. (Note that Table 4.5 is not intended to imply that all these technologies would necessarily be deployed together.) The estimates are intended as illustrations of achievable deployment levels, based on historical case studies of comparable technology changes; these estimates suggest that relative annual increases of 8–10 percent in the deployment rate are plausible. With changes in the factors that affect vehicle attributes or purchases, such as stricter regulatory standards or high fuel prices, the timeline for reaching these market shares could be shortened.

TABLE 4.5 Plausible Share of Advanced Light-Duty Vehicles in the New-Vehicle Market by 2020 and 2035 (percent)

Savings in Total Fleet Fuel Consumption from Deployment of Light-Duty Vehicles

As noted previously, the Energy Independence and Security Act of 2007 (EISA 2007) requires CAFE standards to be set for LDVs through 2020 in order to ensure that the industry-wide average fuel economy by that time is at least 35 mpg. This would be a 40 percent increase over today’s average of 25 mpg.22

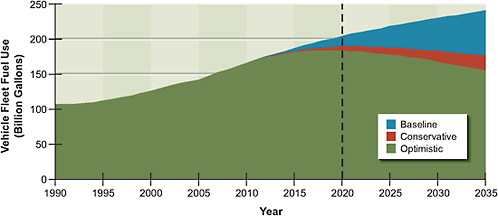

The AEF Committee examined two scenarios to explore how the deployment of the advanced technologies listed in Table 4.3, together with vehicle-efficiency improvements (such as reductions in vehicle weight, aerodynamic drag, and tire rolling resistance), could reduce the petroleum consumption of the LDV fleet in the United States. These scenarios, based on the methodology described in Bandivadekar et al. (2008), are not predictions of what the LDV fleet will be like in the future. Instead, they are intended as illustrative examples of the degree of change to the LDV fleet that will be necessary to improve fleet average fuel economy. The two scenarios—termed “optimistic” and “conservative”—are described below.

-

Optimistic scenario. The new CAFE target of 35 mpg for LDVs is met in 2020. This improvement rate is then extrapolated out through 2035. Under this scenario, 75 percent of the improvement is used to reduce actual fuel consumption; the remaining 25 percent is offset by increases

-

in vehicle size, weight, and performance. The resulting new LDV fuel economy in 2035 is double today’s value.

-

Conservative scenario. The new CAFE target is met 5 years later, in 2025. This improvement rate is then extrapolated out through 2035. Under this scenario, only half of the improvement is used to reduce actual fuel consumption; the remaining half is offset by increases in vehicle size, weight, and performance. The resulting new LDV fuel economy in 2035 is 62 percent above today’s value.

Both scenarios are compared with a “no-change” baseline that corresponds roughly to meeting the EISA target for 2020. The baseline also includes some growth in overall fleet size and miles driven, but no resulting change in fuel consumption. This is because the baseline extrapolates the history of the past 20 years, during which time power train efficiency improvements essentially offset any negative effects on fuel consumption from increasing vehicle performance, size, and weight.

Based on the estimated fuel consumption characteristics of individual vehicle types, shown in Table 4.3, and the fleet efficiency improvements represented in the scenarios, Table 4.6 shows examples of the sales mixes and weight reduction that would be required to meet the CAFE targets and to meet the scenario assumptions beyond 2020. Figure 4.7 shows, for the two scenarios, the corresponding annual gasoline consumption of the U.S. in-use LDV fleet from the present out to 2035. Table 4.7 shows the cumulative fleet-wide fuel savings, as compared with the no-change baseline. These savings can be substantial so long as the proposed fuel-economy standards are met and the rate of improvement is sustained. Table 4.8 gives the corresponding annual fuel savings from the no-change baseline in 2020 and 2035.

