Chapter 6

National Support for Emerging Industries

The appropriate role of public policy in promoting specific industries has been a source of passionate debate in the United States since the founding of the Republic.1 Many nations in Europe and Asia have not hesitated to use the full force of government to attain commercial competitive advantage in industries they regarded as strategic. In the United States, however, the idea of proactive government help for private industry in the name of economic development has sometimes raised concerns about distorting market forces and the wisdom of letting public servants “pick winners.” The debate began with Alexander Hamilton, who was an early advocate of “bounties” to encourage desirable industry, continued through the 19th century, and has resurfaced many times in the post-war era as U.S. industry confronted new competitive challenges. These policy debates have to some extent obscured actual practice, both in the United States and abroad.

In reality, the U.S. federal government has played an integral role in the early development of numerous strategic industries, not only by funding research and development but also through financial support for new companies and government procurement. Telecommunications, aerospace, semiconductors, computers, pharmaceuticals, and nuclear power are among the many industries that were launched and nurtured with federal support.

The intensifying global race to dominate an array of emerging hightech industries once again has focused attention on the role of public policy. As China, South Korea, Germany, and Taiwan target industries such as renewable energy equipment, solid-state lighting, electric vehicles, and next-generation

______________________

1 The link between national security and the need to develop key domestic industries was identified by Adam Smith, a contemporary of Hamilton, who noted that “if any particular manufacture was necessary, indeed, for the defense of the society it might not always be prudent to depend upon our neighbors for the supply.” Adam Smith, An Inquiry into the Nature and Causes of the Wealth of Nations, 1776.

displays with comprehensive strategies and generous subsidies, the U.S. has struggled to compete. The financial crisis of 2008 has made it even more difficult for U.S. technology companies to raise the capital needed to turn designs into prototypes and prototypes into products made in large volumes.

In recent years, the Science, Technology, and Economic Policy Board of the National Academies has extensively studied the competitive challenges facing a number of important high-tech industries. The STEP board also has studied the policies adopted other nations and compared them to those of the United States.

This chapter explores the major policy issues in four of these industries—semiconductors, photovoltaic products, advanced batteries, and pharmaceuticals. Each of these industries can be regarded as strategic to the United States. Integrated circuits are the building blocks of all electronics products and have enabled the breathtaking advances in information technology that drive productivity gains across all industries. American leadership in semiconductors also is vital to the technological superiority of the U.S. military. Photovoltaic cells are the enabling technology of solar power, a key source of renewable energy that can serve America’s national interests in reducing dependence on petroleum and cutting greenhouse gas emissions. Advanced batteries and their electrical management systems are the core components of hybrid and electric vehicles, much as internal combustion engines have been to conventional gasoline-powered cars and trucks. A strong domestic battery industry, therefore, is regarded as crucial to the future competitiveness of the U.S. auto industry. Lightweight, long-lasting, rechargeable energy-storage systems also are required for advanced weapons systems being developed by the U.S. military and for storing renewable energy for utility power grids. The pharmaceuticals industry is likewise strategic, producing medicines and vaccines that are essential to the well-being of Americans and indeed the world’s people. U.S. leadership in this sector has been secured through enormous federal investments, though the industry faces numerous challenges in terms of litigation, regulatory pressure, and counterfeit drugs.

Each of these three industries shares another characteristic. The core technologies are the fruits of decades of research at U.S. universities and national laboratories at considerable American taxpayer expense. Many of the early U.S. companies that pioneered these industries, moreover, were supported over the years through federal research grants, small-business loans, and government and military procurement.

As they reached the point of large-scale commercial production, each of these U.S. industries encountered severe global competitive challenges2. Concerted Japanese government policies to facilitate joint R&D, transfer

______________________

2 See Glenn Fong, “Breaking New Ground, Breaking the Rules—Strategic Reorientation in U.S. Industrial Policy,” International Security 25:2 pp 152ff.

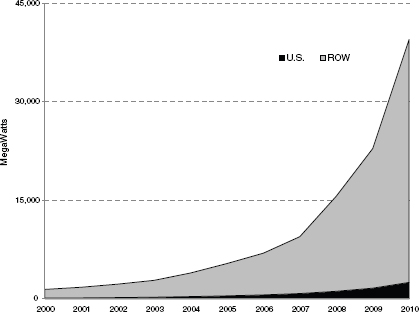

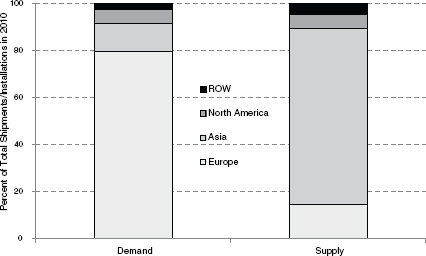

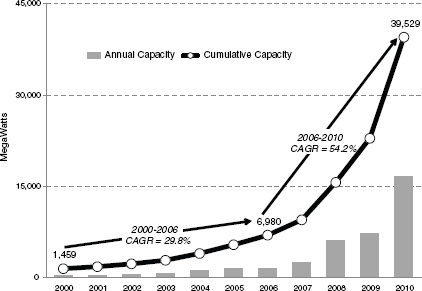

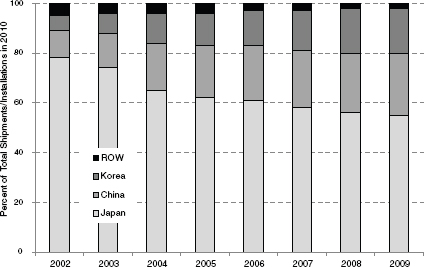

commercial technology to companies, protect domestic producers from imports helped Japanese companies in the 1970s and 1980s seize a commanding global market share in dynamic random-access memory chips, sending the U.S. semiconductor industry into crisis. U.S. companies dominated the nascent photovoltaic industry through the 1980s. Leadership in mass production of cells and modules, however, was assumed by Japan in the 1990s—and then Germany, Taiwan, and China—after each of these nations or regions enacted policies to build domestic markets for solar power or to promote manufacturing. The lithium-ion industry is one of several high-tech sectors that grew from U.S.-invented technology but was never industrialized domestically. Instead, Japanese companies were the first to mass-produce rechargeable lithium-ion batteries for electronic devices and notebook computers because of their largescale production of consumer electronics. South Korean and Chinese manufacturers followed their lead. Asian producers, therefore, have a huge advantage in the small but extremely promising market for rechargeable batteries for cars and trucks.

The four industries illustrate different aspects of the public policy debate. The U.S. semiconductor industry is a case study in how a strategic sector that had lost competitive advantage in production and a once-dominant market share was able to regain global leadership through cooperation on precompetitive R&D and public policy initiatives with responsive government actions. The public-private research consortium SEMATECH and assertive U.S. trade policies in response to Japanese dumping and protectionism enabled the industry rebound.

The photovoltaic industry is an example of a U.S. high-tech sector that has lost global share but has a solid opportunity to re-emerge as a leader with the right mix of federal and state policy support. In the case of solar power, a deciding factor will be whether the United States will become a big enough market to support a large-scale, globally competitive manufacturing industry. Federal and state incentives will be essential for the next few years, until the cost of solar energy can compete against electricity generated from fossil fuels without subsidies. Another question is whether U.S. companies that focus on products incorporating promising new technologies will be able to survive surging imports of low-cost photovoltaic cells and modules based on mature technologies long enough to attain economies of scale. What’s more, because technologies are still evolving rapidly, and there are not yet commonly accepted manufacturing standards, the global race for future leadership remains wide open. Public-private research partnerships will be essential to ensure that the U.S. can be a leader in the race for global market share.

The emerging U.S. advanced battery industry represents a bold experiment by the federal government in direct financial support of private companies to establish a domestic manufacturing industry. Prior to 2008, the

U.S. had a number of lithium-ion battery start-ups but virtually no production plants.3 It now has dozens of battery-related factories that are beginning to rampup, thanks in part to $2.4 billion in grants and support under the American Recovery and Reinvestment Act. Like photovoltaic cells, however, prices of lithium-ion auto batteries are too high, making hybrid and electric vehicles expensive for most consumers compared to conventional gasoline-powered vehicles. Larger demand, in turn, is required for the industry to attain the economies of scale that will bring prices down, in turn generating higher demand. In addition, further innovation is required to improve battery performance and reduce cost. Federal policies to support expansion of the market and public-private R&D collaboration will likely be required for the foreseeable future, but the long-term gain to the economy and national security can be significant.

