Reference Guide on Estimation of Economic Damages

Mark Allen, J.D., is Senior Consultant at Cornerstone Research, Menlo Park, California.

Robert Hall, Ph.D., is Robert and Carole McNeil Hoover Senior Fellow and Professor of Economics, Stanford University, Stanford, California.

Victoria Lazear, M.S., is Vice President at Cornerstone Research, Menlo Park, California.

CONTENTS

II. Damages Experts’ Qualifications

III. The Standard General Approach to Quantification of Damages

A. Isolating the Effect of the Harmful Act

B. The Damages Quantum Prescribed by Law

V. Quantifying Damages Using a Market Approach Based on Prices or Values

A. Is One of the Parties Using an Appraisal Approach to the Measurement of Damages?

B. Are the Parties Disputing an Adjustment of an Appraisal for Partial Loss?

C. Is One of the Parties Using the Assets and Liabilities Approach?

D. Are the Parties Disputing an Adjustment for Market Frictions?

E. Is One of the Parties Relying on Hypothetical Property in Its Damages Analysis?

F. What Complications Arise When Anticipation of Damages Affects Market Values?

VI. Quantifying Damages as the Sum of Discounted Lost Cash Flows

A. Is There Disagreement About But-For Revenues in the Past?

C. Is There Disagreement About the Plaintiff’s Actual Revenue After the Harmful Event?

D. What Is the Role of Inflation?

2. Are the parties using a discount rate properly matched to the projection?

3. Is one of the parties assuming that discounting and earnings growth offset each other?

E. Are Losses Measured Before or After the Plaintiff’s Income Taxes?

F. Is There a Dispute About the Costs of Stock Options?

G. Is There a Dispute About Prejudgment Interest?

H. Is There Disagreement About the Interest Rate Used to Discount Future Lost Value?

I. Is One of the Parties Using a Capitalization Factor?

A. Is the Defendant Arguing That Plaintiff’s Damages Estimate Is Too Uncertain and Speculative?

B. Are the Parties Disputing the Remoteness of Damages?

C. Are the Parties Disputing the Plaintiff’s Efforts to Mitigate Its Losses?

D. Are the Parties Disputing Damages That May Exceed the Cost of Avoidance?

E. Are the Parties Disputing a Liquidated Damages Clause?

VIII. Other Issues Arising in General in Damages Measurement

A. Damages for a Startup Business

1. Is the defendant challenging the fact of economic loss?

2. Is the defendant challenging the use of the expected value approach?

3. Are the parties disputing the relevance and validity of the data on the value of a startup?

B. Issues Specific to Damages from Loss of Personal Income

1. Calculating losses over a person’s lifetime

2. Calculation of fringe benefits

D. Is There a Dispute About Whether the Plaintiff Is Entitled to All the Damages?

E. Are the Defendants Disputing the Apportionment of Damages Among Themselves?

2. Are the defendants disputing the apportionment because the wrongdoer is unknown?

F. Is There Disagreement About the Role of Subsequent Unexpected Events?

IX. Data Used to Measure Damages

B. Are the Parties Disputing the Validity of the Data?

1. Criteria for determining validity of data

2. Quantitative methods for validation

C. Are the Parties Disputing the Handling of Missing Data?

X. Standards for Disclosing Data to Opposing Parties

D. Special Masters and Neutral Experts

C. Damages of Individual Class Members

D. Have the Defendant and the Class’s Counsel Proposed a Fair Settlement?

XII. Illustrations of General Principles

A. Claim for Lost Personal Income

1. Is there a dispute about projected earnings but for the harmful event?

2. Are the parties disputing the valuation of benefits?

3. Is there disagreement about how earnings should be discounted to present value?

4. Is there disagreement about subsequent unexpected events?

5. Is there disagreement about retirement and mortality?

6. Is there a dispute about mitigation?

7. Is there disagreement about how the plaintiff’s career path should be projected?

B. Lost Profits for a Business

1. Is there a dispute about projected revenues?

2. Are the parties disputing the calculation of marginal costs?

3. Is there a dispute about mitigation?

4. Is there disagreement about how profits should be discounted to present value?

5. Is there disagreement about subsequent unexpected events?

This reference guide identifies areas of dispute that arise when economic losses are at issue in a legal proceeding. Our focus is on explaining the issues in these disputes rather than taking positions on their proper resolutions. We discuss the application of economic analysis within established legal frameworks for damages. We cover topics in economics that arise in measuring damages and provide citations to cases to illustrate the principles and techniques discussed in the text.

We begin by discussing the qualifications required of experts who quantify damages. We then set forth the standard general approach to damages quantification, with particular focus on defining the harmful event and the alternative, often called the but-for scenario. In principle, the difference between the plaintiff’s economic value in the but-for scenario and in actuality measures the loss caused by the harmful act of the defendant. We then consider damages estimation for two cases: (1) a discrete loss of market value and (2) the loss of a flow of income over time, where damages are the discounted value of the lost cash flow. Other topics include the role of inflation, issues relating to income taxes and stock options, adjustments for the time value of money, legal limitations on damages, damages for a new business, disaggregation of damages when there are multiple challenged acts, the role of random events occurring between the harmful act and trial, data for damages measurement, standards for disclosing data to opposing parties, special masters and neutral experts, liquidated damages, damages in class actions, and lost earnings.1

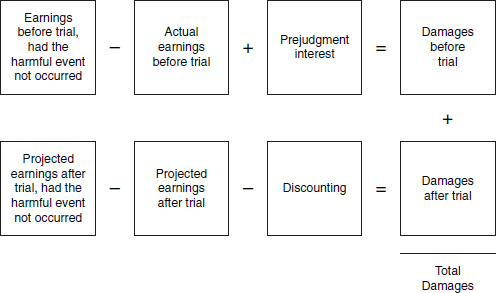

Our discussion follows the structure of the standard damages study, as shown in Figure 1. Damages quantification operates on the premise that the defendant is liable for damages from the defendant’s harmful act. The plaintiff is entitled to recover monetary damages for losses occurring before and possibly after the time of the trial. The top line of Figure 1 measures the losses before trial; the bottom line measures the losses after trial.2

The goal of damages measurement is to find the plaintiff’s loss of economic value from the defendant’s harmful act. The loss of value may have a one-time character, such as the diminished market value of a business or property, or it may take the form of a reduced stream of profit or earnings. The losses are net of any costs avoided because of the harmful act.

The essential elements of a study of losses are the quantification of the reduction in economic value, the calculation of interest on past losses, and the appli-

1. For a discussion of specific issues relating to estimating damages in antitrust, intellectual property, and securities litigation, see Mark A. Allen et al., Estimation of Economic Damages in Antitrust, Intellectual Property, and Securities Litigation (June 2011), available at http://www.stanford.edu/~rehall/DamagesEstimation.pdf.

2. Our scope here is limited to losses of actual dollar income. However, economists sometimes have a role in the measurement of nondollar damages, including pain and suffering and the hedonic value of life. See generally W. Kip Viscusi, Reforming Products Liability (1991).

Figure 1. Standard format for a damages study.

cation of financial discounting to future losses. The losses are the difference between the value the plaintiff would have received if the harmful event had not occurred and the value the plaintiff has or will receive, given the harmful event. The plaintiff may be entitled to interest for losses occurring before trial. Losses occurring after trial are usually discounted to the time of trial. The plaintiff may be due interest on the judgment from the time of trial to the time the defendant actually pays. The majority of damages studies fit this format; thus, we have used such a format as the basic model for this reference guide.

We use numerous brief examples to explain the disputes that can arise. These examples are not full case descriptions; they are deliberately stylized. They attempt to capture the types of disagreements about damages that arise in practical experience, although they are purely hypothetical. In many examples, the dispute involves factual as well as legal issues. We do not try to resolve the disputes in these examples and hope that the examples will help clarify the legal and factual disputes that need to be resolved before or at trial. We introduce many areas of potential dispute with a question, because asking the parties these questions can identify and clarify the majority of disputes over economic damages.

