Introduction to Part 2

Roger G. Noll

National policy regarding the information infrastructure is often debated as if it were a novel idea; however, the current debate is in many ways old wine in new bottles. The backbone of the information sector of the economy—the telecommunications network—has been regulated by both national and state governments since the Bell system first perfected reasonably high quality long-distance interconnection in the first decade of the 20th century. From the beginning, at the center of the policy debate has been the importance of nationwide interexchange traffic to the welfare of consumers and the long-term economic growth of the nation. Thus, any attempt to implement a dramatic new initiative regarding the national telecommunications infrastructure must deal explicitly with the presence of an elaborate regulatory superstructure that, despite two decades of liberalization, still extensively controls the decisions of the most important players in the telecommunications industry regarding prices, investment, technology, and system integration. And, in the mid-1990s, many of the policy proposals for encouraging enhancements to the telecommunications infrastructure amount to recommended changes in regulatory rules and processes.

The purpose of the papers in this section is to examine the role of regulatory policy in shaping the evolution of the nation's information infrastructure, with special attention being given to how regulation affects the rate and pattern of technological change. In both public discourse and the scholarly literature in law, economics, and political science, the debate about the merits of regulatory policy deals with two quite separate and distinct issues. The first is philosophical and deals with the legitimate uses of the coercive power of government. The second is more prosaically practical and deals with the actual effect of regulation on the performance of industry. Although this section deals primarily with the latter, we must first briefly deal with the former in order to clarify the range of issues of concern.

REGULATION AND POLITICAL LEGITIMACY

The first focus of debate about the merits of regulation concerns the enduring philosophical question about the legitimate boundaries to the use of the coercive powers of government. Regulation makes rules about how people can spend their incomes, use their wealth, and engage in transactions, and so infringes upon private property rights. From this fact has emerged a debate concerning whether regulatory policy goes too far, or not far enough, in making a trade-off between individual liberty and collective welfare. Thus, this form of the debate about regulatory policy deals with the principles that should be adopted through a nation's constitutional and legal system to define the proper role of the state in economic affairs.

An important feature of this debate is that the instrumental value of regulation—its effects on the performance of regulated industries—plays a minor role. Causing the trains to run on time is not regarded as a compelling defense of fascism, for example, nor is the production efficiency of antebellum southern agriculture regarded as a serious argument against the Emancipation Proclamation.

More importantly, this form of the debate about regulation is most likely incapable of resolution regarding such prosaic issues as how, or even whether, government should attempt to control the development of infrastructural industries. Whereas the philosophical debate about the proper scope of state interference with private property rights does provide a compelling case against the more outrageous forms of authoritarian government, it does not contribute much to the debate in advanced western democracies about the appropriate methods for making and implementing economic policy. Among advanced western countries, for example, although no nation leaves the sector totally unregulated or has nationalized every aspect of it, national telecommunications policy does vary from near laissez-faire (New Zealand, United Kingdom) to an extensive nationalized enterprise (France, Italy). One cannot convincingly argue that any of these nations have organized telecommunications policy in a morally indefensible way. Hence, because the philosophical debate about the proper scope of government is, and is likely to remain, unresolved among the range of policies that are likely to be considered in a modern western democracy, this aspect of the debate about regulation is largely irrelevant and forms no part of the analysis in the remainder of this section.

INSTRUMENTAL ANALYSIS OF REGULATION

The papers that follow examine the second focus of debate over regulatory policy, which is concerned with the instrumental value of regulation.1 At the most general level, the instrumental issue is how the presence of government supervision of an industry, regardless of the details, affects its performance. The existence of regulation redirects the time of a firm's management from ordinary business activities, such as production supervision, technological innovation, and customer relations, to dealing with and strategizing about political affairs and the regulatory process. An inherent feature of regulation is that, no matter how enlightened, it creates costs and affects the rate and pattern of technological change in an industry.

Some specific instrumental issues are how the performance of the regulated industry depends on the details of regulatory policy, such as the decisions about who will be regulated, what powers will be given to the regulators, how the regulatory authority will be organized and what procedures it will be required to follow, which level of government will be responsible for each element of regulatory policy, and what role will be assigned to the courts in overseeing regulatory policy. In the case of telecommunications, examples of specific issues that have been especially prominent in recent years are the debates about the jurisdictional separation of regulation of prices and entry between the Federal Communications Commission (FCC) and state public utilities regulators, the continuing judicial intervention in structuring the market for telecommunications services and equipment arising from antitrust litigation, and methods for regulating prices by a monopolist (e.g., rate of return, price caps, residual pricing, and so on).

The instrumental issues about regulation can be phrased in either a negative or a positive way. The negative version inquires about the extent to which regulatory policies and institutions distort the evolution of the telecommunications infrastructure, to the detriment of the welfare of society. The positive version seeks to identify ways that regulatory policy should be changed to improve the performance of a regulated industry. Of course, the way in which the question is put is primarily a rhetorical device, revealing more about the conclusion of the person addressing the issue than the actual nature of the debate. Regardless of how the issue is phrased, the core of the relevant

policy debate is the following question: What will be the effect of different approaches to regulatory policy on the performance of regulated industry?

SOME GENERAL CAVEATS

By way of introduction to the papers that follow, the current debate about the national information infrastructure should be considered in the context of over a century of U.S. experience with regulatory policy in a variety of infrastructural industries. Economic regulation in the United States takes a peculiar form that is not found anywhere else in the world. It evolved as it did because of certain unique features of the U.S. political and legal system: the federalist system of government, the separation of powers among the three branches of government, the unusually strong role of the courts in the American system, and the specificity of certain rights in the U.S. Constitution, such as the guarantee of the sanctity of contracts, the protection against expropriation of property without compensation and due process of law, and the guarantees of free speech and freedom of the press. These special features of the U.S. system thwarted numerous attempts to establish economic regulation during the 19th century and continue to affect how regulation is implemented today.

The first important consequence of the U.S. system of government is that it makes policymaking very difficult. A significant change in policy requires a statutory mandate, and statutes are very difficult to enact. Both houses of Congress and, in the absence of a two-thirds majority in either, the President, elected on the basis of different principles of representation, must agree before a statute can be passed. And, if someone then protests the new statute, the Supreme Court can declare it invalid—a power that was controversial at the time it was asserted by the court early in the 19th century, and that is shared by almost no other high court anywhere in the world.

The second important consequence of the U.S. Constitution is the elaboration of economic protection accorded citizens in the Constitution, as enforced and interpreted by an especially powerful court. Numerous statutes, mostly enacted by states, have been overturned by the Supreme Court because they were judged to interfere with one or another constitutional provision. Judicial skepticism of regulatory interference with the private economy persisted into the early years of the New Deal, when, under the threat of increasing the size of the Supreme Court to accommodate a more interventionist political philosophy, the "switch in time to save nine" finally permitted extensive interventionist policies. But even the post-New Deal courts placed important constraints on economic regulation. These constraints have been derived from both constitutional principles of economic rights and the details of statutes that elaborate how the constitutional role of the courts and protection of individual rights should be embodied in the details of regulatory policymaking.