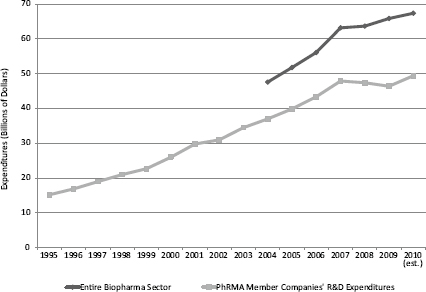

The ascent of the U.S. pharmaceutical industry has been driven by massive federal support for life sciences R&D, primarily by the National Institutes of Health (NIH). During the decade of 2001, U.S. firms developed 57 “new chemical entities” (NCEs) compared with 33 by European firms and nine by Japanese firms, erasing the European lead which existed in prior decades. Despite the spectacular successes of past two decades, the U.S. pharmaceutical industry’s future prospects are uncertain. Many of the blockbuster drugs that drove the industry’s success have gone off patent or will do so soon, including first-generation biotechnology drugs, and branded producers face growing competitive pressure from generic drug makers. The costs and risks of developing new drugs and bringing them to market are rising, while the productivity of the industry’s R&D appears to be declining. In light of key developments, especially in emerging markets, a key challenge is to sustain the productivity and competitiveness of this strategic U.S. industry.

A little more than two decades ago, the U.S. semiconductor industry appeared to be going the way of the U.S. consumer electronics industry. Japanese companies had seized a commanding world market share and technological lead in memory devices and were rapidly adding more production capacity. Struggling U.S. chipmakers were abandoning a large segment of the industry that made memory products, an essential part of computers and other leading semiconductor technologies of the eighties. There was widespread concern that erosion of America’s semiconductor industry posed not only economic challenges, but national security risks as well. Even after the U.S. government had begun to mount a strong policy response to bolster U.S.

______________________

3 “In 2009, the U.S. made less than 2 percent of the world’s lithium-ion batteries.” Jon Gertner, “Does America Need Manufacturing?” The New York Times, August 24, 2011.

competitiveness, a defense task force warned in 1987 that a dependence on foreign suppliers for state-of-the-art chips for weapons was an “unacceptable situation” because it would undermine the U.S. military strategy of maintaining technological superiority.4 This national security concern and the willingness of the semiconductor industry to collectively seek policy help from Washington were instrumental in reversing the loss of market share and technology lead that seemed irretrievably lost.

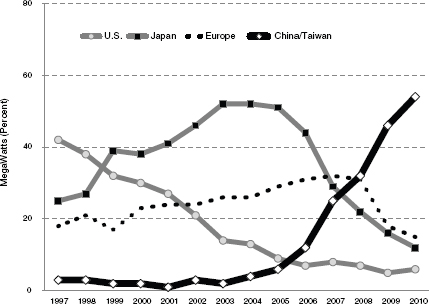

Remarkably, as recounted below, the U.S. semiconductor regained global leadership by the early -1990s and —despite the dramatic rise of new competitors in South Korea, Taiwan, and China—remains today a top semiconductor producer. Even though the U.S. market accounts for only 18 percent of the global sales for integrated circuits, sales by U.S. companies accounted for 48 percent of the world market in 2010.5 [See Figure 6.1] While only one U.S. company is still a major player in memory chips, the U.S. semiconductor industry dominates the lucrative market for logic devices such as microprocessors and analog mixed signal products.6

Moreover, despite rapid growth in outsourcing to Asian foundries (wafer fabrication factories that produce integrated circuits on a contract basis for other firms), the vast majority of production and R&D by U.S. semiconductor companies remains in the United States.7 Seventy-seven percent of capacity owned by America semiconductor companies is located in U.S. and 74 percent of compensation and benefits is paid to U.S.-based workers.8 And while the vast majority of chip companies now outsource fabrication of the devices they design to foundries located in Asia, approximately 500 of the world’s 1,200 so-called “fabless” design firms—including most of the industry leaders—are headquartered in North America.9

______________________

4 See U.S. Department of Defense, Report on Semiconductor Dependency, Office of the Undersecretary of Defense for Acquisition, prepared by the Defense Science Board Task Force, Washington, DC, February 1987.

5 Source: Semiconductor Industry Association citing data from based on World Semiconductor Trade Statistics data.

6 Micron Technologies, headquartered in Boise, Idaho, is the leading U.S. producer of computer memory chips.

7 For an analysis of semiconductor R&D has remained in the U.S. despite outsourcing of production, see Jeffrey T. Macher, David C. Mowery, and Alberto Di Minin, “Semiconductors,” chapter 3 in National Research Council, Innovation in Global Industries: U.S. Firms Competing in a New World, Jeffrey T. Macher and David C. Mowery, eds., Washington, DC: The National Academies Press, 2008.

8 Semiconductor Industry Association (SIA), Maintaining America’s Competitive Edge: Government Policies Affecting Semiconductor Industry R&D and Manufacturing Activity, March 2009. This report can be accessed at http://www.sia-online.org/galleries/defaultfile/Competitiveness_White_Paper.pdf.

9 Global Semiconductor Alliance, Industry Data at http://www.gsaglobal.org/resources/industrydata/facts.asp. The largest fabless companies include QUALCOMM, Broadcom, AMD, NVIDIA, and LSI.

FIGURE 6.1 Global market share of U.S. semiconductor companies, 19822010.

SOURCE: Semiconductor Industry Association.

NOTE: Share data based on nationality of company.

This turn of fortunes is primarily due to strategic moves and investments in new technologies by U.S. semiconductor manufacturers. Yet, their success also rests on the important contributions of U.S. policy that was driven by an engaged industry. There were two additional interrelated elements to the U.S. success:10 The research consortium SEMATECH, a $200 million-ayear research effort co-funded by the federal government and most large American chip companies, accelerated productivity and innovation in semiconductor manufacturing based on a common technology roadmap and

______________________

10 The recovery of the U.S. industry has been described as a three-legged stool. It is unlikely that any one factor would have proved sufficient independently. Trade policy, no matter how innovative, could not have met the requirement to improve U.S. product quality. On the other hand, by their long-term nature, even effective industry-government partnerships can be rendered useless in a market unprotected against dumping. Most importantly, neither trade nor technology policy can succeed in the absence of adaptable, adequately capitalized, effectively managed, technologically innovative companies.

enabled a rapid decline in prices.11 Persistent trade negotiations and enforcement of previous agreements won commitments from Japan to open its market to U.S. semiconductors and curtail dumping in any world market.12 This was deemed essential to prevent the United States from becoming a highpriced island in a sea of underpriced semiconductors. Had that occurred, it would have severely disadvantaged downstream American electronics equipment producers compared with competitors producing abroad utilizing lower-priced dumped chips.13

The decline and resurgence of the U.S. semiconductor industry offers many useful lessons for policymakers and industrialists grappling with how to bolster other American high-technology sectors facing intense international competitive pressure. It shows that erosion of U.S. leadership in manufacturing is not irreversible as long as both industry and government are committed to cooperative action, both on trade policy and in well-designed research programs that will lead to innovation. In a comprehensive analysis of the semiconductor experience, the National Research Council concluded that overcoming competitive challenges requires “continued policy engagement and public investment through renewed attention to basic research and cooperative mechanisms such as public-private partnerships.”14

______________________

11For analysis of the contributions of SEMATECH, see presentation by Kenneth Flamm of the University of Texas in National Research Council, Innovative Flanders: Innovation Policies for the 21st Century—Report of a Symposium, Charles W. Wessner, editor, Washington, DC: The National Academies Press, 2008. For a more extensive treatment, see Kenneth Flamm, “SEMATECH Revisited: Assessing Consortium Impacts on Semiconductor Industry R&D,” in National Research Council, Securing the Future, OP. CIT. See also, Peter Grindley, David C. Mowery and Brian Silverman. “SEMATECH and Collaborative Research: Lessons in the Design of High Technology Consortia, Journal of Policy Analysis and Management, 13(4) 1994, pp. 723-758.

12 In the U.S.-Japan Semiconductor Trade Agreement, signed on Sept. 2, 1986, Japan agreed to eliminate dumping of semiconductors following a U.S. Department of Commerce finding that Japanese producers sold memory chips in the U.S. at below the cost of production. Japan also agreed to open its market to foreign-made chips and to cease dumping in any market. In 1990, Japan signed a second bilateral trade agreement that provided U.S. producers with a “fast-track” process for addressing dumping allegations and promised to fulfill an earlier pledge that foreign producers achieve a minimum 20 percent share of the Japanese semiconductor market. This figure was chosen because it would give foreign producers access to the customer base of the six giant vertically integrated Japanese companies that controlled the Japanese market. The trade agreement was remarkable in that it did not close the U.S. market, but instead opened the previously closed Japanese markets and stopped dumping in third markets.

13 For a full description of the how Japan closed its market for all foreign semiconductor producers, see Thomas R. Howell, William A. Noellert, Janet H. McLaughlin, and Alan Wm. Wolff, The Microelectronics Race, Boulder, Colo., and London: Westview Press, 1988.

