The Greening of Industrial Ecosystems. 1994.

Pp. 191-200. Washington, DC:

National Academy Press.

Zero-Loss Environmental Accounting Systems

REBECCA TODD

Few people realize that existing accounting systems are a critical barrier to intemalization of environmental costs and considerations by the modem firm. Simply put, you can't manage what you never see—and, with today's managerial accounting systems, managers don't see most environmental costs. All persons have a stake in the health of the environment and the conservation of scarce resources. However, managers of firms uniquely possess the necessary authority to decide which products to manufacture and which processes to employ to control how efficiently productive resources are used and, thus, to improve and preserve the quality of the environment. The information set that supports such managerial decision making derives ultimately from data collected by development and production engineers within a firm. Although accounting systems are frequently the conduits for some or all of this information, in a real sense, managers and engineers are the ultimate fiduciaries of the environment. The reason is that only the engineers know what the decision-choice set looks like and only the managers can choose.

Wastes released to the environment represent inefficient use of costly scarce resources as well as potential liability to the firm. Therefore, the reduction and elimination of wastes will, in the long ran, increase firm profitability as it reduces imbedded risk. It is thus in the firm's interest to minimize wastes. Our objective must be the development and implementation on a routine basis of a zero-loss environmental information accounting, control, and accountability system. This system will ultimately record and monitor the flow and disposition of all inputs, including obvious waste disposal, recycling, and reprocessing. However, to approach zero information loss and, ultimately, zero environmental loss, systems

must capture currently hidden and unaccountable costs, for example, product-related legal expenses, regulatory costs, public relations expenses, and the opportunity costs of clean technologies not adopted.

Unfortunately, severe institutional impediments serve to hinder managers who would otherwise pursue optimal environmental waste reduction strategies. First, traditional accounting systems were not designed to capture much of the engineering and accounting data required for environmental decision making. Second, the data that are collected and processed are almost always aggregated in such a fashion as to lose their environmental (as well as managerial control) information content. Third, line managers are rarely made responsible for environmental costs. As managers' compensation is routinely based at least partially on profitability, including reduction of controllable costs, managers have strong disincentives to seek "full environmental costing" methods that would cause additional costs to enter their control domains. Simply put, managers can't act if they don't have adequate information, and they won't act voluntarily if they will bring harm to themselves by doing so. Thus, our ultimate goals must be (1) to develop techniques for removing or minimizing the most important institutional barriers managers face in their role as environmental stewards, and (2) to provide incentives to motivate the aggressive and creative development of solutions to promote current and future waste reduction and elimination.

The specific immediate goal is to revise our traditional production accounting methods, which capture and apply to products the costs that occur in production but fail to capture any costs arising after the finished product leaves the shop floor. In this way these accounting methods disassociate the costs of waste treatment, reprocessing, and disposal (as well as regulatory costs, disposal site remediation, and contingent liabilities) from the products that produced them. We must generate feasible methods for (1) corporate accounting system capture of the costs of manufacturing wastes and effluents, and (2) the application of such costs to the individual products giving rise to them. The methods should be both specific enough to provide a basis for management decision making and sufficiently general to be applicable across a broad range of industries and national accounting systems.

In recent years, the legal, regulatory, and accounting domains have undergone significant changes that greatly enhance the likelihood that these objectives can be achieved. Indeed, certain of the changes make such change essential to the continued viability of many firms.

Application of these methods will require short-term adjustments in cost information gathering and allocation and in corporate decision making based on cost reports. However, the long-run payoffs to firms operating in the increasingly competitive global markets are higher profitability as a result of selecting the most cost-efficient products and production methods, and much lower firm risk from potential product and environmental liability. The techniques being developed

will be applicable across all product costing problems, not just those associated with environmental waste.

THE INCENTIVE CLIMATE FOR ENVIRONMENTAL ACCOUNTING

Accounting may be defined as a ''reconstruction" of a firm, a financial model. That is, accounting provides an image of the firm reflected from a financial mirror. In a traditional financial accounting system, only those economic events that can ultimately be defined in financial terms will be captured by the system. The information may be timely, in which case it may be highly valuable, or dated and stale, which may render the information useless. The level of aggregation at which the information is reported to decision makers is also crucial. Details are lost as information is collected into pools. As only a limited subset of all economic data available for a firm is collected, the resulting aggregated information is likely to be incomplete or flawed, depending on which economic decisions need to be made and the information necessary in a given case to support the decision.