Constitutional and statutory requirements impose substantial burdens on regulators to prove that their decisions are justified. Regulators bear a legal burden to show that their decisions are based on a constitutionally valid statutory mandate, and an evidentiary burden to show that their decisions are rational means to pursue a statutory objective and take into account all of the relevant facts and arguments presented by those who might be affected by the decision. Again, the structure of the Constitution has the effect of making policy change slow and difficult, and subject to veto by the courts. Moreover, these requirements advantage large business interests with a major financial stake in regulatory outcomes, because they are more likely to provide detailed evidence in support of their interests than are consumers and other less well-organized user groups, and more likely to appeal adverse regulatory decision to the courts.2

The history of telecommunications regulation illustrates these points. The origins of telecommunications regulation can be traced to the middle of the 19th century and the battle to establish railroad regulation.3 Many states attempted to regulate railroads for the purpose of eliminating the "long-haul, short-haul" price differential in railroad prices. Typically, railroads

competed for long-haul traffic but were monopolists at intermediate rural terminals along their networks. Railroads exploited these local monopolies by charging far higher prices for shipments to and from these rural locations than for more competitive transportation between large urban centers. Except for a brief period between 1877 and 1886, the Supreme Court persistently declared as unconstitutional these attempts by states to deal with short-haul monopolies.

In 1887, after the 1886 Wabash decision in which the Court declared all state regulation of any aspect of an interstate railroad to be an unconstitutional interference with interstate commerce, the federal government enacted the Interstate Commerce Act (ICA). This statute had two important elements. The ICA established federal regulation of railroads, and it gave states the authority to regulate railroad tariffs for shipments between terminals in the same state.

Two decades later, the scope of the ICA was expanded to include telecommunications.4 The Mann-Elkins Act of 1910 enabled the Interstate Commerce Commission (ICC) to regulate the interstate portion of telecommunications; however, this business was then so inconsequential that the ICC ignored its new responsibility. The important effect of this extension of the statute was that it legalized state regulation of intrastate telecommunications. Then, in 1934, the Communications Act created a new institution to regulate the interstate portion of the industry, the Federal Communications Commission. But most of the telecommunications sections of the 1934 act were transferred wholesale from the ICA, despite many failed attempts within Congress to alter these provisions to match the differences in the technologies and market structures between railroads and telephones.5

In the ensuing decades, Congress has made numerous attempts to rewrite the Communications Act to reflect the realities of new technologies and changing market structures in the industry. Except for a handful of exceptions (laws dealing with satellites, cable television, and radio telephony), these attempts have failed. In 1994, Congress again failed to pass a reform bill (S. 1822, sponsored by Senator Ernest F. Hollings) that died in the Senate after passing overwhelmingly in the House. Consequently, the 1934 statute remains the basis for almost all telecommunications regulation today, including the scope and methods of regulation by the FCC and separation of authority between the FCC and the states. Thus, as the United States attempts to make policy about the information infrastructure of the 21st century, it does so in the context of a regulatory statute that was written in the 19th century to deal with local railroad monopolies.

The significance of the U.S. courts is clearly evident in telecommunications regulatory policy. Most of the important changes in telecommunications regulation since the passage of the Communications Act of 1934 are the result of court decisions, rather than new statutes or policies adopted by the FCC. Examples are the Execunet6 decisions, which led to competition in ordinary long-distance telephone service, the restructuring of the industry in the settlement of U.S. v. AT&T,7 and the Louisiana8 decision, reversing 50 years of precedent to give more regulatory authority to the states over aspects of the local exchange that have a significant effect on interstate elements of the industry.

The preceding history is crucial to understanding why the academic literature is so skeptical about the value of economic regulation, both in general and with respect to telecommunications. As an instrument of public policy, regulation—at least in the U.S. system of government—has inherent properties that limit its effectiveness. Regulation is intrinsically slow, and changing regulatory policy is extremely difficult. The U.S. system of government exalts the status of individuals and private property like no other, and so imposing costly rules on anyone is difficult. In the United States, policies are developed and changed by an elaborate process that is designed to protect individuals against significant, targeted economic harm by government, and to allow change only when a broad consensus supports it. Thus, regulation is especially problematic as an institution for channeling the development of an industry in which technology is evolving rapidly and involves an ever-changing cast of companies and user groups.9

The fact that the "information superhighway" of the 21st century is being constructed under the aegis of a 19th-century statute for regulating railroads is not the result of stupidity, corruption, or

inattentiveness on the part of government, but a highly significant example of a fundamental feature of U.S. governance. The United States operates under a system that is based on a deep skepticism of government intervention in economic affairs and that makes rational national planning of industrial development extremely difficult.

It is important to note that making industrial policy difficult and cumbersome, and hence less extensive, is not necessarily bad. To illustrate the point, consider the differences in the performance of the telecommunications sector in Japan and the United States10 In Japan, judicial supervision and authority over economic policy are far less extensive, and legislative and executive functions are not formally separated. As a result, the legislature can more easily change policies by statute, and the implementing bureaucracy is less constrained about the scope of its decisions.

In 1986, the Japanese passed new laws that in many ways are very similar to the combination of court decisions and regulatory policies that took place in the United States in the previous two decades. By statute the Japanese created a structurally competitive telecommunications industry, but they retained their traditional system of ubiquitous government control over prices, investment, and entry into facilities-based telecommunications services. As a result, the number of facilities-based domestic telecommunications companies grew from 1 to 38 in 6 years, counting all satellite, wire, and over-the-air carriers.

Because the core economic decisions of the industry continued to be controlled by the government, the new structural competition did not lead to real economic competition. The new entrants were permitted to charge much lower prices for dedicated circuits, which are typically purchased by very large, multifacility businesses; however, in other aspects of the industry companies were prohibited from competing on the basis of either price or the quality of service. The objectives of this policy were in part to allow more companies to participate in the lucrative telecommunications services business, and in part, like U.S. policy objectives, to encourage more rapid development of a ubiquitous, integrated, high-performance telecommunications infrastructure.

By the criteria most Americans would use to evaluate the success of the Japanese policy change, the outcomes are not attractive. In 1992, a Japanese customer of telephone service paid about $560 for the installation of new telephone service, which is about 10 times the price charged for initial residential installations in the United States. Consequently, the number of telephones per capita in Japan is about 20 percent lower in Japan than in the United States. Thus, the more extensively regulated, less competitive system does a significantly worse job of achieving universal service.

After paying $560, a Japanese residential subscriber paid about $20 a month for basic access service in 1992, but this service does not include any calling. In addition, a Japanese consumer paid 8 cents for each 3-minute interval of a local telephone call, a charge that has since risen to 15 cents. In addition, the Japanese consumer faces significantly higher prices for long-distance calls, especially for calls at distances over 100 miles. As a result of this pricing system, the Japanese use their telephone system much less intensively than do Americans. Minutes of use per line per year in Japan are about one-sixth the amount of usage in the United States. The Japanese place many fewer telephone calls and have much lower average connect time than is the case in the United States.

Higher prices, lower penetration, and less usage in Japan obviously result in lower consumer welfare; however, the problems with Japanese telecommunications policy go beyond these effects. If an important social objective is to facilitate the introduction of new telecommunications services, the Japanese policy thwarts them. New services require more calls and connect time, and their ubiquitous availability requires universal service. The Japanese system accommodates neither, and so serves to retard the evolution of the Japanese information infrastructure in comparison to that in the United States.

