1—

Introduction

Background

After decades of outstanding contributions to the nation's naval capability, the U.S. shipbuilding industry is in crisis. During the 1980s, under the Reagan administration, U.S. shipbuilders carried out an extensive construction program to renew the U.S. naval fleet. However, as this program flourished, U.S. yards were becoming increasingly isolated from major developments in the world's commercial industry. During that time, other shipbuilding nations, particularly South Korea, Germany, and Japan, concentrated—often with the help of new forms of government assistance—on building ships in series, benefiting from economies of scale and learning efficiencies. Between 1974 and 1993, U.S. shipbuilding for the commercial market declined precipitously. In the mid-1970s, a combined total of about 20 large oceangoing commercial ships were built every year in all private U.S. yards; since 1984, that number has been 10 or fewer ships every year, and no vessels were on order at all between 1989 and 1991 (SCA, 1993). Since 1985, Japan and Europe have supplied the dwindling number of commercial ships built for U.S. owners. Finally, after 1990, with the end of the Cold War, U.S. shipbuilders lost significant military work, as well as a large part of their work force. From any perspective, then, the U.S. shipbuilding industry confronts enormous challenges.

At the same time, there are new potential roles for the U.S. shipbuilding industry. The Maritime Administration (MARAD) has estimated that between 5,500 and 7,500 large oceangoing ships will be built for the commercial market between 1996 and 2001, largely to replace an aging world fleet (Executive Office

of the President, 1993). These figures compare well with figures from a recent study for the National Shipbuilding Research Program (NSRP). That study predicts a market of about 1,130 ships per year (NSRP, 1995). During the late 1980s and early 1990s, the international market experienced a combination of rapidly increasing world shipbuilding costs relative to the United States, along with increased demand, especially for tank vessels, and an associated rise in ship prices ($60 million to $100 million for very large crude carriers). This situation was forecast by Temple, Barker & Sloane (1990). This shipbuilding market situation became very evident to the Clinton administration policy-setters when they established the five-point shipbuilding initiative described in the following paragraph. Since 1993, the international market has changed again. The spurt of new ship orders in the 1989-1992 time period, plus the Desert Shield/Desert Storm activities, created a near-term oversupply of ships. This decrease in shipping requirements abruptly decreased the demand for new ships and created a significant drop in prices. However, U.S. construction has become more competitive in the international market because of increasing foreign labor and material costs, competitive U.S. labor rates, and improved U.S. productivity and capacity (Dallas et al., 1994; Temple, Barker & Sloane, 1990).

All of these considerations prompted the U.S. government to consider how it might best support the reestablishment of a commercial shipbuilding industry, with the hope that the industry can serve both commercial and military markets to their mutual benefit. Through the National Defense Authorization Act of 1993, the U.S. Congress specifically required the president to develop "a comprehensive plan to enable and ensure that domestic shipyards can compete effectively in the international shipbuilding market." In October 1993, the Clinton administration issued a corresponding five-part plan, Strengthening America's Shipyards (Clinton, W.J., 1993).

The nation's goal, according to this plan, should be to assist the efforts of the nation's shipyards to make a successful transition from military to commercial shipbuilding—a competitive industry in a truly competitive marketplace. The plan points out that such a proposed transition program is consistent with federal assistance to other industries seeking to convert from defense to civilian markets.

Three parts of the administration's plan concern financial issues: ensuring fair international competition; financing ship sales through loan guarantees; and assisting in international marketing. Another part of the plan is aimed at eliminating unnecessary government regulations to increase U.S. competitiveness. The fifth part of the plan intends to advance the industry's competitiveness through a government cost-sharing program that features industry-initiated research and development projects in technology transfer and shipbuilding process change.

More specifically, the five elements are as follows:

- Level the playing field for foreign and domestic subsidies, both direct and

- indirect, through formal agreement of the Organization for Economic Cooperation and Development (OECD).

- Develop manufacturing and information technologies for ship design and production through the Maritime Systems Technology (MARITECH) program of the Department of Defense's Advanced Research Projects Agency (ARPA), in part by encouraging needed alliances among customers, suppliers, and technologists.

- Eliminate unnecessary government regulations in such areas as procurement, standardization of international construction standards by the U.S. Coast Guard, and updated Office of Occupational Safety and Health Administration standards.

- Finance foreign-flag as well as U.S.-flag sales through Title XI loan guarantees.

- Provide executive-branch assistance with international marketing.

Scope and Objectives of this Study

In keeping with these developments, ARPA and the Office of Naval Research (ONR) asked that the National Research Council (NRC), through the Marine Board, conduct a study of the potential role of technology in revitalizing the U.S. shipbuilding industry and of the health of the shipbuilding industry's infrastructure for research, education, and training.

The Marine Board's Committee on National Needs in Maritime Technology was formed and was given the following three-part charge:

- Assess the current state of research and technology application in the U.S. shipbuilding industry and identify changes that could assist in making the transition from the current state of the industry to an internationally competitive state and convene a workshop to assist in this part of the project.