The reader with limited experience in the economic analysis of damages may find it most helpful to begin with Sections II and III and then read Section XII.A, which provides a straightforward application of the principles. Sections IV, V, and VI may be particularly helpful for readers knowledgeable in accounting and valuation. The other sections discuss specific issues relating to damages, and some readers may find it useful to review only those specific to their needs. Section XII.B

discusses an application of some of these more specific issues in the context of a damages analysis for a business.

II. Damages Experts’ Qualifications

Experts who quantify damages come from a variety of backgrounds. The expert should be trained and experienced in quantitative analysis. For economists, the common qualification is the Ph.D. Damages experts with business or accounting backgrounds often have M.B.A. degrees or other advanced degrees, or C.P.A. credentials. Both the method used and the substance of the damages claim dictate the specific areas of specialization the expert needs. In some cases, participation in original research and authorship of professional publications may add to the qualifications of an expert. However, relevant research and publications are not likely to be on the topic of damages measurement per se but rather on topics and methods encountered in damages analysis. For example, a damages expert may need to restate prices and quantities for a but-for market with more sellers than are present in the actual market. For an expert undertaking this task, direct participation in research on the relation between market structure and performance would be helpful.

Many damages studies use statistical regression analysis.3 Specific training is required to apply regression analysis. Damages studies sometimes use field surveys.4 In this case, the damages expert should be trained in survey methods or should work in collaboration with a qualified survey statistician. Because damages estimation often makes use of accounting records, most damages experts need to be able to interpret materials prepared by professional accountants. Some damages issues may require assistance from a professional accountant.

Experts also benefit from professional training and experience in areas relevant to the substance of the damages claim. For example, in antitrust, a background in industrial organization may be helpful; in securities damages, a background in finance may assist the expert; and in the case of lost earnings, an expert may benefit from training in labor economics.

An analysis by even the most qualified expert may face a challenge under the criteria associated with the Daubert and Kumho cases.5 These criteria are intended to exclude testimony based on untested and unreliable theories. Relatively few economists serving as damages experts succumb to Daubert challenges, because

3. For a discussion of regression analysis, see generally Daniel L. Rubinfeld, Reference Guide on Multiple Regression, in this manual.

4. For a discussion of survey methods, see generally Shari Seidman Diamond, Reference Guide on Survey Research, in this manual.

5. Daubert v. Merrell Dow Pharms., Inc., 509 U.S. 579 (1993); Kumho Tire Co. v. Carmichael, 526 U.S. 137 (1999). For a discussion of emerging standards of scientific evidence, see Margaret A. Berger, The Admissibility of Expert Testimony, Section IV, in this manual.

most damages analyses operate in the familiar territory of measuring economic values using a combination of professional judgment and standard tools. But the circumstances of each damages analysis are unique, and a party may raise a Daubert challenge based on the proposition that the tools have never before been applied to these circumstances. Even if a Daubert challenge fails, it can be an effective way for the opposing party to probe the damages analysis prior to trial.

III. The Standard General Approach to Quantification of Damages

In this section, we review the elements of the standard loss measurement in the format of Figure 1. For each element, there are several areas of potential dispute. The sequence of issues discussed here should identify most of the areas of disagreement between the damages analyses of opposing parties.

A. Isolating the Effect of the Harmful Act

The first step in a damages study is the translation of the legal theory of the harmful event into an analysis of the economic impact of that event. In most cases, the analysis considers the difference between the plaintiff’s economic position if the harmful event had not occurred and the plaintiff’s actual economic position.

In almost all cases, the damages expert proceeds on the hypothesis that the defendant committed the harmful act and that the act was unlawful. Accordingly, throughout this discussion, we assume that the plaintiff is entitled to compensation for losses sustained from a harmful act of the defendant. The characterization of the harmful event begins with a clear statement of what occurred. The characterization also will include a description of the defendant’s proper actions in place of its unlawful actions and a statement about the economic situation absent the wrongdoing, with the defendant’s proper actions replacing the unlawful ones (the but-for scenario). Damages measurement then determines the plaintiff’s hypothetical value in the but-for scenario. Economic damages are the difference between that value and the actual value that the plaintiff achieved.

Because the but-for scenario differs from what actually happened only with respect to the harmful act, damages measured in this way isolate the loss of value caused by the harmful act and exclude any change in the plaintiff’s value arising from other sources. Thus, a proper construction of the but-for scenario and measurement of the hypothetical but-for plaintiff’s value by definition includes in damages only the loss caused by the harmful act. The damages expert using the but-for approach does not usually testify separately about the causal relation between damages and the harmful act, although variations may occur where there are issues about the directness of the causal link.

B. The Damages Quantum Prescribed by Law

In most cases, the law prescribes a damages measure that falls into one of the following five categories:

- Expectation: Plaintiff restored to the same financial position as if the defendant had performed as promised.

- Reliance: Plaintiff restored to the same position as if the relationship with the defendant or the defendant’s misrepresentation (and resulting harm) had not existed in the first place.

- Restitution: Plaintiff compensated by the amount of the defendant’s gain from the unlawful conduct, also called compensation for unjust enrichment, disgorgement of ill-gotten gains, or compensation for unbargained-for benefits.6

- Statutory: Plaintiff’s compensation is a set amount per occurrence of wrongdoing. This occurs in cases involving violations of state labor codes and in copyright infringement.

- Punitive: Compensation rewards the plaintiff for detecting and prosecuting wrongdoing to deter similar future wrongdoing.

Expectation damages7 often apply to breach of contract claims, where the wrongdoing is the failure to perform as promised, and the but-for scenario hypothesizes the absence of that wrongdoing, that is, proper performance by the defendant. Expectation damages are an amount sufficient to give the plaintiff the same economic value the plaintiff would have received if the defendant had fulfilled the promise or bargain.8

6. Courts and commentators often subsume unjust enrichment in defining restitution. Professor Farnsworth, for example, states: “[T]he object of restitution is not the enforcement of a promise, but rather the prevention of unjust enrichment…. The party in breach is required to disgorge what he has received in money or services….” See, e.g., E. Allen Farnsworth, Contracts § 12.1, at 814 (1982). However, others have argued that restitution and unjust enrichment are different concepts. See, e.g., James J. Edelman, Unjust Enrichment, Restitution, and Wrongs, 79 Tex. L. Rev. 1869 (2001); Peter Birks, Unjust Enrichment and Wrongful Enrichment, 79 Tex. L. Rev. 1767 (2001); and Emily Sherwin, Restitution and Equity: An Analysis of the Principle of Unjust Enrichment, 79 Tex. L. Rev. 2083 (2001). Judge Posner discusses restitution (defined as returning the breaching party’s profits from the breach) in relation to contract damages and unjust enrichment (defined as compensation for unbargained-for benefits) in connection with implied contracts. See Richard A. Posner, Economic Analysis of Law 130, 151 (1998). See also Restatement (Third) of Restitution and Unjust Enrichment (2011).

7. See John R. Trentacosta, Damages in Breach of Contract Cases, 76 Mich. Bus. J. 1068, 1068 (1997) (describing expectation damages as damages that place the injured party in the same position as if the breaching party completely performed the contract); Bausch & Lomb, Inc. v. Bressler, 977 F.2d 720, 728–29 (2d Cir. 1992) (defining expectation damages as damages that put the injured party in the same economic position the party would have enjoyed if the contract had been performed).

8. See Restatement (Second) of Contracts § 344 cmt. a (1981). Expectation has been called “a queer kind of ‘compensation,’’’ because it gives the promisee something it never had, i.e., the benefit

Reliance damages generally apply to torts and to some contract breaches. Such damages restore the plaintiff to the same financial position it would have enjoyed absent the defendant’s conduct as well as, in the case of torts, compensation for nonpecuniary losses such as pain and suffering.9 Reliance most often includes out-of-pocket costs, but may also include compensation for lost opportunities, when appropriate. In such cases, reliance damages may approach expectation damages. For a tort, reliance damages place the plaintiff in a position economically equivalent to the position absent the harmful act.10 For a breach of contract, measuring damages as the amount of compensation needed to place the plaintiff in the same position as if the contract had not been made in the first place will result in refunding the part of the plaintiff’s reliance investment that cannot be recovered in other ways.11 Thus, reliance damages may be appropriate when the plaintiff made an investment relying on the defendant’s performance.

of its bargain. L.L. Fuller & William R. Perdue, Jr., The Reliance Interest in Contract Damages: 1, 46 Yale L.J. 52, 53 (1936). The policy underlying expectation damages is that they promote and facilitate reliance on business agreements. Id. at 61–62.

