II

Policies Driving the Expansion of Biofuel Production

Many presentations at the workshop described increases in the production and use of biofuels over the last decade. These have been driven largely by federal and state policies intended to create a biofuel industry, while at the same time reducing U.S. reliance on imported petroleum, promoting energy security, and decreasing emissions of greenhouse gases (GHGs). These policies include various forms of subsidies as well as mandates for production and use.

FEDERAL LEGISLATION

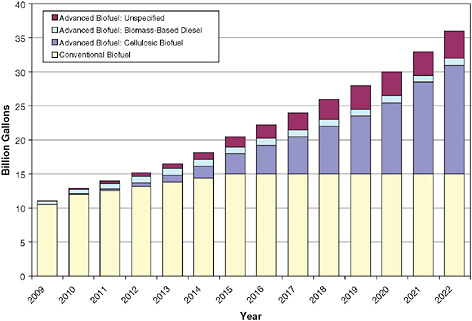

Key legislative drivers include the Energy Policy Act of 2005 (EPACT), the Energy Independence and Security Act of 2007 (EISA), and the 2002 and 2008 Farm Bills. EPACT set numerical goals for ethanol production—7.5 billion gallons by 2012—and provided credits to refiners and blenders. EISA expanded these mandates, increasing the required production level to 36 billion gallons by 2022 (Figure 1). Of the total, 21 billion gallons are to be obtained from cellulosic and other advanced biofuels.

Energy Independence and Security Act of 2007

EISA’s provisions have important implications for the sustainable production and use of biofuels. The act:

-

Requires significantly increased volumes of renewable fuel production,

FIGURE 1 Volume changes over time.

Source: U.S. Environmental Protection Agency, Office of Transportation and Air Quality, Workshop Presentation by Bruce Rodan, June 23, 2009.

-

with separate volume requirements for cellulosic biofuels, biomass-based diesel, advanced biofuels,1 and total renewable fuels.

-

Modifies the definition of renewable fuels to include minimum life-cycle GHG reduction thresholds. These reductions are to include both direct emissions and indirect emissions resulting from significant land-use changes—including international land-use changes.

-

Restricts the types of feedstocks that can be used to make renewable fuels and the types of land that can be used to grow feedstocks.

-

Includes specific waivers and U.S. Environmental Protection Agency (EPA)-generated credits for cellulosic biofuels.

While EISA has a number of sustainability provisions, it “grandfathers” the first 15 billion gallons/year of biofuel, exempting this amount of fuel from

the EISA’s GHG reduction and source requirements. EISA also grandfathers all existing ethanol production facilities, thereby exempting them from meeting the requirements. Only new production, beyond 15 billion gallons/year, must meet the specific GHG requirements outlined in the Act. (See Box 1)

EISA also restricts the types of renewable feedstocks that can be used and the types of lands from which the feedstocks can be derived. For example, feedstocks can be grown on agricultural land that has been cleared and cultivated prior to December 2007, but not on federal land, except for wildfire areas. While there are no other specific environmental requirements, EISA requires EPA, in consultation with the U.S. Department of Agriculture (USDA) and the U.S. Department of Energy, to report every three years on environmental impacts, including:

-

Environmental issues, including air quality, effects on hypoxia, pesticides, sediment, nutrient and pathogen levels in waters, acreage and function of waters, and soil environmental quality;

-

Resource conservation issues, such as soil conservation, water availability, and ecosystem health and biodiversity, including impacts on forests, grasslands, and wetlands; and

-

The growth and use of cultivated invasive or noxious plants and their impacts on the environment and agriculture.

|

BOX 1 Greenhouse Gas Requirements, EISA 2007 Cellulosic Biofuel: 16 billion gallons by 2022 Renewable fuel produced from cellulose, hemicellulose, orlignin—cellulosic ethanol, biomass-to-liquid diesel, green gasoline, etc. Must meet a 60 percent life-cycle GHG threshold. Biomass-Based Diesel: 1 billion gallons by 2012 and beyond e.g., biodiesel, “renewable diesel” if fats and oils are not co-processed with petroleum. Must meet a 50 percent life-cycle GHG threshold. Advanced Biofuel: Minimum of 4 billion additional gallons by 2022 Essentially anything but corn starch ethanol; includes cellulosic biofuels and biomass-based diesel. Must meet a 50 percent life-cycle GHG threshold. Renewable Biofuel: Up to 15 billion gallons of other biofuels Ethanol derived from corn starch, or anyother qualifying renewable fuel. Must meet a 20 percent life-cycle GHG threshold; only applies to fuel produced in new facilities. Source: Energy Independence and Security Act of 2007 (HR6). |

Food, Conservation, and Energy Act of 2008

In addition to EISA, the Food, Conservation, and Energy Act of 2008 (the 2008 Farm Bill) has a number of provisions encouraging the expansion of biofuel production and use, including tax credits for ethanol, blender credits for cellulosic fuels, and continuation of import duties on imported ethanol. One of the Farm Bill’s most important provisions is USDA’s Biomass Crop Assistance Program, which provides payments to farmers for growing new feedstocks and subsidizes the costs of collection, harvest, storage, and transportation to conversion facilities.2

STATE POLICY INCENTIVES

Iowa, Minnesota, and Wisconsin have also developed a set of policy incentives to encourage development of a local biofuel industry.3 During the workshop, state representatives and researchers described current and planned state biofuel policies.