Japan differs from the United States in many respects other than the legal and institutional structure of industrial policy, and so broad conclusions drawn from these facts need to be strongly qualified. Nevertheless, a slow-moving but limited regulatory system, coupled with greater reliance

on competition, actually produces relatively good performance in comparison with the systems in other advanced, industrialized nations.

IMPLICATIONS FOR EVALUATING REGULATORY STRATEGIES

Of course, the preceding observations do not fully resolve the debate about regulation. Regardless of the problems associated with regulation, both citizens and government officials will seek to interfere with private economic decisions if they believe that these decisions do not adequately take into account important collective values. Although regulation has inherent features that limit its effectiveness, these effects are only one part of a larger concern. Inherently imperfect regulation can be better than nothing when dealing with a firmly entrenched monopoly or an economic activity that imposes significant social costs, such as creating pollution.

This introduction is intended to make a simple point that is often overlooked in the debate about regulatory policy: citing a meritorious policy objective is not sufficient to justify the conclusion that regulation is warranted. Moreover, even a strong case for a serious market failure leaves another important issue unaddressed: how to design the details of regulation to ameliorate to the maximum feasible extent the inherent infirmities of the regulatory process. Questions about how best to divide jurisdiction between federal and state authorities, or between regulators and the courts, and about what principles to adopt in controlling prices and service attributes, must be answered in part on the basis of their feasibility in the U.S. legal and political system. Because the process of policymaking is important in the American system, the instrumental value of regulatory policies is often strongly influenced by the details of its implementation.

An important illustration of these points is the ongoing debate about cable television regulation. In 1992, Congress enacted a statute, over presidential veto, to reregulate cable television. A veto-proof two-thirds majority was obtained by constructing an elaborate statute, carefully defining what could and could not be regulated, how regulation was to be implemented, and who was to implement each aspect of regulation among the FCC, states, and local government. A year later, the FCC implemented the statute by issuing detailed pricing rules and a process for certifying local regulation.

On the basis of initial studies, the effects of this elaborate process appear to have been minimal. Some prices went up, others went down, but on average the changes were small. Most local governments have decided not to attempt to become certified regulators, regarding the cost as not worth the candle. The main observable effect has been a reshuffling of the channel numbers assigned to various programmers, a step necessary for most cable systems to minimize the effect of the new rules on their total revenues from subscribers.

At the heart of the new cable regulations was an important economic fact: cable television systems are enormously profitable, selling for several times their construction costs, because typically they have considerable monopoly power. But the question posed by the history of the construction and implementation of the 1992 statute is whether any cable regulatory system that is politically feasible and constitutionally valid can yield benefits that exceed its costs. Thus far, the preliminary results indicate that the answer is no, even though cable does enjoy revenues that substantially exceed the economic costs of service.

The problem with cable regulation is not the validity of the objective, but the thus-far unsolved problem of implementing a regulatory system that can make significant progress in achieving that objective. Of course, the cable lesson does not translate directly to telecommunications. Cable is a far less important industry than telecommunications, at least for now. Unlike telecommunications, cable is not an important factor determining the performance of many other rapidly growing, high-technology industries, and for consumers cable does not yet offer the highly valued, almost indispensable services that are accessible only through the telephone. Thus,

the prospective benefits of telecommunications regulation are larger and would justify considerable inefficiency in an imperfect regulatory system.

Nevertheless, the cable debate makes clear the preference for competition rather than regulation that is expressed by numerous observers of the communications industry. The experience with cable adds weight to the argument that easing the entry of direct broadcast satellites, of off-air digital distribution systems, and even of second cable companies or telephone companies into the cable business will do a better job than regulation in holding down cable prices and expanding service offerings to consumers. Likewise, the cable experience raises important questions about whether the promotion of competition, perhaps accompanied by some direct, targeted subsidies for particular users, will do a better job than regulation of encouraging the development of the information superhighway of the 21st century.

Congress, the FCC, the Justice Department's Antitrust Division, and the courts have before them numerous proposals to restructure telecommunications regulation. The failed Hollings bill combined with alternative proposals from Republican Senate leader Robert Dole will continue to be live legislative issues in the next session of Congress. Two competing visions of the future are embodied in these legislative proposals. One (Hollings) formalizes the importance of competition policy by placing a burden of proof on Bell operating companies for having their line-of-business restrictions removed, reestablishes the preLouisiana preemption authority of the FCC, and legislates a broad universal service requirement that, among other things, requires all telecommunications carriers to subsidize service to various educational and nonprofit institutions. The other (Dole) imagines a smaller role for federal intervention, eliminating the line-of-business restrictions without further requirements, and all but deregulating interstate service and interconnection among carriers.11 Nevertheless, these two bills share two important policies. First, both proposals would establish a tax on all telecommunications services for the purpose of subsidizing local exchange service in smaller communities. Second, both would eliminate restrictions against entry into local exchange service, including prohibitions against entry by cable television and other utility companies. (In Japan, electric utilities have been an important source of entry into facilities-based telecommunications services.)

Meanwhile, significant restructuring proposals have been submitted to the Antitrust Division, the FCC, and the D.C. District Court that oversees the divestiture decree. These proposals involve the movement of local exchange carriers into long distance and manufacturing, and of long-distance carriers into local access.

In the summer of 1994, the Antitrust Division allowed AT&T back into the local access business by allowing the merger of AT&T and McCaw Cellular, the nation's largest radio telephone company, after insisting that McCaw provide equal access to all long-distance carriers and that AT&T continue to supply cellular system equipment to McCaw's competitors on a nondiscriminatory basis. Later in the fall, implementing 1992 legislation that will eventually allow a competitive radio telephone industry, the FCC auctioned new spectrum for radio telephone services, which is expected to lead to the entry of several new access providers in all major metropolitan areas.

Facing some access competition already in the downtown areas of large cities, and much more potential competition from radio telephony and, conceivably, cable television, some local exchange carriers have proposed deals that would allow them to enter manufacturing and long distance, both of which would increase the chance that they could be more effective competitors in markets for information services. The most imaginative of these proposals comes from Ameritech, the regional Bell operating company in the Great Lakes region. Ameritech proposes complete unbundling of the elements of local service and relaxing all regulatory barriers to the entry of competitive access providers in return for eliminating its line-of-business restrictions. Unbundling, accompanied with realistic, cost-based prices, would enable competitors to enter the local access market by leasing and reselling elements of the Ameritech network in combination with their own

facilities. For example, MCI might lease copper wire connections between households and the local central office, but at that point branch the connections to its own local switch rather than use Ameritech's switch, and might provide metropolitan interexchange service by building some of its own trunks between switches, but leasing some trunk capacity from Ameritech.

All of these proposals share a new vision of local access: because of encouraging prospects for radio telephony, independent local networks (most private, but a few public), cable television, other utility companies, and extension of the reach of long-distance carriers, local access ought not to be a protected monopoly, and may some day be reasonably competitive—and, perhaps, even unregulated. Disagreements arise about exactly when each type of company should be permitted into which markets and under what conditions, and about how to define, and to pay for, universal service. But the present reality is that more than half of investments in telecommunications networks are now being made for local systems other than the traditional monopoly local exchange network, and the political system, at least at the federal level, has pretty much reached accord that this diversity should be facilitated rather than retarded.