9. Generally, the objective of reliance damages is to put the promisee or nonbreaching party back to the position in which it would have been had the promise not been made. See E. Allan Farnsworth, Legal Remedies for Breach of Contract, 70 Colum. L. Rev. 1145, 1148 (1979). See also Restatement (Second) of Contracts § 344(b). Reliance damages include expenditures made in preparation for performance and performance itself. Restatement (Second) of Contracts § 349.

10. See, e.g., East River Steamship Corp. v. Transamerica Delaval Inc., 476 U.S. 858, 873 n.9 (1986) (“tort damages generally compensate the plaintiff for loss and return him to the position he occupied before the injury”). The compensatory goal of tort damages is to make the plaintiff whole as nearly as possible through an award of money damages. See Randall R. Bovbjerg et al., Valuing Life and Limb in Tort: Scheduling “Pain and Suffering,” 83 Nw. U. L. Rev. 908, 910 (1989); John C.P. Goldberg, Two Conceptions of Tort Damages: Fair v. Full Compensation, 5 DePaul L. Rev. 435 (2006). Often, the damages expert is not asked to provide guidance relating to estimating damages for nonpecuniary losses such as pain and suffering. However, hedonic analysis may sometimes be used.

11. Economists and legal scholars have debated contract damages and the concepts of expectation and reliance for decades. Fuller and Perdue’s definition of reliance included the plaintiff’s foregone lost opportunities in addition to his expenditures. But courts that award reliance damages typically award only out-of-pocket expenditures. See, e.g., Michael B. Kelly, The Phantom Reliance Interest in Contract Damages, 1992 Wis. L. Rev. 1755, 1771 (1992). Farnsworth has suggested that this is most likely explained by difficulties in damages proof rather than any rule excluding lost opportunities from reliance damages—that is, that the reason for barring the expectation measure (most often lack of proof of damages with reasonable certainty) will apply equally to bar lost opportunities. E Allan Farnsworth, Precontractual Liability and Preliminary Agreements: Fair Dealing and Failed Negotiations, 87 Colum. L. Rev. 217, 225 (1987). Reliance damages including lost opportunities may be awarded in cases where the expectation is unavailable because the agreement is illusory or too indefinite to be enforceable. See, e.g., Grouse v. Group Health Plan, Inc., 306 N.W.2d 114 (Minn. 1981), where the plaintiff employee resigned one job and turned down the offer of another in reliance on defendant’s promise of employment, but the promised employment would have been at will. The court stated that the proper measure of damages was not what the plaintiff would have earned in his employment with the defendant, but what he lost in quitting his job and turning down an additional offer of employment. Id. at 116. Finally, we note that in a competitive market, reliance damages including lost opportunities

Example: Agent contracts with Owner for Agent to sell Owner’s farm. The asking price is $1,000,000, and the agreed fee is 6%. Agent incurs costs of $1,000 in listing the property. A potential buyer offers the asking price, but Owner withdraws the listing. Agent calculates damages as $60,000, the agreed fee for selling the property. Owner calculates damages as $1,000, the amount that Agent spent to advertise the property.

Comment: Under the expectation remedy, Agent is entitled to $60,000, the fee for selling the property. However, the Agent has only partly performed under the contract, and thus it may be appropriate to limit damages to $1,000. Some states limit recovery in this situation by law to the $1,000, the reliance measure of damages, unless the property is actually sold.12

Restitution damages13 are often the same, from the perspective of quantification, as reliance damages. If the only loss to the plaintiff from the defendant’s harmful act arises from an expenditure that the plaintiff made that cannot otherwise be recovered, the plaintiff receives compensation equal to the amount of that expenditure.14

Interesting and often difficult issues arise in cases that involve elements of both contract and tort. Consider a contract for a product that turns out to be defective. Generally, under what has become known as the economic loss rule, if the defective product only causes economic or commercial loss, the dispute is a private matter between the parties, and the contract will likely control their dispute. But if the product causes personal injury or property damage (other than to the product itself), then tort law and tort damages will likely control.15

are generally equivalent to expectation damages. See, e.g., Robert Cooter & Melvin Aron Eisenberg, Damages for Breach of Contract, 73 Cal. L. Rev. 1432, 1445 (1985).

12. Compare Hollinger v. McMichael, 177 Mont. 144, 580 P.2d 927, 929 (1978) (broker earned his commission when he “procured a purchaser able, ready and willing to purchase the seller’s property”) with Ellsworth Dobbs, Inc. v. Johnson, 50 N.J. 528, 236 A.2d 843, 855 (1967) (broker earns commission only when the transaction is completed by closing the title in accordance with the provisions of the contract). See generally Steven K. Mulliken, When Does the Seller Owe the Broker a Commission? A Discussion of the Law and What It Teaches About Listing Agreements, 132 Mil. L. Rev. 265 (1991).

13. The objective of restitution damages is to put the promisor or breaching party back in the position in which it would have been had the promise not been made. Note the traditional legal distinction between restitution and reliance damages: Reliance damages seek to put the promisee or nonbreaching party back in the position in which it would have been if the promise had not been made. See E. Allan Farnsworth, Legal Remedies for Breach of Contract, 70 Colum. L. Rev. 1145, 1148 (1979). Both measures seek to restore the status quo ante. See also Restatement (Third) of Restitution and Unjust Enrichment (2011).

14. See Restatement (Second) of Contracts § 344(c).

15. Judge Posner has advocated using the term “commercial” rather than “economic” loss because, since personal injuries and property losses destroy values that can be monetized, they are economic losses also. See Miller v. United States Steel Corp., 902 F.2d 573, 574 (7th Cir. 1990). See generally Dan B. Dobbs, An Introduction to Non-Statutory Economic Loss Claims, 48 Ariz. L. Rev. 713

Fraud actions can present particularly difficult problems. For example, if the claim is that the defendant fraudulently induced the plaintiff to enter into an agreement that caused purely commercial losses, the economic loss rule may apply to limit the plaintiff’s recovery to only commercial losses for breach of contract, and thus not allow recovery of additional damages recoverable under fraud, such as punitive damages. Generally, courts have taken three approaches to this problem. Some courts have found that the economic loss rule applies to bar the tort claim completely, so that the plaintiff can proceed only under a breach of contract theory. Other courts have found that fraud is an exception to the economic loss doctrine, allowing fraud actions to proceed. A third approach allows a separate fraud action, but only if the fraud is “independent of” or “extraneous to” the contract promises.16

A plaintiff asserting fraud can generally recover either out-of-pocket costs or expectation damages,17 but courts today more commonly award expectation damages to place the plaintiff in the position it would have occupied had the fraudulent statement been true.18 In cases where the court interprets the fraudulent statement as an actual warranty, then the appropriate remedy is expectation damages. Courts, though, have awarded expectation damages even when the fraudulent statement is not interpreted as an actual warranty. Some of these cases may be situations where a contract exists but is legally unenforceable for technical reasons.

As an alternative, the but-for analysis may consider the value the plaintiff would have received in the absence of the economically detrimental relationship created by the fraud. In this case, the but-for analysis for fraud may adopt the premise that the plaintiff would have entered into a valuable relationship with an entity other than the defendant. For example, if the defendant’s misrepresentations have caused the plaintiff to purchase property unsuited to the plaintiff’s planned use, then the but-for analysis might consider the value that the plaintiff would have received by purchasing a suitable property from another seller.19

(2006); Richard A. Posner, Common-Law Economic Torts: An Economic and Legal Analysis, 48 Ariz. L. Rev. 735 (2006).