- Assess current and proposed programs that invest in ship design and production-related research and identify appropriate changes that would improve their effectiveness and contribution to the goal of an internationally competitive U.S. shipbuilding industry.

- Assess the current state of U.S. education in naval architecture and marine engineering and identify steps that should be taken to strengthen the education base to achieve national shipbuilding goals. If appropriate, convene a workshop to assist in this part of the project.

This report addresses these three tasks in the manner described at the end of this chapter under "Organization of the Report." First, however, some additional background is given on the shipbuilding industry's structure and employment, on potential commercial markets for large U.S. shipbuilders, on past and present forms of support for the U.S. shipbuilding industry, on foreign government support of their shipbuilding industries, and on the recently signed OECD agreement

to terminate a wide variety of subsidies to the shipbuilding industries of signatory nations to promote more equitable and productive competition.

Although there may be a military benefit to having a viable commercial shipbuilding industry, neither the administration's plan nor the charge to the committee addresses the national capability for naval shipbuilding. The subject of building military ships is discussed only to the extent that practices developed to build ships for the Navy may help or hinder commercial ship production.

Industry Structure and Employment

The following discussion briefly describes some critical characteristics of the U.S. shipbuilding industry with regard to the industry's competitiveness.

Size

The employment level of shipyards is sometimes difficult to determine because many shipyards are both shipbuilding yards and ship-repair yards. The U.S. Maritime Administration reports employment levels for both types as shipyard employment; therefore, none of the 21 shipyards they consider capable of building large oceangoing ships has built any ships recently. In addition, there are several smaller shipyards, many under common ownership, that are developing the concept of the "virtual shipyard" and are operating together to form what can be considered yards of more than 1,000 employees. Total employment at the 21 major private U.S. shipyards in 1994 was about 75,000. Total employment in private U.S. shipyards was about 107,000 during 1994 (MARAD, 1994). That figure for employment represents a steady decline since 1982, when about 172,000 people were employed in all private U.S. shipyards. These figures are for shipyard employment only and do not include suppliers and related employment, which would more than double the number. The Shipbuilders Council of America estimates that, if present industry trends continue, a total of 180,000 shipyard, supplier, and second-tier and support jobs could be lost by 1999 (SCA, 1993).

Although the term "shipyard" generally includes both shipbuilding companies and ship-repair companies, this study is restricted to shipbuilding companies, and further, to those shipbuilding companies that can build large, oceangoing ships. Ship repair may share some of the same facilities and personnel as shipbuilding; however, the production process is very different. Moreover, many builders of small vessels are currently competitive and even leading in the international market for their products. These builders of smaller vessels have been examined by the committee for beneficial practices. Factors for successful competition cited by small shipyards include improved efficiency from less complex management organizations, the ability to change products quickly to enter new markets, and a willingness to price products at a loss in order to enter new markets. In the committee's analysis here, there are three size categories of active

TABLE 1-1 U.S. Builders of Large Oceangoing Ships by Work Force Size

|

Size of Shipbuilder |

Number of Employees |

Number of Companies |

|

Large Established |

More than 3,000 |

4 |

|

Medium, Emerging |

1,000 to 3,000 |

3 |

|

Small |

Less than 1,000 |

12 |

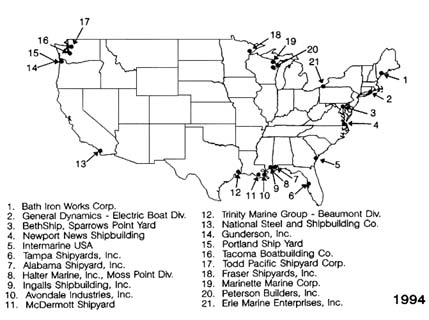

U.S. large, oceangoing shipbuilders, as expressed by the number of their employees (Table 1-1). Most of the employees of these 21 companies are involved in building U.S. Navy vessels, which will be true through 1997 and perhaps beyond. The names of these shipbuilders and their locations are shown in Figure 1-1.

MARAD has sometimes used a different, but related, classification of shipbuilding companies. MARAD distinguishes "major" shipbuilding facilities, which can construct vessels of at least 400 feet in length, from "second-tier" facilities. According to this classification, there are 21 major facilities in the United States. Second-tier shipbuilding facilities are those remaining, that is, those that construct vessels smaller than 400 feet. Second-tier facilities number about 100, and

FIGURE 1-1

Major shipbuilders in the United States and their locations.

(SOURCE: MARAD, 1994).

some of them now compete successfully in specific international markets. Major shipbuilders employ about 70 percent of the U.S. shipbuilding and ship-repair industry's total work force (MARAD, 1994); 90 percent of those workers are engaged in Navy or Coast Guard ship construction and repair work. At the end of 1994, nine of these 21 shipyards were performing only repair and overhaul work, small Navy vessel construction, or non-ship construction work. The MARAD classification is based only on the capabilities of the facilities in the shipyard, not on actual performance. One-fourth of the 21 major shipyards have not built a large ship in the last 15 years.