Traditionally, accountants have held that a fundamentally important trait of accounting information to be used for economic decision making is that it be unbiased, or neutral. This property means that accountants should be detached and impartial observers of the operations of the firm rather than instigators or advocates of various courses of action. As a consequence, managers usually specify which decisions they desire to make, and accountants make recommendations regarding the information to be collected and summarized, and the analyses to be prepared in support of the decisions. Rarely is an accountant a graduate chemical engineer or operations management specialist. For accountants to provide enough relevant information to managers for environmental decision making, substantial support and advice will be required from the experts—the engineers and environmental scientists. It is not reasonable to expect managerial accountants to know the appropriate data to seek or even the general questions to ask. Consequently, routine mechanisms must be established for the cooperative collecting and reporting of environmentally relevant information.

Internal Accounting

Economic decision making is the domain of the managers of the firm. Most internal accounting systems, called managerial accounting systems, are capable of capturing any information that the management of a firm may regard as potentially useful. For example, it is common to find that the traditional accounting system has been extended to include such items as product volume information, qualitative personnel record data, and engineering data, as well as a boundless set of other information that managers at some time found it desirable to collect. Thus, managers can direct the firm's accountants to collect, analyze, aggregate, summa-

rize, and report any information they desire, conditional only on the usual benefit/ cost and other feasibility constraints. Most of the decisions about what information will be captured by the accounting system (other than that mandated by regulatory bodies) will be made by managers and other agencies outside of the accounting department.

Financial Accounting and Reporting

A subset of the managerial information collected is provided to outsiders, for example, investors, creditors, and others. Such information frequently includes voluntary disclosure of information that management may, for a variety of reasons, desire to make public. However, the greatest portion of publicly available firm-specific financial information is provided under the requirements of the two accounting rule-making bodies, namely, the Financial Accounting Standards Board (FASB) and the Securities and Exchange Commission (SEC). The FASB is the private accounting rule-making organization that provides guidelines for the public accounting profession. The SEC has the mandate of the United States Congress to oversee disclosure of financial accounting information for use in the equity and debt securities markets.

For a variety of reasons, including the pressure of competition and potential information overload by users, public disclosure of financial information is necessarily in a highly aggregated form. The information is designed to address questions of the profitability, riskiness, and viability of a firm, taken as a whole, rather than individual product profitability. Thus, the financial accounting rules do not require the collection and summarization of the finely detailed product cost information necessary to provide a basis for managers' environmental cost-reduction decisions.

Regulatory Oversight Agencies

Regulatory agencies, such as the U.S. Environmental Protection Agency (EPA), are concerned with the quality of the environment and waste minimization to enhance that quality, rather than issues of profitability. The EPA seeks, through the use of persuasion, negotiation, and regulatory tools, to measure and reduce waste emissions and effluents as well as to monitor remediation of past and current waste disposal sites. Thus, the regulatory focus is largely on the end-of-pipeline emissions and substantially less on the individual products and processes that produce the wastes, the ultimate point of control for managers. That is, the EPA and similar agencies are not in the business of micromanaging the product and process decisions of firms, but rather define the constraints under which such decisions will be made.

Managers

It is sometimes assumed that in business, as in other endeavors, more information is better than less. If so, then we should expect to find that managers routinely request and receive finely detailed cost accounting data, including breakdowns by product line of "overhead," or pooled, costs that are not direct costs of manufacturing. However, detailed breakdowns of manufacturing total cost are relatively rare. Common reasons given for the lack of such detailed cost information include difficulties in attributing so-called joint costs, costs that are shared by a variety of product lines, for example, heating costs for a large manufacturing facility; the expense of tracking and collecting numerous such costs on an individual product line basis; and, in some cases, the technical difficulty of measuring product-specific material flows and emissions. Another reason, however, relates to responsibility for costs and the use of such accountable costs in management compensation contracts as well as in cost-based product pricing formulas.

We will first consider the issue of detailed costs and management compensation. If manufacturing costs can be individually attributed to products, then managers may be held responsible for controlling the costs, and such controllable costs may well be used in profitability calculations used in management incentive compensation formulas. Thus, managers may have an incentive not to request and use the most detailed information that could be made available to them. The unrequested information may well include costs of environmental wastes, recycling and reprocessing, site remediation, and contingent liabilities.

The second problem, cost-based market pricing formulas for products, leads to the possibility that at least some of the firm's products may be found to be unprofitable to produce if all of the costs associated with their manufacture are properly attributed to the product. This would seem a simple problem with a straightforward solution: just discontinue the product. Such products may, however, account for a relatively large portion of the revenues of the firm and their discontinuance would mean loss of "market power" for the firm as well as prestige for the managers of products.