14 National Research Council, Securing the Future: Regional and National Programs to Support the Semiconductor Industry, Charles W. Wessner, editor, Washington, DC: The National Academies Press, 2003.

The Strategic Importance of Semiconductors

The importance of semiconductors to the United States is difficult to overstate. As an industry, the semiconductor sector directly employs over 180,000 Americans and has consistently ranked as either America’s No. 1 or No. 2 export industry.15 Semiconductors represent the core technology of the modern electronics revolution, enabling products from smart phones and computers to advanced weapons systems. More importantly, semiconductors have made possible the rapid advances in information technology that drive productivity gains across other industries. As one National Academies study noted—

“…often called the ‘crude oil of the information age,’ semiconductors are the basic building blocks of many electronics industries. Declines in the price/performance ratio of semiconductor components have propelled their adoption in an ever-expanding array of applications and have supported the rapid diffusion of products utilizing them. Semiconductors have accelerated the development and productivity of industries as diverse as telecommunications, automobiles, and military systems. Semiconductor technology has increased the variety of products offered in industries such as consumer electronics, personal communications, and home appliances.”16

The impact of semiconductor-based information technology has been so pervasive that many economists regard it as the catalyst behind the acceleration in productivity growth in the U.S. economy since the mid-1990s.17 Meeting critical national needs such as increased energy efficiency, lower-cost and improved health care services, and ubiquitous access to high-speed broadband data communications will depend on further advances in

______________________

15 Patrick Wilson, Director of Government Affairs, Semiconductor Industry Association, “Maintaining US Leadership in Semiconductors,” AAAS Annual Meeting, February 18, 2011.

16 This excerpt is taken from Jeffrey T. Macher, David C. Mowery, and David A. Hodges, “Semiconductors,” U.S. Industry in 2000: Studies in Competitive Performance, David C. Mowery, ed., Washington, DC: National Academy Press, 1999, p. 245.

17 For an analysis of the role of new information technologies in recent high productivity growth, often described as the New Economy, see Dale W. Jorgenson, “The Emergence of the New Economy” in Enhancing Productivity Growth in the Information Age, Dale W. Jorgenson and Charles W. Wessner, eds., Washington, DC: National Academy Press, 2007. Also see National Research Council, Measuring and Sustaining the New Economy, Report of a Workshop, D. Jorgenson and C. Wessner, eds., Washington, DC: National Academy Press, 2003, and Council of Economic Advisers, Economic Report of the President, H.Doc.107-2, Washington, DC: USGPO, January 2001.

semiconductors.18 Semiconductors also remain vital to national security, observes the Industrial College of the Armed Forces, because “they are the building blocks of the nation’s infrastructure and the space, communications, and weapons systems that allow the projection of American diplomatic, information, military, and economic power.”19

Continued American leadership in semiconductors certainly cannot be taken for granted, however. The industry faces a range of technological, financial, and competitive challenges. Among the most prominent—

• Declining share of capacity: U.S. semiconductor companies still invest billions of dollars in wafer fabrication facilities in the United States. But investment by manufacturers in Asia is expanding faster. The share of global installed wafer fabrication capacity in the United States declined from 42 percent in 1980 to about 16 percent in 2007.20 American semiconductor companies are investing a proportionately larger share of their total worldwide fabrication capacity spending outside of the United States. The share of spending in the United States for wafer manufacturing capacity has dropped by 14.6 percentage points between 1997-1999 and 2005-2007, from 78.5 percent to 63.9 percent.21 The Semiconductor Industry Association (SIA) expects the U.S. share to decline by another 9.3 percentage points by 2013.22 What’s more, only 14 percent of leading-edge capacity (300 mm wafers) is located in the United States. The largest market for state-ofthe-art manufacturing equipment is in Asia, principally South Korea, Taiwan and Japan.23

• Business and capital costs: As the cost of building new leading-edge wafer fabrication plants reach some $4 to $6 billion, factors such as tax rates and government incentives now heavily influence corporate

______________________

18 The RAND Corporation, for example, estimates that application of information technology in the health care sector could result in annual efficiency savings of $77 billion. See RAND Corporation, Health Information Technology: Can HIT Lower Costs and Improve Quality?, 2005, (http://www.rand.org/pubs/research_briefs/RB9136/index1.html). Also see Jorgenson, “The Emergence of the New Economy,” op. cit.

19 Industrial College of the Armed Forces, Electronics 2010, Industry Study Final Report, National Defense University, Spring 2010, (http://www.ndu.edu/icaf/programs/academic/industry/reports/2010/pdf/icaf-is-report-electronics2010.pdf).

20 SIA, Maintaining America’s Competitive Edge, op cit.

21 Ibid.

22 Ibid.

23 SEMI Industry Research and Statistics Group data.

decisions on where to build capacity. Countries such as Malaysia, India, Singapore, China, and Israel and regions such as Taiwan offer tax holidays or significantly reduced rates. Germany offers grants and loans to chip manufacturers. Federal and state tax breaks and other benefits offered in the U.S. are often either insignificant or noncompetitive,24 according to the SIA.

• Talent: The American semiconductor industry is becoming increasingly dependent on foreign-born R&D staff at a time when immigration rules have tightened and opportunities abroad are growing. More than 50 percent of students graduating from U.S. universities with master’s degrees and 70 percent of doctorates in science and engineering disciplines applicable to semiconductors are foreign nationals.25 Meanwhile, nations and regions such as India, China, and Taiwan are rapidly increasing their supply of semiconductor engineers. An inability of industry to hire top talent in the U.S. could lead to a greater shift of R&D offshore.

• Offshore R&D: Even though U.S. semiconductor companies conduct most of their R&D onshore, that proportion has declined by 8.4 percent points from 1997-1999 to the 2005-2007 period. Most of the work is going to Europe, Israel, and Singapore, and increasingly to Romania. Meanwhile, the outsourcing by American companies of chip fabrication to Asian foundries—plants that fabricate chips on a contract basis— means that semiconductor design can go to any place that has the best supply of engineers.26

• Competing Consortia: While federally funded U.S. research is under budget pressure, other nations have learned from the accomplishments of SEMATECH and have formed their own public-private partnerships aimed at becoming the first to commercialize next-generation semiconductor technologies. At the same time, the ability to continue improving the performance of integrated circuits along the path predicted by Moore’s Law27 through current transistor technology may be nearing its physical limits.28 The U.S. faces growing competition to develop technologies to replace silicon-based, CMOS semiconductors,

______________________

24 The U.S. currently offers a 9 percent manufacturing tax credit and a temporary R&D tax credit, although states such as New York offer sizeable incentives.

25 SIA, Maintaining America’s Competitive Edge, op cit.

26 Ibid.

27 Moore’s Law is based on the prediction by Intel co-founder Gordon Moore in 1965 that the number of transistors that can be placed inexpensively on an integrated circuit doubles every two years.

28 One recent development that could alter this view is Intel Corp.’s recent announcement that it had successfully demonstrated the world’s first 3-D transistor, called Tri-Gate, used in a 22nm microprocessor. Intel claimed its technology will “advance Moore’s Law into new realms.”

a challenge that Nanotechnology Research Institute Director Jeffrey Welser says is as dramatic as the replacement of vacuum tubes by semiconductors in the 1940s.29

These challenges must be addressed. “At some point,” the SIA warns, “without sufficient U.S. government support of basic R&D and supportive tax, immigration, and education policies, it may well prove to be very difficult if not impossible to reverse current trends.”30

Industry Growth and U.S. Policy

The federal government was at the outset deeply involved in the U.S. semiconductor industry. Indeed, as economist Laura Tyson observed in 1992: “The semiconductor industry has never been free of the visible hand of government intervention.”31

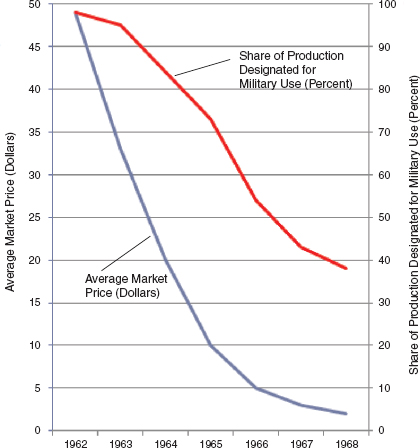

The U.S. Signal Corps was the prime funder of the R&D that led to development of the transistor and semiconductors for three decades and purchased most of the initial output. The military funded the first pilot production lines of Western Electric, General Electric, Raytheon, and Sylvania and construction of production capacity far in excess of demand. From the late 1950s through the early 1970s, the federal government funded between 40 to 45 percent of U.S. R&D in semiconductors.32 Military purchases of semiconductors enabled the industry to establish the scale that led to a dramatic drop in prices between 1962 and 1968,33 making them more practical for commercial use.