Ownership

Ownership of the 21 companies shown in Table 1-1 varies. Several are subsidiaries of a larger parent company, several are independent, and several are employee owned. Therefore, the commitment to continued operation during times of financial stress varies, as does the ability to raise capital for investing in improved facilities and processes.

Location

Shipbuilding companies are located on all four U.S. seacoasts. Of the major shipyard facilities reported by MARAD, five are on or near the Atlantic, seven are on the Gulf, five are on the Pacific, and four are on the Great Lakes. The locations are shown in Figure 1-1.

Experience

Most of the 21 companies have neither designed nor built an oceangoing commercial ship in 15 years.

Designs

Numerous types of commercial ship designs can be purchased if a shipbuilder wishes to employ a firm of naval architects. However, several of the builders are developing the capability to generate commercial ship designs tailored to their fabrication methods and facilities.

Building Facilities (Including Waterfront)

Only a few of the 21 companies are capable of building ships of 20,000 tons or more. In many cases, there has been no significant upgrading of facilities since the 1970s. However, several of the builders planning to build ships for the international market have begun to invest in new facilities.

Costs

Builders that have competed successfully in the construction of large, complex U.S. Navy vessels in the past 15 years now find themselves shouldering excess personnel, needlessly complex procedures, and high overhead costs when compared to commercially competitive U.S. and international shipbuilders. U.S. wages are higher than for most Asian shipbuilders, although they are lower than most European shipbuilders. One recent survey showed the hourly rates for workers in U.S. shipyards to be about $18, compared with $10 in Korea and $25 in Japan, Denmark and Germany (Anderson and Sverdrup, 1992). Other factors, including the effect of environmental concerns on such activities as open-air blasting and coating of structure and the additional safety requirements mandated for U.S. workers posed by the Occupational Safety and Health Administration, tend to increase the cost of ship construction in the United States as compared with other nations that do not have such stringent requirements. Few of the companies shown in Table 1-1 can successfully compete with overseas builders of commercial ships at this time.

Potential Markets for Major U.S. Shipbuilders

The administration's plan to strengthen the U.S. shipbuilding industry does not identify specific goals to define international competitiveness. Some experts have suggested that capturing 10 percent of the projected world market of 700 to 1,100 ships per year (for the next decade) might be an appropriate measure. The committee believes this view is overly optimistic. A more realistic goal for U.S. shipbuilders to achieve is 3 to 5 percent of the estimated world market. A 30-to 50-ship annual volume would be twice the production level of the 1950s, 1960s, and 1970s. Perhaps a more helpful benchmark might be established with reference to the individual shipbuilder, who might be defined as a full player in the international market when the builder competitively produces the equivalent of four mid-sized (40,000-deadweight ton [DWT]) ships per year.

With regard to U.S. industry's reentry to the international market, the committee also agreed in another fundamental assumption; namely, that to become commercially competitive internationally, U.S. industry as a whole will almost certainly need more (perhaps considerably more) than five years to catch up to international competitors. Recent experience in many major U.S. industries, including automobiles, steel, and construction, indicates that, where industries have been severely challenged by foreign competitors, recapturing a significant market share, under the best of circumstances, requires a considerable period of time.

The shipbuilding market today is clearly better understood as a collection of niche markets. U.S. builders will need to target their products to particular niches to survive. In general, a new shipbuilder in the market, which is the position of every U.S. large oceangoing shipbuilder, should pick emerging market niches

unless the market is of sufficiently high volume that securing a modest share can be economical. For example, to compete in the dry bulk ships market with Korea, a nation that is now well experienced in this high-volume market and far ahead in productivity, some other initial advantage may be needed. Although the economies of scale associated with building ships in series help international competitiveness, in some markets small lots can be economically produced. This has been shown by builders in other countries with costs of living similar to those of the United States, as well as by builders in the United States when U.S. yards were stronger participants in commercial markets some years ago.

Table 1-2 shows the classification of world shipbuilding market segments that emerged from a recent gaming exercise sponsored by ARPA and the U.S. Navy in which more than 50 shipbuilding experts, both U.S. and foreign, participated (Dallas et al., 1994). Similar information is provided by a recent study sponsored by the NSRP (Storch et al., 1994). More than half of the forecast market of 1,127 ships per year cited in that study are in the category of ''high volume" market. Within that market sector, about 40 percent are bulk carriers, 40 percent are tankers, and the remaining 20 percent are general cargo ships.

Table 1-3 presents the committee's view of the difficulty U.S. shipbuilders face in entering the international market at a profit in selected important segments. The factors that can influence entry include the cost of shipbuilding facilities, market maturity (being well established in a mature market is an advantage), the capability of designing for the market, and the degree of sophistication required. The terms "easy," "average," and "hard" are relative. U.S. shipbuilders trying to market in the "average" category are finding it very difficult.