VARYING VIEWS ON REGULATION

The papers that follow provide a range of views about these developments, the prospects for competition in all elements of the industry, and the ways that federal and state regulators are responding to them. Robert Crandall summarizes the objectives and performance of telecommunications regulation. He points out that the objectives of regulation are more complex than simply protecting consumers against monopoly, and in particular that the objective of fairness—all citizens should have access to approximately the same range of services at roughly the same prices—conflicts with giving service providers proper incentives for operating efficiently and adopting warranted new technologies. Because of this conflict, regulation often is the primary barrier to competitive entry, made so because regulators fear that entry will upset the fairness of the system. Crandall explains that this sacrifice of efficiency for fairness is becoming increasingly costly as telecommunications technology progresses, and he advocates regulatory reforms that minimize the scope of regulation and, where regulation is necessary because of market power, that accord greater weight to economic efficiency.

Robert Harris picks up Crandall's themes about the growing importance of an efficient telecommunications system and the desirability of less extensive regulation. According to Harris, telecommunications must be seen as part of an overall strategy for economic growth, much as railroads were a primary engine of economic development in the 19th century. The rationale for government intervention is gradually shifting from protecting consumers against monopoly to assuring complete interconnection, including among competitive carriers. The latter concern arises because the network is more valuable to each user as the number of accessible people and businesses increases. Harris concludes with a survey of regulatory reform activities in several states that appear to be placing a greater emphasis on efficiency, and in some cases to be proactively procompetitive.

Dale Hatfield addresses the issue of competition between local telephone and cable television companies. Because of fundamental structural differences in the nature of these two local networks, Hatfield concludes that neither is likely to become an important competitor to the other in the next few years. Hatfield expresses concern that the movement by Bell operating companies into video services will be expensive and will be driven more by the distorting effects of regulation than by any efficiency or procompetitive advantage flowing from such entry.

Nina Cornell focuses on the precise nature of the bottleneck monopoly enjoyed by local access providers. Cornell's main theme is that as long as local exchange carriers have control over termination, they will have market power over the entire network. And, according to Cornell,

historical experience teaches that control over termination has inevitably led to actions to extend the monopoly to other elements of the industry. Thus, for a procompetitive, free-entry regime to work, policy must succeed in making both originating and terminating access competitive. To do so will require unbundling of termination and efficient pricing of the unbundled elements. Moreover, the pricing regime will require more than price-cap regulation, since price caps do not prevent, and sometimes reward, strategic pricing to harm competitors.

Thomas Long expresses the common concerns of consumer advocates about the diversification of telephone companies and the adoption of efficient pricing systems for local access. The essence of Long's concern is that network upgrades for the few or that may not be efficient for anyone will lead to higher prices for all consumers. Reliance on access competition to prevent this outcome is, in Long's view, unrealistic, and regulators seem prone to believing that there is more competition than in fact exists. Long believes that allocating some of the fixed costs of the local network to services other than basic access is the best safeguard against consumers becoming involuntary investors in high-technology services that they do not want or need.

Bridger Mitchell's paper clarifies the economics of local telephone networks, and in particular the concepts of subsidy that are relevant for policymakers. Cross-subsidy occurs when, given current prices, other customers and the network supplier would be better off if a service were abandoned. Basically, this means that a service is not being subsidized if its price exceed the incremental cost of service. Mitchell than examines the cost structure of California local access companies to ascertain exactly who is and is not subsidized. Mitchell's work indicates that:

-

Flat-rate residential service is probably economically efficient (the gains from measured rates are more than offset by the measuring and billing costs);

-

Because local access costs are driven primarily by the distance of customers to the local switch, state-wide rate averaging subsidizes customers in sparsely populated areas and discourages the efficient adoption of radio telephony rather than wirelines as the means of providing access in rural areas; and

-

The incremental cost of service is less than half of the average cost, indicating that in most areas wireline access is a natural monopoly and that most residential subscribers are not being subsidized.

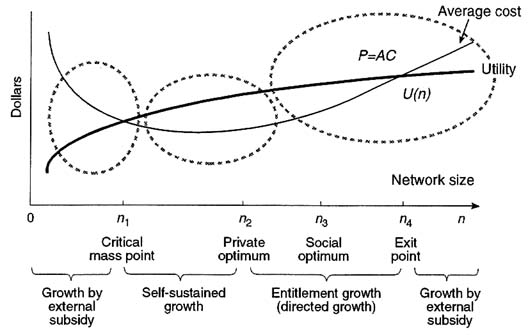

Eli Noam provides a conceptual framework for understanding how regulatory issues evolve over the life of a communications network. Initially, because of economies of scale and the fact that each consumer values the network more highly as it acquires more customers (the ''network externality"), the primary issue is promoting the growth of the system. This phenomenon applied to basic access for the early history of telephony, and applies today to new capabilities such as Internet and, perhaps, digital transmission. Once these scale and externality factors become less important, the primary policy issues shifts—to promoting competition and mandatory interconnection where warranted, but to protecting "cream-skimming" entry driven not by efficiency but by price distortions arising from the "fairness" objective. Finally, in the late stage of a system, costs are rising and further expansion of the system is not worthwhile, and policy focuses more on encouraging migration to another, usually more advanced system and making certain that those with investments in the old system do not succeed in artificially maintaining its dominance by erecting barriers to entry—including regulatory, legal, and political barriers.

Collectively, the papers in this section reflect the dilemma of regulatory policy as technology and market structure rapidly evolve in the telecommunications industry. The core economic uncertainty is how important the new technologies will be, whether that importance is limited to a minority of sophisticated customers or a large fraction of the businesses and residences in the

nation, and the extent of natural monopoly that will be present in each major component of the network during the next decade or two as the use of these new technologies spreads. The political problem flowing from this economic uncertainty is the relative importance of the two major duties of regulatory policy: protecting consumers against a ubiquitous, impregnable monopoly and assuring universal access to prosaic telephone service, or facilitating the rapid adoption of advanced new technologies. For the most part, conflicts over the proper nature and scope of regulation, including whether extensive deregulation is in order, arise from continuing disagreement about the technological and economic future. But in setting a future course, policymakers need to take into account that a regulation-intensive process tends to equalize prices and access across groups, but in the process tends to slow change, inhibit the entry of new firms with new ideas, and advantage status quo players.

REFERENCES

Brock, Gerald W. 1981. The Telecommunications Industry: The Dynamics of Market Structure. Harvard University Press, Cambridge, Mass.

Capron, William. 1971. Technological Change in Regulated Industries. Brookings Institution, Washington, D.C.

Cass, Ronald A. 1989. "Review, Enforcement, and Power under the Communications Act of 1934," A Legislative History of the Communications Act of 1934, Max D. Paglin, ed. Oxford University Press, Oxford.

Joskow, Paul L., and Nancy L. Rose. 1989. "The Effects of Economic Regulation," pp. 1449–1506 in Handbook of Industrial Organization, Richard Schmalensee and Robert Willig, eds. North-Holland, Amsterdam.

Kanazawa, Mark T., and Roger G. Noll. 1994. "The Origins of State Railroad Regulation," pp. 13–54 in The Regulated Economy, Claudia Goldin and Gary D. Libecap, eds. University of Chicago Press, Chicago, Ill.