Air Transportation

Air transportation represents almost half of nonhighway transportation energy use (personal and freight), or about 10 percent of total transportation energy consumption. Fuel expenditures are the largest operating cost for most airlines, thereby driving their investment decisions toward higher energy efficiency. For example, Boeing’s and Airbus’s newest generation of airliners, the Boeing 787 Dreamliner and 747-8, and the Airbus 350XWB, attain a 15–20 percent improvement in fuel efficiency over the aircraft they replace. The new aircraft all employ

TABLE 4.6 Illustrative Vehicle Sales Mix Scenarios

|

|

Percent Emphasis on Reducing Fuel Consumptiona |

Percent Light Trucks vs. Cars |

Percent Vehicle Weight Reduction |

Market Share by Power Train (percent) |

Percent Fuel Efficiency Increase from Today |

|||||

|

Naturally Aspirated SI |

Turbo SI |

Diesel |

Hybrid |

Plug-in Hybrid |

Total Advanced Power Train |

|||||

|

Optimistic |

|

|

|

|

|

|

|

|

|

|

|

2020 |

75 |

40 |

17 |

52 |

26 |

7 |

15 |

0 |

48 |

+38 |

|

2035 |

75 |

30 |

25 |

36 |

26 |

9 |

20 |

9 |

64 |

+100 |

|

Conservative |

|

|

|

|

|

|

|

|

|

|

|

2025 |

50 |

40 |

17 |

55 |

24 |

7 |

14 |

0 |

45 |

+38 |

|

2035 |

50 |

40 |

20 |

49 |

21 |

7 |

16 |

7 |

51 |

+62 |

|

Note: Assumed average new-vehicle weight (cars and light trucks) currently is 1900 kg (4180 lb). Thus, average weight reductions of 700–1050 lb per vehicle would be required. Neither of these scenarios includes BEVs or FCVs. aThe amount of the efficiency improvement that is dedicated to reducing fuel consumption (i.e., that is not offset by increases in vehicle power, size, and weight). |

||||||||||

FIGURE 4.7 Vehicle fleet fuel use for the no-change baseline and the optimistic and conservative scenarios described in the text.

TABLE 4.7 Cumulative Fuel Savings from the Baseline Shown in Figure 4.7

TABLE 4.8 Annual Fuel Savings in 2020 and 2035 from the No-Change Baseline Shown in Figure 4.7

weight-reducing carbon composite structural materials and less energy-intensive electric systems.

Because the DOE expects air travel to grow about 3 percent per year over the next several decades, efforts to reduce aviation-fuel consumption face a stiff challenge. The expected efficiency improvement of 1–2 percent per year (Lee et al., 2004) will not be enough to offset the expected growth in demand.

Potential Energy Efficiency Improvements in Freight Transportation

The movement of freight represents about 6–7 percent of the U.S. GDP. Given that the EIA expects freight transport to continue to increase by 2 percent per year over the next two to three decades, energy use in the freight sector could grow by more than 40 percent by 2030.

Truck Transport

Pressure to reduce fuel costs has led truck manufacturers to make continuous progress in raising engine efficiency. Technological improvements have included more sophisticated fuel-injection systems, enhanced combustion, higher cylinder pressure (due to increased turbocharging), and automated manual-transmission systems. Technologies on the horizon include continuously variable transmissions, power-shift transmissions, and hybrid-electric systems that could be used to modulate auxiliaries (pumping, fans, compressors, air-conditioning, and power steering) and reduce idling. Auxiliary-power units with greater efficiency could increase fuel economy, as could use of utility-supplied electricity when parked at truck stops. Reduced idling is especially desirable in urban-duty cycles and in sleeper cabs, where idling alone can account for 10 percent of the vehicle’s fuel use.

Air, Rail, and Waterborne Freight Transport

A small proportion (less than 1 percent by weight) of total freight shipments is transported by air. Potential gains in efficiency would stem from the same improvements made to passenger aircraft.

Rail accounts for 2 percent of transportation energy use in the United States but about 10 percent of all freight shipments by weight. Freight railroads are nearly all diesel powered, unlike the mostly electrified rail systems of Europe and Japan. Per ton-mile, rail is 10 times more efficient than trucking is. Still, improvements in railroad technology would offer modest opportunities for gains in U.S.

transportation-energy efficiency. Advances in railroad operation could contribute to improved efficiency as well.

Shifting some freight from trucks to rail could save fuel. Candidates for diversion include trailers and containers carrying commodities that are not time sensitive and are being transported more than 500 miles.

The main fuels used in waterborne shipping—by ocean, inland, coastal, and Great Lakes routes—are diesel fuel (about 70 percent) and heavy fuel oil (30 percent). Waterborne freight accounts for about 3.5 percent of all shipments by weight.