Similar predictions are made in NSRP (1995) where the market categories "strongly recommended" are for 5,000- to 50,000-DWT tankers, 5,000-to

TABLE 1-2 Global Market Segments for Commercial Ships

|

Percent of Market |

Ship Type |

Characteristics |

|

40–45 |

Bulk carriers |

Unsophisticated to design and build. "Easy" technology. Competition among all shipbuilders. |

|

30–35 |

Tankers |

Not too sophisticated to design and build. Again, worldwide competition. Huge Japanese and Korean lead in building this ship type. |

|

10 |

Container ships |

Higher technological skill required. More segmented competition. |

|

10 |

Specialty market |

United States has greatest chance in this part of the market. Unfortunately, low volume of ships. |

|

SOURCE: Dallas et al., 1994. |

||

TABLE 1-3 Difficulty of U.S. Entry to Selected Segments of the International Shipbuilding Market (Committee Estimate)

|

15-Year Market Size |

Difficulty of U.S. Entry to Marketa |

||

|

|

Easy |

Average |

Hard |

|

Large >500 Ships |

|

40K–DWT product tanker |

VLCC 40K–DWT bulk carrier |

|

Medium 100–499 Ships |

|

General cargob; Complex bulk carriers; Container; Cruise ships |

Simple bulk carriers |

|

Small <100 Ships |

High-speed cargo; Small chemical and product carriers; Reefer ships |

RO/RO; LNG; Cruise ferries |

|

|

a DWT, deadweight ton; VLCC, very large crude carrier; RO/RO, roll-on/roll-off unitized cargo ship; LNG, liquid natural gas carrier. b Palletized, partial container, break bulk, liberty ship replacement vessels. |

|||

20,000-DWT general cargo ships, liquid natural gas (LNG) ships, and passenger ships. That report considers as "recommended with reservations" tankers of 50,000 DWT and above, bulk carriers, refrigerated cargo ships, and roll-on/roll-off (RO/RO) unitized cargo ships.

In short, along with many other experts, the committee believes that it will likely be a niche world in international shipbuilding, and particularly so for the United States in the near term. Although Japan and Korea will probably continue to dominate the tanker and bulk cargo markets, for example, the U.S. could do well in selected markets, such as ships with high outfit content. However, the U.S. domestic market, which is protected by the cabotage features of the Jones Act, is different, and in fact can provide leverage for entering niches in the international market, such as 40,000-DWT tankers.1

It is perhaps a contradiction that the 40,000-DWT tanker market is perceived by the committee to be a hard market to enter, yet that market is the first international market for which orders have been placed with U.S. shipbuilders. This success can be attributed to the financing provided by Title XI, as well as the

determination with which shipbuilders are pursuing this market because of the large size of both the foreign and domestic (Jones Act) market for 40,000-DWT product carriers. Likewise, the LNG market, a small niche market, in spite of the higher risk involved because of the cost of licensing and developing required facilities, shows promise for U.S. shipbuilders because of the availability of Title XI financing for these very expensive ships and the sophisticated shipbuilding skills required to build them successfully.

Support of the Shipbuilding Industry

Government can try to support the shipbuilding industry in international competition by:

- reducing government regulations in processes, products, and business practices, when verified to be appropriate;

- providing nationwide tax incentives for modernization (e.g., capital gains tax reduction and investment tax credit), including new facilities that are more productive and quality improvement activities;

- developing training programs to increase skills in yards (in designing, building, or marketing);

- initiating research and development programs to improve materials, processes, and products;

- promoting technology transfer both from within the industry and from other industries and foreign shipbuilders;

- developing training programs in international purchasing, international sales methods, and international financing; and

- encouraging builders in joint ventures with foreign shipyards through the departments of Commerce, State, and Treasury.

Limitations of Technology

A precondition of this study was the assumption that technology could make an impact on the U.S. shipbuilding industry and its successful transition into an international industry. It is important to realize that although technology is clearly a major competitive factor in certain industries—particularly industries with lower capital cost products—it is not necessarily a competitive factor in more capital-intensive industries. An analogy is that if you're running a trucking company and have a fleet of trucks, you don't discard your fleet when a new model arrives with new performance technology (unless that technology would make a major dent in operating costs) or with lower acquisition cost. You wait until your trucks wear out and then replace them with the new model. In other words, the process by which the product was made has a relatively small impact on your buying decision.

It stands to reason, therefore, that in the shipbuilding industry, both product and process technology are necessary and essential ingredients to compete, although they do not necessarily lead to a competitive advantage. Process technology will only be able to modify costs and probably will not do enough to influence buying decisions in the face of financing advantages. As discussed in Chapter 2, the committee did not identify any new product technologies that would provide a competitive advantage for U.S. shipbuilders in the international shipbuilding market beyond the niche advantages already achieved.