Japan’s entry into the dynamic random-access memory (DRAM) industry, backed by low-cost capital and a protected home market, resulted in dramatic increases in capacity and dumping of product on third-country markets. Some U.S. companies also lagged the Japanese competition in quality and productivity using the same equipment sets. The result was a reduction of the U.S. global share in this market from around 90 percent to less than 10 percent by 1985, and producers such as Intel, Advanced Micro Devices, and National

______________________

29 Testimony by Jeffrey Welser, Nanoelectronics Research Initiative director, before the House Committee on Science, Space, and Technology’s Subcommittee on Research and Science Education, April 14, 2011, http://science.house.gov/sites/republicans.science.house.gov/files/documents/hearings/Welser%20Testimony%20FINAL.pdf).

30 SIA, Maintaining America’s Competitive Edge, op. cit.

31 Laura D’Andrea Tyson, Who’s Bashing Whom? Trade Conflict in High Technology Industries, Washington, DC: Institute for International Economics, 1992.

32 A concise history of U.S. government involvement in establishment of America’s electronics industry is found in Kenneth Flamm, Mismanaged Trade?: Strategic Policy and the Semiconductor Industry, Washington, DC, Brookings Institution, 1996. pp. 27-38.

33 Defense Science Board, “High Performance Microchip Supply,” 2005.

FIGURE 6.2 Government procurement as a catalyst for semiconductor development

SOURCE: Defense Science Board, “High Performance Microchip Supply,” 2005.

Semiconductors were driven from the DRAM business.34 The loss of market leadership in DRAMs was considered a major setback for the U.S. industry,35

______________________

34For a discussion of American competitiveness challenges in the 1980s, See Laura Tyson, Who’s Bashing Whom? Trade Conflict in High Technology Industries, Washington, DC: Institute for International Economics, 1992. Also see Clyde Prestowitz, Trading Places: How We are Giving Away our Future to Japan and How to Reclaim It, New York: Basic Books, 1988.

especially because the high-volume memory devices were process technology drivers for the industry. The scale of production of the high-volume commodity DRAM chips justified investment in new process technologies and wafer fabrication facilities that could then also be used for lower-volume integrated circuits.

The impact of these policies and trade practices convinced the industry that it needed government policy support. By the early 1980s, the U.S. industry was in crisis and reached out to the federal government for help. The industry argued that Japan violated rules of the General Agreement on Tariffs and Trade as a consequence of trade and industry policy coordinated by Japan’s Ministry of International Trade and Industry (MITI) and supported by NTT.36 The industry also blamed Japanese government toleration of anticompetitive practices of Japanese companies. Reflecting growing concern for the health of the industry, the Defense Science Report in 1987 cited declining U.S. market share in semiconductors as a national security concern.37 By that time, the U.S. government had put into place the measures that were to improve the competitive position of U.S. producers to counter Japan government’s industrial policies.

The first step was to shore up research and enable U.S. companies to collaborate. In 1982, the semiconductor industry formed and funded the Semiconductor Research Corporation, an independent affiliate of the SIA, to conduct silicon-based research at universities. Two years later, President Ronald Reagan signed the National Cooperative Research Act, which reformed U.S. antitrust law to encourage joint R&D consortia.38 The Microelectronics and Computer Technology Corp., a privately funded industry consortium, was established in response to Japan’s government-funded “Fifth Generation” R&D program that aimed to put Japanese computer makers at the leading edge of technology. This first U.S. semiconductor consortium had a menu of projects that members could choose to fund and participate in, but was viewed as a failure and shut down in 2001.39

SEMATECH was the second and more successful consortium. At the

______________________

35 See Andy Procassini, Competitors in Alliance: Industry Associations, Global Rivalries, and Business-Government Relations, New York: Greenwood Publishing, 1995.

36 For an account of Japanese trade practices, see Prestowitz, op. cit. MITI and Nippon Telephone and Telegraph had worked with the large vertically integrated Japanese producers to move at least a generation ahead of their Western competitors in the production of DRAMs.

37 Department of Defense, Report on Semiconductor Dependency, op. cit.

38 For an account of the evolution of U.S. semiconductor research policy, see Kenneth Flamm presentation in National Research Council, 21st Century Innovation Systems for Japan and the United States: Lessons from a Decade of Change, Sadao Nagaoka, Masayuki Kondo, Kenneth Flamm, and Charles W. Wessner, eds., Washington, DC: The National Academies Press, 2009. Also see Kenneth Flamm and Qifei Wang, “SEMATECH Revisited: Assessing Consortium Impacts on Semiconductor Industry R&D,” in National Research Council, Securing the Future, op. cit.

39 Flamm, ibid.

recommendation of industry and the Defense Science Board, Congress in 1987 voted to match industry contributions for precompetitive research in a non-profit consortium. SEMATECH corporate members consisted of all of the largest device makers at the time, including IBM, Intel, Motorola, Texas Instruments, Hewlett Packard, and National Semiconductor. Former Intel chairman Gordon Moore described the organization as unique in that industry made sure that U.S. companies assigned top people to a public-private partnership.40 The strategy was to have SEMATECH focus on fabrication equipment and processes so that semiconductor companies could focus on design, quality, and innovation. The consortium included major initiatives in critical processing technologies, such as lithography, furnace and implant, plasma etch, and deposition. The SIA also coordinated government, industry, and academia to produce a roadmap guiding research and development and oversaw implementation of research.

SEMATECH is widely perceived as effective in accomplishing its goals and making a contribution to the U.S. semiconductor industry’s resurgence. By 1993, the U.S. industry had regained leadership in world market share in semiconductors.

A National Research Council analysis found that the consortium “played an integral role in promoting effective manufacturing technology in the semiconductor industry.” 41 SEMATECH also helped the equipment industry develop reliable, standardized chip-manufacturing tools, particularly in lithography. SEMATECH is credited with reducing R&D duplication by its members, thus lowering costs and freeing funds for additional investment.42

SEMATECH also helped achieve the original goals of the DOD to preserve access to state-of-the-art, low-cost chips from domestic commercial sources.43 In a subsequent review, a defense task force labeled the consortium “a resounding success.”44

______________________

40 For a first-hand account of the formation of the SEMATECH consortium, see Gordon Moore, “The SEMATECH Contribution,” in National Research Council, Securing the Future: Regional and National Programs to Support the Semiconductor Industry, C. Wessner, ed., Washington, DC: The National Academies Press, 2003. Also see Larry D. Browning and Judy C. Shetler, SEMATECH: Saving the U.S. Semiconductor- tor Industry, College Station: Texas A&M University Press, 2000. For a view from the Semiconductor Industry Association at that time, see also Procassini, op. cit.

41 Securing the Future, op. cit. In particular, see Gordon Moore presentation in that volume.

42 Flamm and Wang, op. cit.

43 See Jacques Gansler, Defense Conversion: Transforming the Arsenal of Democracy, Cambridge, MA: MIT Press, 1995. See also the presentation by Paul Kaminski, then Under Secretary of Defense for Technology and Acquisition, in National Research Council, International Friction and Cooperation in High-Technology Development, Washington, DC: National Academy Press, 1997. Dr. Kaminski points out that tighter linkage with commercial markets shortens cycle time for weapons-systems development and reduces the cost of inserting technological improvements into DoD weapons systems. By placing greater reliance on commercial sources, the DoD can field technologically superior weapons at a more affordable cost.

44 Department of Defense, “SEMATECH 1987-1997: A Final Report to the Department of Defense,” Defense Science Board Task Force on Semiconductor Dependency,” February 21, 1997.

Rapid advances in semiconductors, in turn, enabled dramatic innovation in information technology that resulted in robust industries and higher productivity growth.45 The Securing the Future report observed: “SEMATECH’s record of accomplishment was achieved in no small part through the flexibility granted its management and the sustained support provided by DARPA, the public partner, complemented by the close engagement of its members’ senior management and leading researchers.”46

Perhaps the clearest measure of SEMATECH’s success is that corporate members in 1994 agreed to continue the consortium without further government financial help, except for a $50 million grant by the DoD. Foreign companies have since joined SEMATECH, which became an international consortium in 1999, and other governments have established similar programs— often on a larger scale with greater political support. (See descriptions of several of these programs below).