Noll, Roger G. 1989. "Economic Perspectives on the Politics of Regulation," pp. 1253–1287 in Handbook of Industrial Organization, Richard Schmalensee and Robert Willig, eds. North-Holland, Amsterdam.

Noll, Roger G., and Frances M. Rosenbluth. 1995. "Telecommunications Policy: Structure, Process, Outcomes," Structure and Policy in Japan and the United States, Peter Cowhey and Mathew D. McCubbins, eds. Cambridge University Press, New York, forthcoming.

Poole, Keith T., and Howard Rosenthal. 1994. "Congress and Railroad Regulation: 1874–1887," pp. 81–120 in The Regulated Economy, Claudia Goldin and Gary D. Libecap, eds. University of Chicago Press, Chicago, Ill.

Robinson, Glen O. 1989. "The Federal Communications Act: An Essay on Origins and Regulatory Purpose," A Legislative History of the Communications Act of 1934, Max D. Paglin, ed. Oxford University Press, Oxford.

Thierer, Alan D. 1994. "Senator Dole's Welcome Proposal for Telecommunication Freedom," Heritage Foundation Backgrounder, No. 233 (August 24).

NOTES

Government Regulation and Infrastructure Development

Robert W. Crandall

The 1970s and 1980s provided students of regulation with a wealth of empirical evidence on the effects of regulation and deregulation on prices, output, and service quality in many industries. This evidence has confirmed much of the prior research that concluded that regulation reduced economic welfare. Indeed, Winston's recent comprehensive survey of the field suggests that, if anything, economists underestimated the benefits of deregulation, in large part because they failed to predict the development of new services and technology after deregulation (Winston, 1993).

It has been 34 years since the Federal Communications Commission (FCC) began to liberalize the telecommunications sector by allowing private microwave service; 24 years since the FCC allowed entry into private-line long-distance service; 19 years since MCI entered switched long-distance service despite the FCC; and 11 years since AT&T agreed to a divestiture to settle a 1974 antitrust suit. Communications technology has improved at an explosive rate over this period, and there appears to be no slowing of this progress on the horizon. Despite all of these changes, telecommunications remains a highly regulated industry—regulation that is still justified by concerns over natural monopoly.

If, as Winston found, economists were unable to predict how the airlines would build their networks after deregulation with a fleet of jets whose technology has changed very little since the 1978 deregulation, economists should certainly be wary of pretending to know how the nation's communications infrastructure will develop with or without the heavy hand of government regulation and/or subsidy. While some students of telecommunications technology—many of whom are potentially heavy users of new network infrastructure—may have strong views about how they would like to see the nation's communications infrastructure develop, their vision may not be consistent with the developments that maximize economic welfare.

It is my view that regulation should not be seen as a form of government infrastructure planning, but rather as a source of restraint on actors who enjoy some modicum of market power that should decline as the potential for monopoly diminishes. In this paper I attempt to outline the major regulatory issues that have arisen in telecommunications as some regulators have moved to liberalize market entry while still maintaining control over a variety of rates and other operating parameters of incumbent carriers. In so doing I shall focus as much as possible on the implications of these issues for infrastructure evolution. I start, however, with a brief digression on the definition of "infrastructure."

WHAT IS INFRASTRUCTURE?

To many participants in the debate over industrial policy, infrastructure is generally thought of as those facilities owned by government or by private, regulated utilities. By this definition, common-carrier telephone systems, common-carrier energy distribution systems, sewers, water utilities, government buildings, and public schools are infrastructure, but private computer networks, private schools, private roads, or shopping centers are not.

This distinction between public capital and private capital in unregulated firms may be useful for some purposes, but it is surely misleading in telecommunications. Billions of dollars have been invested in private networks that are at least related to if not part of our communications infrastructure even though they are not generally available to other users. Presumably, these facilities reflect the decisions by private concerns that total reliance on common-carrier facilities is not in their best interests. Indeed, it may be that the role of common carriage is rather limited in an efficient, dynamic market with rapidly changing technology and equally rapidly changing user requirements. It is even possible that the only communications infrastructure may eventually be a set of interfaces among myriad private networks.

Unfortunately, there may be no way for the student of telecommunications to determine which combinations of private and common-carriage network facilities reflect an optimal configuration. It is for this reason, among others, that public policy is moving toward more open access of unbundled common-carrier facilities, allowing a myriad of possible combinations of common-carrier and other facilities.

In the discussion that follows, I assume that the goal of public policy should be to allow a multitude of actors to invest in new technology and to develop the public/private network in a fashion consistent with their needs. This may result in a multitude of private networks that interconnect in some hierarchical fashion with or without the assistance of large common carriers, or it could lead to a number of competing large networks—owned by, say, AT&T, MCI, TCI, Time-Warner, Hughes, and the regional Bell operating companies.

WHERE IS THE NATURAL MONOPOLY?

The stated objectives of most telecommunications regulation is the protection of the public from the evils of monopoly power that might be exerted by telephone common carriers through raising rates above incremental costs and/or denying their actual or potential rivals access to their bottleneck facilities. In fact, the objectives of most regulators are much broader than this. Operating in a political arena, these regulators view regulation as an exercise in "fairness," protecting residences, small businesses, and rural Americans from having to pay the full (long-run incremental) cost of basic telephone service.1 As a result, it is widely accepted that other services "subsidize" basic local service for these groups of ratepayers.

Some may and will debate this conventional wisdom about widespread cross-subsidization in telephone regulation. However, one recent empirical study confirmed the existence of such cross-subsidies (Palmer, 1992) using Faulhaber's test for subsidization (Faulhaber, 1975). Many others have reached the same conclusion through more informal empirical tests (Perl, 1985; Crandall, 1991).

Even if cross-subsidies do not exist in the sense that rates do not lie outside the range between stand-alone costs and incremental costs, it seems clear that state regulators in particular have historically been quite reluctant to allow prices to move toward Ramsey (quasi-optimal) levels (Baumol and Bradford, 1970). Specifically, usage rates—particularly for toll calls—have been kept too high and access rates too low for most customers in response to apparent political demands.

Ironically, it has always been thought that the most likely locus of natural monopoly in telecommunications is in providing access to dispersed small customers. But there cannot be any test of the existence of such power as long as regulators deliberately keep the price of access artificially low to satisfy political objectives while frustrating entry into other markets from which the "subsidies" are paid.

Recent changes in technology have cast doubt on the notion that local access markets are natural monopolies. The development of new access technologies that employ the electromagnetic spectrum are threatening to provide ubiquitous competition for the traditional wire-based systems. Cellular competition is increasing as providers seek out new spectrum and employ new digital technology. Personal communications networks are only in their infancy, but they too may add substantially to consumers' choices for gaining access to the network.

On the other hand, fiber optics may have such large-scale economies as to threaten to reestablish AT&T's long distance monopoly (Huber et al., 1992).2 Now that there are three national long-distance networks and numerous other regional carriers, one might have expected interstate long distance services to be deregulated by the FCC. But fear of AT&T dominance and evidence that competition has not been responsible for lower rates (Taylor and Taylor, 1993) have made such deregulation difficult to complete. Fortunately, even if minimum efficient scale in fiber optics transmission is very large, transmission costs may be such a small share of total long-distance service costs that such economies alone could not reestablish AT&T's monopoly.