16. See, e.g., Dan B. Dobbs, An Introduction to Non-Statutory Economic Loss Claims, 48 Ariz. L. Rev. 713, 728–30 (2006); Ralph C. Anzivino, The Fraud in the Inducement Exception to the Economic Loss Doctrine, 90 Marq. L. Rev. 921, 931–36 (2007); Richard A. Posner, Common-Law Economic Torts: An Economic and Legal Analysis, 48 Ariz. L. Rev. 735 (2006); R. Joseph Barton, Note: Drowning in a Sea of Contract: Application of the Economic Loss Rule to Fraud and Negligent Misrepresentation Claims, 41 Wm. & Mary L. Rev. 1789 (2000). See also Marvin Lumber and Cedar Co. v. PPG Industries, 34 F. Supp. 2d 738 (D.C. Minn. 1999) aff’d, 223 F.3d 873 (7th Cir. 2000) (economic loss doctrine barred fraud claim of merchant against manufacturer where facts supporting such claim were not independent of those supporting its UCC contract claims).

17. See Restatement (Second) of Torts § 549 (1974). Under the Restatement, expectation damages are available only to “the recipient of a fraudulent misrepresentation in a business transaction,” and only for intentional, not negligent, misrepresentation. Id. §§ 549(2), 552.

18. See, e.g., Richard Craswell, Against Fuller and Perdue, 67 U. Chi. L. Rev. 99, 148 (2000).

19. This measure is equivalent to the reliance interest with recovery for lost opportunities, which can approach expectation damages. See supra note 11.

Plaintiffs cannot normally seek punitive damages in a claim for breach of contract,20 but may seek them in addition to compensatory damages in connection with a tort claim. Although punitive damages are rarely the subject of expert testimony, economists have advanced the concept that punitive damages compensate a plaintiff who brings a case for a wrongdoing that is hard to detect or hard to prosecute. Thus under this concept, punitive damages should be calculated so that the expected recovery for a randomly chosen victim is equal to the victim’s loss. To do this, actual damages are multiplied by a factor that is equal to the reciprocal of the probability of both detecting the harmful act and prosecuting the wrongdoer. This adjustment to the damages estimate ensures that the expected recovery from a randomly chosen victim is equal to the victim’s loss.21

In some situations, the plaintiff may have a choice of remedies under different legal theories. For example, in determining damages for fraud in connection with a contract, damages may be awarded under tort law for deceit or under contract law for breach.22

Example: Buyer purchases a condominium from Owner for $900,000. However, the condominium is known by the Owner to be worth only $800,000 at the time of sale because of defects. Buyer chooses to compute damages under the expectation measure of damages as $100,000 and to retain the condominium. Owner computes damages under the reliance measure owed to Buyer as $900,000 and also seeks the return of the condominium to Owner, despite the fact that the condominium is now worth $1,200,000.

Comment: Owner’s application of the reliance remedy is incomplete. Absent the fraud, Buyer would have purchased another condominium and enjoyed the general appreciation in the market. Thus, correctly applied, the two measures are likely to be similar.

20. Posner explains that most breaches are either involuntary, where performance is impossible at a reasonable cost, or voluntary but efficient. The policy of contract law is not to compel adherence to contracts, but only to require each party either to perform under the contract or compensate the other party for any resulting injuries. See Richard A. Posner, Economic Analysis of Law, supra note 6, at 131. For an argument in favor of punitive damages in contracts, see William S. Dodge, The Case for Punitive Damages in Contracts, 48 Duke L. J. 629 (1999).

21. See A. Mitchell Polinsky & Steven Shavell, Punitive Damages: An Economic Analysis, 111 Harv. L. Rev. 879 (1998).

22. This assumes that the economic loss rule does not apply. Generally, plaintiffs will prefer tort remedies to contract remedies because such remedies are broader, affording the possibility of recovery for nonpecuniary losses and punitive damages. For fraud actions, most jurisdictions do not allow recovery for nonpecuniary loses such as emotional distress, although some do if the distress is severe. See, e.g., Nelson v. Progressive Corp., 976 P.2d 859, 868 (Alaska 1999). The Restatement advocates restricting fraud recovery to pecuniary losses. See Restatement (Second) of Torts § 549.

A plaintiff may argue that a harmful act has caused significant losses for many years. The defendant may reply that most of the losses that occurred from the injury are the result of causes other than the harmful act. Thus, the defendant may argue that the injury was caused by multiple factors only one of which was the result of the harmful act, or the defendant may argue that the observed injury over time was caused by subsequent events.

Example: Worker is the victim of a disease caused either by exposure to xerxium or by smoking. Worker makes leather jackets tanned with xerxium. Worker sues the producer of the xerxium, Xerxium Mine, and calculates damages as all lost wages. Defendant Xerxium Mine, in contrast, attributes most of the losses to smoking and calculates damages as only a fraction of lost wages.

Comment: The resolution of this dispute will turn on the legal question of comparative or contributory fault. If the law permits the division of damages into parts attributable to exposure to xerxium and smoking, then medical evidence on the likelihood of cause may be needed to make that division. We discuss this topic further in Section VIII.B. on disaggregation of damages.

Example: Real Estate Agent is wrongfully denied affiliation with Broker. Agent’s damages study projects past earnings into the future at the rate of growth of the previous 3 years. Broker’s study projects that earnings would have declined even without the breach because the real estate market has turned downward.

Comment: The difference between a damages study based on extrapolation from the past, here used by Agent, and a study based on actual data after the harmful act, here used by Broker, is one of the most common sources of disagreement in damages. This is a factual dispute that hinges on the broker demonstrating that there is a relationship between real estate market conditions and the earnings of agents. The example also illustrates how subsequent unexplained events can affect damages calculations, discussed in Section VIII.E.

Frequently, the defendant will calculate damages on the premise that the harmful act had no causal relationship to the plaintiff’s losses—that is, that the plaintiff’s losses would have occurred without the harmful act. The defendant’s but-for scenario will thus describe a situation in which the losses happen anyway. This is equivalent to arguing that the harmful act occurred but the plaintiff suffered no losses.

Example: Contractors conspired to rig bids in a construction deal. State seeks damages for subsequent higher prices. Contractors’ damages estimate is

zero because they assert that the only effect of the bid rigging was to determine the winner of the contract and that prices were not affected.

Comment: This is a factual dispute about how much effect bid rigging has on the ultimate price. The analysis should go beyond the mechanics of the bid-rigging system to consider how the bids would be different had there been no collaboration among the bidders.

The defendant may also argue that the plaintiff has overstated the scope of the harmful act. Here, the legal character of the harmful act may be critical; the law may limit the scope to proximate effects if the harmful act was negligence, but may require a broader scope if the harmful act was intentional.23

Example: Plaintiff Drugstore Network experiences losses because defendant Superstore priced its products predatorily. Drugstore Network reduced prices in all its stores because it has a policy of uniform national pricing. Drugstore Network’s damages study considers the entire effect of national price cuts on profits. Defendant Superstore argues that Network should have lowered prices only on the West Coast and its price reductions elsewhere should not be included in damages.

Comment: Whether adherence to a policy of national pricing is the reasonable response to predatory pricing in only part of the market is a question of fact.

One party’s damages analysis may hypothesize the absence of any act of the defendant that influenced the plaintiff, whereas the other’s damages analysis may hypothesize an alternative, legal act. This type of disagreement is particularly common in antitrust and intellectual property disputes. Although disagreement over the alternative scenario in a damages study is generally a legal question, opposing experts may have been given different legal guidance and therefore made different economic assumptions, resulting in major differences in their damages estimates.