Measured in tonnage, the oceangoing segment accounts for about half the freight moved on water into or within the United States. In terms of energy consumed per ton-mile, ocean shipping is highly efficient, as the vessels carry large payloads over long distances. Gains in energy efficiency are still possible, however. For example, one study estimates that improvements of 20–30 percent could be achieved in ocean shipping by 2020 (Kromer and Heywood, 2008). Speed reduction offers the greatest potential, although there are strong incentives to move shipments rapidly.

Potential System-Level Improvements in Transportation

Transitions in transportation systems—such as expanded use of rail for freight or passenger service—provide opportunities to boost overall energy efficiency. Such changes are usually costly and complicated, however, and are often driven by factors other than energy efficiency (such as productivity). Nevertheless, energy costs can play a motivating role.

The freight sector offers examples. The use of shipping containers has stimulated intermodal transfers among trucks, rail, ships, and even cargo airplanes, leading to dramatic productivity improvements, although gains in overall energy efficiency are less clear. Rail is much more energy-efficient than trucking is; thus, enhancing the quality of rail services and facilitating intermodal transfers should lead to significant gains in freight-transport energy efficiency.

In passenger transport, the opportunities for systemic approaches to improve energy efficiency may be even greater. Some studies have suggested that greater use of advanced information and communication technologies—“intelligent” transportation systems that electronically link vehicles to one another and to the infrastructure—could enable better traffic management. These and other studies have also examined the potential for reducing vehicle use by enhancing collective

modes of travel, substituting information and communication technologies for travel, enhancing nonmotorized travel, and reorganizing land use to achieve higher population densities.

In order for a diversified and efficient system to evolve, two types of policy changes are needed: better land-use management and greater use of pricing. The former would have to be implemented on a substantial scale to have a significant effect on fuel consumption and greenhouse gas emissions, and the timeframes of such deployments would span several decades, but the long-term implications could be enormous. The net effect of a concerted effort to internalize congestion-related and environmental externalities into prices could also be large, especially in reducing the numbers of single-occupant vehicles on the roads and encouraging the use of small and efficient city cars for local travel.

Barriers to Improving Energy Efficiency in Transportation

Numerous factors hinder the improvement of energy efficiency and the reduction of fuel consumption in passenger and freight transportation. Some of the most important are noted in the following list:

-

In the United States, many factors—including a century of falling energy prices and rising incomes, together with personal preferences and some government policies—have contributed to decentralized land-use patterns and a transportation-intensive economy.

-

Low-priced energy has led to consumer purchasing behavior, vehicle designs, and operating decisions that emphasize convenience, style, and speed over fuel economy in automobiles and light trucks. Changing these preferences, which have been developed and reinforced over decades, will not be easy.

-

The primary barriers to realizing greater energy efficiency in the transportation sector are the expectations of individuals and companies about future energy prices, fuel availability, and government policies. Although there is an extensive menu of existing technologies for saving energy in transportation, before decision makers decide to invest in these technologies they must be convinced that energy-price increases (or other factors that influence market demand) will persist.

-

Even if sufficient demand exists for certain vehicle technologies, there must be the capacity to supply them at the needed scale—vehicle manu-

-

facturers and their suppliers must have been able to make adequate capital investments for bringing new production capacity on line. Typical product-development times for individual automotive products are 3–5 years, but to deploy a new-vehicle technology across all product platforms and vehicle classes usually takes more than a decade, unless mandated by law.

-

Even when new or improved vehicle technologies are available on the market, barriers to purchasing them include high initial cost, safety concerns, reliability and durability issues, and lack of awareness. Reaching a substantial fraction of vehicle sales usually takes more than a decade unless mandated by law or made possible by clear consumer demand for the new or improved technology.

Findings: Transportation

In the transportation sector, the potential for reducing fuel consumption resides both in increasing the efficiency with which liquid fuels (especially petroleum) are used and in shifting some of the vehicle fleet’s energy demand to electricity. The greenhouse gas emissions and other environmental effects of such a shift depend on how the electricity (or hydrogen, if fuel-cell vehicles are used) is generated.

An extensive menu of technologies exists today for increasing energy efficiency in transportation. Even so, improving new-vehicle fuel economy substantially is a challenging task. A continued decrease in fuel consumption (and associated greenhouse gas emissions) beyond 2020, when the EISA standards must be met, will require that the historic emphasis on ever-increasing vehicle power and size virtually be abandoned.