All of the current discussions about the locus of natural monopoly in telecommunications avoid a central fact: the potential monopoly power that exists today is as much a reflection of regulatory barriers to entry as to technology and market conditions. We simply do not know whether such power would persist in the absence of regulation because we have no market experiment to instruct and guide us. Moreover, given the incredible rate of technical change in this sector, we have no reason to believe that assertions based on today's array of telephone poles, paired wires, cables, and switches are very informative. Somehow, we need a market test of the effectiveness of competition in this sector.

THE REQUISITES OF PUBLIC POLICY

Given the rate of progress and the large number of actual and potential players in this sector, it is my view that regulatory policy should now stress:

-

Removal of the worst of the remaining rate distortions for access and usage;

-

Elimination of entry barriers into local, interexchange, and "information" services markets;

-

Deregulation of all but the "core monopoly" services and substitution of price regulation for rate-of-return regulation for these services; and

-

Regulatory forbearance from any attempt to guide network design or investment decisions.

Removal of Rate Distortions

There is no way that regulators can know the "true" costs of various telecommunications services given the pervasive joint and common costs in this sector and the rapid rate of technical change. Allocations of historical accounting costs are quite simply arbitrary exercises. Simulations of costs through forward-looking engineering models are equally subject to error and abuse by regulatory participants.

Nevertheless, it is fairly clear that toll usage rates are undoubtedly too high because regulated carrier access rates are kept above long-run incremental costs. Moreover, it is equally

clear that the incremental cost of a business loop is generally little different from the cost of a residential loop in the same geographical area and that the cost of access increases with the distance from the switch. Thus, a reduction in business access rates, an increase in residential rates—particularly in smaller communities—and a reduction in carrier access rates are generally required to move rates closer to incremental costs.

As rates are moved toward incremental cost, competition in providing local access to smaller customers will increase. At some point, cellular, personal communication networks (PCNs), or other technologies might actually begin to make local access a contestable market. Once this occurs, the degree of regulation of local exchange carriers (LECs) can be reduced, and LECs can be freed to compete in vertically related markets.

Removal of Entry Barriers

State regulators have historically been reluctant to admit competitors into local markets for fear of undermining the cross-subsidies they have crafted. Not only will elimination of cross-subsidies increase the probability of competition, but increasing competition will reduce the possibility for cross-subsidies.

Entry is taking place. State regulators are finding it increasingly difficult to prevent new fiber optics networks from developing in large cities, and they are largely powerless to stop the new entry that is occurring or is likely to occur in radio-based services.3 Cable companies are beginning to reconfigure their networks to compete in some fashion with the LECs. PCNs will begin to appear in a few years.

No one can foresee how the local access market will evolve. A few years ago it was widely believed that high-definition television would probably be an analog system. Until just recently, there was considerable doubt that telephone companies could deliver video services without extending fiber optics loops all the way to the subscriber. Given the rapid and unpredictable nature of technological change, regulators should allow relatively free entry and allow the market to determine the best arrangements for connecting residences and business to communications networks.

Of course, facilitating entry into access markets is not that simple. Entry is more likely if the new entrants can connect readily with incumbents, who, in turn, are obviously not eager to cooperate. Regulation of the terms of interconnection is thus inevitable, but on what terms? This leads to all of the problems of open network architecture, unbundling of basic service elements, collocation, and the provision of information on changes in the technical design of the core network. If regulators cannot know the incumbents' costs, how can they know the costs of the basic elements? I offer no magic solution to these problems.

Deregulation of Noncore Services

Among the most contentious issues in telecommunications policy is the development of safeguards to prevent a regulated carrier from cross-subsidizing competitive services from regulated monopoly profits. I do not intend to revisit the history of the FCC's approach to this problem in successive computer decisions, but the problem is pervasive and is likely to get worse.

As new technologies develop, the size of the monopoly "core" that requires regulation shrinks. Competition in intra-local access and transport area (LATA) toll, central-office services, or even local switching cannot be fully effective if the incumbent carrier is regulated and its rivals are not. Yet once the incumbent is allowed to compete freely in some markets while being regulated in upstream services, complaints of cross-subsidy and denial of comparable interconnection will

abound. The choice for regulators is either to require incumbents to shed services successively as they become competitive or to deal with the potential problems by shifting to price caps and enforcing rules of comparable interconnection. Neither "safeguard" is perfect, but the choice should be viewed as just one difficult step along the road to a competitive pluralistic network.

The substitution of price-cap regulation for the current cost-based approached favored by most state regulators will not only reduce the incentives for cross-subsidization by the regulated carriers but also will eliminate a powerful disincentive for technical progress. Cost-based regulation stunts the carriers' incentives to seek cost-saving or revenue-enhancing technologies, particularly when such regulation is accompanied by unrealistically slow depreciation schedules. Even though price caps are far from foolproof, any movement away from cost-based regulation should be eagerly supported by those who want to encourage major network investments by regulated carriers.

Forbearance from Mandating Network Technology

Historically, regulators have assumed a planning role in an attempt to prevent regulated carriers from padding the rate base under rate-of-return regulation. Investments are permitted if the new capital is "used and useful." In some instances, regulators have forced changes in technology to accommodate new services or new competitors, but they have generally stopped short of forcing regulated firms to push out the envelope of technology for fear that such investment will expose ratepayers to too much risk.

Some industry observers and users of advanced services now want to use regulation as a prod to investment in an advanced national information infrastructure or "superhighway." Regulated firms would be given assurances on rates for basic services in return for their commitment to build a high-speed switched network using fiber optics all the way to the subscriber or to the "pedestal." The precise configuration of such a network—whether it employs synchronous or asynchronous technology, for instance—is subject to considerable debate and uncertainty. Nor is it clear which services will be demanded by most subscribers or who will be allowed to provide them.

Given the speed of technological progress in this area, it is particularly dangerous to suggest that regulated firms, operating under a constitutional guarantee that they can recover their investment through subsequent rate increases, should be instructed by regulators to invest billions of dollars in new technology that may either prove unwanted or be surpassed by other technologies. Public utilities are not particularly good in making such decisions, as our recent sorry experience with nuclear power should confirm. Two years after being liberated from the Modified Final Judgment restrictions on information services, the Bell operating companies have not been very successful in developing and marketing new content-based services.

There is another important reason for not forcing (or subsidizing) investment by regulated carriers in advanced networks. Such a policy will only increase the pressure on regulators and legislators to limit competition since these massive new investments must be recovered through ratepayers or taxpayers. This will only increase the argument for protecting cable television companies, newspapers, and other information providers from the potential competition of regulated telephone companies. Rather than expanding the domain of regulated competition, we should be contracting it as rapidly as possible.

Given the bewildering array of technical possibilities for the "network of the future," it would be very dangerous for regulators (or legislators) to exclude competition from certain large players while mandating that telephone companies invest in what is perceived to be today's best choice for the network of the future. At this juncture, it is widely believed that residential demand for video services will drive the network design. But no one can be sure whether video on demand

(VOD) will completely replace today's multichannel offerings or just how it will be delivered. Will paired copper wires suffice for the last mile? Will coaxial cable systems be the best local loop for VOD? Can the current coaxial systems be modified to offer truly universal switched wide-band services, or will such services be offered best by telephone company asynchronous transfer mode (ATM) networks? One shudders at the thought of state regulatory commissions making these decisions.