Example: Defendant Copier Service’s long-term contracts with customers are found to be unlawful because they create a barrier to entry that maintains Copier Service’s monopoly power. Rival’s damages study hypothesizes

23. See generally Prosser and Keeton on the Law of Torts § 65, at 462 (Prosser et al. 5th ed., 1984). Dean Prosser states that simple negligence and intentional wrongdoing differ “not merely in degree but in the kind of fault…and in the social condemnation attached to it.” Id.

no contracts between Copier Service and its customers, so Rival would face no contractual barrier to bidding those customers away from Copier Service. Copier Service’s damages study hypothesizes medium-term contracts with its customers and argues that these would not have been found to be unlawful. Under Copier Service’s assumption, Rival would have been much less successful in bidding away Copier Service’s customers, and damages are correspondingly lower.

Comment: Assessment of damages will depend greatly on the substantive law governing the injury. The proper characterization of Copier Service’s permissible conduct usually is an economic issue. However, the expert must also have legal guidance as to the proper legal framework for damages. Counsel for plaintiff may instruct plaintiff’s damages expert to use a different legal framework from that of counsel for the defendant.

The analysis of some types of harmful events requires consideration of effects, such as price erosion,24 that involve changes in the economic environment caused by the harmful event. For a business, the main elements of the economic environment that may be affected by the harmful event are the prices charged by rivals, the demand facing the seller, and the prices of inputs. For example, misappropriation of intellectual property can cause lower prices because products produced with the misappropriated intellectual property compete with products sold by the owner of the intellectual property. In contrast, some harmful events do not change the plaintiff’s economic environment. The theft of some of the plaintiff’s products would not change the market price of those products, nor would an injury to a worker change the general level of wages in the labor market. A damages study need not analyze changes in broader markets when the harmful act plainly has minuscule effects in those markets. The plaintiff may assert that, absent the defendant’s wrongdoing, a higher price could have been charged and therefore that the defendant’s harmful act has eroded the market price. The defendant may reply that the higher price would lower the quantity sold. The parties may then dispute how much the quantity would fall as a result of higher prices.

24. See, e.g., General Am. Transp. Corp. v. Cryo-Trans, Inc., 897 F. Supp. 1121, 1123–24 (N.D. Ill. 1995), modified, 93 F.3d 766 (Fed. Cir. 1996); Rawlplug Co., Inc. v. Illinois Tool Works Inc., No. 91 Civ. 1781, 1994 WL 202600, at *2 (S.D.N.Y. May 23, 1994); Micro Motion, Inc. v. Exac Corp., 761 F. Supp. 1420, 1430–31 (N.D. Cal. 1991) (holding in all three cases that the patentee is entitled to recover lost profits due to past price erosion caused by the wrongdoer’s infringement).

Example: Valve Maker infringes patent of Rival. Rival calculates lost profits as the profits Rival would have made plus a price-erosion effect. The amount of price erosion is the difference between the higher price that Rival would have been able to charge absent Valve Maker’s presence in the market and the actual price. The price-erosion effect is that price difference multiplied by the combined sales volume of Valve Maker and Rival. Defendant Valve Maker counters that the volume would have been lower had the price been higher and measures damages using the lower volume.

Comment: Wrongful competition is likely to cause some price erosion25 and, correspondingly, some enlargement of the total market because of the lower price. The more elastic the demand, the lower the volume would have been with a higher price. The actual magnitude of the price-erosion effect could be determined by economic analysis.

Price erosion is a common issue in quantifying intellectual property damages. However, price erosion may be an issue in many other commercial disputes. For example, a plaintiff may argue that the disparagement of its product due to false advertising has eroded the product’s price.26

In more complicated situations, the damages analysis may need to focus on how an entire industry would be affected by the defendant’s wrongdoing. For example, one federal appeals court held that a damages analysis for exclusionary conduct must consider that other firms beside the plaintiff would have enjoyed the benefits of the absence of that conduct. Thus, prices would have been lower, and the plaintiff’s profits correspondingly less than those posited in the plaintiff’s damages analysis.27

Example: Computer Printer Maker has used unlawful means to exclude rival suppliers of ink cartridges. Rival calculates damages on the assumption that it would have been the only additional seller in the market absent the exclusionary conduct, and that Rival would have been able to sell its cartridges at the same price actually charged by Printer Maker. Printer Maker counters that other sellers would have entered the market and driven the price down, and so Rival has overstated its damages.

25. See, e.g., Micro Motion, 761 F. Supp. at 1430 (citing Yale Lock Mfg. Co. v. Sargent, 117 U.S. 536, 553 (1886), in which the Micro Motion court stated that “[i]n most price erosion cases, a patent owner has reduced the actual price of its patented product in response to an infringer’s competition”).

26. See, e.g., BASF Corp. v. Old World Trading Co., Inc., 41 F.3d 1081 (7th Cir. 1994) (finding that the plaintiff’s damages only consisted of lost profits before consideration of price erosion, prejudgment interest, and costs due to the presence of other competitors who would keep prices low).

27. See Dolphin Tours, Inc. v. Pacifico Creative Servs., Inc., 773 F.2d 1506, 1512 (9th Cir. 1985).

Comment: Increased competition lowers price in all but the most unusual situations. Again, determination of the number of entrants attracted by the elimination of exclusionary conduct and their effect on the price probably requires a full economic analysis.

A comparison of the parties’ statements about the harmful event and the likely impact of its absence will likely reveal differences in legal theories that can result in large differences in damages claims.

Example: Client is the victim of unsuitable investment advice by Broker (all of Client’s investments made by Broker are the result of Broker’s negligence). Client’s damages study measures the sum of the losses of the investments made by Broker, including only the investments that incurred losses. Broker’s damages study measures the net loss by including an offset for those investments that achieved gains.

Comment: Client is considering the harmful event to be the recommendation of investments that resulted in losses, whereas Broker is considering the harmful event to be the entire body of investment advice. Under Client’s theory, Client would not have made the unsuccessful investments but would have made the successful ones, absent the unsuitable advice. Under Broker’s theory, Client would not have made any investments based on Broker’s advice.

A clear statement about the plaintiff’s situation but for the harmful event is also helpful in avoiding double counting that can arise if a damages study confuses or combines reliance28 and expectation damages.

Example: Marketer is the victim of defective products made by Manufacturer; Marketer’s business fails as a result. Marketer’s damages study adds together the out-of-pocket costs of creating the business in the first place and the projected profits of the business had there been no defects. Manufacturer’s damages study measures the difference between the profit margin Marketer would have made absent the defects and the profit margin Marketer actually made.

28. See Section III.B. Reliance damages are distinguished from expectation damages. Reliance damages are defined as damages that do not place the injured party in as good a position as if the contract had been fully performed (expectation damages) but in the same position as if promises were never made. Reliance damages reimburse the injured party for expenses incurred in reliance of promises made. See, e.g., Satellite Broad. Cable, Inc. v. Telefonica de Espana, S.A., 807 F. Supp. 218 (D.P.R. 1992) (holding that under Puerto Rican law an injured party is entitled to reliance but not expectation damages due to the wrongdoer’s willful and malicious termination or withdrawal from precontractual negotiations).

Comment: Marketer has mistakenly added together damages from the reliance principle and the expectation principle.29 Under the reliance principle, Marketer is entitled to be put back to where it would have been had it not started the business in the first place. Damages are total outlays less the revenue actually received. Under the expectation principle, as applied in Manufacturer’s damages study, Marketer is entitled to the profit on the extra sales it would have received had there been no product defects. Out-of-pocket expenses of starting the business would have no effect on expectation damages because they would be present in both the actual and the but-for cases and would offset each other in the comparison of actual and but-for value.

Most damages measurements deal, one way or another, with the question of the economic value of streams of profit or income. In this section, we introduce some of the basic concepts of valuation. In the following two sections, we first address market approaches that use current data on prices and values to estimate value directly. Second, we address income approaches that start by estimating future flows and then discounting them back to a reference date (often referred to as discounting cash flows). The income approaches apply to losses of personal earnings as well as to business losses from lost streams of profits or income, where damages are calculated as the present value of a lost stream of earnings. Although commonly called income approaches, the methods include discounting any form of cash flow, such as revenues and costs as well as income, to arrive at an estimate of damages.