Technology Versus Finance

The United States has long supported commercial shipbuilders through subsidies, loan guarantees, and tax credits, as well as cabotage and cargo-preference laws. In the past decade, however, much of this assistance has been discontinued, with the exception of assistance for financing, and the emphasis has shifted from financial assistance to technology-based assistance. This change has occurred over more than three decades of policy development for a multitude of reasons, through significant shifts in both U.S. military requirements and world markets. For policymakers, the paramount issue remains the satisfaction of sealift requirements to maintain a robust national capability for naval force projection and access to the imported goods and raw materials needed to conduct a war and to maintain national economic well-being.

In looking at how assistance programs might help reinvigorate U.S. commercial shipbuilding, the committee remained within its charter of assessing technology investments. Examination of traditional financial incentives, such as subsidies and loan guarantees, falls outside the study's charge. However, nontechnical factors, such as financing, could easily outweigh technology in determining whether the industry survives. The high product cost in the shipbuilding industry, for example, means that financing arrangements can be especially critical determinants of winners in the marketplace. For this reason, as well as to provide historical context, past and present financial programs of support to U.S. industry are briefly reviewed here before technology needs and technology-assistance programs are considered in depth in later chapters.

Programs of Financial Assistance

Principal government financial programs that support U.S. shipbuilders originated in Merchant Marine Act of 1936, which has since been amended several times. Programs currently on the books include direct subsidies for ship construction and operation (the construction differential subsidy, or CDS, and the operating differential subsidy, or ODS), loan guarantees (Title XI under the Federal Ship Financing Program), and tax incentives (the Capital Construction Fund, or CCF). When enacted, each was seen as a component of a larger strategy

to promote the construction of ships in U.S. yards and crew them with U.S. citizen sailors.

Construction Differential Subsidy

Under the CDS program, U.S. shipbuilders were eligible to receive a subsidy for up to half the cost of building a U.S.-flag vessel. The program was terminated in 1981 as part of a reform program of the Reagan administration. Support for this termination was given by the report of the Grace Commission (1983), which did not support CDS. In addition, the announcement of the U.S. Navy at that time of a goal for a 600-ship fleet provided another argument for terminating the program, as many viewed that construction task as sufficient to occupy virtually all existing U.S.-shipbuilding capacity for more than a decade. Since 1981, no presidential administration has requested funds for the CDS program, and it is effectively dormant. When it was funded, the CDS program created a distortion of the market that was favorable to building of commercial ships for the domestic market by U.S. shipbuilders. Shipbuilders were not able to compensate at the time for the disappearance of that market distortion. Unlike other industries, such as steel and automotive, that also saw the disappearance of market distortions, shipbuilders had a strong military market during the 1980s and, thus, had less incentive to invest in recovering the commercial market.

Operating Differential Subsidy

The ODS program, which seeks to make eligible U.S. ship operators more competitive, primarily by paying the wage differential between U.S.-flag and foreign-flag crews, met a fate similar to that of CDS. Throughout the 1970s, the size of the U.S.-flag fleet declined. In 1981, a determination was made to stop granting new subsidy contracts and to allow existing contracts to expire. Since 1981, no new ODS contracts have been issued.

Title XI Loan Guarantees

Title XI of the Merchant Marine Act of 1936, as amended, established the Federal Ship Financing Guarantee Program. This program offers loan guarantees of up to 87.5 percent on U.S.-flag ships constructed in U.S. yards. Since enactment of the National Shipbuilding and Shipyard Conversion Act of 1993, this program has been authorized to issue guarantees for foreign-flag vessel construction in U.S. yards and for U.S. shipyard modernization projects. Annual appropriations cover the projected cost of projects to the government and administrative expenses. The dollar value of the loans guaranteed is 10 times greater than the required appropriations. Funds appropriated for Title XI annually are on the order of $50 million to $100 million a year, and considerably less than this amount may

be spent in the absence of loan defaults. Under the pending OECD agreement discussed below, loan guarantee programs for vessels of OECD participants will be limited to a term of 12 years and a level of financing of 80 percent.

Capital Construction Fund

The Merchant Marine Act of 1970 modified existing legislation and resulted in the current CCF. The program allows U.S. ship operators to shelter pretax revenues in tax-deferred accounts for future use in building U.S.-flag vessels in U.S. shipyards. (The fund can be used for projects other than new buildings, such as for ship modifications and containers.) The benefits of the CCF were reduced by the Tax Reform Act of 1986. However, this program is still in full operation and represents an incentive for U.S. owners to build commercial vessels in the United States for U.S.-flag operation. No U.S. owners have used the CCF in recent years for the purchase of new ships for international commerce.