International SEMATECH remains active, and has broadened its activities to design, materials, testing, and packaging technologies. Among other activities, it funds development of new 300-mm tools and continues to pursue technology roadmaps. Initiatives include mask-making tools and next-generation lithography using very-short-wavelength violet light from a special laser. Other U.S. industries, such as optoelectronics and nanotechnologies, also have emulated the SEMATECH model.47

State-of-the-art manufacturing process technologies and yield improvements were not the only elements that helped restore the U.S. semiconductor industry to health. An assertive U.S. response to Japanese trade practices that began in the mid-1980s also helped stem and then reverse the decline of the American semiconductor industry. In response to Japanese dumping and protection of its own market,48 the United States and Japan

______________________

45 Council of Economic Advisers. Economic Report of the President, Washington, DC: Government Printing Office, 2001.

46 Securing the Future, op. cit.

47 Flamm and Wang, op. cit. In April 2011, the school received a $57.5 million Department of Energy grant to become the base of the U.S. Photovoltaic Manufacturing Consortium, a partnership that includes SEMATECH and the University of Central Florida. See College of Nanoscale Science and Engineering news release, April 5, 2011 (http://www.albany.edu/news/12770.php).

48 See Prestowitz, op. cit, for an inside account of early U.S.-Japan trade conflicts over semiconductors. Also see Kenneth Flamm, Mismanaged Trade? Strategic Policy and the Semiconductor Industry, Washington, DC: Brookings Institution Press, 1996. Prestowitz co-chaired a U.S. Japan High Tech Work Group set of discussions, a largely fruitless exchange of views between the U.S. and Japan during his term of government service, but this allowed time for further industry research into the nature of Japan’s market closure and was a useful step in obtaining U.S. government understanding of the problem and action several years later. He was also instrumental in getting the Department of Commerce to self-initiate an antidumping case that provided needed leverage to obtain an end to the dumping of chips by Japan.

initiated a bilateral working group on high technology in 1983 to address trade conflicts. Two years later, the two nations agreed to completely eliminate tariffs on imported semiconductors. The SIA filed a Section 301 petition alleging that the Japanese government kept out imported chips through non-tariff barriers. In 1986, the U.S. Department of Commerce concluded that Japanese semiconductor firms were selling memory chips in the U.S. market at prices substantially below the cost of production. Together with the injury caused to U.S. industry, this warranted a finding of dumping. The further finding by the U.S. Trade Representative in 1987 that Japan had still not opened it market for foreign products and had breached its antidumping commitment prompted President Ronald Reagan to impose a 100 percent duty on $300 million worth of Japanese goods.49

The two nations reached an unprecedented agreement in 1986 under which Japan pledged that imported chips would account for 20 percent of its domestic market.50 The number was chosen because Japan’s integrated producers of semiconductors, who were at the same time large semiconductor consumers, accounted for only 13 percent of Japanese consumption of semiconductors. A 20 percent goal required that Japanese producers and the Japanese government allow access to a customer base beyond the big vertically integrated Japanese producers. Japan also agreed to a “fast-track” approach to resolving dumping allegations. In return, the U.S. dropped anti-dumping duties and its Section 301 case. By late 1992, the Japanese market was open to competitive foreign products, and foreign chips did indeed account for 20.2 percent of Japan’s market.51

The series of U.S. Japan Semiconductor Agreements “was a pivotal point in the recovery of the U.S. semiconductor industry and its return to global leadership,” said Semiconductor Industry Association President George M. Scalise.52 Antidumping cases provided a means for companies like Intel to stay in the production of erasable programmable read only memories (EPROMS), which allowed it to progress to the production of flash memory. The U.S.-Japan Semiconductor Agreements also enabled Texas Instruments and Micron Technologies to stay in the DRAM business and gave South Korea and Taiwan

______________________

49 Proclamation 5631 by President Ronald Reagan, “Increase in the Rate of Duty for Certain Articles from Japan,” April 17, 1987. The details of penalties were provided in an April 22, 1987 annex to the Federal Registry.

50 The original target amount committed to was in a side letter to the agreement.

51 For a discussion of the Semiconductor Trade Agreement, see National Research Council, Hamburg Institute for Economic Research, and Kiel Institute for World Economics, Conflict and Cooperation in National Competition for High-Technology Industry, Washington, DC: National Academy Press, 1996. Andrew A. Procassini, Competitors in Alliance: Industry Associations, Global Rivalries, and Business-government Relations, Westport, CT: Quorum Books, 1995.

52 Interview with Semiconductor Industry Association President George Scalise.

an opportunity to enter the memory market. Creation of a competitive multiple vendor base, in turn, spurred the production of ever more powerful personal and mainframe computers at diminishing cost and fueled the information technology revolution. Also, the agreements allowed Intel and other companies to pursue more attractive opportunities in devices such as microprocessors.53 The trade pacts with Japan are widely credited with giving the U.S. and foreign industries breathing room to adjust and regain the profitability needed to invest in advanced capacity and new technologies. Notably, by 2010, five of the top 10 semiconductor producers in the world were based in the United States, compared to two from Japan.54 [See Table 6.1] The agreements also enabled some U.S. manufacturers to make the transition from commodity memory products to new types of highly specialized products. In short, intervention to end Japan’s market closure and the restoration of the U.S. industry produced a worldwide burst of innovation that has never slowed.

The United States has a number of other public-private research collaborations addressing technological challenges under the umbrella of the Semiconductor Research Corp. Since its founding, the SRC has managed more than $1.2 billion in research funds, supported 2,000 faculty and 9,000 students at 257 universities, and produced 373 patents.55 One of the most extensive programs is the Nanotechnology Research Initiative (NRI), which seeks to advance technologies that ultimately can replace complementary metal-oxide semiconductor (CMOS) technology,56 the digital design style and set of

______________________

53 Dale A. Irwin, “The Politics and the Semiconductor Industry,” in Anne O. Kreuger, editor, The Political Economy of American Trade Policy, Chicago: University of Chicago Press, 1996. Few if any academics understood the dangers posed for the IT revolution due to Japan’s dumping and market closure. Nor could the participants in the bilateral U.S.-Japan Semiconductor Agreement negotiations foresee how these agreements would expand to cover all major semiconductorproducing countries and industries, create a tariff-free global trade environment for semiconductors, and encourage full cooperation toward shared environmental and energy-saving goals. For a short description of these new arrangements, see the World Semiconductor Council Web site and the series of conclusions reached by the six-nation Government and Association meeting on Semiconductors, and the tariff agreement on multi-component chips (MCPs) announced by then USTR and now Ohio Senator Rob Portman.

54 Two of the five U.S. companies (Qualcomm and Broadcom) are “fabless” producers, companies that develop and design integrated circuits but contract the production out to “foundries,” or contract fabrication facilities run by other companies.

55 Welser testimony, op. cit.

56 Complementary metal-oxide-semiconductor (CMOS) refers to a style of digital circuitry design and process used to implement the circuitry. CMOS is the most common technology used in verylarge-scale integrated circuits, such as microprocessors, static random-access memory devices, and microcontrollers. In CMOS devices, power is drawn by switching transistors between on and off stages. The devices have gates, typically of polysilicon or metals. The technology allows a high density of logic functions.

processes used in very large-scale integrated circuits such as microprocessors. Industry experts say that at some point, the extreme miniaturization of transistors—the basic building block within an integrated circuit—results in undesirable quantum effects that inhibit performance of the device.57 Today’s most advanced semiconductors contain billions of transistors.58

The Nanotechnology Research Initiative: The NRI, which receives funding through the National Science Foundation and NIST, supports four institutes—each based at universities—that pursue high-risk, pre-commercial research on technologies that are likely to result in commercial products within the next decade. Each institute, which brings together its own partnerships of universities, focuses on different approaches to developing devices cable of replacing CMOS in logic chips by 2020.59 Corporate members GlobalFoundries, IBM, Intel, Micron Technology, and Texas Instruments, as well as the states where the centers are based, also contribute funds.

The Western Institute of Nanoelectronics (WIN), for example, is led by the University of California at Los Angeles and includes UC Berkeley,

TABLE 6.1 Top Ten Semiconductor Companies in 2010 by Sales

| Rank | Company | 2010 Revenue (Billions of Dollars) | Country |

| 1 | Intel | 40.4 | U.S. |

| 2 | Samsung | 27.8 | Korea |

| 3 | Toshiba | 13.0 | Japan |

| 4 | Texas Instruments | 13.0 | U.S. |

| 5 | Renesas | 11.9 | Japan |

| 6 | Hynix | 10.4 | Korea |

| 7 | STMicroelectronics | 10.3 | France/Italy |

| 8 | Micron Technology | 8.9 | U.S. |

| 9 | Qualcomm | 7.2 | U.S. |

| 10 | Broadcom | 6.7 | U.S. |

| SOURCE: iSuppli, “Samsung Closes in on Intel for Semiconductor Market Leadership in 2010,” April 19, 2011. NOTE: Sales based on vendor. Foundries not included. |

|||

______________________

57 The physical limits of transistor size was described in Paul A. Packan, “Pushing the Limits: Integrated Circuits Run Into Limits Due to Transistors,” Science, September 24, 1999.