The choice between the two types of approaches is a matter of expert judgment. In some cases, an expert will use both types of approaches. Much of our discussion is stated in terms of business valuation, but the discussion also applies to real estate and other assets.

Some of the ways experts implement a market approach, based on market prices or values, to determine damages include

- Relying on comparables such as a similar business or property,

- Using balance sheet information such as assets and liabilities,

29. The injured party cannot recover both reliance and expectation damages if such recovery would result in double counting. See, e.g., West Haven Sound Development Corp. v. City of West Haven, 514 A.2d 734, 746–47 (Conn. 1986) (plaintiff could seek recovery of reliance expenditures instead of lost profits, but not in addition to lost profits, because reliance expenditures were part of the value of the business as a going concern). See also George M. Cohen, The Fault Lines in Contract Damages, 80 Va. L. Rev. 1225, 1262 (1994).

- Using known ratios from valuing comparables to measure losses, and

- Multiplying existing valuations by changes in market values from publicly available information.

Different methods that experts use to implement an income approach, based on discounting cash flows, to determine damages include

- Projecting revenues and costs with and without the alleged bad act,

- Adjusting profit streams to present value using measures of inflation and the real rate of interest, and

- Projecting profit streams to present value implicitly using capitalization rates.

Each approach presents challenges. The expert must identify the most appropriate method and implement it properly.

Although these methods may seem different and may rely on different information about the firm, each should generate similar numbers. If not, then there is usually an underlying difference in assumptions. Section V discusses the issues and pitfalls frequently encountered when damages are computed from prices or values, while Section VI discusses the issues and pitfalls frequently encountered when damages are computed relying on discounted cash flows.

V. Quantifying Damages Using a Market Approach Based on Prices or Values

An expert can sometimes measure damages as of the time of the wrongdoing directly from market prices or values. For example, if the defendant’s negligence causes the total destruction of the plaintiff’s cargo of wheat, worth $17 million at the current market price, damages are simply that amount. The only task for the expert is to restate the damages as the economic equivalent at time of trial, through the calculation of prejudgment interest, a topic we consider in Section VI.G.

In many cases, the expert does not take a market price and apply it directly. The price of the product or object at issue may not itself be known from a market, but the expert can approximate the market value from the prices of similar products or objects. Appraisers are experts whose task is to estimate the fair market value of real estate, equipment, and works of art. Experts who assess the value of businesses—some of whom specialize as business valuation experts—often perform similar functions based on the known market values of comparable businesses.

A. Is One of the Parties Using an Appraisal Approach to the Measurement of Damages?

Damages analyses based on appraisals usually have two parts. The first is an appraisal of the property, and the second is an application of that appraisal to quantify the loss from the harmful act. The starting point for an appraisal is the choice of comparable properties or businesses. For real estate, the comparables are nearby similar properties. For businesses, the comparables are businesses similar in as many ways as possible to the business at issue, based on characteristics such as type of business, type of customers, size, type of location, and so forth. Only in the case of publicly traded companies is there a known market value at virtually all times. For real estate and private businesses, the comparables must have traded hands at a known transaction price fairly recently. Numerous firms sell databases of transaction prices and other data for the use of business valuation experts.

The second step in an appraisal is the adjustment of the comparables to account for differences between each comparable business or property and the one at issue. Business values are often restated as valuation ratios, such as the ratio of price to revenue or to earnings. Real estate is restated as value per square foot of land or interior space. Such ratios usually need to be specific to the type of business or real estate. In particular, rapidly growing businesses and real estate in growing areas have higher valuation ratios than those with zero or negative growth outlooks.

Example: Oil Company deprives Gas Station Operator of the benefits of Operator’s business. Oil Company’s damages study starts by calculating the ratio of sales value to gasoline sales for five nearby gas station businesses that have sold recently. The ratio is $0.26 per gallon of sales per year. The Operator sells 1.6 million gallons per year, so the business was worth $0.26 × 1,600,000 = $416,000, according to the Oil Company’s expert. The Gas Station Expert argues that the sales used by the Oil Company occurred before a major business relocated nearby. Thus, the sales value to gasoline sales should be increased to $0.30 to reflect the new growth rate as a result of the expected increase in business. He calculates his business to be worth $0.30 × 1,600,000 = $480,000.

B. Are the Parties Disputing an Adjustment of an Appraisal for Partial Loss?

In most cases where the appraisal approach is appropriate, the plaintiff has not suffered a total loss of property or business, but rather some impairment of its value. In that case, the damages expert will adapt the appraisal to measure the loss from the impairment. Here, again, the use of valuation ratios is common.

Example: Oil Company breaches an earlier agreement with Gas Station Operator and opens another station near Operator’s station. Operator’s gasoline sales fall by 700,000 gallons per year. Oil Company’s damages study applies the ratio of $0.26 per gallon of sales per year to the loss: $0.26 × 700,000 = $182,000. Operator’s damages study uses a regression analysis of the valuation of recently sold businesses and finds that each gallon of added sales raises value by $0.47 and so calculates damages as $0.47 × 700,000 = $329,000.

Comment: Because of fixed costs, the average valuation of gasoline sales will be less than the marginal valuation, and the latter is the conceptually correct approach.

C. Is One of the Parties Using the Assets and Liabilities Approach?

The assets and liabilities approach starts with the accounting balance sheet of a company and adjusts assets and liabilities to approximate current market values. It then nets the assets and the liabilities to compute the net asset value of the firm. The asset values include the value of intangibles. Because these values are hard to determine, the assets and liabilities method is not generally suited to the valuation of businesses with substantial intangible assets.

D. Are the Parties Disputing an Adjustment for Market Frictions?

Purely competitive markets have what economists term a “frictionless” market structure. These markets have (1) a large number of buyers and sellers of a single, homogeneous product; (2) fully informed participants; and (3) the feature that sellers can easily enter or exit from the market. A “friction” is anything that prevents the market from being purely competitive. The markets for businesses and properties have frictions that may make transaction values depart from the usual concept of the price negotiated by a willing seller and a willing buyer. In the case of a forced sale and thus a less willing seller, the transaction price may understate the value. Adverse selection, which occurs when one party knows more about a property or business than the other, may cause severe understatements in some markets.30 Because equipment with hidden defects is more likely to be offered for sale than equipment in unusually good condition, and sales prices are lower as a result, owners of the good equipment tend not to offer it on the market.

30. See, e.g., George A. Akerlof, The Market for “Lemons”: Quality Uncertainty and the Market Mechanism, 84 Q. J. Econ. 488 (1970).

Example: Negligence of Tire Maker causes the total loss of a 747 aircraft. Tire Maker’s damages analysis uses the prices of 747s of similar age in the used airplane market to set a value of $23 million on the ruined airplane. However, Airline offers the testimony of an economist expert who explains that only a small fraction of 747s are ever put up for sale in the used airplane market. Rather, airlines choose to sell only defective planes because they continue to fly nondefective 747s. He then adjusts for the adverse selection of inferior airplanes in the used market and places a value of $42 million on the plane.

Comment: Although merited in principle, the airline’s adjustment is challenging to carry out and is likely to be the subject of expert disagreement.

A major source of friction in property and business markets is the capital gains tax. Because capital gains are taxed only at realization, after-tax sales prices will generally understate the value of a business or property to the existing owners if they have no plans to sell except in the more distant future. The forced sale implicit in any act that harms a business or property imposes a loss on the owners in excess of their after-tax loss. We discuss this topic later in Section VI.E on taxes.

E. Is One of the Parties Relying on Hypothetical Property in Its Damages Analysis?

Plaintiffs may argue that undeveloped land or a business opportunity yet to be pursued was taken from them by the defendant’s harmful act and that the value lost should include the value of the still hypothetical improvements. We consider this topic in more detail in Section VIII.A in its most important form, damages for harm to a startup business.