CONCLUSION

Students of regulation have seen how it is the enemy of technical progress. Regulatory accounting, entry protection, and fears of cross-subsidies often prevent regulated firms and potential entrants from exploiting technological progress. The introduction of new freight cars, piggyback services, hub-spoke airline networks, multichannel urban coaxial cable systems, pay-television channels, and a myriad of telephone terminal equipment was delayed by regulators bent on protecting the public from the evils of monopoly restrictions of output. Given the extraordinary current rate of technical progress in communications, they should be reluctant to limit the domain of current players or of potential entry. Instead, regulators should look to open markets, constrict the core of regulated monopoly, and increase the number of participants in the communications sector.

Of course, a reliance on competition to develop network infrastructure will not please those who think they already know what a modern telecommunications network should look like. I would prefer this risk to repeating the mistakes made earlier in this century by regulating airlines, trucking, broadcasting, cable television, and telephony in the first place.

REFERENCES

Baumol, William J., and David F. Bradford. 1970. "Optimal Departures from Marginal Cost Pricing," American Economic Review 60(3):265–283.

Crandall, Robert W. 1991. After the Breakup: U.S. Telecommunications in a More Competitive Era. Brookings Institution, Washington, D.C.

Faulhaber, Gerald R. 1975. "Cross-subsidization: Pricing in Public Enterprises," American Economic Review 65(5):966–977.

Huber, Peter W., Michael K. Kellogg, and John Thorne. 1992. The Geodesic Network II: 1993 Report on Competition in the Telephone Industry. Geodesic Company, Washington, D.C.

Noll, Roger G. 1989. "Telecommunications Regulation in the 1990s," New Directions in Telecommunications Policy, Paul R. Newberg, ed. Duke University Press, Durham, N.C.

Palmer, Karen. 1992. "A Test for Cross Subsidies in Local Telephone Rates: Do Business Customers Subsidize Residential Customers?" The RAND Journal of Economics (Autumn):415–431.

Perl, Lewis. 1985. "Social Welfare and Distributional Consequences of Cost-based Telephone Pricing," paper presented at the Annual Telecommunications Policy Conference, Airlie, Virginia.

Taylor, William E., and Lester D. Taylor. 1993. "Postdivestiture Long-Distance Competition in the United States," American Economic Review: Papers and Proceedings 83(2):185–190.

Winston, Clifford. 1993. "Economic Deregulation: Days of Reckoning for Microeconomists," Journal of Economic Literature 31(3):1263–1289.

State Regulatory Policies and the Telecommunications/Information Infrastructure

Robert G. Harris

INTRODUCTION

Historically, the term "infrastructure" has been applied to public-sector investments in highways, airways, schools, and libraries. Because virtually all investment in the communications infrastructure was done by private business enterprises, there was a tendency to take it for granted. No longer. Historically, the United States has relied on a dual system of regulation, federal and state, that strictly limited competition and provided for a nearly guaranteed rate of return to private investors, to ensure the development of a ubiquitous public switched telephone network with affordable rates. It has become evident that the traditional regulatory policies for achieving and sustaining universal service are no longer viable. Because of dual jurisdiction, though, there has been a growing gap between procompetitive federal regulatory policies and those of many states, which are clinging to the regulatory regime of the past.

In this paper I briefly review some of the changes that have been and will be occurring in telecommunications technology, markets, and public policies. I explain the implications of these changes for the telecommunications/information infrastructure in the context of global competition and the strategic character of telecommunications and information services. I consider the implications of the changing character of telecommunications infrastructure for public policy objectives, emphasizing the need for public policies that place greater emphasis on dynamics than statistics, on the grounds that innovation and productivity improvements will generate more benefits than efforts to control prices or limit competition in hopes of maintaining historical cross-subsidies. I also briefly describe several recent state regulatory policy changes or pending initiatives that are consistent with the following progressive policy objectives: reducing rate distortions in the pricing of telecommunications services; reducing entry barriers in local exchange services; deregulating competitive or discretionary telecommunications services; and the adoption of price regulation, rather than rate-of-return regulation, of noncompetitive telecommunications services.

CHANGES IN THE TELECOMMUNICATIONS INDUSTRY

In the past decade or so the United States and other highly developed economies have entered the postindustrial era. In the industrial age the extraction of natural resources for energy and raw materials and the manufacturing of goods were the chief drivers of economic growth. While manufacturing continues to be important, employment in the service sector continues to grow, owing mainly to the tremendous advances in computers and communications. In the past century, agricultural employment has declined from 45 percent to less than 5 percent and employment in

manufacturing has returned to its 1890 level of 20 percent after peaking at 30 percent in 1960, while employment in services has exploded from 30 percent to over 77 percent (and 75 percent of the gross national product). Even in manufacturing industries, knowledge-based service activities (e.g., information processing, communications, research and development) constitute 65 to 75 percent of manufacturing costs and even more of the "value added" in the manufacturing sector (Quinn, 1992, pp. 3–30).

What railways, waterways, and highways were and are to the goods economy, telecommunications networks are to the service economy, since a very large share of value creation in the service sector involves the generation, manipulation, storage, retrieval, and other use of information. Today, information-based enhancements have become the main avenue to revitalize mature businesses and transform them into new ones. As chronicled by George Gilder in Microcosm, the basis of this transformation is microelectronics technologies and their application to computers, communications, manufacturing equipment, consumer products such as autos and household appliances, and virtually all service industries (Gilder, 1989, pp. 317–383).

As Davis and Davidson (1991) have pointed out, "Today, information-based enhancements have become the main avenue to revitalize mature businesses and transform them into new ones. In every economy, the core technology becomes the basis for revitalization and growth. Information technologies are the core for today's economy, and to survive all businesses must informationalize" (p. 17; emphasis in original).

To understand the role of telecommunications in that transformation, one must consider three major types of change in telecommunications—namely, changes in technology, markets, and public policies. In combination with the relatively faster growth of service industries, these changes have heightened the importance of telecommunications in economic development and, therefore, increased the value of developmental telecommunications policies (i.e., policies that promote, rather than inhibit, the development of a vital telecommunications sector).

After several decades of steady, but incremental, technological innovation and adoption in telecommunications, there has been a virtual explosion of new technologies in the past decade. Along with computers, telecommunications is on center stage of the microelectronics revolution: the application of transistors, semiconductors, integrated circuits and other microelectronics in telecommunications equipment has dramatically reduced equipment costs, improved the quality of service, and generated a host of new services and capabilities in the public switched telephone network (PSTN).

Through microelectronics the digitization of telephone switching has made possible many new services and reduced the costs of enhanced services. Digitization and optical technology in interexchange transmission, interoffice trunking, and cable TV distribution systems have reduced the costs of those services and created entry opportunities for cable companies and alternate access providers such as Metropolitan Fiber Systems. As federal policies and market competition have driven the prices of interexchange and data communications services toward costs, technological change has induced substantial increases in demand, thereby inducing investments in capital-embodied technological innovation.