Wisconsin

Wisconsin uses a combination of financial and regulatory incentives to encourage industry development—making the state a “market participant” in an industry promoted heavily through federal government regulation. For example, the state’s Ethanol and Biodiesel Fuel Pump Income Tax Credit allocates 25 percent (or up to up to $5,000) of the cost of installation for ethanol and biodiesel purveyors. Wisconsin has also proposed an income tax credit for biodiesel production—10 cents per gallon, with a minimum production of 2.5 million gallons and a maximum credit of $1 million. Laws were also passed mandating that state employees operate flex-fuel vehicles whenever possible and use alternative fuels, as Wisconsin is attempting to reduce its petroleum consumption by 20 percent by 2010 and 50 percent by 2015. However, the current lack of E854 facilities proves to be a significant challenge for the industry.

Wisconsin’s Department of Commerce has also established an Energy Independence Fund, whereby the governor has committed $150 million over 10 years, encouraging energy independence. Thus far, $22.5 million has been awarded— mainly to R&D projects on advanced biofuels and for additional research on improving the efficiency of existing biofuel plants. However, due to budget cuts, this program is suspended until 2011. Although Wisconsin continues to promote the state biofuel industry through various incentive programs, the current eco-

|

2 |

See http://www.fsa.usda.gov/FSA/webapp?area=home&subject=ener&topic=bcap. |

|

3 |

Note no formal presentation was made about Iowa’s biofuel policy. Information on Iowa programs, however, is included in Appendix D. |

|

4 |

E85 is a fuel blend of 85 percent ethanol and 15 percent gasoline. |

nomic downturn and the uncertainty of the market have forced many ethanol plants to be idle.

Minnesota

Minnesota was the first state to develop an ethanol mandate requiring that all gasoline sold in the state contain 10 percent ethanol, increasing to 20 percent by 2013. The state also created a variety of biofuel incentives—blenders’ credits, producer payments, tax benefits for refineries under the state’s Job Opportunity Building Zone (JOBZ) Program, reduced fuel taxes for consumption of E85, and grants for the development of next-generation fuels. For older plants, blenders’ credits for ethanol were issued through a producer payment program for ethanol plants built before 2000—issuing a credit for 20 cents per gallon of ethanol produced, up to 15 million gallons of ethanol per year per plant. Newer ethanol plants are covered by JOBZ, which is a more general economic development program (i.e., not solely a biofuel industry program) that provides financial incentives and tax credits/breaks to a variety of businesses.

By 2015, one-quarter of Minnesota ethanol supplies must come from cellulosic feedstocks. Also, Minnesota was the first state to institute a biodiesel mandate—currently 5 percent and increasing to 10 percent in 2012 and 20 percent in 2015. However, like Wisconsin, Minnesota’s biofuel industry has suffered during the current economic decline, and many of the state’s larger plants have been shut down. Meeting the 5 percent target as well as the latter goals will be difficult unless the industry can recover economically.

Recent scientific data and pressure on declining state budgets have to some extent eroded support for biofuels in Minnesota, leading the state legislature to commission an analysis of the scientific literature and the specific impacts of state subsidy policies. The legislative auditor’s report5 concluded that traditional corn-based ethanol and soy-based biodiesel have reduced petroleum consumption and have provided some economic development benefits in rural areas, while also causing some negative environmental impacts. Some of these impacts—especially increases in nitrous oxide emissions and the effects of changes in land use and water availability—have not been fully assessed, but are in need of critical analysis as the industry expands. Where the biomass would be grown was also raised as one of the report’s critical issues, as well as the associated land-use and environmental impacts. The report also questioned the need for state subsidies, noting that they now account for a very small percentage of producer revenues and are unlikely to play a major factor in business decisions. The report concluded that if Minnesota intends to scale up its biofuel industry to meet the goal of increasing cellulosic biofuel production, additional studies

|

5 |

Office of the Legislative Auditor, State of Minnesota. Evaluation Report—Biofuel Policies and Programs. St. Paul, Minnesota. April 2009. Available at http://www.auditor.leg.state.mn.us/PED/pedrep/biofuels.pdf. |

must be conducted to mitigate negative environmental and economic impacts. The report also strongly encouraged the Minnesota state legislature to remove the subsidies and credits for older ethanol plants, citing rising profits for plants that still receive the subsidies.

EISA grandfathers existing production facilities thereby providing no incentive to improve production practices or increase efficiency. New production facilities will be required to reduce by at least 20 percent the life cycle greenhouse gas (GHG) emissions relative to life cycle emissions from gasoline and diesel. Biorefineries will qualify for cash awards for producing fuels that displace more than 80 percent of the fossil-derived processing fuels used to operate a biorefinery. Workshop participants raised a number of concerns about current policies and the lack of incentives for performance improvements and innovation. In particular, many participants suggested that the current policy framework sends mixed signals to producers and consumers. For example, EISA grandfathers existing production facilities, thereby discouraging efficiency improvements in these facilities. Current policies effectively reduce the cost of biofuels, encouraging greater consumption rather than the development of more fuel-efficient vehicles. And policies do not provide adequate means of fully accounting for the potential loss of ecosystem services caused by increasing soil erosion, water use, etc.

New climate legislation, which was being debated in Congress during the workshop, was seen as potentially exacerbating potential negative land-use and environmental costs and diluting the positive environmental provisions of previously enacted legislation. Decisions to delay provisions allowing for the calculation of indirect land-use impacts under EPA’s new renewable fuels standard and the potential for expanding feedstock production on environmentally sensitive lands were particularly troublesome to many participants, as were decisions to shift some responsibilities for administering EISA from EPA to USDA.

State representatives at the workshop implied that they were waiting for federal leadership before proposing new energy policies and expressed frustration with the complexity and slow-moving federal policy process. They suggested that a federal framework with clear goals and metrics was needed to address climate change and to support the development of a sustainable domestic biofuel industry. While the state representatives recognized the role of the states in supporting both biofuel and climate goals, they expressed frustration with conflicting federal energy policies.