Example: Property Owner sues County for the value of undeveloped property condemned for a rapid transit extension. Owner’s damages claim is $18 million, the appraisal value of a hypothetical condominium development on the property less the anticipated cost of building the development. The County’s expert, an appraiser, argues that the market value of the property is $2 million, based on comparable undeveloped land nearby.

Comment: In principle, the current market value of undeveloped land and the market value of the same land with proper development, less the cost of that development, should be the same, because buyers would bid based on the value of the undeveloped land. Property Owner probably understated the development costs. But the value of the nearby property may understate the value of the condemned property—it is for sale because it lacks certain features that make it less desirable to

develop, such as a view. On the other hand, the Property Owner’s valuation does not reflect the probability that the Property Owner may not succeed in building the condominium.

F. What Complications Arise When Anticipation of Damages Affects Market Values?

For publicly traded companies, the harmful act may depress the market value of the company itself. For example, suppose that a manufacturer of wood windows treats its windows with a preservative that is defective, causing the windows to rot. The window manufacturer sues the manufacturer of the preservative for damages from lost sales in addition to the cost of replacing the defective windows. The window manufacturer’s expert may be tempted to use the decline following the harm as a measure of damages. In cases when the news of the harm reaches the public discretely, say in a single day, the technique of an event study, commonly used in securities fraud cases, can be used to isolate the special component of the decline in market value.

The problem with using the plaintiff’s market value is that the market will anticipate recovery in the form of damages, and this will offset at least some of the decline in market value. In the extreme, if stock traders expect that the plaintiff will receive exactly full compensation, the plaintiff’s market value will not change at all when knowledge of the wrongdoing—including the fact that a damages award will be made—hits the stock market. Thus, the use of the observed decline in the value of the plaintiff company at the time of the injury understates the actual amount of harm by an unknown amount, so the expert should consider using other valuation techniques. Note that this understatement arises when the publicly traded company itself stands to recover damages.

Changes in market values have a different role in situations, such as fraud on the market, where the public company is the defendant. If the release of previously fraudulently concealed adverse information causes both a reduction in the value of the company because of the information and a further reduction because the market anticipates that the company will pay damages to investors who overpaid for their shares during the period when the information was concealed, damages may be overstated by an unknown amount.

VI. Quantifying Damages as the Sum of Discounted Lost Cash Flows

The fundamental principle of economics governing the second approach to valuation is that the value of a business is the present value of its expected future cash

flows.31 In forming a present value, the expert multiplies each future year’s cash flows by the value today for a dollar received in that future year. This price is the discount factor. Thus, the discount factor reflects the decreased value for a dollar received in the future compared to the value of a dollar received today.

In broad summary, the damages expert using the discounted cash flow approach projects historical and future but-for revenue and cost, actual historical revenue and cost, and projected actual revenue and cost. The difference between revenue and cost is cash flow, and the difference between but-for and actual cash flow is the loss of cash flow attributable to the harmful act. The expert then applies discount rates to each year’s lost cash flow to determine damages.

A. Is There Disagreement About But-For Revenues in the Past?

A common source of disagreement about the likely profitability of a business is the absence of a track record of earlier profitability. Whenever the plaintiff is a startup business, the issue will arise of reconstructing the value of a business with no historical benchmark.

Example: Plaintiff Xterm is a failed startup. Defendant VenFund has breached a venture capital financing agreement. Xterm’s damages study projects the profits it would have made under its business plan. VenFund’s damages estimate, which is much lower, is based on the value of the startup as revealed by sales of Xterm equity made just before the breach.

Comment: Both sides confront factual issues to validate their damages estimates. Xterm needs to show that its business plan was still a reasonable forecast as of the time of the breach. VenFund needs to show that the sale of equity places a reasonable value on the firm, that is, that the equity sale was at arm’s length and was not subject to discounts. This dispute can also be characterized as whether the plaintiff is entitled to expectation damages or reliance damages. The jurisdiction may limit damages for firms with no track record.

Where the injury takes the form of lost sales volume, the plaintiff usually has avoided the cost of production for the lost sales. Calculation of these avoided costs is a common area of disagreement about damages. Conceptually, avoided cost is the difference between the cost that would have been incurred at the higher volume of

31. This discussion follows that in Shannon Pratt, Business Valuation Body of Knowledge 85–95 (2d ed. 2003).

sales but for the harmful event and the cost actually incurred at the lower volume of sales achieved. In the format of Figure 1, the avoided-cost calculation is done each year. The following are some of the issues that arise in calculating avoided cost:

- For a firm operating at capacity, expansion of sales is cheaper in the long run than in the short run, whereas, if there is unused capacity, expansion may be cheaper in the short run.

- The costs that can be avoided if sales fall abruptly are smaller in the short run than in the long run.

- Avoided costs may include marketing, selling, and administrative costs as well as the cost of manufacturing.

- Some costs are fixed, at least in the short run, and are not avoided as a result of the reduced volume of sales caused by the harmful act.

Sometimes putting costs into just two categories is useful: those that vary with sales (variable costs) and those that do not vary with sales (fixed costs). This breakdown is approximate, however, and does not do justice to important aspects of avoided costs. In particular, costs that are fixed in the short run may be variable in the longer run. Disputes frequently arise over whether particular costs are fixed or variable. One side may argue that most costs are fixed and were not avoided by losing sales volume, whereas the other side may argue that many costs are variable.

Certain accounting concepts relate to the calculation of avoided cost. Profit- and-loss statements frequently report the “cost of goods sold.”32 Costs in this category are frequently, but not uniformly, avoided when sales volume is lower. But costs in other categories, called “operating costs” or “overhead costs,” also may be avoided, especially in the long run. One approach to the measurement of avoided cost is based on an examination of all of a firm’s cost categories. The expert determines how much of each category of cost was avoided.

An alternative approach uses regression analysis or some other statistical method to determine how costs vary with sales as a general matter within the firm or across similar firms. The results of such an analysis can be used to measure the costs avoided by the decline in sales volume caused by the harmful act.

C. Is There Disagreement About the Plaintiff’s Actual Revenue After the Harmful Event?

When the plaintiff has mitigated the adverse effects of the harmful act by making an investment that has not yet paid off at the time of trial, disagreement may arise about the value that the plaintiff has actually achieved.

32. See, e.g., United States v. Arnous, 122 F.3d 321, 323 (6th Cir. 1997) (finding that the district court erred when it relied on government’s theory of loss because the theory ignored the cost of goods sold).

Example: Manufacturer breaches agreement with Distributor. Distributor starts a new business that shows no accounting profit as of the time of trial. Distributor’s damages study makes no deduction for actual earnings during the period from breach to trial. Manufacturer’s damages study places a value on the new business as of the time of trial and deducts that value from damages.

Comment: Some offset for economic value created by Distributor’s mitigation efforts may be appropriate. Note that if Distributor made a good-faith effort to create a new business, but was unsuccessful because of adverse events outside its control, the issue of the treatment of unexpected subsequent events will arise.33

D. What Is the Role of Inflation?

Persistent inflation in the U.S. economy complicates projections of future losses. Although inflation rates in the United States since 1987 have been only in the range of 1% to 3% per year, the cumulative effect of inflation has a pronounced effect on future dollar quantities. At 3% annual inflation, a dollar today buys what $4.38 will buy 50 years from now. Under inflation, the unit of measurement of economic values becomes smaller each year, and this shrinkage must be considered if future losses are measured in the smaller dollars of the future. Calculations of this type are often termed “escalation.” Dollar losses grow in the future because of the use of the shrinking unit of measurement. For example, an expert might project that revenues for a firm will rise at approximately 5% per year for the next 10 years—3% because of general inflation and 2% more because of the growth of the firm.34

Alternatively, the expert may project future losses in constant dollars without explicitly accounting for escalation for future inflation.35 The use of constant dollars avoids the problems of dealing with a shrinking unit of measurement. In the example just given, the expert might project that revenues will rise at 2% per year in constant dollars. Constant dollars must be stated with respect to a base year. Thus, a calculation in constant 2009 dollars means that the unit for future measurement is the purchasing power of the dollar in 2009.