At the same time, these developments have eroded the traditional natural monopoly character of the PSTN and stimulated the rapid market penetration of private branch exchanges, private telecommunications networks, facilities-based carriers, and resellers. Thus, local exchange carriers face competition from equipment suppliers (e.g., Centrex services competing with PBX vendors); with their own customers, who increasingly turn to self-supply of switching and network services; with competitive access providers for local exchange services; with established carriers like AT&T, MCI, and Sprint for switched and dedicated services; and with private pay phone vendors for public phone services.1

Contemporaneous with these changes in the wireline telephone network, technological developments in radio communications (including microwave), satellite (including direct broadcast

satellite to customers' premises), terrestrial broadcast radio and television, and cellular telephony have dramatically lowered the cost, improved the quality, and stimulated the proliferation of a wide range of wireless communications services. Not only has competition grown rapidly in each of these communications media, but as the capacity and range of services available through each medium have increased, so too has the competition among communications media. So, for example, sideband FM and TV broadcasting are now used to distribute financial market data and credit card verification information, in direct competition with the PSTN.2

There is every reason to believe that rapid technological change in both wireline and wireless telecommunications will continue, at accelerating rates, into the indefinite future. One major boost to innovation is the growing quest for technological advantage by leading competitor nations to the United States. Once the unrivaled leader in telecommunications equipment technology and system deployment, the United States faces competition from equipment manufacturers from Japan, Germany, France, and the United Kingdom, among others. Companies from these countries have committed major resources to telecommunications research and development and have caught up with U.S. suppliers in some technologies and passed them in others.3 This heightened international competition will almost certainly accelerate technological change, increasing the risk of economic obsolescence in the PSTN, but also expanding the potential benefits of investment in new technologies.

Dramatic changes are also occurring on both the supply side and the demand side of telecommunications markets. As little as ten years ago, local exchange carriers faced very limited competition for local network access. Today, traditional local telephone carriers face competition from a host of competitors and potential competitors: competitive access providers, interexchange carriers, cellular carriers, cable TV carriers, and, soon, personal communications services providers. Even small businesses and residential users have an increasing array of alternatives to PSTN services. For example, one can now use, in certain localities, (1) FM sideband for delivery of stocks and bonds price information to personal computers; (2) public TV sideband for delivery of credit card validation information to retail point-of-sale terminals; (3) a cable TV carrier for provision of local service bypass, local area networks, and metropolitan area networks; (4) cellular mobile as a substitute for coin-operated telephone service; and (5) a CD-ROM or magnetic disk database as a substitute for on-line access to information. More generally, there is growing competition between PSTN service providers and equipment vendors, including "SmartSets" (competing with "custom calling features"), auxiliary equipment such as answering machines (competing with voice mail), and personal computers.

Recent policy decisions by the Federal Communications Commission (FCC) to further open up local access to competition portend even more rapid change.4 The allocation of spectrum to facilitate the development of personal communications networks is one of the last nails in the coffin of the local exchange monopoly. Not surprisingly, other telecommunications companies are rushing to exploit new technological and regulatory opportunities in local exchange services. Recent announcements of the formation of strategic alliances among interexchange carriers, cellular carriers, and cable television carriers, such as AT&T's acquisition of a 33 percent interest in McCaw Cellular Communications (Karpinski, 1992a) and the Time Warner-MCI switched access trial in New York City (Karpinski, 1992b), will accelerate the emergence of vigorous competition for local exchange services.

The dramatic changes on the "supply side" of telecommunications markets have been matched by equally significant changes on the "demand" side. Rapid growth in the use of computers, data, and transactions processing systems (e.g., electronic funds transfers, credit card verification, automated teller machine networks, travel reservation services) has induced demand for data communications services, which is growing much faster than voice communications. With recent developments in computer graphics and image processing and storage systems, it is becoming evident that data will be superseded in the near future by images as the fastest-growing share of

communications traffic (e.g., American Express used to first keypunch data from credit card transactions, then move those data electronically from place to place; it now takes a "picture" of the credit receipt and moves the image from place to place). These changes from voice to data and image communications explain the need for and use of broadband transmission media.

As the demand for sophisticated telecommunications applications has grown, large business users have developed specialists in managing and purchasing telecommunications services. In just the past ten years, more than half of the Fortune 500 and thousands of medium and smaller enterprises have created a "chief information officer" position, to whom a range of computer, communications, and information experts and analysts report. With intimate knowledge of the technical and economic alternatives, these buyers continually seek out and exploit small differences in prices and have the capacity to assemble integrated systems from purchased "piece-parts." This means, in turn, that when regulated prices vary from market realities, buyers will turn to more economic alternatives.

Even among residential users, there are rapidly growing demands for advanced telecommunications and information services. With nearly 30 percent of the U.S. population engaged in work at home, and with more than 35 million personal computers in American homes, it is simply no longer true that residential customers will be satisfied with "plain old telephone service."

The divestiture of the Bell operating companies by AT&T and competition policy decisions by the FCC, in combination with the changes in telecommunications technology and market conditions, have facilitated competition in customer premises equipment, interexchange services, and, most recently, local exchange services. The FCC has consistently pursued procompetitive policies for the past decade, often in opposition to states, sometimes requiring the use of preemption over state regulations (e.g., customer premise equipment, inside wiring decisions). Clearly, the general direction of federal policy is procompetitive (NTIA, 1988).

ROLE OF THE TELECOMMUNICATIONS INFRASTRUCTURE

Some states have begun to liberalize their telecommunications regulatory policies since divestiture in recognition that traditional policies cannot cope with rapid changes in technology, competition, and market conditions. States such as Michigan, New Jersey, and Tennessee are explicitly using reformed telecommunications policies to promote state economic development, improve public services, expand educational and social services, and create a better economic environment to attract businesses and skilled jobs. As more and more states implement progressive, procompetitive policies in telecommunications, the cost of not keeping pace with these changes, in terms of lost jobs and economic development to other states, will increase.

These recent changes in state policies and perspectives reflect a growing awareness of the vital role of telecommunications in economic development. There is, in fact, a deep intellectual tradition that views telecommunications and other infrastructure industries in this way. In his seminal work, The Strategy of Economic Development, Albert O. Hirschman introduced the notion of backward and forward linkages from an infrastructure sector (e.g., energy, transportation, communications) to supplier and user industries (Hirschman, 1958). Hirschman explained why and how high investment in sectors with strong linkages will lead to more rapid economic growth. He coined the term "social overhead capital" to describe infrastructure industries that:

-

Provide services that are basic to a great variety of economic activities;

-

Exhibit a high degree of "publicness" (and are therefore usually provided by public agencies or private firms under public control);

-

Are immobile and therefore cannot be imported;

-

Have substantial "lumpiness" or technical indivisibilities; and

-

Have very high capital/output ratios, with large fixed investment required to achieve an economically viable level of output.

Given these characteristics, Hirschman argued that investment in social overhead capital not only was essential, but also required a national strategy for economic development. Hirschman's ideas provide the intellectual underpinning of national and state investments in railroads, waterways, highways, airports and air traffic control systems, hydroelectric projects, and public schools and universities.5 None of these investments could have been justified solely on the basis of a private cost-benefit calculation. Initially, both the Interstate Highway System and the air transportation system were used by a relatively small share of the population, often traveling for business purposes. Yet everyone contributed to the cost of the public investments through:

-

Preferential tax treatment (e.g., exemption from property taxes and tax-free financing of public debt);

-

Collection of excise taxes on gasoline used on city streets (the construction, maintenance, and operation of which are paid for by property taxes) to finance construction of intercity highways; and

-