Discussion

Today, the only clear, internationally competitive U.S. government financial assistance program for U.S. shipbuilders is provided by the Title XI loan guarantee program. Because CDS has not been funded since 1981, ODS operators have no way to build ships in U.S. shipyards, which means that no new ships are eligible for ODS. Therefore, the programs are declining. CDS and ODS, which had been lures for U.S. ship operators to construct vessels in U.S. yards, can no longer have the desired effects due to political decisions made in the early 1980s to phase out such subsidies. The financial advantages of the CCF program have lost their relevance to the construction of new vessels, except for U.S.-flag vessel operators in the Jones Act trade. Also, there is currently little or no demand for U.S.-flag, U.S.-built ships from vessel operators.

Government programs of financial assistance obviously pose an important dilemma. Consistent with economic theory and numerous observations, past programs of financial assistance to U.S. shipbuilders may have retarded certain critical efficiencies that might otherwise have arisen in response to market forces and helped to maintain the industry's commercial success.2 However, it is important to recognize that U.S. subsidy programs have been undertaken in an international environment in which most foreign shipbuilders received subsidies from their governments or were owned outright or controlled by their governments. However, as a note of caution, the effect of subsidies is not always obvious or beneficial, especially when production far in excess of market demand is encouraged.

Although no direct subsidies for ship construction have been available to U.S. shipbuilders since 1981, shipbuilders in all foreign countries are subsidized, both directly and indirectly, by their governments. Hard numbers are difficult to come by, but it is generally agreed that, due in part to foreign government support, foreign competitors have had a clear pricing advantage over U.S. shipbuilders. Substantiation of this position was provided by Transportation Secretary Federico Peña, who stated that "of key interest are the international negotiations to eliminate the shipbuilding subsidies by the countries of the Organization for Economic Cooperation and Development. … American shipyards deserve to compete on a level playing field" (Peña, 1993). Shipbuilding countries did not fully disclose the nature or quantity of their shipbuilding support in discussions relating to the OECD agreement. The Shipbuilding Council of America, however, has estimated that South Korea provided an average $2.4 billion in aid annually to its shipbuilding industry between 1988 and 1993; Germany provided $2.3 billion; Japan, $1.9 billion; Italy, $940 million; Spain, $897 million; and France, $634 million (SCA, 1993). In contrast, the last commercial ship constructed in U.S. yards (delivered in 1992) for Jones Act trade cost perhaps $40 million more than a comparable ship would if it were purchased on the international market. Although some view the Jones Act as creating a virtual subsidy paid for by U.S. shipowners, the act actually creates a distortion in trade. Shipowners operating in the U.S. coastal trade are required to buy from U.S. shipbuilders that have only built for the small domestic market, which results in limited production and high prices. Because they are buying from limited production runs, there is a tendency for these owners to order special features that increase the price of ships even more.

Current U.S. market demand (Jones Act) is made considerably weaker by owners and operators delaying ship-buying decisions in the hope—supported by discussions of modifying the Jones Act—of being able to purchase less costly vessels from foreign yards. In addition, the possibility that the limitations on exporting Alaskan oil will be removed weakens that market. Owners assume that the exports will replace domestic markets, which would significantly reduce (by about 60 percent) the number of U.S.-flag ships carrying Alaskan oil.

There are many reasons the market price for ships can vary widely from the cost of construction and can frequently be significantly below cost. Many countries consider a commercial shipbuilding industry important to their economic well-being and offer many means of support, both direct and indirect, for their domestic shipbuilding industries. Subsidies are an example of direct support. Indirect support can take many forms and can very from training programs for workers to permitting the write-off of loans to cover operating losses. Over the last several years, orders for new ships in the international market have increased, but world shipbuilding capacity has increased even faster; therefore, pressures to provide financial support are increasing even though the OECD agreement eliminates many methods of support, especially direct subsidy. The important aspect

of the price versus cost discrepancy to consider is that technology may have an effect on cost, but it will have far less effect on price.

Definitive analyses or conclusions in the area of financial support by government for shipbuilding are beyond the scope of this report. However, current widespread subsidies by competitors and the high product cost mean that financial issues are particularly significant in determining success in the industry. (Appendix C gives a brief overview of specific factors involved in determining the financing of ships and, therefore, the builders from whom ships are ordered.)

U.S. Versus Foreign Support of Shipbuilding Technology

The magnitude of government aid for the research and development of ship designs and ship manufacturing technology is one of the most clouded categories covered by the OECD arrangement. Germany, for example, does not report specific projects to the OECD. The Japanese define "subsidy" very narrowly to cover only outright grants but do not include government loans at special terms, equity participation by the government's Japan Development Bank, tax deductions, or the use of government facilities. Such indirect support applies not only to ship production but to materials used in production, including steel. In 1992, in a rare report on the Japanese industry (in the Japanese publication Kaiji Press), the government shipbuilding research and development (R&D) budget for 1991 was identified as over $1 billion, including direct subsidies to 44 organizations, such as the Japanese Foundation for the Promotion of Marine Science ($30.3 million) and the Ship and Ocean Foundation ($21 million) (SCA, 1993).