Another difficulty that managers of firms face, particularly senior management, is the confidentiality of highly sensitive information, especially that related to potentially costly contingent liabilities and regulatory constraints. That is to say, managers would have an incentive to discourage broad dissemination, even within the firm, of information deemed to have a potential negative effect on the fortunes of the firm and, consequently, the managers. In this case, the perceived risks to the firm and the managers would outweigh the possible long-term benefits from accumulating the information and attempting to control the costs. Thus, managers who may, in general, strongly support efforts to improve the quality of the environment may find that the short-term costs to themselves and their firms may outweigh the benefits.

It is thus apparent that firms, the environmental regulatory authorities, and

accounting rule-making bodies have a number of incentives not to pursue highly refined cost accounting and control techniques for environmental wastes. The following section discusses in more detail what such systems might look like, and how they might best be established.

ACCOUNTING INFORMATION AND CONTROL SYSTEM COMPONENTS

Environmental accounting often means different things to different writers on the subject. I will define environmental accounting for purposes of this discussion as the incorporation and treatment of "environment"-related information in internal accounting (i.e., management accounting) systems.

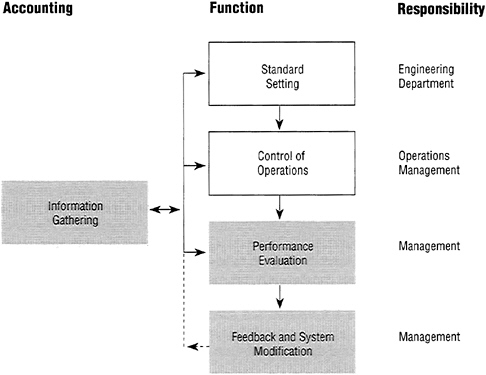

The role of management accounting systems is threefold: (1) to direct managerial attention to problem areas, (2) to provide informational support for managerial decisions, and (3) in decentralized organizations, to promote the harmonization of divisional goals with corporate goals through performance measurement and incentive (management control) mechanisms. The major components of a managerial information system that includes cost accounting data collection are shown schematically in Figure 1. The first two components, standard setting and

FIGURE 1

Management information system (including control system components).

control of operations, are primarily the province of the engineering departments and operations management. Standards are based on engineering process designs, actual operational data, forecasts of demand and sales of products, existing inventories, capacity constraints, and other such factors. Control of operations is an ongoing function that includes periodic monitoring of production units, yields, and quality of outputs. Both of these components are commonly based on volumes, weights, and other physical measures of productivity. Information is usually gathered in some form at every stage of production (as well as in other activities of the firm, such as sales).

At the end of some regular period of time, the information gathered is aggregated and summarized into a variety of performance evaluation reports. These reports include, but are not limited to, financial reports such as income statements, balance sheets, and cash flow information for internal as well as external dissemination, detailed cost accounting schedules for production and sales during the period, and comparisons of actual production numbers with operating budgets and forecasts. The various performance evaluation reports are then used for feedback and system modification, to control operations, improve profitability, reduce risk, take advantage of business opportunities, and reward managers who are "successful" (as measured by the performance evaluation reports).

Feedback and modification are the ultimate objectives of the management information and control systems. The success of the system depends on (1) the quality of information produced by the system, and (2) the timeliness of the information received by those in a position to modify the system.

Traditional Cost Accounting Systems

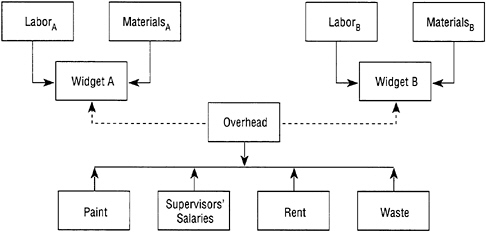

A traditional cost accounting system is shown in Figure 2. The system assumes that the firm produces two products, Widget A and Widget B, both of which use direct labor and materials. By direct labor and materials, we mean those factors that not only are associated with the production of the product, but also become a part of the product, such as raw materials, or are required to transform the raw materials, such as direct labor.

All other costs of production, including supervisory salaries, occupancy costs of manufacturing facilities, janitorial services, utilities, property taxes, materials handling costs, and disposal of wastes, including "environmental" wastes, and a host of other costs, are accumulated into "pools" of costs, usually termed "overhead" costs. Such costs are then allocated to individual products based on some systematic and rational cost allocation scheme, for example, budgeted labor hours per unit of product.