58 The coming generation of advanced chips will have line widths of 22nm.

59 The mission statement and research objections of the Nanotechnology Research Initiative are found on the Semiconductor Research Corporation Web site at http://www.src.org/program/nri/about/mission/.

UC Santa Barbara, and UC Irvine. WIN focuses on nano-magnetic circuits, spin wave devices, spin torque logic, and SpinFET. The Institute for Nanoelectronics Discovery (INDEX) based at the University of Albany in New York, partners with schools such as MIT, Purdue, and Harvard. INDEX conducts research on a wide range of topics, such as new nanomaterials and atomic-scale fabrication technologies. Among other things, the INDEX consortium is studying the use of graphene to transmit electrons. Graphene is a strong, flexible atom-thick carbon material that are capable of carrying 1,000 times the density of electric current as copper wires, which researchers believe could lead to a new generation of super-fast, super-efficient electronics.60 The Midwest Institute for Nanoelectronics Discovery (MIND), based at Notre Dame, concentrates on energy-efficient devices and systems. The Southwest Academy of Nanoelectronics (SWAN), led by the University of Texas at Austin, focuses on the Bilayer Pseudospin Field Effect Transistor, which the SRC describes as a promising graphene-based device in terms of power consumption and speed.61

The Focus Center Research Program: The SRC oversees a number of other semiconductor-related research initiatives. The Focus Center Research Program, funded by $40 million from the DoD and industry contributions and run by SIA affiliate Microelectronics Advanced Research Corp. (MARCO), is devoted to pushing CMOS technology to its limits. The Focus Center program, supported by the Defense Advanced Research Projects Agency, involves 41 universities, 33 faculty, and 1,215 doctoral students.62 The guiding philosophy of MARCO is to have universities control research projects, back them with significant funding, train top students, and encourage “out of the box” approaches to technical problems.63 The Global Research Collaboration, another initiative of the SRC, funds R&D projects that address everything from sub-32 nm mixed-signal manufacturing processes and computer-aided design to advanced circuit and systems design. The new National Institute for Nanoengineering, based at Sandia National Laboratories, explores nano-enabled solutions to technologies that address various critical national challenges.

Today’s Competitive Challenges

The competitive landscape has changed dramatically since the 1980s. The market is increasingly global, as are the locations of supply among the U.S., Japan, South Korea, Taiwan, the EU and China. Important new pools of

______________________

60 Holly B. Martin, “Miracle Material: Two-Dimensional Graphene May Lead to Faster Electronics, Stronger Spacecraft and Much More,” National Science Foundation Web site, May 19, 2011, accessed at http://www.nsf.gov/discoveries/disc_summ.jsp?cntn_id=119493&WT.mc_id=USNSF_1.

61 Semiconductor Research Corp. Web site.

62 Semiconductor Research Corp. data.

63 See Securing the Future, op. cit.

engineering talent are emerging. Decisions on where to build capacity are heavily influenced by government incentives. In addition to commodity memory chips, the new market-share battles are also fought on the basis of design and innovation. The coming technology transition has launched a new global R&D race. Government policy will loom large in determining the winners and losers. The following are some of the new challenges facing policymakers.

Declining U.S. Share of Global Capacity in the United States

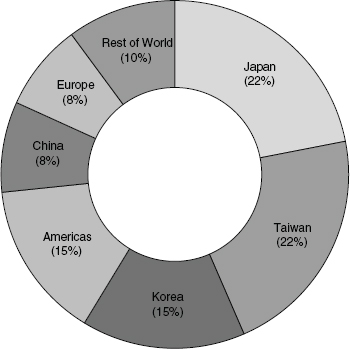

The share of global production capacity located in the United States continues to decline. In 1980, 42 percent of worldwide fabrication capacity was located in the United States. That dropped to 30 percent in 1990 and reached 16 percent in 2007.64 IC Insights, a market research firm for the semiconductor industry, estimated that the share of installed wafer fabrication capacity in the Americas (primarily the United States) was 14.7 percent in 2010.65 [See Figure 6.3] Japan and Europe also lost share over the same period.

The rapid expansion of Asian semiconductor companies and offshore investment by U.S. companies are behind the shift. South Korea and Taiwan have been the largest gainers, led by Samsung and Hynix for South Korea and Taiwan Semiconductor Manufacturing Corp and UMC for Taiwan.66 Both Taiwanese companies are foundries. Samsung, one of the largest integrated device manufacturers, also entered the foundry business in 2005. Significantly, the vast majority of new leading-edge 300mm wafer fabrication capacity is being installed in Asia, an estimated 80 percent in 2011 and a forecasted 70 percent in 2012.67

The U.S. is drawing some important new investment. In 2009, GlobalFoundries, the former manufacturing operations of AMD and Chartered Semiconductor and 86 percent owned by Abu Dhabi’s Advanced Technology Investment Co., began construction of a $4.6 billion 300mm fab in Malta, NY,

______________________

64 SIA analysis of data from SEMI Industry Research and Statistics Group and Robert C. Leachman and Chien H. Leachman, “Globalization of Semiconductors,” in Martin Kenney and Richard L. Florida (eds.), Locating Global Advantage: Industry Dynamics in the International Economy, Palo Alto, Calif.: Stanford University Press, 2004.

65 IC Insights, “Taiwan to Pass Japan as Largest Source of IC Wafer Fab Capacity,” Research Bulletin, November 11, 2010.

66 The history of ITRI’s role in establishing Taiwan’s semiconductor industry is addressed below. The U.S. investigated brought a countervailing duty case against South Korean DRAM producer Hynix in response to allegations that the South Korean government had subsidized the company’s exports by orchestrating a financial bailout. The dispute was dropped without punitive duties being assessed.

67 Paul Dempsey, “Foundry Overcapacity – Yes, It Could Happen,” Tech Design Forum, June 20, 2011. The data cited in the article are from Gartner Dataquest. Article at http://www.techdesignforums.com/eda/eda-topics/design-to-silicon/foundry-overcapacity-–-yes-itcould-happen/.

FIGURE 6.3 Estimated integrated circuit wafer fabrication installed capacity by region – July 2010.

SOURCE: IC Insights, “Taiwan to Pass Japan as Largest Source of IC Wafer Fab Capacity,” Research Bulletin, November 11, 2010.

not far from the College of Nanoscale Science and Engineering at the University of New York at Albany. This facility will be able to produce 60,000 wafers per month with line widths of 28nm and below.68 The plant will deploy a technology called High K Metal Gate developed with IBM, Samsung, Infineon, and other partners that it claims far exceeds the capabilities of competing foundries. The company is seeking further financial aid from the state of New York to expand the plant.69 Intel announced in 2009 that it intends to invest $7 billion to upgrade

______________________

68 GlobalFoundries Web site. See also Chapter 7 of this report.

69 Drew Kerr, “GlobalFoundries Seeks New Incentive Money From State to Expand Operations,” PostStar, March 26, 2010.

existing plants in Oregon, Arizona, and New Mexico to produce next-generation 32nm chips.70

Capital spending by U.S. semiconductor companies on new or upgraded wafer plants rose by 10.6 percent from 1997-1999 to 2005-2007.71 Yet the portion of total investment in the United States slid from 78.5 percent to 63.9 percent over that period.

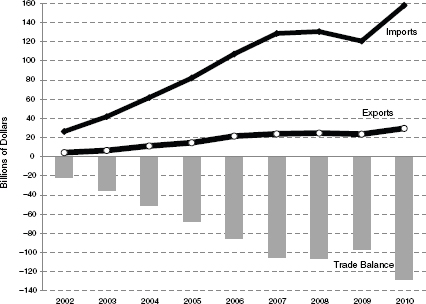

China is rising fast as a semiconductor consumer and producer, although the vast majority of production in China is still carried out by foreign semiconductor firms.72 Sales of integrated circuits produced in China reached 144 billion yuan ($21.3 billion) in 2010,73 which represented about 7.6 percent of total world integrated circuit sales in 2010.74 Because labor constitutes a small share of semiconductor manufacturing cost, China’s low wages are not a significant advantage. Rather, its advantages are access to low-cost capital and government policies aimed at leveraging China’s immense domestic market.75 Chinese consumption of semiconductors has grown at a 25 percent compound annual rate since 2001, four times faster than total worldwide consumption, and has represented 43 percent of global sales growth since 2003.76 Since 2009, China has become the largest consumer of semiconductors because approximately one-quarter of the world’s electronic products are assembled there by foreign-invested enterprises. Most of these products, once assembled, are then exported by foreign-invested factories as finished goods.77 Thus, approximately two-thirds of chips sold in China go into electronics products that are exported, such as mobile phones, personal computers, color TVs, and digital cameras.78 Most chips have to be imported because China does not produce many of these sophisticated semiconductor devices. This has led to a large and growing Chinese trade deficit in integrated circuits, which reached $128 billion in 2010. [See Figure 6.4] From 2008 through 2010, China’s imports of integrated circuits have exceeded its oil imports. Domestic demand is growing

______________________

70 Nicholas Kolakowski, “Intel Investing $7 Billion in Manufacturing Facilities,” eWeek, Feb. 10, 2009.

71 SIA, Maintaining America’s Competitive Edge, op. cit.

72 PricewaterhouseCoopers estimates that “there is no Chinese company within the top 50 suppliers to the Chinese semiconductor market.” PricewaterhouseCoopers, Global Reach: China’s Impact on the Semiconductor Industry 2010 Update, November 2010, p. 14, (http://www.pwc.com/gx/en/technology/assets/china-semicon-2010.pdf).