Both public and private investments in developing U.S. shipbuilding technology have been substantially less in the United States than in Europe, according to estimates made by participants at a committee workshop on shipbuilding technology (NRC, 1995). MARITECH's current budget is for $220 million over a five-year period that began in 1994, and MARAD's entire current budget for R&D is less than $2 million. The Department of Defense does invest heavily in technology related to shipbuilding—they provide at least $100 million annually. However, as will be shown in Chapter 3, the thrust of current programs is toward developing warships that have greater military capability cost less and not on the technology for producing commercial ships for the international market.

According to high level technical representatives of European yards who attended the workshop, European yards typically invest about 2 percent of their annual revenues in R&D and about 5 percent in productivity improvement and facilities upgrading. A small yard with building docks and revenues of $250 million a year invests about $18 million a year. A larger European yard with four to six large customers and at least $500 million in revenues spends twice as much ($36 million).

U.S. yards have been investing about one-fifth to one-tenth the equivalent dollar amount, according to estimates of the workshop participants. As a result, U.S. yards first need to catch up with foreign competitors. The workshop participants estimated that large U.S. yards would need to spend between $150 million and $200 million initially to make up the technological deficit in commercial vessel design and construction, considering the status of U.S. yards and general experience in modernizing obsolete European yards. The need for such U.S. investments is discussed further in Chapter 3.

The 1994 Organization of Economic Cooperation and Development (OECD) Antisubsidy Agreement

During the course of this study, on December 21, 1994, the long-sought OECD agreement to end shipyard subsidies and other anticompetitive industry practices was signed by OECD and other shipbuilding countries. Not all of the signatories have passed implementing legislation in their respective legislative bodies, even though the agreement was scheduled to go into effect on January 1, 1996. Signatories are Japan, South Korea, the United States, Norway, Finland, and Sweden; and the European Union countries, Belgium, Denmark, France, Germany, Greece, Ireland, Italy, the Netherlands, Spain, and the United Kingdom.

The OECD agreement defines the types of subsidy practices to be terminated and provides for enforcement measures, including penalties for violations. Some of the direct and indirect subsidies to be eliminated include government cash subsidies to shipyards for contracts, operations, and improving facilities; some research and development funds; forgiving some shipyard debt; and removing discriminatory regulations and practices. The agreement also identifies a mechanism for bringing complaints for ships sold below cost.

With regard to government assistance specifically targeted at shipbuilding R&D, governments will be unrestricted in the "fundamental research" they can support. Otherwise, they can provide public assistance in the form of grants, preferential loans, or preferential tax treatment up to certain levels of eligible costs. For large yards, aid will be limited to 50 percent of eligible costs for "basic industrial research," 35 percent for "applied research,'' and 25 percent for "development." If the parties to the agreement concur that R&D is related to safety or the environment, aid levels can be up to 25 percentage points higher for any of the three aid-restricted categories. Small yards can also receive 20 percent more aid for each of the three restricted R&D categories.3

Issues

The most contentious issues for U.S. shipbuilders in the OECD agreement (and their resolution) were as follows:

- U.S. Jones Act conditions remain in effect, but if U.S. shipyards exceed an annual threshold, the yard that breaches the threshold will not be able to bid against the yards of other signatory nations for one year. The Jones Act market is quite small, amounting to only four ships for all U.S. yards between 1988 and 1993.

- ship financing, notably in the form of Title XI loan guarantees in the United States, has been removed from the dispute settlement procedures and enforcement mechanism that will apply to other practices covered by the agreement. Instead, government-supported financing for ships built in domestic yards for both domestic and export customers will be subject to the terms and conditions of the Understanding for Export Credits for Ships, which is currently undergoing revision. It is expected that 80 percent allowable government financing for ships will have a repayment ceiling of 12 years (instead of the current 25 years) and that interest will be at commercial interest reference rates (CIRRs).

- restructuring aid programs of Spain, Portugal, and Belgium and a Korean shipyard-rescue program were exempted from the original January 1, 1996, deadline.

Thus, the only government support for the U.S. shipbuilding industry remaining after ratification of the OECD agreement will be an abbreviated version of the Title XI program and a more restricted version of MARITECH. (The current MARITECH program offers up to 50 percent cost-sharing of technology development by U.S. shipbuilders. This technology-oriented assistance program is described further in Chapter 3.)

Discussion

Earlier it was pointed out that other factors may be more critical for the immediate survival of the U.S. industry than any technological development. Notably, under the best of circumstances, some period of time will be required for the United States to reenter international markets, and considerations of financing and subsidies, especially as they differ between the U.S. and foreign shipbuilding industries, may predominate in shaping the U.S. industry's future, especially in the near term.