33. See Section VIII.F.

34. See Section VI.D.2.

35. See, e.g., Willamette Indus., Inc. v. Commissioner, 64 T.C.M. (CCH) 202 (1992) (holding expert witness erred in failing to take inflation escalation into account).

2. Are the parties using a discount rate properly matched to the projection?

For future losses, a damages study calculates the amount of compensation needed at the time of trial to replace expected future lost income. The result is discounted future losses;36 it is also sometimes referred to as the present value of future losses.37 Discounting is conceptually separate from the adjustment for inflation considered in the preceding section. Discounting is typically carried out in the format shown in Table 1.

Table 1. Calculation of Discounted Loss at 5% Interest

| Years in Future | Loss | Discount Factor | Discounted Lossa |

| 0 | $100 | 1.000 | $100 |

| 1 | 125 | 0.952 | 119 |

| 2 | 130 | 0.907 | 118 |

| Total | $337 | ||

| aDiscounted Loss = Loss x Discount Factor. | |||

“Loss” is the estimated future loss, in either escalated or constant-dollar form. “Discount factor” is a factor that calculates the number of dollars needed at the time of trial to compensate for a lost dollar in the future year. The discount factor is the ratio of the value at a future date of a cash flow received today to its value today. It is calculated from the discount rate, which is the interest rate that values a cash flow at a future date. If the current 1-year interest rate is 5%, then the discount rate is 1.05—the value of $1 will be $1.05 a year from now. The discount factor will therefore be $1/$1.05. The 2-year discount rate is the square of 1.05, and the discount factor will be 1/(1.05 × 1.05) Thus, the discount factor is computed by compounding the discount rate forward from the base year to the future year and then taking the reciprocal.

For example, in Table 1, the interest rate is 5%. As discussed, the discount factor for the next year is calculated as the reciprocal of 1.05, and the discount factor for 2 years in the future is calculated as the reciprocal of 1.05 squared. Future discounts would be obtained by multiplying by 1.05 a suitably larger number of times and then taking the reciprocal. The discounted loss is the loss multiplied by the discount factor for that year. The number of dollars at time of trial that compensates for the loss is the sum of the discounted losses, $337 in this example.

36. See generally Michael A. Rosenhouse, Annotation, Effect of Anticipated Inflation on Damages for Future Losses—Modern Cases, 21 A.L.R. 4th 21 (1981) (discussing discounted future losses extensively).

37. See generally George A. Schieren, Is There an Advantage in Using Time-Series to Forecast Lost Earnings? 4 J. Legal Econ. 43 (1994) (discussing effects of different forecasting methods on present discounted value of future losses). See, e.g., Wingad v. John Deere & Co., 523 N.W.2d 274, 277–79 (Wis. Ct. App. 1994) (calculating present discounted value of future losses).

To discount a future loss projected in escalated terms, one should use an ordinary interest rate. For example, in Table 1, if the losses of $125 and $130 are in dollars of those years, and not in constant dollars of the initial year, then the use of a 5% discount rate is appropriate if 5% represents an accurate measure of the current interest rate, also known as the time value of money. The ordinary interest rate is often called the nominal interest rate to distinguish it from the real interest rate.

To discount a future loss projected in constant dollars, one should use a real interest rate as the discount rate. A real interest rate is an ordinary interest rate less an assumed rate of future inflation.38 In Table 1, the use of a 5% discount rate for discounting constant-dollar losses would be appropriate if the ordinary interest rate was 8% and the rate of inflation was 3%.39 Then the real interest rate would be 8% minus 3%, or 5%. The deduction of the inflation rate from the discount rate is the counterpart of the omission of escalation for inflation from the projection of future losses.

3. Is one of the parties assuming that discounting and earnings growth offset each other?

An expert might make the assumption that future growth of losses will occur at the same rate as the discount rate. Table 2 illustrates the standard format for this method of calculating discounted loss.

Table 2. Calculation of Discounted Loss When Growth and Discounting Offset Each Other

| Years in Future | Loss | Discount Factor | Discounted Lossa |

| 0 | $100 | 1.000 | $100 |

| 1 | 105 | 0.952 | 100 |

| 2 | 110 | 0.907 | 100 |

| Total | $300 | ||

| aDiscounted Loss = Loss × Discount Factor. | |||

When growth and discounting exactly offset each other, the present discounted value is the number of years of lost future earnings multiplied by the

38. Some experts rely on the real interest rate inferred from the price of TIPS (Treasury Inflation Protected Securities).

39. Technically, the formula is: (1 + real rate of interest) = (1 + ordinary rate of interest)/(1 + inflation). However, the difference is diminimus unless the ordinary rate of interest is high. Thus, using this formula, the real interest rate is 4.85%.

current amount of lost earnings.40 In Table 2, the loss of $300 is exactly three times the base year’s loss of $100. Thus the discounted value of future losses can be calculated by a shortcut in this special case. The explicit projection of future losses and the discounting back to the time of trial are unnecessary. However, the parties may dispute whether the assumption that growth and discounting are exactly offsetting is realistic in view of projected rates of growth of losses and market interest rates at the time of trial.

In Jones & Laughlin Steel Corp. v. Pfeifer,41 the Supreme Court considered the issue of escalated dollars with nominal discounting against constant dollars with real discounting. It found both acceptable, although the Court seemed to express a preference for the second format.

E. Are Losses Measured Before or After the Plaintiff’s Income Taxes?

A damages award compensates the plaintiff for lost economic value. In principle, the calculation of compensation should measure the plaintiff’s loss after taxes and then calculate the magnitude of the pretax award needed to compensate the plaintiff fully, once taxation of the award is considered. In practice, the tax rates applied to the original loss and to the compensation are frequently the same. When the rates are the same, the two tax adjustments are a wash. In that case, the appropriate pretax compensation is simply the pretax loss, and the damages calculation may be simplified by the omission of tax considerations.42

In some damages analyses, explicit consideration of taxes is essential, and disagreements between the parties may arise about these tax issues. If the plaintiff’s lost income would have been taxed as a capital gain (at a preferential rate), but the damages award will be taxed as ordinary income, the plaintiff can be expected to include an explicit calculation of the extra compensation needed to make up for the loss of the tax advantage. Sometimes tax considerations are paramount in damages calculations.43

40. Certain state courts have, in the past, required that the offset rule be used so as to avoid speculation about future earnings growth. In Beaulieu v. Elliott, 434 P.2d 665, 671–72 (Alaska 1967), the court ruled that discounting was exactly offset by wage growth. In Kaczkowki v. Bolubasz, 421 A.2d 1027, 1036–38 (Pa. 1980), the Pennsylvania Supreme Court ruled that no evidence on price inflation was to be introduced and deemed that inflation was exactly offset by discounting.

41. 462 U.S. 523 (1983).

42. There is a separate issue about the effect of taxes on the interest rate for prejudgment interest and discounting. See discussion infra Sections VI.G, VI.H.

43. See generally John H. Derrick, Annotation, Damages for Breach of Contract as Affected by Income Tax Considerations, 50 A.L.R. 4th 452 (1987) (discussing a variety of state and federal cases in which courts ruled on the propriety of tax considerations in damage calculations; courts have often been reluctant to award difference in taxes as damages because it is calling for too much speculation).

Example: Trustee wrongfully sells Beneficiary’s property at full market value. Beneficiary would have owned the property until death and deferred the capital gains tax.

Comment: Damages are the difference between the actual capital gains tax and the present value of the future capital gains tax that would have been paid but for the wrongful sale, even though the property sold at its full value.

In some cases, the law requires different tax treatment of loss and compensatory awards. Again, the tax adjustments do not offset each other, and consideration of taxes may be a source of dispute.

Example: Driver injures Victim in a truck accident. A state law provides that awards for personal injury are not taxable, even though the income lost as a result of the injury would have been taxable. Victim calculates damages as lost pretax earnings, but Driver calculates damages as lost earnings after tax.44 Driver argues that the nontaxable award would exceed actual economic loss if it were not adjusted for the taxation of the lost income.