73 “China to Boost IC Sector as ‘State Strategy’,” Xinhua, April 16, 2011. China IC sales data from MIIT.

74 WSTS IC sales for 2010 were $278.52 billion. Total semiconductor sales (ICs plus discretes) were $298 billion. WSTS, “WSTS Projects Semiconductor Market to Grow by 7.6 Percent to $338.4 Billion in 2012,” Press Release, June 7, 2011.

75 SIA, Maintaining America’s Competitive Edge, op. cit.

76 PricewaterhouseCoopers, Global Reach, Ibid.

77 Ulrich Schaefer, “Semiconductor Market Forecast 2010-2013,” WSTS European Chapter, EECAESIA & WSTS, December 1, 2010.

78 PricewaterhouseCoopers, Global Reach, Ibid.

rapidly as well, including advanced devices required for weapons systems and telecommunications.

Most Chinese wafer fabs are several generations behind those of Japan, South Korea, Taiwan, and the United States. Only 27 percent of the new or committed capacity in China is for 300mm wafers, compared to a global average of 45 percent. Most will produce 6-inch or 8-inch wafers.79 As businesses, moreover, many of China’s semiconductor manufacturers have met with mixed success. In the first quarter of 2009, capacity utilization in China sank to 43 percent, the lowest level since 2000 and dramatically below the 92 percent utilization rate of mid-2004.80 Most Chinese fabs are foundries. Because most use mature technology, they cannot fabricate the most advanced chips and instead make thin-margin, commodity devices. As a result, many Chinese chip manufacturers have not earned the high profits required to invest in nextgeneration wafer fabs. Some analysts believe that China’s strategy has “collapsed.”81

It is important to note that there is more to China’s semiconductor strategy than just investment in Chinese-owned fabs or inducing foreign manufacturers to produce chips in China. The government also has introduced programs to deploy Chinese-owned intellectual property. The Ministry of Information Industry has announced a goal that China become 70 percent selfsufficient in integrated circuits used for information and national security and 30 percent for those used in communications and digital household appliances. 82 One of the government’s goals, to have all Chinese supercomputers use Chinese-made central processors, reached a milestone in late 2011 when China’s National Supercomputer Center in Jinan unveiled its first supercomputer, the Sunway BlueLight MPP, based entirely on Chinese microprocessors.83

The Chinese government still regards developing a globally competitive semiconductor industry as a high strategic priority. As part of its “indigenous innovation drive,” the government also is offering generous incentives to convince multinationals to build advanced capacity in China. In 2007, Intel agreed to build a 300 mm wafer fab in the coastal city of Dalian for chip sets. China’s glut in capacity also means that it is in a strong position to gain substantial share in chips and other silicon-based devices that do not require

______________________

79 Ibid.

80 Dylan McGrath, “China’s Fab Utilization Sinks to 43%, says iSuppli,” EE Times, April 20, 2009.

81 See for example, iSuppli analyst Len Jelinek quoted in McGrath, Ibid.

82 Ministry of Information Industry, “Outline of the 11th Five-Year Plan and Medium-and-LongTerm Plan for 2020 for Science and Technology Development in the Information Industry,” Xin Bu Ke [2006] No. 309, posted on ministry website August 29, 2006.

83 John Markoff, “China Has Homemade Supercomputer Gain,” The New York Times, Oct. 28, 2011. See also Alan Wm. Wolff, testimony before the U.S. China Economic and Security Review Commission, Washington, DC, May 4, 2011.

FIGURE 6.4 China trade in integrated circuits, 2002 to 2010.

SOURCE: United Nations, UN Comtrade database. Accessed at

<http://comtrade.un.org/db/dqQuickQuery.aspx>.

NOTE: Commodity code HS 8542 used to calculate trade values.

the most advanced technology, such as photovoltaic cells and light-emitting diode chips for solid-state lighting.84

Asia will likely remain the largest market for leading-edge semiconductor manufacturing equipment. Because process R&D and wafer fabrication are closely linked, moreover, the continued erosion of U.S. market share in wafer fabrication capacity could eventually give the technological advantage to nations that are investing more aggressively in state-of-the-art capacity. For this reason, U.S. industry leaders say, it is important that tax and regulatory measures be taken to encourage chip companies to build new and next-generation wafer fabs in the United States.85

______________________

84 China had an estimated 62 manufacturers of light-emitting diode chips as of 2010. LEDinside, “Ranking of LED Chip Manufacturers in China—Report on China’s LED Epitaxy Industry,” 2009.

85 SIA, Maintaining America’s Competitive Edge, op. cit.

Competition for Financial Incentives

The soaring cost of fabricating chips has made financial incentives an important determinant of where new capacity is built. Tax breaks, grants, lowcost loans, free land and other incentives typical defray $1 billion of a plant’s cost over a 10-year period. The SIA maintains—

“As a practical matter, any U.S. semiconductor management answerable to its shareholders must establish a new fab in a location that offers this type of incentive package or risk becoming less competitive vis-à-vis a competitor who receives such incentives. In other words, government incentives play a decisive role in determining the geographic location of advanced wafer fabrication facilities, and thus indirectly determine the location of the process R&D associated with that facility.”86

Nations and regions such as India, Israel, Malaysia, China, Taiwan and Singapore offer complete five- to 10-year tax holidays for corporate profit taxes or sharply reduced rates for R&D and for plant construction spending. Germany and other governments offer direct grants, project equipment, and central and state government loans and loan guarantees to semiconductor manufacturers. The German federal government and the state of Saxony, for example, covered the total construction cost of AMD’s “Fab 36” to produce 45nm and 65nm 300mm wafers in Dresden in 2004. Government agencies also provided $798 million in cash and allowances, a loan guarantee of 80 percent of losses sustained by lenders, and further funds for expansion.87 The Israeli government offered more than $1 billion in aid, including a $525 million grant, for Intel’s 300 mm plant in Kiryat Gat in 2005, plus $660 million in the form of tax benefits to upgrade another fab. Intel said the grants were pivotal in deciding to build the plant in Israel.88

Some U.S. states have offered generous incentives nearly matching those of foreign governments. New York, for instance, awarded incentives worth $660 million over 10 years to persuade IBM to build a new $2.5 billion wafer fab in Fishkill N.Y., in 2001.89 The state also awarded $1.2 billion in cash and tax incentives to GlobalFoundries, 86 percent owned by Abu Dhabi’s Advanced Technology Investment Co., to build a $4.6 billion fab in Malta, N.Y.

______________________

86 Ibid.

87 Ibid.

88 Ibid.

89 Jack Lyne, “IBM’s Cutting-Edge $2.5 Billion Fab Reaps $500 Million in NY Incentives,” Site Selection.

The deal amounted to the largest private-public investment in the state’s history.90

Such U.S. state incentives are awarded case by case, however, and remain highly controversial—especially at a time when budget deficits are forcing states to slash public services. What’s more, semiconductor manufacturers still must pay federal corporate taxes. In 2006, Intel CEO Craig R. Barrett testified that it cost $1 billion more to “build, equip, and operate” a $3 billion chip plant in the United States than it does outside the U.S., with 90 percent of that difference due to government policies.91

The Dispersion of Design

The United States remains the world leader in semiconductor design. Three-quarters of what American chip companies invest in R&D is spent in the U.S. America’s continued dominance of semiconductor design cannot be taken for granted, however. The chip-design industries in Taiwan, India, and China have grown tremendously, either as outsourcing destinations or as development bases for domestic industries. The share of research by U.S. companies performed in the United States declined from 86.2 percent in 1997-99 to 77.8 percent in 2005-2007, according to the SIA. By 2013, the portion invested in the United States is projected to drop by another 9.3 percentage points, with most of that activity going to Europe.92

The growing importance of foundries, wafer fabrication plants dedicated to contract manufacturing, has brought about a significant structural shift in the semiconductor industry that has accelerated the global dispersion of design work. By outsourcing manufacturing to large foundries, even small chip companies can gain access to state-of-the-art wafers and production processes without having to raise the billions of dollars required to build their own modern production capacity. Instead, they can focus their resources on design around standardized parameters. What’s more, major foundries offer “IP libraries” so that companies with only specialized proprietary designs can develop entire “systems on a chip.” 93 As a result, the industry has been undergoing a process that D. A. Hodges and R. C. Leachman describe as “vertical disintegration.”