It should be noted that when both international market conditions and currency exchange rates are favorable and the U.S. government has taken an aggressive position in support of competitive shipbuilding, U.S. yards have performed well using advanced ship-design and ship-production technology for that

period. However, this is not the case in the international market. A prime example is the implementation of the Merchant Marine Act of 1970, which modernized the provisions of the 1936 act to allow negotiated procurements, direct payments to shipyards using two-party contracts (rather than the more cumbersome three-party contracts), support for bulk as well as liner ships, and a shipbuilding R&D program worth more than $12 million per year at today's dollar value. Eighty modern merchant ships of many types were built under this act during the 1970s. The 1970 act included a provision that successively lowered the allowable subsidy rate each year. Many ships were contracted for at subsidy rates under 38 percent. High-technology, LNG ships were constructed at zero to 15 percent subsidy rates. However, all of the ships constructed by U.S. yards during this period were for U.S. owners only. The ships were competitively priced only among U.S. shipbuilders, not the international market. Although the subsidy system can discourage yards from striving to compete, during several periods the U.S. Merchant Marine acts have encouraged shipbuilding capital expenditures and aggressive marketing by U.S. shipbuilders in the international commercial shipbuilding market. In spite of this encouragement, U.S. shipbuilders were unable to market commercial ships overseas successfully.

This discussion identifies a related nontechnological factor that may weigh more heavily in shaping U.S. industry success than any technology; namely, the U.S. must closely monitor the ratified OECD agreement if the U.S. commercial shipbuilding industry is to survive. Especially in the face of reduced defense budgets, without a level playing field, if other nations continue to subsidize their industries in a greater measure than the United States, U.S. industry faces massive layoffs and yard closures and cannot survive to benefit either from public or private technology development or investment.

Organization of the Report

Chapters 2 through 4 of this report respond to the three elements of the committee's charge. In Chapter 2, on technology application, the committee reviews four major areas to assess the technology needs for revitalizating U.S. commercial shipbuilding. In Chapter 3, significant programs of assistance to U.S. shipbuilding are assessed, particularly in light of the technology needs the committee identified. In Chapter 4, the committee considers current programs in naval architecture and marine engineering (NA&ME) education and steps that might be taken to strengthen the education base to achieve national shipbuilding goals. Finally, Chapter 5 presents the conclusions and recommendations reached in the preceding chapters.

Appendix A provides information about members of the committee. Appendix B provides the names of individuals who made presentations to the committee and the subject of their presentations. Appendix C provides brief background information on international subsidies in shipbuilding. Appendix D provides

information beyond that in Chapter 3 on programs to assist shipbuilding. Finally, Appendix E provides information on schools of naval architecture and marine engineering.

References

Anderson, J., and C. F. Sverdrup. 1992. Can U.S. Shipbuilders Become Competitive in the International Merchant Market? Presented to National Shipbuilding Research Program 1993 Ship Production Symposium, New Orleans, Louisiana, September 2–4, 1992, Society of Naval Architects and Marine Engineers, Jersey City, New Jersey.

Clinton, W. J. 1993. Strengthening America's Shipyards: A Plan for Competing in the International Market. Washington, D.C.: Executive Office of the President.

Dallas, A., E.D. McGrady, P.P. Perla, and K.J. Robertson. 1994. The Shipbuilding Game: A Summary Report. Alexandria, Virginia: The CNA Corporation.

Grace Commission. 1983. President's Private Sector Survey on Cost Control: Report on the Department of the Navy. Washington D.C.: Government Printing Office.

MARAD (United States Maritime Administration). 1994. Report on Survey of U.S. Shipbuilding and Repair Facilities. Washington, D.C.: MARAD.

National Research Council. 1995. Committee on National Needs in Maritime Technology (CNNMT). Marine Board, National Research Council. Washington, D.C. Meeting summary of a "Workshop on the Role of Technology Application in Shipbuilding," convened by the Marine Board, August 25–26, 1994. (Available in limited quantities from the Marine Board, National Research Council, 2101 Constitution Avenue N.W., Washington, DC 20418.)

Peña, F. 1993. Address by the Honorable Federico Peña to the 101st Annual Banquet of the Society of Naval Architects and Marine Engineers, September 17, 1993, New York, New York. Pp. 24-26 in Transactions of the Society of Naval Architects and Marine Engineers, vol. 101. New Jersey: SNAME.

SCA. 1993. International Shipbuilding Aid—Shipbuilding Aid Practices of the Top OECD Subsidizing Nations and Their Impacts on U.S. Shipyards. Arlington, Virginia: Shipbuilders Council of America.

Storch, R.L., A&P Appledore International, Ltd., and T. Lamb. 1994. Requirements and Assessments for Global Shipbuilding Competitiveness. Project funded by the National Shipbuilding Research Program, for the Society of Naval Architects and Marine Engineers, Ship Production Committee, Program Design/Production Integration Panel. October 7. Report NSRP 0434. Ann Arbor, Michigan: University of Michigan Transportation Research Institute.

Temple, Barker & Sloane, Inc. 1990. Prospects for Improving Competitiveness of the U.S. Shipbuilding Industry. Data presented to the Shipbuilders Council of America, January, 1990, Arlington, Virginia.