In the near term, reductions in fuel consumption will come predominantly from improved gasoline and diesel engines, superior transmissions, and reduced vehicle weight and drag. Evolutionary improvements in gasoline internal-combustion engine vehicles are likely to prove the most cost-effective choice for reducing petroleum consumption in the 2009–2020 timeframe. Gasoline-electric hybrids will play an increasingly important role as their production volumes increase and their cost, relative to conventional vehicles, decreases. Meeting the EISA standards is likely to require that, over the next decade or two, an ever-larger fraction of the new-vehicle fleet be hybrids or plug-in hybrids.

Beyond 2020, continuing reductions in fuel consumption are possible. Plausible efficiency improvements and weight reductions in LDVs, alongside more extensive use of hybrid and plug-in hybrid (and possibly battery-electric) vehicles, could reduce transportation fuel consumption beyond 2020 to below the levels implied by EISA 2007 so long as a plausible rate of improvement can be sustained. An especially important R&D focus here will be developing marketable vehicles that use electricity, which will require improving the performance and reducing the cost of high-energy-storage batteries.

A parallel long-term prospect is fuel cells, with hydrogen as the energy carrier. But major improvements, especially in reducing costs, are needed if this option is to be attractive. Widespread implementation requires significant investment in low-emissions hydrogen supply and in ensuring efficient distribution systems. Onboard hydrogen storage is another key R&D issue. Because establishing a new propulsion-system technology and new fuel infrastructure on a large scale is a formidable task, significant deployment is unlikely before 2035.

Reduced energy use in freight transportation can occur both by improving vehicle efficiency and by streamlining freight-system logistics and infrastructure. Reductions of 10–20 percent in the fuel economy of heavy- and medium-duty vehicles appear feasible over a decade or so. Meanwhile, a broad examination is needed of the potential for further reductions in energy consumption stemming from improved freight-system effectiveness.

Most transportation-related energy efficiency studies and proposals have focused on the considerable gains that could be achieved with improved vehicles rather than on changing the transportation system as a whole. This emphasis is appropriate, given the potential impact of such gains. But major improvements will also come from a broader as well as deeper understanding of transportation-system issues for all transportation modes. The potential overall impact of systemic changes, such as densifying and reorganizing land uses and enhancing collective modes of travel, needs further exploration and quantification. Developing better tools for analyzing and forecasting the effects of different policies and investments on entire transportation systems is therefore an important task.

ENERGY EFFICIENCY IN INDUSTRY

U.S. industrial energy efficiency has improved over the past several decades in response to volatile fossil-fuel prices, fuel shortages, and technological advances, but improving the energy efficiency of the nation’s industrial sector even further is essential for maintaining its viability in an increasingly competitive world. Yet there still remain opportunities to incorporate cost-effective, energy-efficient technologies, processes, and practices into U.S. manufacturing. This section describes the progress made to date and the magnitude of the remaining opportunities, stemming both from broader use of current best practices and from a range of possible advances enabled by future innovations.

Energy Use in U.S. Industry

The U.S. industrial sector is composed of an exceptionally diverse set of businesses and products with a broad range of prospects for energy efficiency. While industry used more than 50 percent of the worldwide delivered energy in 2005, in the United States in 2008 industry’s share was only 31 percent (Figure 4.1), reflecting the high energy intensity of the domestic housing and transportation sectors as well as the net import into the United States of products containing embodied energy. U.S. industrial energy use is substantial: 31.3 quads of primary energy in 2008 (almost a third of the national total) at a cost of $205 billion. In 2006, about 7 quads of this total was dedicated to nonfuel needs, such as petroleum feedstocks for petrochemicals and coke used in the production of steel (DOE, 2009). Industries in the United States use more energy than those of any other G8 nation and about half of the total energy used by China.

The average annual growth of energy use in the U.S. industrial sector is projected to be 0.3 percent out to 2030. Industry’s CO2 emissions are projected to increase more slowly, at 0.2 percent annually (EIA, 2008). These low growth rates are due partly to the presumed updating with more energy-efficient technologies and practices in industry. They also reflect the restructuring of the economy away from energy-intensive manufacturing and toward service- and information-based activities.