______________________

90 Empire State Develop Corporation, “Empire State Development Corporation: A Description of the Corporations Operations and Accomplishments,” (http://www.siteselection.com/ssinsider/incentive/ti0011.htm).

91 Craig R. Barrett, testimony before the Subcommittee on Select Revenue Measures of the House Ways and Means Committee, June 22, 2006.

92 SIA, Maintaining America’s Competitive Edge, op. cit.

93 D.A. Hodges and R.C. Leachman, “The New Geography of Innovation in the Semiconductor Industry.” For the full presentation, see <http://web.mit.edu/ipc/www/hodges.pdf>.

Even though the dedicated foundry industry is almost entirely based in Asia and is dominated by two Taiwanese companies—TSMC94 and United Semiconductor Corp. (UMC)—the U.S. design industry has thrived.

Seventeen of the top 25 “fabless” semiconductor companies in the world and nine of the top 10 are based in the United States, led by Qualcomm, AMD, and Broadcom.95 Because chip designs can be transmitted digitally, design R&D does not need to be close to wafer production plants. Indeed, an SIA survey found that location of fabrication capacity is not a key factor in a company’s decision of where to locate design R&D.96

By the same token, however, the shift to the foundry model means that design can be based any place with the best available talent. A number of governments are targeting semiconductor design and development for rapid development. India, already a major R&D base for companies such as Intel and Texas Instruments, has a plan to increase the nation’s share of the very large integrated-circuit market from 0.5 percent to 5 percent and to boost annual revenue to $1 billion.97 The India Semiconductor Association predicts that annual revenue of India’s semiconductor development industry will grow from $7.5 billion in 2010 to $10.6 billion in 2012. It also advocates a strategy to incubate at least 50 fabless semiconductor companies, each with annual revenue of $200 million or more, by 2020. 98 Eastern Europe, Russia, Brazil, and Israel are growing centers of semiconductor design as well.99

As a world technology leader in computers, displays, and smart phones, Taiwan also has become a major factor in semiconductor design. In 2002, the Taiwanese government launched the Si-Soft Project, which stands for “silicon and software.” The objective is to push the island’s industry beyond contract manufacturing and to become a major player in design of very large-scale

______________________

94 Taiwan Semiconductor Manufacturing Co., led by former Texas Instruments executive Morris Chang, was formed in 1987 as a joint venture between the Taiwan government and Philips Electronics NV. It was the first company dedicated entirely to the foundry business. United Microelectronics Corp. was spun off of the Industrial Technology Research Institute in 1980 as Taiwan’s first semiconductor manufacturer. UMC evolved into a dedicated foundry and became to first to fabricate 300mm chips on a contract basis.

95 See David Manners, “Top 25 Fabless Companies,” Electronics Weekly, January 19, 2010, (http://www.electronicsweekly.com/Articles/2010/01/19/47816/top-25-fabless-companies.htm).

96 SIA, op. cit.

97 Department of Information Technology, Special Manpower Development Programme in the Area of VLSI Design and Related Software (http://www.mit.gov.in/content/special-manpowerdevelopment-programme).

98 India Semiconductor Association, Study on Semiconductor Design, Embedded Software and Services Industry, prepared by Ernst & Young, April 2011, (http://www.ey.com/Publication/vwLUAssets/Study_on_semiconductor_design_embedded_software_and_services_industry/$FILE/Study-on-semiconductor-design-embedded-software-and-servicesindustry.pdf).

99 SIA, op. cit.

integrated circuits.100 Initiatives include establishment of a science park modeled after the Hsinchu Science and Industrial Park dedicated to design of systems on a chip. Sci-Soft also established six university research consortia in fields such as mixed-signal design, digital IP, electronic design automation, and system on a chip.101

China also is becoming a major location for chip design. Multinationals such as Intel and Freescale have opened Chinese design centers and a number of fabless design companies have opened in Shanghai and Beijing. China’s lack of intellectual property protection, however, has prevented the country from attracting more foreign investment. In an SIA survey of U.S. chip companies, a majority indicated they would not locate their most advanced and critical R&D activities in China, “despite encouragement and even pressure by the government to do so, and regardless of the availability, quality and size of incentives, due to concerns about the inadequacy of intellectual property protection.”102 If China follows through on commitments to protect intellectual property, however, the fact that it has the fastest growing market for semiconductors indicates that it has enormous potential to grow in chip R&D.

Workforce Issues

Perhaps the biggest threat to long-term U.S. leadership in semiconductor R&D is availability of talent. Foreign nationals comprise half of the master’s degree candidates and 71 percent of the PhD candidates graduating from U.S. universities in the engineering fields needed to design and manufacture integrated circuits and other semiconductor devices.103 One indicator of this foreign dependence is to look at where engineering Ph. D. graduates from U.S. universities receive their bachelor’s degrees. Only one U.S. school—MIT—ranked among the top 10. The leading university, Tsinghua University in Beijing, had 421 students who went on to earn Ph. D’s from U.S. universities in 2006, which was more than the 241 graduates from all California universities combined.104

The ability of companies to hire this talent in the United States has been complicated by tightened immigration procedures and a sharp reduction in temporary H-1B work visas. Taken together, these restrictions serve to inhibit U.S. semiconductor firms from growing research programs in the United States

______________________

100 For an explanation of the objectives of Si-Soft, see Chun-Yen Chang and Charles V. Trappey, “The National Si-Soft Project,” National Chiao-Tung University, (http://web.eecs.utk.edu/~bouldin/MUGSTUFF/NEWSLETTERS/DATA/si-soft-speech.pdf).

101 See Chang Chun-Yen and Wei Hwang, “Development of National System-on-Chip (NSoC) Program in Taiwan,” National Chiao Tung University, November 18, 2004 (http://www.cs.tut.fi/soc/Chang04.pdf).

102 SIA, Maintaining America’s Competitive Edge, op. cit.

103 Ibid.

104 Ibid.

that depend on being able to hire the best and the brightest talent,” says the SIA.105

Other nations, meanwhile, are expanding their pools of semiconductor engineers and expanding efforts to woo émigrés back home. India, which has an available semiconductor engineering workforce of 160,000,106 has a number of programs to increase the supply further. The VLSI Manpower Initiative107 of the Department of Information Technology operates programs to expand semiconductor engineering training through the master’s and doctorate level at universities and the nation’s famed Indian Institutes of Technology and Indian Institutes of Information Technology.108 The India Semiconductor Association calls for boosting semiconductor manpower 20 percent a year and for India to have 500,000 in five years.109

Other Research Consortia

The perceived success of SEMATECH and other U.S. public-private partnerships have encouraged other nations and regions to expand semiconductor research collaborations among government, industry, and academia. For example—

• Japan: After curtailing heavy government industrial policies in the 1980s, the Japanese government and industry established a number of new consortia when the industry slumped in the 1990s.110

The Association of Super-Advanced Electronics Technology (ASET) is completely funded by the government and focuses on equipment and chip R&D. ASET has produced more than 100 patents and completed a number of projects with industry, including ones that developed technology for X-ray lithography and plasma physics and diagnostics. It recently has launched the Dream Chip Project, which focuses on 3-D integration technology, and another relating to next-generation information appliances.111

The Semiconductor Leading Edge Technology Corp. (SELETE), by contrast, is a joint venture funded by 10 large Japanese semiconductor

______________________

105 Ibid.

106 India Semiconductor Association, op. cit.

107 VLSI is an acronym for “very large scale integrated” circuits.

108 Department of Information Technology, op. cit.

109 India Semiconductor Association, op. cit.

110 For an overview of Japanese semiconductor consortia, see Shuzo Fujimura presentation in 21st Century Innovation Systems for Japan and the United States, op. cit.

111 Association of Super-Advanced Electronics Technologies Web site, http://www.aset.or.jp/english/e-link/e-link_index.html.

companies with no government contributions. Established in 1996, the joint venture conducts precompetitive R&D for production technologies using 300mm wafer equipment. Currently, SELETE is nearing completion of a research collaboration to develop 45nm to 32nm technologies.112