It is readily apparent that there are several problems that can have a profound effect on economic decision-making for individual products. First, important information is lost in the process of aggregation. For example, the amount of a certain waste material produced by Widget A will not be specifically captured for

FIGURE 2

Traditional cost accounting system.

control purposes but will be added in with all other costs in the overhead pool. Second, unless environmental costs are produced by individual products at the same rate as the allocation basis (e.g., labor hours), then a misallocation of the environmental costs will occur across products. Although the logic behind the evolution of the system of aggregation of overhead in large pools (which are then allocated to individual products or product lines) may seem obscure, the explanation is straightforward. Historically, accounting data collection, aggregation, and summarization, before the wide use of computers, was a labor-intensive and extremely costly activity. Companies therefore minimized some costs, that is, accounting costs, by simplifying the accounting process at the sacrifice of more detailed cost information, relying on the budgetary process to identify costs that were "excessive."

Third, in the absence of accountability, no individual manager has an incentive to reduce or eliminate the cost. In the language of finance, each individual manager has a potential "put" to the firm as a whole for each cost that can be assigned to an overhead pool rather than treated as a direct cost. The value of the put is a function of the manager's ability to minimize the firm's consumption of the allocation base.

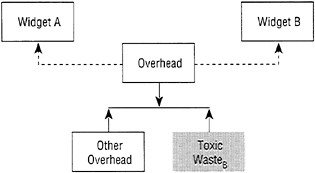

Let us consider an extreme example, illustrated in Figure 3. Assume that only Widget B produces a particular toxic chemical waste, Toxic WasteB, and that the cost of disposal for Toxic WasteB is a proportionately large cost of manufacturing. In addition, we will assume for simplicity that the usual overhead allocation basis is labor hours. Under the traditional overhead cost accounting system, Widget A will be allocated a portion of the cost of disposal of Toxic WasteB, although the manufacturing process for A did not require the use of the chemical. Moreover, if A requires substantially more labor hours than B, A will effectively subsidize the

FIGURE 3

Misallocation of environmental costs under traditional cost accounting system.

production of B to the extent of most of the cost of the Toxic WasteB. Observe that under this traditional system, the production manager for Widget A can reduce the costs allocated to A's production only by reducing A's consumption of labor hours relative to those of B. Clearly, the production manager of B has little incentive either to reduce the use of Toxic WasteB or to search for and invest in improved production technologies that will eliminate the use of the chemical.

The research question for the reduction and elimination of environmental wastes thus revolves about the problem of the assignment of the costs of such wastes to the individual product managers who are in a position to control and ultimately eliminate the wastes. Assignment of the costs requires that all costs be identified with individual products to the extent possible.

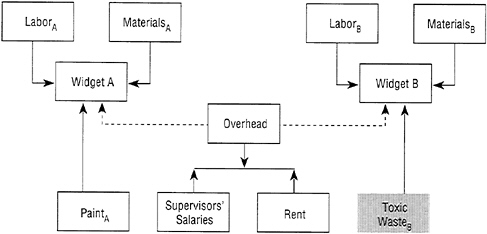

An Environmentally "Enlightened" Cost Accounting System

Figure 4 modifies the traditional accounting system (Figure 2) to indicate how the accounting and "accountability" system needs to be changed to provide both the opportunity and the incentives to the manager of Widget B to reduce toxic waste. If the cost of the chemical is removed from the overhead pool and applied directly to Widget B, just as LaborB and MaterialsB are applied, then the manager of B will have an immediate incentive to focus attention on the control Of the cost. This system makes it possible to (1) ascertain the relevant controllable costs, (2) determine the operating risks (e.g., contingent liabilities resulting from the production of Toxic WasteB), and (3) seek other, less costly means of production for the product or contemplate its elimination from the product line.

Perhaps the most difficult issue to resolve is that of manager B's incentive compensation contract, if it is based at least partially on the profitability of B. Manager B will clearly suffer loss of wealth if the cost structure is arbitrarily changed. Thus, an essential part of the transition to a new accountability system is

FIGURE 4

Environmentally "enlightened" cost accounting system.

to restructure the incentive compensation system to encourage the ultimate objectives of waste minimization and elimination.

Numerous possibilities exist for accomplishing this goal. Two such schemes would be (1) gradual phasing in of the new system over a period of years, and (2) basing incentive compensation on the direct cost structure for manager A. In addition, incentive compensation might include the direct cost structure plus a "bonus" for reduction of Toxic WasteB, for manager B, with a target elimination horizon of, for example, five years for the chemical, over which time the full disposal costs will gradually be entered into the direct cost structure.

Modification of traditional accounting systems will require establishing hierarchies of all input and environmental costs based on difficulty of achievement, developing taxonomies of product-costing strategies for capturing and assigning all such costs to a responsible manager, and setting target horizons for reduction of environmental effluents. Nearly all the information required, including clean technology alternatives, will be provided by engineers. The system will require enormous collaborative efforts among engineers, accountants, and managers and potentially the development of new material measuring and tracking technologies as well. The potential payoff to society as well as the firm, however, is incalculable.